Author: Arthur Hayes, founder of BitMEX; Translator: Deng Tong, Jinse Finance

The USD/JPY exchange rate is the most important macroeconomic indicator. In my last article "Arthur Hayes: Why Yen Weakness Could Push BTC to $1 Million", I wrote that something had to be done to make the yen appreciate. The solution I proposed was that the Federal Reserve (Fed) could exchange an unlimited amount of freshly printed dollars with the Bank of Japan (BOJ) for yen. This would enable the Bank of Japan to provide unlimited dollar firepower to the Ministry of Finance (MOF), which could use these dollars to buy yen in the global foreign exchange market.

While I still believe in the effectiveness of this solution, it looks like the central bank scammers who run the Group of Fools (i.e., the G7) have chosen to convince the market that the interest rate differential between the yen and the dollar, euro, pound, and Canadian dollar will narrow over time. If the market believes this future state, it will buy the yen and sell all other currencies. Mission accomplished!

For this magic to work, the G7 central banks with “higher” policy rates (Fed, European Central Bank “ECB”, Bank of Canada “BOC” and Bank of England “BOE”) had to lower their rates.

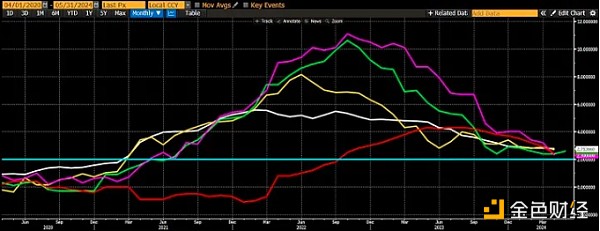

The key thing to note is that the Bank of Japan’s policy rate (green) is 0.1%, while all other countries have 4-5%. The interest rate differential between the domestic and foreign currencies fundamentally drives the exchange rate. The G7 central banks (except the Bank of Japan) all raised rates sharply when inflation was so severe that the elites could no longer ignore the pain and suffering of the common people.

The BoJ can’t raise rates because it owns more than 50% of the Japanese Government Bond (JGB) market. Rate cuts cause JGB prices to surge, making the BoJ look solvent. However, if the BoJ allows rates to rise and its JGB holdings fall, the highly leveraged central bank will suffer catastrophic losses. I did some scary math for readers in Arthur Hayes: Why a Weak Yen Could Push BTC to $1 Million.

That’s why if Bad Gurl Yellen, the G7 helmsman, decides to reduce the spread, the only option is for the central banks with “high” policy rates to lower rates. According to orthodox central bank thinking, if inflation is below target, rate cuts are a good thing. What is the target?

For some reason, I don’t know why, every G7 central bank has an inflation target of 2%, regardless of differences in culture, growth, debt, population, etc. Has the current inflation rate already broken through 2%?

Each colored line represents a different G7 central bank inflation target. The horizontal line is 2%. No G7 government has ever published manipulative and dishonest inflation statistics that are below target. From my technical analysis, it looks like G7 inflation is forming a local bottom in the 2-3% range before exploding higher.

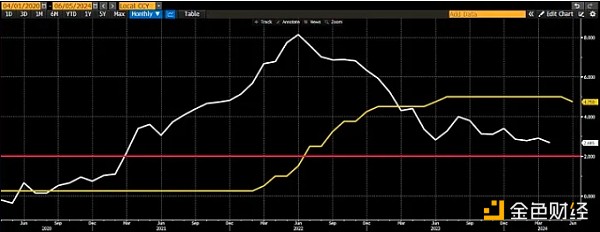

Given this chart, orthodox central bankers would not cut rates to current levels. Yet this week, the Bank of Canada and the European Central Bank cut rates even as inflation was above target. This is odd. Is there financial turmoil that requires cheap money? No.

The Bank of Canada cut its policy rate (yellow) as inflation (white) ran above target (red).

The ECB cuts policy rates (yellow) while inflation (white) is above target (red).

The problem is a weak yen. I believe bad girl Yellen stopped the kabuki show of rate hikes. Now is the time to start working on preserving the US-led global financial system. If the yen doesn't appreciate, US Treasuries will sell off, and if that happens, it will be a game, set and match for the US-led peace.

Next steps

The G7 will meet in a week. The communique released after the meeting will be of great interest to the market. Will they announce some kind of coordinated currency or bond market manipulation to strengthen the yen? Or will they remain silent but agree that everyone except the Bank of Japan should start cutting rates? Stay tuned!

The big question is whether the Fed will start cutting rates as the US presidential election approaches in November. Usually, the Fed does not change direction as the election approaches.

If the Fed cuts rates at their upcoming June meeting and their preferred inflation measure is above target, USD/JPY will fall sharply, which means a stronger yen. I don't think the Fed is ready to cut rates as "Slow Joe Biden" is being blasted in the polls for rising prices. It's understandable that the American civilian population is more concerned about whether the vegetables they eat are more expensive than the cognitive ability of the vegetables they are running for reelection. To be fair, Trump is also a vegetable, as he enjoys watching Shark Week while eating McDonald's fries. I still think a rate cut is political suicide. My base case is for the Fed to keep rates unchanged. On June 13, as these amateurs sit down to their taxpayer-paid dinner, the Fed and the Bank of Japan will hold their June policy meetings. As I have said before, I do not expect any changes in monetary policy from the Fed or the Bank of Japan. The Bank of England will meet shortly after the G7, and while the consensus is that they will keep policy rates unchanged, I think a move to the downside could be a surprise given the rate cuts from the BoE and ECB. The BoE has nothing to lose. The Conservatives are going to lose badly at the next election, so there is no reason to defy the orders of their former colonial rulers in order to control inflation.

Multiple central banks kick off rate cuts

This week, the Bank of Canada and the European Central Bank cut rates to kick off the June central bank governors’ slump that will pull cryptocurrencies out of the northern hemisphere summer doldrums. This is not the base case I expected. I thought the party would start in August, just as the Fed holds its Jackson Hole Symposium. This is typically where sudden policy changes are announced in the fall.

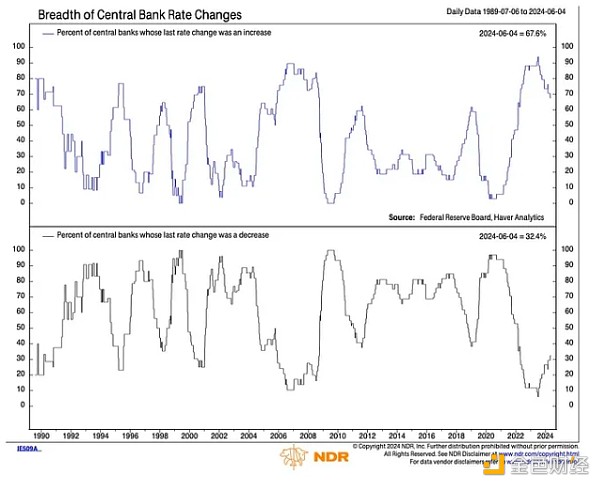

The trend is clear. Fringe central banks are starting easing cycles.

We know how to play this game. This is the same game we have been playing since 2009 when our savior Satoshi gave us the weapons to defeat the TradFi demons.

Go long Bitcoin, then shitcoins.

The macro landscape has changed compared to my baseline. As a result, my strategy will change as well.

For my excess Ethena’s USD (USDe), which is earning some juicy APY, it’s time to deploy it again into staunch shitcoins. Of course, I will tell my readers what they are after I buy them. But suffice it to say that the crypto bull market is reawakening and is about to prick the skin of profligate central bankers.

Xu Lin

Xu Lin

Xu Lin

Xu Lin Bernice

Bernice Miyuki

Miyuki fx168news

fx168news fx168news

fx168news fx168news

fx168news fx168news

fx168news fx168news

fx168news Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph