AB无处不在:为什么上线币安 Alpha?

2025年6月7日,AB DAO 宣布其原生代币 $AB 在全球顶级加密资产交易平台币安 Alpha(币安早期接入与独家挂牌平台)正式上线交易。详见币安官方公告: https://x.com/binance/status/1931229650543583317

Alex

Alex

Original title: Trump Truth

Author: Arthur Hayes, founder of BitMEX; Compiler: 0xjs@Golden Finance

Four steps: that is, the distance between the position where the vertical wooden board is fixed on the movable bracket and the wall. My yoga teacher taught me to put the heels of my hands where the board and the bracket meet. I curled up like a cat, making sure the back of my head is flush with the board. If the distance is right, I can move my feet up along the wall behind me, turning my body into an L shape, with the back of the skull, back and sacrum all touching the board. I have to resist the tendency of the ribs to open outward by exercising my abdominal muscles and tightening my tailbone. Whew - I'm already sweating, just because of keeping my body in the right position. But the real work has not yet begun. The challenge is to lift one leg to a completely vertical position while maintaining alignment.

The stick was like a cure for bad posture. If your posture is not right, you will notice it immediately, you can feel parts of your back and hips pulling away from the stick. When I lifted my left foot, with my right foot still against the wall, all my musculoskeletal issues were exposed. My left lat was turned outward and my left shoulder was turned inward, looking like an asymmetrical curling iron. But I already knew this because both my athletic trainer and chiropractor had discovered that the muscles in my left back were weaker than my right, which caused my left shoulder to sit higher and roll forward. Doing handstand exercises with the stick only made my imbalances more obvious. There was no quick fix for my problems, only a long road and sometimes painful exercises to slowly correct my imbalances.

If the vertical plank was my truth potion for body alignment, then the president-elect of the United States, Donald Trump, has played a similar role in the various geopolitical and economic issues facing the world today. The reason the global elite hate Trump is that he speaks the truth. The truth about Trump I am referring to is limited to a narrow range of topics. I am not talking about whether Trump will tell you the truth about the size of his dick, his net worth, or his golf handicap. Rather, TrumpTruth tells the story of actual relations between different nation states and the opinions of the average American voter when they are away from the safe space of political correctness Nazis.

As a macroeconomic forecaster, I try to make predictions based on public data and current events to guide the asset mix of my portfolio. I like TrumpTruth because it acts as a catalyst, forcing other heads of state to acknowledge the problems facing their countries and take action. It is these actions that ultimately bring about the future state of the world that Maelstrom hopes to profit from. Even before Trump’s re-entry, countries were acting in the ways I predicted, which further strengthened my confidence in how money printing and financial repression methods should be implemented. This end-of-year article is intended to provide a step-by-step introduction to the major changes that are taking place within and between the four major economic blocs and nation states: the United States, the European Union “EU”, China, and Japan. Whether I believe money printing will continue and accelerate after Trump’s coronation on January 20, 2025 is very important to my near-term stance. This is because I believe there is a large gap between the high expectations that crypto investors have about how quickly Trump can change the status quo, and the fact that Trump has no politically acceptable solutions to quickly effect that change. The market will immediately realize that Trump has at most a year to implement any policy changes around January 20. This realization will lead to a significant sell-off in cryptocurrencies and other Trump 2.0 stock trades. Trump has a year to act because the majority of elected U.S. lawmakers will begin campaigning in late 2025 for the U.S. mid-term elections in November 2026. The entire House of Representatives and a large number of Senators must run for reelection. The Republican majority in the House and Senate is very thin, and they will likely lose power after November 2026. The American people are rightfully angry. Yet it will take even the savviest and most powerful politicians more than a decade, not just a year, to address the underlying domestic and international issues that are negatively impacting them. As a result, investors are preparing for severe buyer’s remorse. But can a wall of money printing and a flood of new regulations designed to stifle savers overcome the “buy the rumor, sell the fact” phenomenon and keep the crypto bull market alive and well into 2025 and beyond? I believe it can, but this post is my cathartic attempt to convince myself of that possibility.

I’ll quote Russell Napier in my very simple timeline of post-WWII monetary structures.

1944–1971 Bretton Woods

Countries fixed their currencies to the dollar, which was pegged to gold at $35/ounce.

1971–1994 Petrodollar

US President Nixon abandoned the gold standard and allowed the dollar to float against all currencies because the country could not maintain its peg to gold while financing a larger welfare state and the Vietnam War. He made a deal with the oil exporting Persian Gulf states (particularly Saudi Arabia) that they would price their oil in dollars, pump as much oil as required, and recycle their trade surpluses into US financial assets. If you believe some reports, the US manipulated certain Gulf states into raising the price of oil in order to use it as a backstop for this new monetary structure.

1994–2024 Petroyuan (Petroyaun)

China drastically devalued the yuan against the dollar to fight inflation, collapse its banking system, and revive its exports. China and the other Asian Tigers (Taiwan, South Korea, Malaysia, etc.) pursued mercantilist policies that provided cheap exports to the US, which led to the accumulation of US dollars overseas as foreign exchange reserves, which enabled them to afford US dollar-denominated energy and high-quality manufactured goods, and ultimately introduced over a billion low-wage workers to the global economy, which in turn suppressed inflation in the developed West, allowing central bankers in those countries to keep interest rates at rock-bottom levels, in the mistaken belief that endogenous inflation had long since fallen.

White is USD/CNY, yellow is China's GDP in constant US dollars.

White is USD/CNY, yellow is China's GDP in constant US dollars.

2024 — now?

I don't know the name of the system currently being developed. Yet, Trump’s election is a catalyst for changes to the global monetary system. To be clear, Trump is not the cause of the realignment; rather, he has been outspoken about the imbalances he believes must change and is willing to enact highly disruptive policies to rapidly achieve changes that he believes will benefit Americans first. These changes will put an end to the petroyuan. Ultimately, as I argue in this article, these changes will increase the supply of fiat currencies and financial repression around the world. Both of these things must happen because no leader in the United States, the European Union, China, or Japan wants to reduce the leverage of their system to a new sustainable equilibrium. Instead, they will print money and destroy the real purchasing power of long-term government bonds and bank savings deposits so that the elites remain in charge of the new system.

I will begin by outlining Trump’s goals and then assess how various groups or countries have responded.

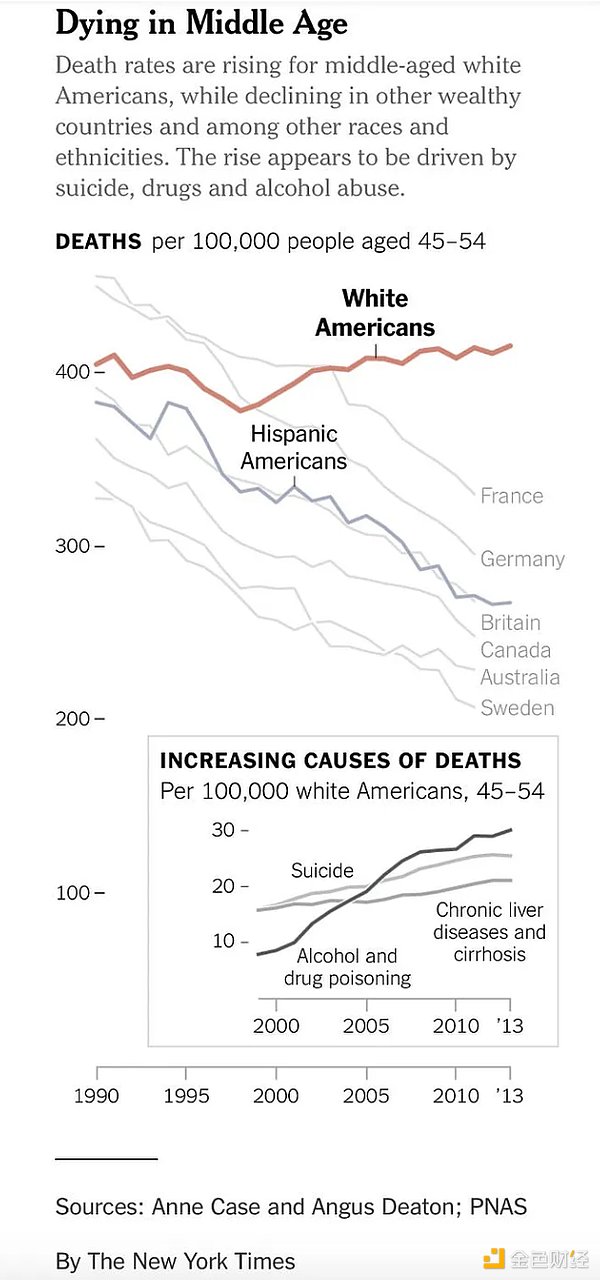

For the petroyuan system to function properly, the United States must maintain current account and trade account surpluses. The result is the deindustrialization and financialization of the U.S. economy. If you want to understand how this works, I recommend reading all of Michael Pettis. I don’t think this is why the world should change its economic system, but since the 1970s, white American males (whom the American state was supposed to serve) have lost their place. The key word here is “average”; I’m not talking about the high-riding types like Jamie Dimon and David Solomon, CEOs of JPMorgan and Goldman Sachs, or the wage hustlers who toil for them. I’m talking about the brother who once worked at Bethlehem Steel, owned a house and a spouse, and now the only women he sees are nurses at a methadone clinic. This is obvious because this group of people in the US are slowly killing themselves with alcohol and prescription drugs. Everything is relative, and relative to the higher standard of living and job satisfaction they enjoyed after WWII, relative to the rest of the US/world, things are not good right now. This is known to Trump’s supporters, and he talks to them in a way that no other politician would dare to do. Trump promises to bring industry back to the US and make their miserable lives meaningful.

For bloodthirsty Americans who love playing war video games, a very powerful political group, the current state of the U.S. military is embarrassing. The myth of the supremacy of the U.S. military relative to near neighbors or peer adversaries (only Russia and China currently meet this standard) began with the notion that the U.S. military liberated the world from Hitler's onslaught. This was not true; the Soviets sacrificed tens of millions to defeat the Germans. The Americans simply mopped up the troops. Stalin was upset that it took the U.S. so long to launch a major offensive against Hitler on the Western European front. U.S. President Franklin Delano Roosevelt let the Soviets bleed so that fewer American soldiers would die. In the Pacific, while the US defeated Japan, they never faced a full-scale onslaught from the Japanese army because Japan committed most of its fighting power to mainland China. Instead of glorifying the Normandy landings, Hollywood should show the Battle of Stalingrad, the heroism of General Zhukov, and the millions of Russian soldiers who died.

For bloodthirsty Americans who love playing war video games, a very powerful political group, the current state of the U.S. military is embarrassing. The myth of the supremacy of the U.S. military relative to near neighbors or peer adversaries (only Russia and China currently meet this standard) began with the notion that the U.S. military liberated the world from Hitler's onslaught. This was not true; the Soviets sacrificed tens of millions to defeat the Germans. The Americans simply mopped up the troops. Stalin was upset that it took the U.S. so long to launch a major offensive against Hitler on the Western European front. U.S. President Franklin Delano Roosevelt let the Soviets bleed so that fewer American soldiers would die. In the Pacific, while the US defeated Japan, they never faced a full-scale onslaught from the Japanese army because Japan committed most of its fighting power to mainland China. Instead of glorifying the Normandy landings, Hollywood should show the Battle of Stalingrad, the heroism of General Zhukov, and the millions of Russian soldiers who died.

After World War II, the US military tied with North Korea in the Korean War, lost to North Vietnam in the Vietnam War, hastily retreated from Afghanistan after a decade in 2021, and is now losing to Russia in Ukraine. The only military record the US military can claim is in the two Gulf Wars, using extremely advanced and extremely expensive weapons against third world countries such as Iraq.

The point is that war victory is a reflection of the robustness of the industrial economy. If you care about war, the US economy is a mess. Yes, Americans can do leveraged buyouts like other countries. However, their weapon systems are a mixture of Chinese imports, sold at high prices to captive customers such as Saudi Arabia, who must buy them under geopolitical agreements. Russia, with an economy that is less than one-tenth the size of the U.S. on paper, produces unstoppable hypersonic missiles at a fraction of the cost of conventional missiles made in the U.S.

Trump is no peace-loving hippie; he fully believes in U.S. military supremacy and exceptionalism, and is happy to use that military might to slaughter humans. Remember, during his first term, he assassinated Iranian General Qassem Soleimani on Iraqi soil, to the delight of large swathes of the American public. Trump had no care to violate Iraqi airspace and unilaterally decide to murder a general of another country that the U.S. was not officially at war with. So he wants to properly rearm the empire so that its capabilities match the hype.

Trump advocates for the re-industrialization of the U.S. to help those who want good manufacturing jobs and those who want a strong military. To do this, the imbalances created under the petro-yuan system need to be reversed. This will be done by devaluing the dollar, providing tax grants and subsidies to produce domestically, and deregulating. All of these factors combined will make it an economically sensible choice for companies to move production to China, as China is currently the best place to make products, due to the pro-growth policies enacted over the past three decades.

In my article Black or White?, I talked about quantitative easing (QE) for the poor and how this would help finance the reindustrialization of the United States. I believe that incoming US Treasury Secretary Bessant will pursue such an industrial policy. However, this will take time, and Trump will need to produce immediate results that can be sold to voters as progress in his first year in office. Therefore, I believe Trump and Bessant must immediately devalue the dollar.I want to discuss how this can be achieved and why it must happen in the first half of 2025.

“Gold is money, everything else is credit.” – J.P Morgan

Trump and Bessant repeatedly discuss the need to weaken the dollar to achieve U.S. economic goals. The question is, what currencies should the dollar be devalued against, and when?

After the United States, the world’s largest exporters are China (currency: renminbi), the European Union (currency: euro), the United Kingdom (currency: pound sterling), and Japan (currency: yen). The dollar must be devalued against all of these currencies to encourage profitable companies to move production to the United States. Companies don’t necessarily need to be registered in the United States; Trump agrees that Chinese manufacturers can set up factories in the United States and sell products locally. But Americans must buy products made in American factories.

Coordinated currency agreements are a thing of the 1980s. Today, the United States is not as economically and militarily powerful relative to the rest of the world as it was then. Therefore, Bessant does not have the ability to unilaterally dictate the exchange rates of other countries. Of course, Bessant can use carrots and sticks to cajole each country into agreeing to devalue its currency against the dollar. This could be accomplished by using tariffs or threatening them. However, this would take time and a lot of diplomacy. There is an easier way.

The United States holds 8,133.46 tons of gold, the most of any sovereign nation, at least on paper. As we all know, gold is the de facto currency for global trade. The United States has only been off the gold standard for 50 years. The gold standard has been the rule throughout history, and the current fiat currency system is the exception. The path of least resistance to achieving Bessant's goal is to devalue the dollar relative to gold.

Currently, the value of gold on the U.S. balance sheet is $42.22 per ounce. Technically, the Treasury issues gold certificates to the U.S. Federal Reserve (Fed), which the Treasury values at $42.22 per ounce. Suppose Bessant can convince the U.S. Congress to change the fiat price of gold, thereby devaluing the dollar against gold. In this case, the Treasury's general account (TGA) at the Fed would receive dollar credits that could be used in the economy. The greater the devaluation, the higher the TGA balance would immediately increase. This makes sense because dollars are essentially created out of thin air by valuing gold at a specific price. For every $3,824/ounce increase in the fiat price of gold, the TGA adds $1 trillion. For example, adjusting the carrying cost to the current spot price of gold would create $695 billion of TGA credits.

By government fiat, dollars can be created by changing the carrying cost of gold, which can then be used to purchase goods and services. This is the definition of fiat currency debasement. Since every other fiat currency also has an implicit gold value based on the amount of gold held by their respective governments, these currencies all automatically appreciate relative to the dollar. Overnight, without consulting any other country’s treasury, the United States can achieve a massive devaluation of the dollar against all of its major trading partners.

The bottom line is, can’t the largest exporter restore its currency weakness by devaluing the dollar more than the gold rate? Sure, they could try, but none of these currencies are global reserve currencies and have no built-in demand from trade and financial flows. Therefore, they cannot match the United States’ gold debasement, which would quickly lead to hyperinflation in their economies. Hyperinflation is inevitable because none of these countries/groups can be self-sufficient in energy or food like the US. This is politically unacceptable because the social unrest caused by inflation will force the ruling elite out of office.

Tell me how much weaker the dollar needs to be to reindustrialize the US economy, and I can tell you the new price of gold. If I were Besant, I would invest heavily. Investing heavily means a $10,000 to $20,000/ounce revaluation. Luke Gromen estimates that a return to the 1980s ratio of gold to the Fed's dollar liabilities would result in a 14x increase in gold prices from current levels, to nearly $40,000/ounce after devaluation. This is not what I expect, but illustrates how overvalued the dollar is relative to gold at the current spot price of about $2,700/ounce.

As many of you know, I’m a bit of a gold bug. I own physical gold bars in vaults and primary gold mining exchange-traded funds (ETFs) because the easiest way to devalue the dollar is against gold. Politicians always push the easy button first. But this is Crypto Trader’s Digest, so how does a $20,000/ounce gold price drive up Bitcoin and crypto prices?

Many crypto hopefuls first focus on the Bitcoin Strategic Reserve (BSR) discussion. U.S. Senator Lummis has introduced legislation that would require the Treasury to purchase 200,000 BTC per year for five years. Interestingly, if you read the bill, she proposes to finance the purchases by increasing the price of gold held on the government’s balance sheet, as I outlined above.

The case for the BSR is similar to the case for the United States to store more gold than any other nation-state; it enables the United States to assert financial hegemony over all others in both the digital and physical realms. If Bitcoin is the hardest currency ever created, then the strongest government fiat currency is the one whose central bank holds the most Bitcoin. Furthermore, a government whose finances rise and fall with the price of Bitcoin will have policies that favor the expansion of the Bitcoin and cryptocurrency ecosystem within its borders. This is similar to how governments encourage domestic gold mining and the establishment of a strong gold trading market. Look at how China encourages domestic gold holdings through the Shanghai Gold Futures Exchange, an example of a state gold-favoring policy designed to increase the financial strength of the state and its citizens in real currency terms.

If the U.S. government creates more dollars through the devaluation of gold, and uses some of those dollars to buy Bitcoin, its fiat price will rise. This in turn will stimulate competitive sovereign purchases by other countries, which must catch up to the United States. Then the price of Bitcoin will gradually rise, because no one will sell Bitcoin and get a fiat currency that the government is actively devaluing. Of course, long-term holders will sell their Bitcoin at a fiat price, but that price will not be $100,000. The argument is logical, but I still don't believe the BSR will happen. I think politicians would rather spend the newly created dollars on the welfare of the people to ensure their victory in the next election, which is coming up soon. However, it does not matter if a BSR occurs in the US, as the mere threat of it will create buying pressure. While I do not believe the US government will buy Bitcoin, this does not affect my bullish view on the price of Bitcoin. Ultimately, the debasement of gold creates dollars, which must find a home in real goods/services and financial assets. We know from experience that due to the limited supply of Bitcoin and the decreasing amount in circulation, its price rises faster than the growth of the global supply of dollars. The Fed's balance sheet is in white, and Bitcoin is in yellow. Both are indexed at 100 on January 1, 2011. The Fed’s balance sheet is up 2.83x, while Bitcoin is up 317,500x.

In summary, a rapid and dramatic devaluation of the dollar is the first step for Trump and Bessant to achieve their economic goals. It is also something they can accomplish overnight, without consulting domestic lawmakers or foreign treasury chiefs. Given that Trump has a year to show progress on some of his goals to help the Republicans retain control of the House and Senate, my base case is a devaluation of the dollar against gold in the first half of 2025.

Next, let’s take a slow look at China and speculate on how they will respond to “Trump Truth.”

China faces two major problems in the near term. It needs to create jobs for the more than 20% of unemployed educated youth and stop the decline in real estate prices. Trump Truth poses problems because the United States also needs to provide civilians with better-paying jobs and increase financial investment in production capacity. I discussed in the last section that the big sticks that Trump and his lieutenants will wield are a weak dollar and tariffs. What are the weapons in China’s hands?

I think China has made it clear that ideologically it must implement quantitative easing and allow the RMB to float freely. So far, China has implemented very little fiscal stimulus paid for by money printed by the central bank. I think this is because they do not want to exacerbate domestic economic imbalances. In addition, they have been on the sidelines until a new American emperor is elected. But in the past few weeks, it has become clear that China will implement massive stimulus through the proven financial channel of quantitative easing and let the RMB float freely.

For those who don’t understand why quantitative easing will lead to a devaluation of the RMB, remember that quantitative easing expands the supply of RMB. If the supply of RMB increases faster than another fiat currency, then mathematically the RMB depreciates relative to that currency. In addition, RMB holders may be able to get ahead of the central bank and sell RMB today in exchange for financial assets with a fixed supply such as Bitcoin, gold, US stocks, etc. to protect their purchasing power in the future. This will also lead to a devaluation of the currency.

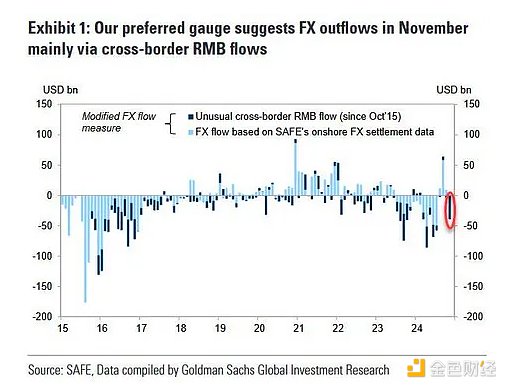

Comrades have already started pulling money out of China.

Comrades have already started pulling money out of China.

As I explained before, due to China’s food and energy shortages, they cannot go toe-to-toe with the US and devalue the RMB against gold. This would lead to hyperinflation. But that doesn’t mean China can’t significantly increase the supply of RMB to support real estate, which is causing deflation. Recent headlines have said that the People’s Bank of China (PBOC) is willing to let the RMB depreciate in response to Trump’s tariff threats, indicating that China is ready to go all-in on quantitative easing.

With Donald Trump back in the White House, China’s top leaders and policymakers are considering allowing the RMB to depreciate in 2025 in response to higher US trade tariffs. – Reuters, 11 December 2024

I believe the reason the PBOC is being vague about why the yuan must be allowed to float freely and eventually depreciate against the dollar in the short term is because they do not want to exacerbate the pace of capital flight. Telling their wealthy comrades directly that PBOC policy is now explicitly focused on printing yuan and buying government bonds would only ring alarm bells in the minds of the investing public and cause a rush of capital across the border, first into Hong Kong and then from Hong Kong to the rest of the world. The PBOC is hoping that investors will take the hint and buy domestic stocks and real estate instead.

Ultimately, as I predicted in my article “Come on Bitcoin, Let’s Go Bitcoin Together”, the PBOC will do enough QE and monetary stimulus to stop deflation. We will know if these policies are working if Chinese government bond (CGB) yields start to rise. Currently, CGB yields are at historical lows as investors would rather buy RMB principal protected investment instruments (government bonds) than risk losing money in the stock and property markets. This shows that people are pessimistic about the medium-term strength of the Chinese economy. It is easy to turn pessimism into optimism by printing a lot of RMB and removing CGB from investors' portfolios through central bank open market operations. This is the definition of quantitative easing. See the T chart in my "Black or White?" article to see how this process works. The problem with money printing at the macro level has always been the external value of the RMB. A strong RMB has some positive externalities. It helps Chinese consumers buy imported goods cheaper. It increases the likelihood that Chinese trading partners will price goods they trade with China in RMB because they can turn RMB to buy Chinese-made goods and believe that the real value of the RMB will remain stable in the long run. It also helps Chinese companies borrow RMB at affordable rates. However, all these positive factors are meaningless in the face of Trump's truth. Let me be clear: the United States can print more money than China can without hyperinflation. Trump and Bessant have made it clear that this is what they intend to do. Therefore, China will allow the yuan to float against the dollar, which means that the yuan will depreciate in the short term.

The depreciation of the yuan will allow Chinese manufacturers to export more products before Bessant significantly devalues the dollar against gold. In the short term, this will bring forward production and help to gain a stronger position in negotiations with Trump, when China must agree to certain demands of the Trump team in exchange for more favorable access to the US consumer market for Chinese producers.

The question that cryptocurrency investors should ponder is how wealthy Chinese investors will respond to signals from the People's Bank of China that it will increase the supply of yuan. Will capital flight through various legal channels in Macau (casinos) and Hong Kong (companies registered in Hong Kong by Chinese owners) be allowed to operate normally, or will these channels be closed to keep capital onshore? Given that the US line is to restrict the ability of certain pools of capital (such as the Texas public university endowment fund) to invest in Chinese assets, why would newly issued RMB be allowed to flow into the US through Hong Kong to help fund Trump's economic goals? The printed RMB must buy Chinese stocks and Chinese real estate. So while the door is open, I expect capital flight from RMB to USD to intensify as this opportunity will disappear sooner or later.

For cryptocurrencies, at least in the short term, Chinese capital will flow out through Hong Kong, exchanged for USD, and buy Bitcoin and other shitcoins. In the medium term, once China responds by prohibiting Chinese capital from fleeing through the liquid and obvious channels, the question is whether Hong Kong cryptocurrency ETFs will be allowed to accept southbound capital flows from mainland Chinese investors. If the mainland believes that de facto control of cryptocurrency ownership through Hong Kong’s state-owned asset management company will strengthen China, or at least make China equally competitive with the United States in the cryptocurrency space, then Hong Kong ETFs will quickly gather assets. This will add another pillar to the crypto bull market, as these ETF managers must buy spot crypto on the global open market.

Across the Sea of Japan, the elites who manage China’s export rivals, Japan’s electronics companies, are thinking about how to deal with Trump’s truth.

As proud of their culture and history, Japan’s elite politicians are still America’s “towel bitches.” Japan moved on after the nuclear strike, and by the early 1990s, with the help of dollar loans and tariff-free access to American consumers, Japan rebuilt into the world’s second largest economy. Most importantly for my lifestyle, Japan built the most ski resorts in the world. Just like today, the trade and financial imbalances of the 1980s caused a stir in American elite political and financial circles, forcing a rebalancing. Some argue that the currency pact of the 1980s weakened the dollar and strengthened the yen, ultimately popping the bubble in Japan's stock and property markets in 1989. The logic is that in order to strengthen the yen, the Bank of Japan (BOJ) had to tighten monetary policy, causing the bubble to burst. As always, real estate and stock bubbles are blown up by printing money, and when easy monetary policy slows or stops, the bubble bursts. The problem is that Japanese politicians will commit financial hara-kiri to please the American daimyo.

Today, just as in the 1980s, there are large financial imbalances between Japan and the United States. Japan is the largest holder of U.S. Treasuries of any country. Japan has also pursued aggressive quantitative easing, which evolved into yield curve control (YCC), which has led to extreme dollar-yen weakness. I have written about the importance of the USD/JPY exchange rate in these two articles: I Don’t Care and Spirited Away.

Trump’s truth is that the dollar should appreciate against the yen. Both Trump and Bessant are well aware that this must happen. Unlike China, which will make an adversarial currency adjustment, in Japan Bessant will decide the direction of the USD/JPY exchange rate and the Japanese will follow.

The problem with a stronger yen is that it means the Bank of Japan must raise interest rates. In the absence of government intervention, the following will happen:

1. As interest rates rise, Japanese Government Bonds (JGBs) become more attractive, and Japanese companies, households, and pension funds will sell foreign stocks and bonds (primarily US Treasuries and US stocks), convert the foreign exchange proceeds into yen, and buy JGBs.

2. Rising Japanese government bond yields mean lower prices, which has a significant negative impact on the Bank of Japan's balance sheet. In addition, the Bank of Japan holds a large number of US Treasury bonds and US stocks, and as Japanese investors sell these bonds to repatriate capital, the prices of these bonds will also fall. In addition, the Bank of Japan must pay higher interest on Japanese yen bank reserves. Ultimately, as this process unfolds, this is bad news for the solvency of the Bank of Japan.

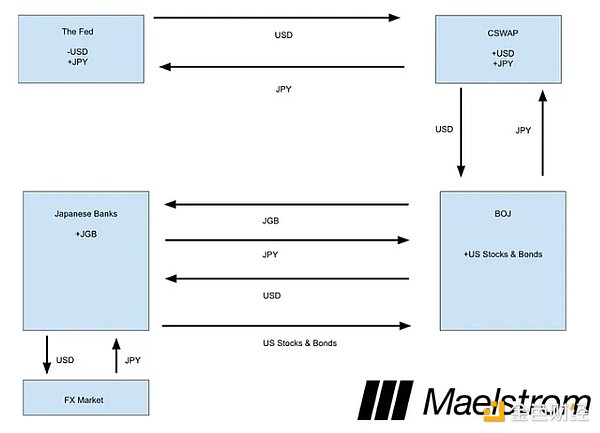

Trump wants the Japanese financial system to avoid collapse. US naval bases in Japan can curb China's maritime power, and semiconductors produced in Japan help ensure that the United States has a friendly supply of key components. Therefore, Trump will instruct Bessant to take the necessary measures to ensure that Japan survives economically in the event of a stronger yen. There are multiple ways to do this; one way is for Bessant to use the power of the US Treasury to provide the Bank of Japan with a dollar-yen central bank currency swap, so that any selling of US Treasury bonds and US stocks will be absorbed over the counter. Here is a description of the process from my article Spirited Away.

Fed - they increase the supply of dollars, or in other words, in return they get the yen that was previously created due to the growth of the carry trade.

CSWAP - the Bank of Japan owes the Fed dollars, and the Fed owes the Bank of Japan yen.

BoJ - they now hold more US stocks and bonds, whose prices will rise due to the increase in the number of dollars caused by the growing CSWAP balance.

Bank of Japan - they now hold additional Japanese government bonds.

This is important for cryptocurrencies because the amount of dollars will increase to finance the unwinding of the massive USD/JPY carry trade. The unwinding will be slow, but trillions of dollars will be printed to keep the Japanese financial system solvent.

Correcting the Japan-US trade and financial imbalances is fairly easy because Japan ultimately has no say and is currently so politically weak to offer any real opposition. The ruling Liberal Democratic Party (LDP) lost its parliamentary majority, leaving Japanese governance in a state of turmoil. The elites are politically incapable of opposing Trump’s truth, just as they secretly loathe the uncivilized Americans.

While many Europeans (at least those not named Muhammad) have a bit of a Christian bent, the biblical saying “the last will be first” definitely does not apply to the EU economically. The last will be last. For whatever reason, Europe’s elite politicians continue to hold onto their positions and accept the relentless blows from Uncle Sam. Europe should do its best to integrate with Russia and China. Russia provides the cheapest energy via pipelines and provides food to feed the people. China provides cheap, high-quality manufactured goods and is willing to buy European luxury goods in quantities that would make even Marie Antoinette blush. Instead of trying to integrate into the vast, unstoppable Eurasian Sphere of Common Prosperity, the European continent has long been confused by the two island nations of Britain and the United States.

The German and French economies are in trouble because of Europe's unwillingness to buy cheap Russian gas, abandon the green energy transition scam, or engage in mutually beneficial trade with China. Germany and France are the economic engine of Europe - the rest of the continent may be just a vacation spot for Arabs, Russians (okay, maybe not now) and Americans. This is ironic considering how much European elites hate people in these regions, but those with money have the final say and those without money stand aside.

This year, there were two very important speeches by Super Mario Draghi (The Future of European Competitiveness, September 2024) and Emmanuel Macron (European Speech, April 2024). If you are European, what is frustrating about these speeches is that both politicians correctly identify the problems facing Europe – namely expensive energy and a lack of domestic investment – but offer solutions that ultimately amount to “we need to print more money to finance the green energy transition, and do more financial repression”. The correct solution is to abandon the unwavering support for the risk-taking of the US elite, achieve detente with Russia for cheap gas, embrace nuclear power, do more trade with China, and thoroughly deregulate financial markets. Another frustrating fact is that many European voters who, like me, believe that the current policy mix is not in their best interests went to the polls and elected parties that want these changes. But the elites in power are doing everything they can to weaken the will of the majority. With no government in office in France or Germany, political unrest continues.

The Trump truth is that the US still demands that Europe shun Russia, limit trade with China, buy US-made weapons to defend against Russian and Chinese attacks, and prevent a strong Eurasian integration. Because these policies have a negative impact on the economy, the EU must resort to financial repression and money printing to make ends meet. I will illustrate the future of European financial policy through a few words from Macron and explain why you should be scared if you hold capital in Europe. You should be worried that your ability to escape from the European capital basement will be closed and the only thing you can buy in your retirement account or bank deposits are bad long-term EU government bonds.

Before I quote Macron, I would like to quote Enrico Letta, former Italian Prime Minister and current director of the Jacques Delors Institute, a think tank:

The EU has a whopping 33 trillion euros of private savings, mainly held in the form of current accounts (34.1%). However, this wealth is not fully utilized to meet the EU's strategic needs; the worrying trend is that European resources are diverted to the US economy and US asset management companies every year. This phenomenon highlights the serious inefficiency of the use of the EU's savings, which, if used effectively within its own economy, would greatly help achieve its strategic goals. -- Much More Than A Market Letta left no doubt as to what he thought the problem was; Macron’s subsequent comments reiterated those points. European capital should not be funded by American companies, but by European ones. The authorities know better than you what to do with your capital, and they can force you to hold underperforming European assets in a variety of ways. For example, for those who keep their money with institutional money managers through pension funds or retirement accounts, EU financial regulators can define the universe of suitable investments so that your investment manager can only legally buy EU stocks and bonds. For those who keep their money in banks, regulators can prohibit banks from offering non-EU stock and bond investments because they are not “appropriate” for depositors. Any time your money is with an EU-regulated trustee, you are at the mercy of the likes of Christine Lagarde and her band of merry muppets. Maybe you like her, but make no mistake, as President of the European Central Bank (ECB), her job is to financially secure the survival of the EU project, not to help your savings grow faster than the inflation her bank needs to keep the system solvent.

If you think only people at the World Economic Forum in Davos would advocate for such things, here’s a quote from the notorious racist, fascist, [fill in the blank]ist…they say so…Marine Le Pen:

Europe should wake up…because America will defend its interests more forcefully.

“Trump Truth” is gaining traction on both the left and right sides of the EU political spectrum.

Coming back to the point about EU politicians refusing to take simple and less economically damaging measures to solve their problems, here is Macron speaking for the people:

“So, the days of Europe buying energy and fertilizer from Russia, outsourcing to China and relying on the United States for security are over.”

Macron went on to stress that EU capital must not be directed to the best performing financial products, but to be invested in the barren lands of Europe:

“The third drawback: every year, about €300 billion of our savings are used to finance Americans, both in treasuries and capital risk. This is ridiculous.”

Finally, in a last-ditch effort, Macron said he would suspend Basel III banking regulation. Essentially, this would allow banks to buy unlimited amounts of high-priced, low-yielding EU government bonds. Holders of euro-denominated assets would be the losers, as this would effectively allow the supply of euros to increase indefinitely.

"Secondly, we need to revisit the way Basel and solvency standards are applied. We cannot be the only economic region in the world to apply these standards. The United States was the source of the 2008-2010 financial crisis, but they chose not to apply them."

Macron correctly points out that Americans do not follow these global banking rules, and concludes that Europeans do not need to follow them either. Hello, fiat financial collapse to Bitcoin and gold.

Draghi goes on to argue in his latest report that in addition to financing the massive welfare state (France, for example, has the highest government spending as a percentage of GDP among developed countries at 57%), the EU will need to invest 800 billion euros per year. Where will this money come from? It will come from the ECB printing money, and EU savers buying lousy long-term EU government bonds in times of financial stress.

I am not making this crap up. These are direct quotes from both the left and right sides of the EU political spectrum. They tell you that they know best how to invest EU savings. They tell you that banks should be able to use unlimited leverage to buy EU member state bonds, which the ECB will eventually issue after pan-Eurobonds. And the rationale behind this is Trump truth. If Trump’s America is to weaken the dollar, suspend prudent bank regulation, and force Europe to cut ties with Russia and China, then EU savers must accept subpar returns and financial repression. EU cowards should sacrifice their capital and their real living standards to preserve the EU project. I’m sure you noticed the large amount of eye-rolling in the tone of this section, but I won’t be mad at you if you want to lower European living standards. I bet many of you enjoy waving the flag in public, but at home will rush to your computer and try to get out as quickly as possible. You know, the escape is to buy Bitcoin before it’s banned and keep it yourself. But EU readers, it’s your choice.

Globally, as more Euros are in circulation and the stranglehold on EU domestic capital gets tighter, Bitcoin will rise dramatically. This is the stated policy of the elites. However, I believe it will be a “do as I say, not as I do” situation. Those in power will secretly move assets to Switzerland and Liechtenstein and go on a crypto buying spree. Meanwhile, those who refuse to listen and protect their savings will suffer under government sanctioned inflation. That’s how the croissant flakes.

The End of Truth

Our end of truth is the 24/7 free crypto market. The rise of Bitcoin after Trump’s victory in early November was a leading indicator of an acceleration in the growth of the fiat money supply. In response to Trump Truth, every major economic bloc/country must react immediately. And the reaction is to devalue currencies and increase financial repression.

Bitcoin (yellow) is leading the increase in US bank credit (white).

Does this mean that the price of Bitcoin will go straight to $1 million without any major correction? Absolutely not.

I don’t think the market realizes that Trump actually has very little time left to accomplish anything. The market believes that Trump and his team can create an economic and political miracle immediately. The problems that led to Trump’s popularity have been brewing for decades. So, no matter what Elon Musk tells you at X, there is no immediate solution. Therefore, it is virtually impossible for Trump to appease his supporters sufficiently to prevent the Democrats from retaking both legislative chambers in 2026. People are impatient because they are desperate. Trump is a savvy politician and understands his supporters. To me, this means he has to do it big and early, which is why I am betting on a massive depreciation of the dollar against gold in his first 100 days in office. This is an easy way to make US production costs globally competitive quickly. It will lead to an immediate reshoring of production capacity, which will lead to increased hiring today, not five years from now.

Before we enter the crash phase of the crypto bull market, I believe the crypto markets will experience a painful crash around Trump’s inauguration on January 20, 2025. Maelstrom will be trimming some positions early, hoping to re-buy some core positions at lower prices sometime in the first half of 2025. Obviously, every trader says this and believes they can time the market. And most of the time, they end up selling too early and subsequently lack the confidence to re-buy at a higher price than they just held. Then, for the remainder of the bull market, the above traders will be underinvested. Knowing this, if the bull market is unstoppable on January 20th, we will admit defeat, lick our wounds, and return to the bull market. Trump Truth shows me the structural flaws of the global order. Trump Truth tells me that the best way to maximize returns is to hold Bitcoin and cryptocurrencies. Therefore, I will buy the dips.

Yahtzee (Note: Yahtzee is a classic dice game that combines a unique combination of luck and strategy) ! ! !

2025年6月7日,AB DAO 宣布其原生代币 $AB 在全球顶级加密资产交易平台币安 Alpha(币安早期接入与独家挂牌平台)正式上线交易。详见币安官方公告: https://x.com/binance/status/1931229650543583317

Alex

AlexOn 9 June, the SEC will host a roundtable to explore how DeFi aligns with current regulations, focusing on tokenisation, custody, and market integrity. The event aims to balance innovation with compliance, with input from the public and industry leaders like SegMint and BlackRock.

Catherine

CatherineAmidst escalating kidnapping threats targeting crypto owners, the Bitcoin Family has adopted a novel security approach—dispersing their seed phrases across four continents.

Kikyo

KikyoWorldcoin will launch in London on 12 June, using eye-scanning technology to verify people’s identity and stop AI fraud. The project is expanding across the UK and aims to help governments and platforms tackle fake users online.

Weatherly

WeatherlyThe US DOJ has seized $7.74 million laundered by North Korean operatives who used stolen US identities to secure remote blockchain jobs and bypass KYC checks. The funds were funnelled back to support the regime’s weapons programme.

Catherine

CatherineMusician Jonathan Mann sold 3,700 songs as NFTs and earned around $3 million in crypto, but its value crashed soon after. He ended up owing over $1 million in taxes and sold a rare NFT to pay the bill, yet he keeps creating new songs daily.

Anais

AnaisCEO Brian Armstrong credited a machine learning overhaul for sharply reducing unnecessary account restrictions by better distinguishing legitimate activity from threats.

Kikyo

KikyoGetty Images is suing Stability AI in London for using millions of copyrighted photos without permission to train its image-generation system. The court’s decision could change rules on how AI companies use creative content and affect copyright laws worldwide.

Weatherly

WeatherlyAI is swiftly replacing white-collar jobs, with tens of thousands cut in 2025 alone. Up to 80% of tasks may soon be automated, and experts warn AGI could trigger mass unemployment across all sectors.

Catherine

CatherineChinese tech companies disabled AI image recognition features during the gaokao exam from 7 to 10 June to stop cheating. Platforms like Qwen, Yuanbao, Kimi, and Doubao paused services to follow rules and protect exam fairness.

Weatherly

Weatherly