Original title: Persistent Weak Layer

Author: Arthur Hayes, founder of BitMEX; Translator: Deng Tong, Golden Finance

I spent the first two weeks of October skiing on the South Island of New Zealand. I spent all of last season in Hokkaido, and my guide assured me that New Zealand was one of the best places in the world for backcountry skiing. I took his word and spent two weeks with him, starting from Wanaka, chasing powder snow and big lines. The weather was great, and I was able to ski past some spectacular peaks and cross huge glaciers. As an added bonus, I also improved my knowledge of alpine mountaineering.

The storms on the South Island are fierce. When there is bad weather, you just sit at home or in a mountain cabin. To kill time, one afternoon my guide gave me an avalanche science course to pass the time. I have done a lot of avalanche training since I first entered the remote areas of British Columbia as a teenager, but I have not taken a proper certification course.

This information is fascinating and thought-provoking because the more you learn, the more you realize that when you are skiing in avalanche terrain, there is always a chance that you will be caught in an avalanche. Therefore, the goal is to reduce the risk to an acceptable level.

The course introduces you to different types of snowpack and how they can cause avalanches. One of the most terrifying scenarios is a persistent weak layer (PWL), which, when stressed, can trigger a sustained slab avalanche.

In avalanche science, a PWL refers to a specific snow layer in a snowpack that is structurally weak over an extended period of time, significantly increasing the risk of avalanches. These layers are particularly dangerous because they can be buried deep in the snowpack, lying dormant and unstable for weeks or even months until they are finally triggered by additional stress, such as skiers or more snowfall. Knowing that PWLs exist is critical to avalanche forecasting, as these layers are often responsible for large, deep, and deadly avalanches.

The geopolitical situation in the Middle East after World War II was fundamental to our modern global order. The triggering factor is usually associated with Israel. From a financial market perspective, we are concerned about how energy prices will react, how global supply chains will be affected, and whether a nuclear weapons exchange will occur if hostilities escalate between Israel and another Middle Eastern country, especially Iran or its proxies.

As investors and traders, we are on a precarious but exciting slope. On one hand, major countries or economic blocs are reducing prices and increasing the quantity of money as China officially kicks off its stimulus policies. Now is the time to take the biggest long-term risk, and obviously, I mean cryptocurrencies. However, if the Israel/Iran situation continues to escalate and leads to the destruction of Persian Gulf oil fields, the closure of the Strait of Hormuz, or the detonation of a nuclear bomb or device, the cryptocurrency market could suffer a massive sell-off. As they say, war is uninvestable.

I am faced with a choice: do I continue to sell fiat currency to buy cryptocurrencies, or do I reduce my crypto exposure and hold cash or US Treasuries? If this is indeed the start of the next leg higher in the crypto bull market, I don't want to be underallocated. Still, I don't want to burn capital if Bitcoin drops 50% in a day because Israel/Iran has triggered an ongoing financial market avalanche. Forget Bitcoin; it will always bounce; I’m more worried about some shit in my portfolio…MEME coins.

As I think about how to allocate Maelstrom’s portfolio, I want to walk readers through the simple scenario analysis I’m using.

Scenarios

Scenario One: The Israel/Iran conflict devolves into tit-for-tat, small-scale military operations. Israel continues to assassinate people and behead people, while Iran responds with Telegram statements, non-threatening missile strikes. No critical infrastructure is destroyed, and no nuclear strikes occur.

Scenario Two: The Israel/Iran conflict escalates and ultimately results in the destruction of some or all of the Middle East oil infrastructure, the closure of the Strait of Hormuz, and/or a nuclear attack.

The persistent vulnerability layer holds true in Scenario One, but fails in Scenario Two, causing an avalanche in financial markets. Let’s focus on the second outcome, which is what jeopardizes my portfolio.

I’ll evaluate the impact of the second scenario as it affects the cryptocurrency market specifically, but primarily Bitcoin. Bitcoin is the crypto reserve asset, and the entire crypto capital market will follow its lead.

I am more concerned that now that the US has committed to deploying the THAAD anti-missile system in Israel, Israel will up the ante. Israel is definitely planning a massive attack, to which they expect Iran to respond strongly. Moreover, the more Israel publicly states that it will not attack Iran's oil or nuclear facilities, the more I believe that this is exactly what they are planning.

On Sunday, the US said it would send US troops to Israel along with advanced US anti-missile systems, a highly unusual deployment designed to bolster the country's air defenses following an Iranian missile attack.

Source: Reuters

Risk One: Physical Destruction of Bitcoin Miners

War is physically destructive. Bitcoin mining equipment is the most valuable and important physical manifestation of cryptocurrency. What will happen to them?

The main assumption of this analysis is to which part of the world the dynamic conflict will spread. While the Israel/Iran war is just a proxy war between the US/EU and China/Russia, I don't think either side wants to attack the other directly. Moreover, the ultimate belligerents are all nuclear powers. The United States is the most aggressive militaristic power in the world and has never directly attacked another nuclear country. This is telling because the United States is the only country to deploy nuclear weapons (at the time, they intimidated Japan into surrendering by nuking two cities in order to end World War II).

The next question is, is there a lot of Bitcoin mining activity in Middle Eastern countries? According to some media reports, Iran is the only country where Bitcoin mining is booming. According to sources, Iranian Bitcoin miners account for up to 7% of the global hashrate. What would happen if Iran's hashrate dropped to 0% due to internal energy shortages or missile attacks on facilities? Nothing.

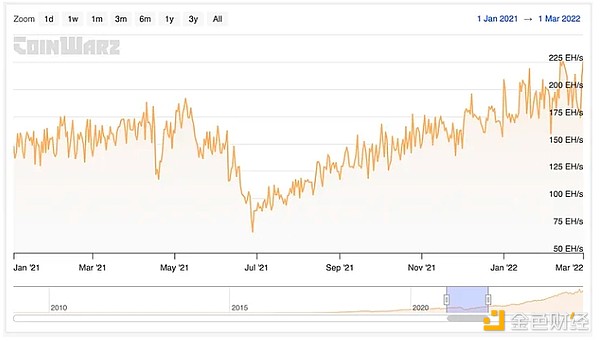

This is a chart of the Bitcoin network hashrate from January 2021 to March 2022.

Remember when China banned Bitcoin mining in mid-2021, the hashrate quickly dropped by 63%?1 The hashrate recovered to its May 2021 high in just eight months. Miners moved out of China, or other global players were able to increase their hashrate due to more favorable economic conditions. On top of that, Bitcoin hit a new all-time high in November 2021. The severe drop in network hashrate did not have a noticeable impact on the price. So even if Iran were completely wiped out by Israel or the United States, which would result in a 7% drop in global hashrate, it would have no impact on Bitcoin.

Risk Two: A Sharp Rise in Energy Prices

The next consideration is what would happen if Iran destroyed major oil and gas fields in retaliation. The Achilles' heel of the overleveraged Western financial system is the shortage of cheap hydrocarbons. Even if Iran could destroy the Israeli state, it would not help prevent war. Israel is just a useful but expendable vassal of Pax Americana. If Iran wanted to strike a blow to the West, it would have to destroy hydrocarbon production and prevent the transit of recipients laden with oil through the Strait of Hormuz.

As oil-scarce countries would use other energy alternatives to power their economies, oil prices would soar, dragging all other energy prices higher. What would happen to the fiat price of Bitcoin?

Bitcoin is energy stored in digital form. Therefore, if energy prices rise, Bitcoin would be worth more relative to fiat currencies. Bitcoin mining profitability would remain the same, as all miners face a parallel rise in energy prices. For some large industrial miners, ensuring energy security may be more challenging as utilities invoke force majeure clauses and cancel contracts at the request of governments. But if hashrate drops, so does mining difficulty, making it easier for new entrants to mine Bitcoin at a profit at higher energy prices. The beauty of our Lord Satoshi’s creation will be on full display.

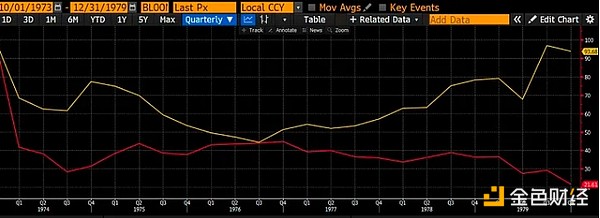

If you want a historical example of the resilience of hard currencies to energy shocks, consider how gold traded from 1973 to 1982. In October 1973, the Arab oil embargo began as retaliation for U.S. support for Israel in the Yom Kippur War. In 1979, Iranian oil supplies were removed from global markets following a revolution that overthrew the Western-backed shah and established the current theocratic regime of Ayotollah.

Spot oil (white) and gold (yellow) prices against the US dollar index of 100. Oil rose 412% and gold almost followed its 380% increase.

This is the price of gold (gold) versus the S&P 500 (red) divided by the price of oil, with the index being 100. Gold bought only 7% less oil, while stocks bought 80% less oil.

Assuming either party removes Middle Eastern hydrocarbons from the market, the Bitcoin blockchain will continue to function and the price will at least maintain its value. Energy, and energy in fiat currency terms will certainly rise.

Let's move on to the final currency issue.

Risk Three: Currency Risk

The key question is how the United States will respond to this conflict. Both political parties are staunch supporters of Israel. The United States supports Israel by providing weapons. Since Israel cannot afford to buy the weapons it needs to wage war against Iran and its proxies, the U.S. government borrows money to pay U.S. arms dealers such as Lockheed Martin to provide ammunition to Israel. Since October 7, 2023, Israel has received $17.9 billion in military aid.

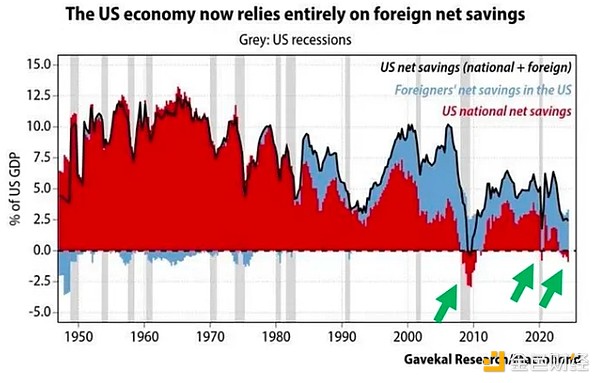

The U.S. government buys goods through credit, not savings. This is the message conveyed by the above chart. In order to provide Israel with free weapons, the bankrupt U.S. government needs to increase borrowing. The question is, who will buy this debt if national savings are negative? The green arrow shows the situation where the U.S. national net savings is negative. Luke Gromen correctly points out that these arrows correspond to the following:

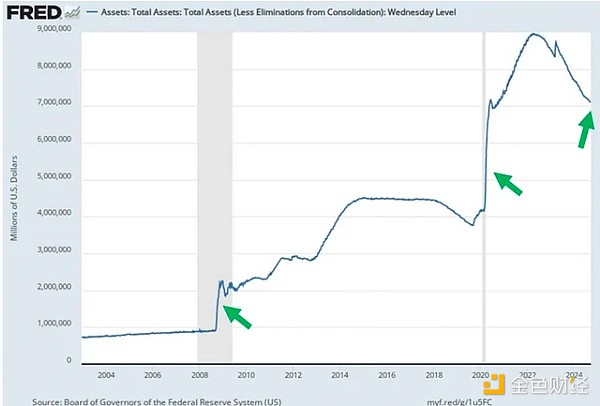

The arrows in the above chart correspond to a sharp increase in the size of the Fed's balance sheet. As the United States plays the role of warlord by supporting Israel's military actions, it must borrow more money. Just like after the 2008 Global Financial Crisis (GFC) and the COVID-19 lockdown, the balance sheet of the Federal Reserve or the commercial banking system will asymptotically rise to buy this increased debt issuance.

How will Bitcoin respond to another sharp increase in the Fed's balance sheet?

This is the price of Bitcoin divided by the price of the Fed's balance sheet, with the Fed's balance sheet indexed at 100. Since its inception, Bitcoin has outperformed the Fed's balance sheet by 25,000%.

We know that war causes inflation. We know that the US government must borrow money to sell bombs to Israel. We know that the Fed and the US commercial banking system will buy up this debt by printing money and expanding their balance sheets. Therefore, we know that Bitcoin will rise sharply in fiat terms as the war intensifies.

What about Iran's military spending? Will China/Russia help Iran's war effort in some way? China is perfectly willing to buy Iranian hydrocarbons, and China and Russia sell Iranian goods; however, none of these deals are on credit. From a cynical perspective, I believe China and Russia will act like cleanup crews. They will publicly condemn the war, but will not take any noteworthy actions to prevent Iran’s destruction.

Israel is not interested in nation-building. Instead, they would be happy if the Iranian regime collapsed due to popular unrest as a result of their attacks.

Chinese and Russian support will not expand the global fiat money supply, if you want to call it that. Therefore, it will not have a noticeable impact on the fiat price of Bitcoin.

Increased conflict in the Middle East will not destroy any of the critical physical infrastructure that supports cryptocurrencies. As energy prices soar, Bitcoin and cryptocurrencies will rise. Hundreds or trillions of newly printed dollars will re-energize the Bitcoin bull market.

Trade with caution

Just because Bitcoin will rise over time doesn’t mean the price won’t fluctuate wildly, or that all shitcoins will share the glory. The name of the game is to size your positions appropriately.

I am prepared for wild mark-to-market pullbacks in any position I hold. I cut those positions significantly when Iran launched its latest wave of missiles into Israel. My position was too large given the unpredictability of how crypto assets will react to heightened hostilities in the short term.

I have not yet instructed Akshat, Maelstrom’s head of investment, to slow or stop the pace at which we are deploying capital into pre-sale token trading. With the idle fiat currency Maelstrom holds, I will stake it on Ethena and make some huge gains while waiting for good entry points into various liquid shitcoins.

As a trader, the worst thing I can do is to trade based on who I think is the "right" side of this war. This will lead to you going bankrupt as both sides of the war will experience financial repression, outright asset confiscation, and destruction. The best thing to do is to keep yourself and your family out of harm's way and then invest your funds in instruments that can outlast the depreciation of fiat currencies and maintain their purchasing power for energy.

Notes

1. I say this because when looking at the IP addresses of miners submitting blocks, China remains one of the largest Bitcoin mining locations.

Catherine

Catherine

Catherine

Catherine Clement

Clement Joy

Joy Aaron

Aaron Jasper

Jasper Kikyo

Kikyo Hui Xin

Hui Xin Jasper

Jasper Aaron

Aaron Clement

Clement