New Era for US Financial Regulation on the Horizon

A Congressman’s bold move to reshape U.S. financial regulation, targeting SEC leadership and strategy.

Kikyo

Kikyo

At the end of 2024, APX Finance (formerly ApolloX) and the yield agreement Astherus announced a strategic merger, which was the most decisive step in the evolution of Aster. Astherus focuses on maximizing "real returns," bringing two core innovations to the combined entity (perhaps inspired by Ethena): asBNB: A liquid staking derivative of BNB, allowing users to use BNB as trading margin while earning BNB staking rewards. USDF: An interest-bearing stablecoin backed by a delta-neutral strategy designed to generate passive income for holders. This merger gave rise to Aster's signature "Trade & Earn" model. Traders' margin is no longer idle capital, but an interest-bearing asset that can continuously generate income, significantly improving capital efficiency and creating a strong competitive barrier. Aster's strategy extends beyond BNB Chain to multiple major blockchains, including Ethereum, Solana, and Arbitrum. It positions itself as a liquidity aggregator, aiming to address liquidity fragmentation in DeFi by enabling users to trade across different chains without requiring a cross-chain bridge. This resulting rebranding and multi-chain expansion reflects the current fiercely competitive landscape, where the fight for liquidity requires superior interoperability and the courage to directly challenge leading players on other chains. Part II: Deconstructing the Engine: A Technical Deep Dive into Aster's Architecture 2.1 Dual-Mode Architecture: A Binary Approach to Market Segmentation Aster's architectural design cleverly reflects a deep understanding of market segmentation. By offering two distinct trading modes, it aims to capture the entire user spectrum, from professional traders to high-risk retail investors. This is a classic CEX strategy applied to the DEX space.

Professional Mode (order book perpetual contract): This mode utilizes a centralized limit order book (CLOB) mechanism, providing a CEX-like trading environment for experienced traders and institutions. It supports advanced order types, offers deep liquidity from deeply bonded professional market makers, and charges highly competitive fees.

Simple Mode (1001x): This mode leverages the AMM-style ALP liquidity pool, offering a simplified one-click trading experience for retail and thrill-seeking "degen" traders with leverage up to 1001x. It features zero slippage and zero entry fees, but profit caps are implemented to manage the risk of the ALP pool. This dual-mode architecture enables Aster to simultaneously serve two distinct user groups, maximizing its total addressable market (TAM). A trader who gets liquidated due to 1001x leverage in Simple Mode has vastly different needs and behaviors than a trader who meticulously manages risk in Professional Mode. By catering to both user groups, Aster avoids alienating either by narrowly focusing on product positioning. 2.2 Capital Efficiency and “Real Returns”: Technical Implementation of USDF and asBNB Aster’s “trading is mining, holding positions and earning income” model is its “secret sauce”, driven by two innovative assets: USDF and asBNB. This model transforms the opportunity cost of providing margin (a major friction point in DeFi) into a source of income, creating a strong incentive for users to lock up capital within the Aster ecosystem. USDF Stablecoin: USDF is a fully collateralized stablecoin minted 1:1 with assets such as USDT. Its core mechanism is that the underlying collateral is deployed in a delta-neutral trading strategy (for example, holding a long spot position and a short perpetual futures contract) to generate returns, which are then distributed to USDF holders. Technical Explanation: A delta-neutral strategy aims to create a portfolio with zero delta, meaning its value is insensitive to small changes in the underlying asset's price. This is typically achieved by holding a long spot position and an equal amount of short perpetual futures positions. Its returns primarily come from the positive funding rate paid by longs to shorts. asBNB Liquidity Staking: asBNB is a liquidity staking token. Users stake BNB and receive asBNB, which serves as margin for Aster trading while continuing to accrue BNB staking rewards (and potential Launchpool/Megadrop rewards). This allows a single asset to generate multiple income streams simultaneously, greatly improving capital efficiency. In traditional derivatives trading, margin is "dead capital," used solely to secure positions. Astherus' core innovation lies in the creation of interest-bearing collateral. By integrating this mechanism, Aster allows a single unit of capital to simultaneously: a) serve as margin; b) earn staking returns (asBNB); c) earn returns on delta-neutral strategies (USDF); and d) earn airdrop points. This creates an extremely sticky ecosystem, making capital less likely to leave, as leaving would mean forgoing multiple income streams. This directly addresses the "mercenary capital" problem that plagued early DeFi protocols. 2.3 Innovations in Privacy and Fairness: Hidden Orders and MEV-Resistant Mechanisms Aster has integrated an iceberg-like feature at the protocol level to enhance transaction fairness and privacy, addressing two core pain points of on-chain trading: maximum extractable value (MEV) and information leakage. Hidden Orders: Hidden orders are limit orders (similar to iceberg orders) that are completely invisible on the public order book until executed. These orders are submitted directly to the core matching engine, sharing liquidity with visible orders but completely concealing the trader's intentions. Technical Background: This feature acts as an on-chain "dark pool," designed to protect large traders from front-running, sandwich attacks, and malicious liquidation by MEV bots. However, this still falls short of true dark pool trading. Simple Mode's MEV Resistance: Simple Mode is advertised as MEV-resistant. This is likely achieved through a variety of mechanisms, such as frequent oracle price updates from multiple sources (Python, Chainlink, Binance Oracle), and possibly transaction batching or the use of a private mempool, which prevent MEV bots from exploiting price slippage by inserting trades. Part III: The Binance Connection: The "Agent" Valuation Theory 3.1 Tracking Funding: Strategic Investment from YZi Labs Aster has deep ties to the Binance ecosystem, and its funding and development support clearly point to Binance's strategic intentions. Direct Investment: Records show that Binance Labs participated in ApolloX's seed round in June 2022. Subsequently, YZi Labs invested in Astherus in November 2024. Strategic Timing: The investment in Astherus (November 2024) coincided with Hyperliquid's rapid rise and significant threat to Binance's dominance in the derivatives market. This suggests the investment was a strategic and defensive move. Ecosystem Support: This investment went beyond funding; it also included mentorship, technical and marketing resources, and ecosystem exposure, ultimately establishing Aster as the "#1 Perp DEX on BNB Chain."

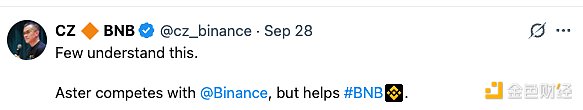

CZ’s public support has injected unparalleled market credibility and attention into Aster. His behavior pattern goes far beyond the ordinary celebrity effect and is more like a well-thought-out strategic signal.

Overt Promotion: CZ has repeatedly posted on Twitter to congratulate Aster on its Token Generation Event (TGE) and promote the project. As analysts have noted, "CZ rarely shares charts," making his promotion of ASTER a significant market signal.

Narrative Construction: CZ's statements, such as highlighting Aster's hidden order feature as a solution to the margin call manipulation issues present in "other on-chain DEXs," directly position Aster as a superior option to competitors like Hyperliquid. He claimed that Aster had become the second-largest holder of BSC-USDT, further expanding the project's potential.

Market Impact: The "CZ Effect" was immediate. Shortly after his initial post, the price of the ASTER token soared over 400%, fueling the narrative that "Aster is Binance's weapon against Hyperliquid."

Aster's API structure design reveals a consistent strategic intent with Binance CEX.

Structural Similarity: The structure and naming conventions of the API documentation in the official GitHub repository (asterdex/api-docs) are highly indicative. Its documentation is divided into aster-finance-futures-api.md and aster-finance-spot-api.md, which mirrors the API structure of CEXs like Binance, which are similarly divided into modules such as spot, futures, and leverage.

Implications for Market Makers: This standardized, CEX-like API structure is no coincidence. It is designed to significantly reduce the onboarding friction for professional market makers and algorithmic trading firms already integrated with Binance. By providing a familiar API, Aster encourages these key liquidity providers to connect to its ecosystem with minimal development overhead. This demonstrates a strategy to bootstrap liquidity from Binance's existing network of professional traders. 3.4 New Valuation Framework: Viewing Aster as a Function of Binance's Market Cap The combined evidence—direct investment, strategic timing, consistent public outreach by the founders, deep ecosystem integration, and a familiar API structure—supports Aster's role as a strategic proxy for Binance. Valuing Aster equivalent to Hyperliquid is a classification error. Hyperliquid's value stems from its independent L1 technology and protocol revenue. Aster's value, on the other hand, is comprised of its protocol revenue plus the significant strategic premium derived from being a native extension of Binance DeFi. Its valuation should be viewed as a parameter of Binance's market cap, reflecting its importance in defending Binance's market share and expanding the Binance ecosystem into the on-chain world. Aster is a key component of Binance's post-compliance defense strategy. It allowed the Binance ecosystem to aggressively compete in the on-chain derivatives space while creating a crucial regulatory barrier between heavily scrutinized CEXs and "decentralized" protocols. Following a 2024 settlement with US authorities, Binance faced intense regulatory oversight, and CZ himself was barred from holding an executive position at a CEX. Meanwhile, the rise of on-chain perpetual swaps, led by Hyperliquid, posed an existential threat by attracting the most sophisticated and DeFi-native traders. Binance couldn't directly launch its own "Binance Perpetual DEX" without incurring immediate and overwhelming regulatory action. The solution was to operate through a proxy. YZi Labs, CZ's family office, provided the perfect vehicle for investment and guidance, while also offering plausible deniability. Aster, built on BNB Chain, directly benefits from Binance's core Layer 1. Designed to feel and function like Binance (API, UI), it offers a frictionless onramp for Binance's existing user base and market makers. Aster thus strategically plays a role in “regulatory arbitrage.” It projects Binance’s power and liquidity into the DeFi space without expanding Binance’s formal regulatory boundaries. The most telling metric is the ratio of trading volume to total value locked (TVL) and open interest (OI). At its peak, Aster's 24-hour trading volume reached a staggering $36 billion to $70 billion, while its OI was only $1.25 billion, resulting in a volume-to-TVL ratio of approximately 19, indicating "extremely aggressive wash trading." The surge in trading volume is clearly linked to Aster's aggressive airdrop points program ("RH Points"), which rewards trading volume, holding time, and profit and loss. 4.2 A Necessary Evil? The Strategic Logic of Guiding Liquidity This artificially generated trading volume is a necessary but temporary measure. The logic is a classic guide flywheel: No volume, no attention: A new DEX without trading volume is like a ghost town, unable to attract liquidity. Incentivizing Volume Generation: Airdrops create strong incentives for users to generate large, but artificial, trading volume. Attracting Market Makers: This high volume, even if artificial, makes the platform appear highly active. This is crucial for attracting professional market makers seeking a high-traffic venue to deploy their strategies. Bringing Real Liquidity Onboard: With the onboarding of market makers, they provide deep, real liquidity and tighten spreads. Attracting Real Traders: The combination of deep liquidity, low fees, and a good user experience ultimately attracts organic, non-incentive-driven traders. By topping the trading volume rankings on data platforms, Aster forced its way into the market and accelerated its path to market acceptance. This was a shrewd calculation: 320 million $aster (4% of supply) was used as a Stage 2 incentive, and approximately $600 million in forward token incentives were used to maintain a $3 billion market capitalization (15 billion FDV). 4.3 Future Debt: Assessing Long-Term Consequences The primary consequence of this strategy was the "future debt" created by the massive airdrop allocation (53.5% of the total supply). This created a significant amount of token overhang, which would be distributed to mining users, who have a high propensity to sell, generating sustained selling pressure. To mitigate this "debt," the protocol designed an extremely long vesting schedule. The TGE unlocked 8.8% (704 million ASTER), with the remaining airdrop allocation to be released linearly over 80 months. This long-term vesting is a key mechanism designed to mitigate the impact of selling pressure by spreading it out over a long period of time. While strategically effective, overt wash trading has led to labels like "Hyperliquid's Temu" and raised concerns about market manipulation. The key challenge lies in successfully transitioning from artificial incentive-driven trading volume to sustainable organic activity before rewards dry up and mining users depart. The massive airdrop and the resulting wash trading volume represent a calculated, high-stakes gamble that leverages game theory to address the cold start problem of DEX liquidity. Aster's incentive approach, similar to Dydx, targets not only liquidity providers but also traders and market makers. By rewarding raw trading volume, it creates the appearance of a highly active and liquid market. This public signal (dominant on the DeFiLlama chart) is designed to attract the true drivers of liquidity: professional market-making firms. The "future debt" of the airdrop represents the cost of this marketing campaign. The bet is that by the time the debt matures (i.e., when the tokens are fully distributed), the platform will have attracted sufficient real liquidity and organic trading flow ("externalities") to absorb the selling pressure. This is a race against time, so the high-profile approach is driven by both the situation and the model. Part V: Challenges to Aster's Financial Stability 5.1 Challenge 1: User Retention in the "Post-Incentive Era" Current trading volume driven by airdrop expectations is unsustainable. Once rewards are reduced or terminated, Aster's biggest challenge will be retaining users, market makers, and liquidity. DeFi history is replete with examples of rapid declines due to incentive exhaustion. Aster's key to success lies in leveraging its unique product advantages—such as the high capital efficiency of interest-bearing asset collateralization, the hidden order feature that protects large investors, and its dual-mode design that serves both professional and retail users—to successfully transform incentive-driven "airdrop hunters" into loyal users who truly recognize the product's value. This is a race against time. The protocol must establish a healthy ecosystem driven by real revenue and organic demand before the "future debt" (i.e., the selling pressure from airdrops) matures. This raises the philosophical question of which comes first, trading or liquidity? Token incentives are two-way. When prices are high, high incentives outweigh the costs, attracting many market makers, studios, and traders to contribute transaction fees, increase trading volume, and achieve "discounted coin purchases." However, as more and more incentive tokens are created, the market's circulating supply will increase. Whether fee income can maintain, or even increase, token prices becomes a question mark. When incentives are reduced, fee income decreases, trading volume falls, token prices further decrease, and incentives further decrease. This cycle repeats, and it won't be long before the platform falls into a negative cycle. The core of an exchange is liquidity (especially when copying CEX algorithms under the Clob model)—and this requires attracting deep participation from multiple market makers. However, judging by Aster's current incentive mechanism, it seems neither the means nor the purpose are there to align their interests. Hyperliquid understands this principle well, and not only is it firmly aligning the interests of various market makers through aspects such as APIs, revenue, and even validator nodes, but also achieving a sustainable profit scenario beyond just revenue is the goal of a DEX.

To add a point, Hyperliquid is essentially a "liquidity hub" disguised as PerpDex—to put it bluntly, with this liquidity architecture, what can't be done?

Starting with transaction data, and looking beyond it, we can understand that DEX and tokens are infrastructure that prioritizes liquidity, followed by trading. In this construction process, tokens are first a token of commitment, then a reward.

High leverage and high open interest are the sword of Damocles hanging over all derivatives exchanges, and some of Aster's mechanism designs may have exacerbated these risks. The inherent fragility of the ALP model: In a simple model, the ALP pool acts as the counterparty to all traders, meaning that if traders as a group consistently profit, LPs face significant losses. Furthermore, the model relies entirely on external oracles for pricing; any oracle delays or manipulation could have disastrous consequences for the pool. The specter of cascading liquidations and automatic deleveraging: When large-scale, one-way "crowded trades" occur in the market (especially for small-cap, highly controlled altcoins), a single sharp price fluctuation could trigger cascading liquidations. Lacking a public and sufficient insurance fund mechanism, Aster relies on automatic deleveraging (ADL) as a last resort in extreme situations. The ADL mechanism forcibly liquidates profitable users' opposing positions to offset system losses. While this maintains the protocol's solvency, it's extremely unfair to profitable users. Once triggered, it could lead to a massive crisis of confidence and capital flight, resulting in a "bank run." The Manipulation Endgame of Small-Cap Altcoins: Due to position transparency and insufficient liquidity, incidents similar to Jelly are highly likely to occur again, especially for platforms that rely heavily on dedicated market makers (with the exception of Aster, which have limited depth), potentially leaving them unable to cope. When the price breaks through the depth of the order book, a liquidity vacuum emerges, and users are faced with a free fall. CEX algorithms can't reach the same level as DEXs: CEX contract algorithms (especially funding rates, margin ratios, leverage-based position openings, liquidation processes, etc.) are designed based on the exchange's own conditions (such as MM, liquidity, and even insurance funds). Aster's current mechanisms and liquidity clearly don't meet these "preconditions." 5.3 Challenge Three: Trust Deficit Under the Decentralized Narrative: The Sword of Concentration: 96% of Token Supply: On-chain data shows that approximately six wallets control 96% of the total $ASTER supply. This extremely centralized ownership structure renders its "community-first" narrative weak and poses significant systemic risks, including potential threats of price manipulation and governance capture. A terrifying boomerang: When the price of a coin cannot be sustained, community backlash could target the founders and their ambassadors. Even the slightest hint of negative sentiment can be amplified. Conclusion: Giant Agents at a Crossroads. Aster's story epitomizes the complexities of the current stage of DeFi development: it is both a protocol innovative in capital efficiency and product design, and a strategic pawn driven by centralized giants intent on reshaping the market. Its past life was a clear evolution from pragmatism to innovation; its present life is a grand extravaganza driven by capital and incentives. However, its future is fraught with uncertainty. After the false prosperity created by wash trading fades, Aster must prove to the market that it can retain users through genuine product value and effectively manage its inherent systemic risks and trust deficit. Whether it can successfully transition from an incentive-based ecosystem to a platform driven by real revenue and organic demand will be crucial to its ultimate success or failure. Aster's future trajectory hinges on its ability to convert artificially generated momentum into sustainable organic growth before its "future debt" matures. However, as a derivative of the Binance ecosystem, Aster still has many untapped avenues. For example, the ability to mechanically bind to market makers (Aster Chain) or become an alpha outpost for Binance Futures will be very interesting. There are no perfect solutions in development, only the courage and tenacity to learn to coexist with problems. We look forward to Aster's subsequent moves.

A Congressman’s bold move to reshape U.S. financial regulation, targeting SEC leadership and strategy.

Kikyo

KikyoNFPrompt merges AI and NFTs, introducing a unique token ecosystem and sustainable roadmap.

Brian

BrianCardano ADA is on the brink of a significant milestone, with debates circulating about its potential to hit the $1 mark. The anticipation surrounding this benchmark has piqued the interest of investors and analysts, acknowledging the psychological impact such an achievement could have on ADA's trajectory.

Joy

JoyLeverFi's new BRC20 Launchpad, LeverPro, signifies a major step in decentralized finance, offering innovative trading features and robust security, with a promising roadmap for 2024 focused on DeFi development and token integration.

Brian

BrianxPet.Tech combines virtual pets with blockchain for interactive gaming, trading, and community engagement on the Arbitrum chain.

Alex

AlexA Trailblazer in Gaming and AI In essence, Sleepless AI stands as a pioneering force in the confluence of AI, gaming, and blockchain. Its success hinges on the execution of its vision and its ability to stand out in the AI and blockchain technology arena. For enthusiasts at the intersection of these fields, Sleepless AI is a venture to observe in the forthcoming years.

Alex

AlexGBA Capital Fund announces over $10 billion investment in Web3, focusing on Metaverse, NFTs, and RWAs.

Alex

AlexRekt Builder's investigation reveals Ledger Live's covert user activity tracking, raising serious privacy concerns for Ledger hardware wallet users.

Kikyo

KikyoBitcoin Ordinals' website experiences its first DDoS attack amidst ongoing debate about its impact on the Bitcoin network.

Brian

BrianPrior to this consultation, the HKMA had issued a Discussion Paper on Crypto-assets and Stablecoins in January 2022, inviting feedback from various stakeholders.

Davin

Davin