Deng Tong, Jinse Finance

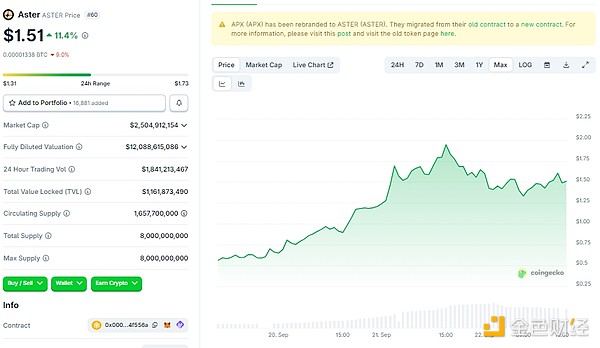

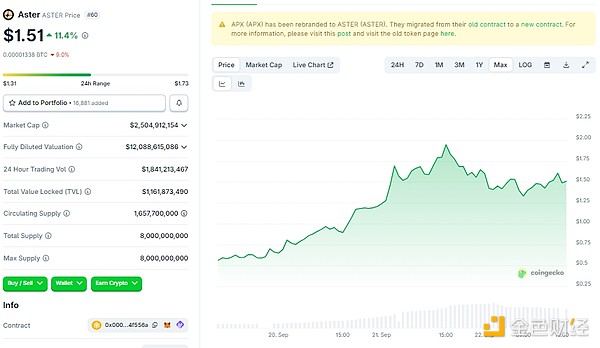

Since its launch, Aster's price has skyrocketed in just a few days. Based on its opening price of $0.025 and its high of $1.94, Aster has risen 7660%, currently trading at $1.51 as of press time.

What is the history of Aster? Are there any other noteworthy on-chain contract DEXs?

I. Aster's History

Aster was first launched in 2021 as ApolloX. ApolloX specializes in DeFi derivatives trading services and once held a key position in the BNB Chain ecosystem. ApolloX attracted numerous users through ultra-high leverage. On the ApolloX platform, users can access up to 100x leverage, catering to investors with varying risk appetites. However, on June 8, 2022, ApolloX suffered a serious attack. An attacker exploited a flaw in the ApolloX signature system, generating 255 signatures and withdrawing approximately $1.6 million worth of APX from the contract. Since then, ApolloX has experienced significant user churn and a significant decline in trading activity. In 2023, ApolloX V2 was released, increasing maximum leverage to 250x. Under specific DeFi modes, leverage can reach as high as 1001x, while offering zero slippage and zero opening fees, providing an option for users seeking the ultimate trading experience. In November 2024, Binance Labs announced an investment in Astherus, a multi-asset liquidity hub. Astherus is dedicated to providing real-yield maximization solutions for crypto assets. Astherus' flagship product, AstherusEarn, combines institutional-grade security with high-yield strategies across multiple blockchains and protocols. At the end of 2024, ApolloX merged with Astherus and was renamed ASTER. Market rumors suggest that ASTER will become one of Binance's new spot trading platforms on October 1st. If confirmed, ASTER will have the opportunity to deeply engage with Binance and its 280 million users. ASTER is currently available for perpetual futures trading on most major exchanges and has processed billions of dollars in daily trading volume since its launch on September 17th. However, the Aster team wallet currently holds 95.77% of all Aster tokens, sparking market concerns about ASTER's future price trends. 2. What other on-chain contract DEXs are worth watching? On-chain contract DEXs specifically refer to DEXs that leverage on-chain smart contracts to implement the entire process, including transaction matching, asset settlement, and margin management. Their core feature is "full on-chain transaction logic"—from user order placement and order matching to fund transfers, all are automatically executed through smart contracts on the blockchain, without relying on any off-chain servers or centralized intermediaries. All transaction records are viewable in real time on blockchain browsers, providing extremely high transparency.

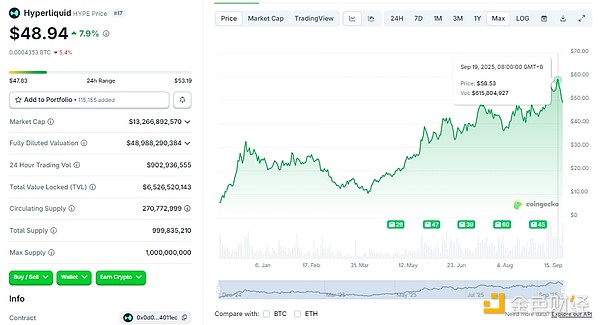

1. Hyperliquid

Hyperliquid is a high-performance DeFi platform focused on providing a fully on-chain order book trading experience. Its core product is a decentralized perpetual futures and spot trading platform, running on Hyperliquid L1, its proprietary Layer 1 blockchain. Hyperliquid is a next-generation order book Perp DEX, utilizing a fully on-chain order book and instant settlement technology. This allows for extremely fast transaction confirmation times, providing users with a trading experience comparable to centralized exchanges.

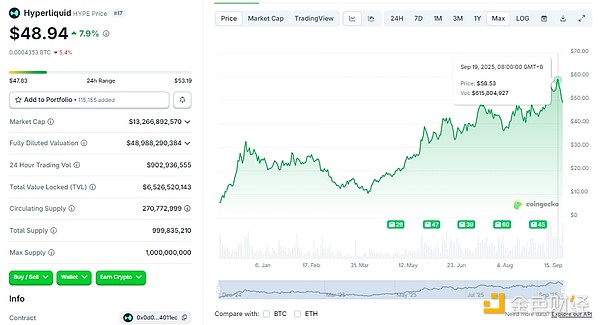

Since its launch in 2023, Hyperliquid has been recognized as a CEX killer in just two years. Hyperliquid's market share has recently risen rapidly, reaching a 6.9% share in August. Its trading volume for the entire month reached $21.4 billion, a 129.3% increase from July, placing it firmly at the top of the growth charts. Hyperliquid currently ranks sixth among derivatives exchanges. After the November 2024 TGE, the price of HYPE soared from $3.9 to $27, reaching a peak of $35.2. On September 19th of this year, HYPE reached an all-time high of $58.53. As of press time, it is trading at $48.94.

For more details, please refer to the Jinse Finance article "Is Hyperliquid the CEX Killer? CEXs are starting to take the fight."

2. dYdX

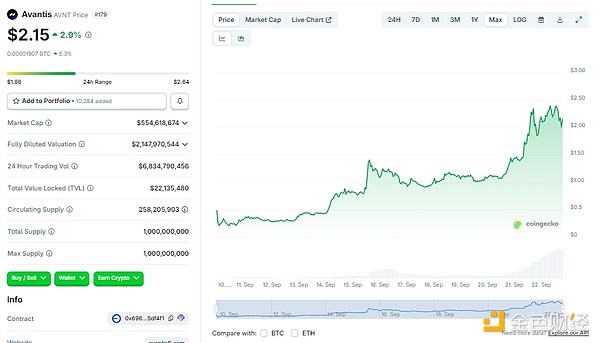

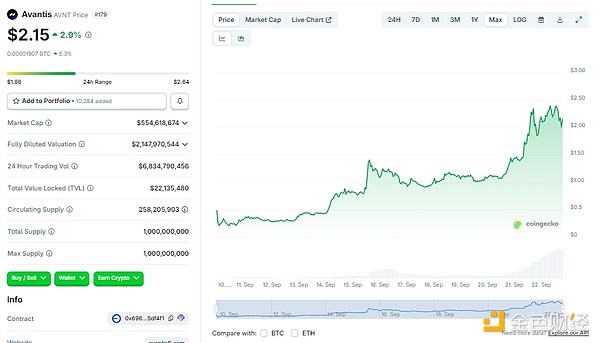

In 2017, software engineer Antonio Juliano founded dYdX. dYdX is the first decentralized futures exchange to launch a viable product. An order-book DEX, dYdX allows traders to conduct peer-to-peer transactions through a three-way game between market makers and long and short traders. Built on the Cosmos SDK and CometBFT consensus, it operates as an independent Layer 1 blockchain with a decentralized order book and matching engine. This architecture ensures high scalability, low latency, and full transparency for traders. dYdX currently ranks 48th on the "Top Derivatives Exchanges by Open Interest and Volume" list, with a 24-hour trading volume of $192 million. Since breaking through $4 in May 2024, dYdX has struggled to surpass its all-time high, trading at $0.63 at press time. 3. Orderly Network Jointly incubated and launched by NEAR and WOO Network in April 2022, the Orderly Network completes the asset trading process through a three-layer architecture consisting of an asset layer, an engine layer, and a settlement layer. According to a chart published by unfolded., over the past 30 days, the Orderly chain has processed more perpetual contract transactions than the Arbitrum chain. Orderly's token, ORDER, once peaked at over $0.35 and, as of press time, is trading at $0.2665. 4. KiloEx KiloEx is a decentralized exchange (DEX) built on the Binance Coin (BNB) blockchain, incubated and invested in by Binance Labs. Supported assets include cryptocurrencies, forex, and stocks. On March 27th of this year, Binance announced that KiloEx (KILO) would hold an exclusive TGE event on Binance Wallet. On the 28th, KILO surpassed $0.12 and, as of press time, was trading at $0.043. 5. Avantis In February 2024, the Avantis mainnet launched and has become the largest derivatives exchange on Base. Users can trade cryptocurrencies and real-world assets with up to 100x leverage and earn income by providing USDC liquidity as a market maker. AVNT has continued its recent upward trend, trading at $2.15 as of press time.

6. Lighter

Lighter was first launched on Arbitrum in 2023 as a spot DEX. Its founder and CEO is Vladimir Novakovski. In March 2024, Lighter transitioned to a zksync layer 3 DEX. In November of the same year, it further transitioned to a ZK Perp DEX, built on zk-rollup.

Lighter introduced scalable, secure, transparent, non-custodial, and verifiable order book trading infrastructure to the Ethereum ecosystem. As an application-specific zk-rollup, Lighter utilizes advanced cryptography and data structures. Its verifiable matching engine significantly improves the security and fairness of order book trading, ensuring scalable and efficient market price discovery. As such, Lighter lays the foundation for the creation of new, high-performance, and secure digital trading platforms. Within its protocol, Lighter features a native market-making vault (LLP), similar to Hyperliquid's HLP. LLP allows retail investors to contribute funds to a public pool managed by professional traders, who then share profits based on their contributions. Currently, this is also fee-free. 7. StandX StandX is a DeFi project running on Solana, with a team hailing from Binance. StandX CEO AG is the head of Binance Futures, and Justin is the former Director of Binance Futures, focusing on the development of a perpetual contract exchange and the DUSD stablecoin. DUSD is StandX's self-yielding stablecoin, generating returns from StandX's staked assets and funding rates in the derivatives market. In the future, it can also be used as margin on StandX's perpetual contract trading platform, allowing users to enjoy annualized returns while trading.

Anais

Anais