Author: Jeff Dorman, Chief Investment Officer of Arca; Translated by 0xjs@黄金财经

FOMC Rebound

At the end of August, we discussed the signs of recovery we were seeing in the market and how cryptocurrencies would inevitably catch up with the continued rise in gold, US Treasuries, and global stocks. However, cryptocurrencies plunged 20% the following week. Many people, including us, were spooked by the price action in late August/early September. But the FOMC came to the rescue. Although the world was arguing about whether it was 25 basis points or 50 basis points, in the end it didn't matter. In any case, this drama was a long one. The rate cuts have finally come, and Powell firmly stated in the press conference that the Fed wants to be ahead of the curve, not behind it.

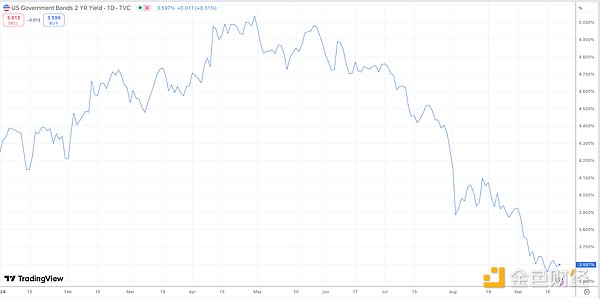

For months, US Treasury yields have been anticipating this rate cut. Since May, the 2-year US Treasury yield has fallen by more than 150 basis points.

Source: TradingView

While Treasuries, gold, and stocks simply needed confirmation of what they already knew, cryptocurrencies needed a true catalyst. While it wasn’t the most exciting reason for digital assets to rally, it was the spark the market needed.

But what’s interesting is that in a year led by Bitcoin, Solana, and a handful of memecoins and newly minted tokens, the market took the Fed’s cue and bought up beaten-down “altcoins.” Now, I hate the term “altcoin” because it doesn’t adequately differentiate between sectors, themes, and individual tokens. But sadly, this past week, it may have accurately described last week's rally. There really is no theme, sector, or reason for the massive rally in many of the lesser-known tokens. If it had been beaten down, it would have probably been up last week.

Given the many false alarms we've seen this year, it's natural to question whether this rally can last. Well, let's look at some factors that will help determine the answer:

Macro - Extremely Bullish

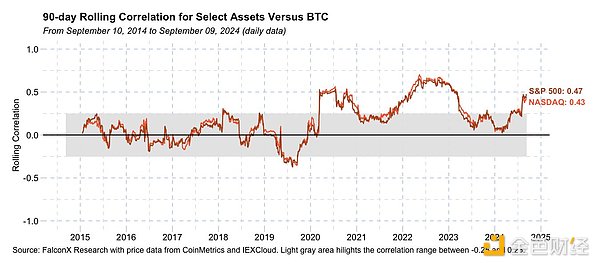

The correlation between digital assets and stocks is at its highest level in two years, so there's no doubt that macro is driving this right now.

Source: FalconX

At present, the positive effects of macroeconomic factors are quite obvious.

After a few spike scares, the VIX is back down to around 15% again

Stocks and gold hit new all-time highs

U.S. Treasury yields are falling again, with the 10-year now comfortably below 4%

The dollar continues to move lower

Corporate credit spreads are approaching tight levels again

Geopolitical risks are relatively small

The Fed has left the market in no doubt that it will slash rates to combat a recession.

All of these factors are, without a doubt, very bullish. Obviously, the next few quarters will tell us if the Fed has indeed pulled off a soft landing, but for now, at least until the election, the picture is pretty clear. Of all these factors, I think the high crypto/equities correlation is probably the least bullish, as it means the digital asset industry doesn't have a lot of catalysts for crypto right now.

Crypto: Slightly Bearish

While the macro economy paints a bullish picture, crypto-specific factors make it hard to get excited. On the positive side:

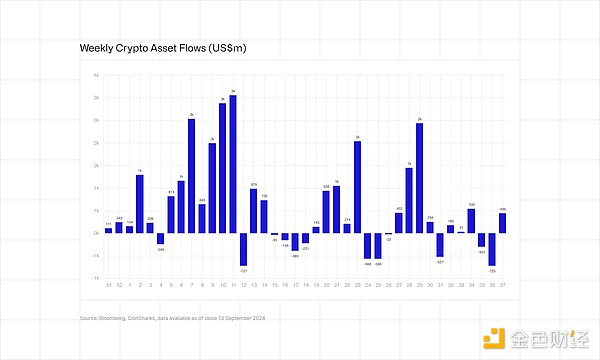

Source: Coinshares

The oversupply from the bankruptcies of crypto companies such as Mt. Gox and Celsius, as well as selling pressure from the US and German governments, has largely dissipated. The lack of sustained selling pressure can be seen as a modest positive.

Dispersion has increased. We are starting to see a small "alt rally" led by a seemingly random collection of coins. For example, in DeFi, Aave (AAVE) is now +37% MTD, but other DeFi tokens haven’t really followed suit. Bittensor (TAO) leads all AI tokens, now +97% MTD. Sui (SUI) has become the popular 0, 1, or 2 layer VC token, now +106% MTD. Immutable X (IMX) is actually the only gaming token that’s up, +37% MTD. Aerodrome Finance (AERO) is +65% MTD, as it’s the only way to get Base activity growing rapidly. Drift Protocol (DRIFT) is +58% MTD, partly due to Multicoin’s investment announcement, and partly because there’s no way to invest in Polymarket, and Drift is the next best thing in prediction markets. The fact that there is some real separation between tokens is certainly a modest positive. But the positives for crypto end there. The biggest problem with this rally is that there’s been no real news other than the Fed.

The Token 2049 conference and Solana Breakpoint conference in Singapore failed to announce any major initiatives. The content of these events was almost lackluster given the large attendance. Arca's field lead Katie Talati barely contacted the parent company because there was no news worth reporting.

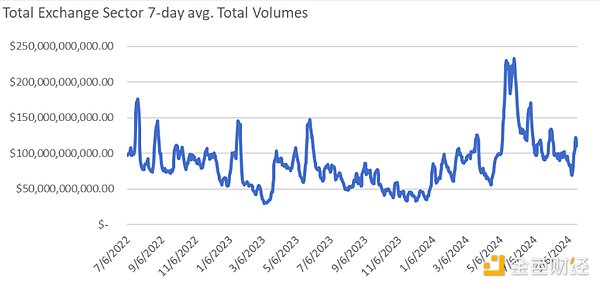

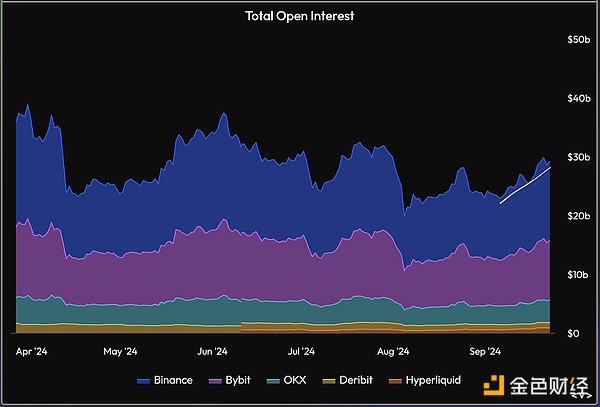

Exchange trading volume, while off lows, is still far from the levels we typically see in more prolonged and significant rallies.

Source: Arca internal calculations

![]()

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan Nulltx

Nulltx Others

Others Bitcoinist

Bitcoinist Nulltx

Nulltx