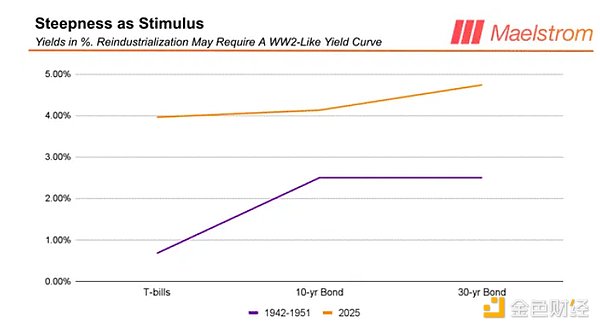

Source: Arthur Hayes, Founder of BitMEX; Translated by Golden Finance. Buffalo Bill Bessent's plan to reindustrialize the United States and prevent the "Pax Americana" from degenerating from a quasi-empire into a pure power was nothing new. The exigencies of World War II allowed the Treasury to take over the Federal Reserve from 1942 to 1951. Part of Bessent's work involved reshaping the yield curve, a practice known as yield curve control. How did the yield curve during that period compare to today?

If Trump's 'America First' Plan Succeeds, BTC Will Reach $1 Million" compiled and published by Jinse Finance). I call Bessant's monetary policy "poor man's quantitative easing."

If Trump's 'America First' Plan Succeeds, BTC Will Reach $1 Million" compiled and published by Jinse Finance). I call Bessant's monetary policy "poor man's quantitative easing."

Banks will now provide loans to real industries that can produce the weapons needed to power Baghdad/Tehran/Gaza/Caracas (yes, the attempt at regime change in Venezuela will be in 2028) , and so on.

This solves the industrial problem. To appease the American populace, who demand an ever-expanding welfare state in exchange for their allegiance, the government must raise funds at more affordable prices. By fixing the yield on long-term bonds, Besant can issue unlimited quantities of low-quality Treasury bonds, which the Fed dutifully buys with printed dollars. Interest payments fall sharply, and with them the federal deficit.

Eventually, the dollar's value relative to other worthless fiat currencies and gold will collapse. This will allow American industry to export goods at competitive prices, first to Europe, and then to the Global South, competing with China, Japan, and Germany.

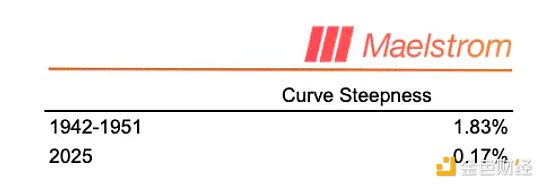

Conceptually, It's easy to understand why Bessant wants to control the Fed and implement YCC, but the current Fed won't cooperate. Therefore, Trump must fill the Fed with his loyalists who will obey the will of "Buffalo Bessant" or they will be "fire hosed" again. Federal Reserve Board Governor Lisa Cook is about to experience a "fire hose" in 2025. If you don't know what that is, look at the tactics used by the establishment during the civil rights protests in the 1960s. The Federal Reserve has two committees, each of which controls the policies necessary for Bessant's plan to succeed. The Federal Reserve Board of Governors (FBOG) controls the IORB, which in turn controls the interest rates on DW loans. The Federal Open Market Committee (FOMC) controls the SOMA. How do the voting members of the two committees interact? How are these voting members selected? How can Trump legally and quickly gain control of both committees? Speed is of the essence, as the 2026 midterm elections are just over a year away, and Trump's "Red Team" Republicans will face a tough electoral battle. If the "Red Team" Republicans lose control of the Senate, and Trump still doesn't have a majority on either committee by November 2026, the "Blue Team" Democrats will not confirm any of his future appointments. This article will answer these questions. I must caution that the risk of error is higher when delving into the realm of pure politics. Humans do strange and unpredictable things. My goal is to point out a very likely path forward, and my portfolio will most likely only need to be held for the long term. There's Bitcoin, junkcoins, physical gold bars, and gold miners.

A Primer on the Federal Reserve

Understanding the bureaucratic decision-making process of the institution responsible for printing money is an integral part of my investment framework. As I explored the mechanics of the world's filthy fiat monetary system, I learned a great deal about how treasuries and central banks operate. As complex adaptive systems populated by human decision-makers, these bureaucracies must follow "rules" to achieve any goals. Certain rules govern the unelected bureaucracy responsible for US monetary policy (the Federal Reserve). Therefore, I must answer several questions to predict how this policy will bend to the will of Trump and "Buffalo Bessant."

1. Who (specifically, which committees) votes on which aspects of monetary policy?

2. How many votes are required for a motion to pass?

3. Who selects the various members of these governing boards?

4. When are the board members replaced?

style="color: rgb(0, 112, 192);">First, Trump must gain four seats to secure a majority on the seven-member Federal Reserve Board of Governors (FBOG). He can then leverage his FBOG majority to secure seven voting seats on the twelve-member Federal Open Market Committee (FOMC) to secure a majority on the FOMC. I'll explain the monetary policy each body can set, how its members are selected, and how Trump could gain control by the end of the first half of 2026.

Let's take a deeper look at the composition of the FBOG.

Understanding the Federal Reserve Board of Governors (FBOG)

The FBOG has seven governors, appointed by the President and confirmed by the Senate. Here's a list of the current governors:

If Trump had a four-seat majority on the Federal Reserve Board (FBOG), he could force the Federal Open Market Committee (FOMC) to quickly cut interest rates to the level he desires. How many current board members are loyal to Trump?

Since Jerome Powell Powell's term as Fed Chair ends in May 2026, and some Board members are seeking to replace him. To demonstrate their loyalty to Trump, they have publicly discussed the Fed's policy direction and, in some cases, dissented from the majority decision at Federal Open Market Committee (FOMC) meetings. At the July 2025 meeting, the two Board members who dissented were Bowman and Waller. Trump is already halfway there. Surprisingly, Adriana Kugler abruptly resigned from the Board this summer, and the Senate confirmed Trump's nominee, Stephen Miran. Rumors circulated that Kugler's husband traded securities during the Fed's lockup period; for those readers without a political background, this behavior might be considered insider trading, and a Department of Justice investigation could land him in jail. Kugler resigned before facing harsh criticism from the Trump administration. With Kugler gone and Milan in, the Trump campaign now has three candidates, only one left. Like everyone else, Fed governors abuse their power. They engage in insider trading (see previous paragraph), and board member Cook is suspected of lying on mortgage applications. Bill Pulte, director of the Federal Housing Finance Agency, accused Cook of mortgage fraud and demanded her resignation. But she stood her ground and refused to resign. Pulte took her case to the Department of Justice (DOJ), where Attorney General Pam Bondi, the head of the DOJ, Bondi is currently reviewing whether to indict Cook for bank fraud before a grand jury. Grand juries almost always agree to indict. The Department of Justice could easily obtain approval to indict Cook, so I can only imagine that the department is hesitant because they want to use the threat of formal indictment as leverage to force Cook's resignation. I don't know if she is guilty; the mainstream media you follow will determine whether you believe her guilt. Bessant allegedly committed irregularities in some of the financial applications he submitted to the bank. In America, everyone is a criminal, you know! Regardless of her ultimate conviction or innocence, the Department of Justice has a nearly 100% conviction rate, and Cook will be doomed if she doesn't resign. I suspect her stubbornness is simply a negotiating tactic to easily secure high-paying government or academic positions offered by the Trump administration. In any case, she won't be a Supreme Court justice until early 2026.

Trump has four votes that can quickly cap Treasury yields because he has instructed the Federal Reserve (Fed) to Next, the FBOG can free up the regional banks from ridiculous regulations and allow them to lend to small businesses in the real economy as Bessant wishes. The FBOG can do this because it handles the regulatory issues (or lack thereof) of commercial banks. The last piece of the puzzle is controlling the quantity of money, which allows him to peg long-term yields even lower through the SOMA. To do this, Trump needs control of the Federal Open Market Committee (FOMC).

So how can the FBOG, which controls the Federal Reserve Board, get a seven-vote majority on the FOMC?

Federal Reserve Regional Bank Presidents

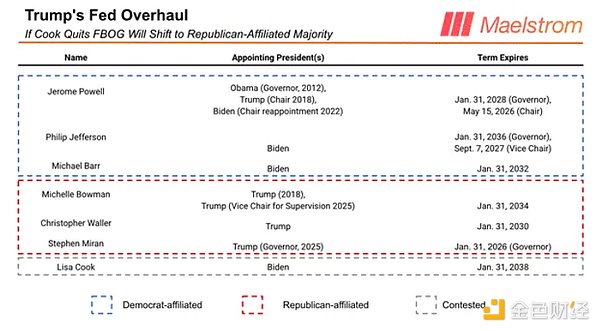

There are twelve Federal Reserve regional banks. In the days when agriculture was more prevalent in the United States, different regions required different interest rates, depending on the types of goods and services provided to the national economy throughout the year—hence the need for twelve regional banks. Each regional bank nominates a governor who must receive at least four votes from the Federal Reserve Board (FBOG) to serve on the Federal Open Market Committee (FOMC). Of the twelve regional bank presidents, only five have voting rights on the FOMC, with the President of the Federal Reserve Bank of New York holding a permanent vote. Therefore, four different regional bank presidents vote on the FOMC each year. For years ending in 1 or 5, regional bank presidents are subject to re-election by the respective regional boards. A simple majority of the Class B and Class C board members (four of the six members) on each regional board elect a bank president. 192);">All bank presidents will be up for re-election in February.Except New York, the relevant voting districts are as follows:

● Cleveland

● Minneapolis

● Dallas

● Philadelphia

Have you noticed the career backgrounds of these board members? Most of them are financiers or industrialists. If money were more abundant and cheaper, their personal net worth would increase significantly. These are human beings, and humans, when unconstrained, will generally act in their own self-interest. I don't know their political affiliations, but I believe that even with their total debt burden (TDS), the antidote of higher asset prices that enrich themselves and their cronies would heal the pain. That being said, if it were common knowledge that the Federal Reserve would only approve a chair who voted for looser monetary policy on the Federal Open Market Committee (FOMC), then the governors of the regional banks would... The Board will act in Trump’s and its own interests.

If the regional councils do not put forward dovish candidates for seats on the FOMC, the Federal Reserve will reject them. Remember, Trump now has four of the seven votes.

Trump only needs three of the four newly elected members to be his loyal supporters. This will give him seven votes on the FOMC and, most importantly, control of the SOMA, the Fed’s printing press. Trump’s cronies on the FOMC will then print money and buy up the mess of debt that even the Bessent can’t find buyers for. Ladies and gentlemen, this is the Treasury-Federal Reserve Agreement for 2026. Both printing money and YCC are perfect. Remember, in this filthy fiat financial system, the different flowers you get before the flop 4 and 7 (in Texas Hold'em, a hand consisting of a four and a seven, with two cards of different suits) are stronger than pocket aces (also known as "pair of aces").

But I know you're all eager to read my bullish article about Bitcoin's future price, assuming my money printing predictions come true. See below.

The Math of the Bull Market

For those who doubt Trump's sincerity in printing money to "revitalize" the American dream of governance, here's a brief historical look at what motivates elite politicians to push for radical change. American elite politicians will always stop at nothing, even if these actions are extremely unpopular, to preserve the so-called fruits of empire for the ruling class.The relationship between the descendants of former African slaves and European immigrants is a good example and has always dominated American political and social discourse. It was during the bloodiest Civil War in American history that President Lincoln devastated the Confederacy’s economy by freeing the slaves. After the Union’s victory, they abandoned the newly freed people in the former Confederate states to suffer Jim Crow racial segregation, which the ruling elites endured until 1965. It wasn't until 1999 that the United States reconsidered formally extending voting rights and other civil rights to former slaves. The rise in literacy among former slaves and the promotion of communism, which preached economic and civic equality for all, appealed to the black underclass. The problem was that the elites needed those poor blacks fighting communist "Charlie" on the front lines in Indochina, producing export goods in Northern factories, doing domestic chores in wealthy homes, and working on Southern farms, and certainly not marching on Washington, D.C., on televised missions, demanding equal rights with everyone else. American propaganda also needed to sell the image of American capitalism as superior to Soviet communism to the non-aligned world. The Declaration of Independence states that “all men are created equal,” but it’s not a good thing when police dogs bark at little girls heading to newly desegregated schools. Thus, to the chagrin of many in his class, Southern Democrat Lyndon Johnson became the civil rights champion of a group of Negroes just a few generations removed from cotton picking. Today, another war with a more united, prosperous, and militarily powerful Eurasia (Russia, India, and Iran) requires a radical change in the allocation of credit. So, I declare with confidence that these white men are serious about printing money.

Trump and Besson Trump believes that their mission is to restore America's global dominance. This requires rebuilding a solid manufacturing base and producing real goods, not "services." China came to a similar conclusion when faced with the 2018 Sino-US trade war provoked by Trump. China has crushed the animal spirits of financiers and CEOs of large technology companies and changed the direction of China's economy. China's best and brightest will not build humble apartments and shared bicycle apps, but will conquer the green economy, rare earths, military drones, ballistic missiles, artificial intelligence, and more. After nearly a decade, China can independently produce all the real goods that a nation-state needs to maintain its sovereignty in the 21st century without the help of the United States.

Having said that, allow me to be a little bit sentimental and imagine how much credit the Federal Reserve and the commercial banking system will create by 2028.

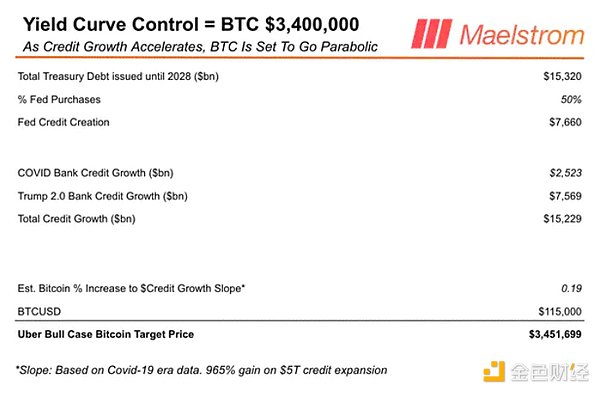

Between now and 2028, the U.S. Treasury must issue new debt to repay old debt and cover the government deficit. I used Bloomberg's feature to estimate the total amount of Treasury debt maturing between now and 2028. I then assumed that the federal deficit would reach $2 trillion per year through 2028. Therefore, I estimate that U.S. Treasury debt issuance would reach $15.32 trillion.

During the COVID-19 pandemic, the Fed used SOMA to purchase about 40% of Treasury bonds have been issued, which increases the size of the balance sheet. I believe the Fed will buy 50% or more of the outstanding Treasury bonds because fewer foreign central banks will buy them now, knowing Trump will issue a lot of them. Estimating bank credit growth is not easy. The most reliable estimates are based on data from the COVID-19 period, during which Trump implemented quantitative easing policies targeting the poor. During this period, bank credit grew by $2.523 trillion, as evidenced by the Fed's weekly report on the growth of other bank deposits and liabilities. Trump still has about three years to stimulate the market, which is equivalent to $7.569 trillion in bank loans. This brings the total credit growth by the Fed and commercial banks to $15.229 trillion. The most confusing part of the model is guessing how much Bitcoin will rise for each dollar of credit created. Again, I'm referring to the COVID-19 period. The slope of Bitcoin's percentage increase relative to one dollar of credit growth is approximately 0.19. Ladies and gentlemen, this leads to a Bitcoin price forecast of $3.4 million in 2028! Do I think Bitcoin will reach $3.4 million by 2028? No, but I believe it will be significantly higher than its current trading price of around $115,000. My goal is to correctly judge the direction of travel and be confident that I'm betting on the fastest horse, assuming Trump truly intends to print trillions of dollars to achieve his policy goals. This model does just that.

Clement

Clement

Clement

Clement Davin

Davin YouQuan

YouQuan Hui Xin

Hui Xin Joy

Joy Hui Xin

Hui Xin Clement

Clement Joy

Joy Catherine

Catherine Kikyo

Kikyo