Author: Jack Inabinet, Bankless; Translator: Deng Tong, Golden Finance

The most anticipated airdrop of all time is (almost) here: EIGEN claims open on May 10th!

EigenLayer’s first “staking airdrop” will distribute 5% of the total EIGEN supply to stakers, with a minimum of 10 EIGEN per person, regardless of how much they stake, with a snapshot date of March 15th.

While the majority of these tokens will be claimed next Friday, 10% of the allocation is reserved and will be distributed to users who have “complex interactions” with EigenLayer via Liquidity Restaking Tokens (LRT). It will be distributed approximately one month after the protocol solicits further feedback from ecosystem participants on potential distributions.

Eligible recipients (i.e. anyone who participated by staking directly through EigenLayer or by re-staking tokens through liquidity) can check their Phase 1, Season 1 allocations through EigenLayer’s official claim portal within two weeks.

Unfortunately, EigenLayer is blocking participants from a large number of countries (including the United States and Canada) from claiming this airdrop, and restricting access via VPNs and other IP proxy technology, which means that if you are an investor from these countries, you will have to arrange to travel abroad.

The remaining 10% of the total EIGEN supply that was not distributed in Season 1 will be distributed to users in subsequent distributions, which will take into account not only future actions, but also the user’s entire history of interaction with EigenLayer.

Re-stakers who joined early, participated longer, and maintained their stake received larger allocations, as did local re-stakers who helped support network resilience and decentralization; future distributions may adopt a similar weighting system.

While a small allocation of EIGEN was reserved for Goerli testnet participants who were inconvenienced by the shutdown of the on-chain EigenLayer deployment, the protocol indicates that Holesky testnet participants will not receive airdrops in future distributions.

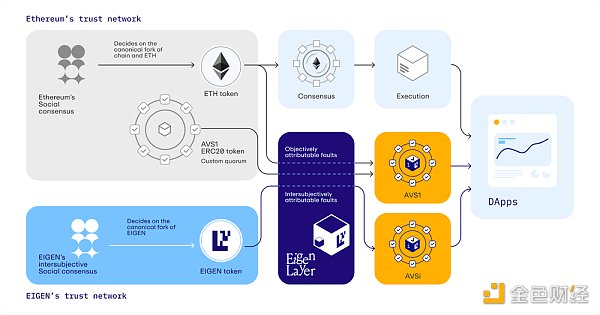

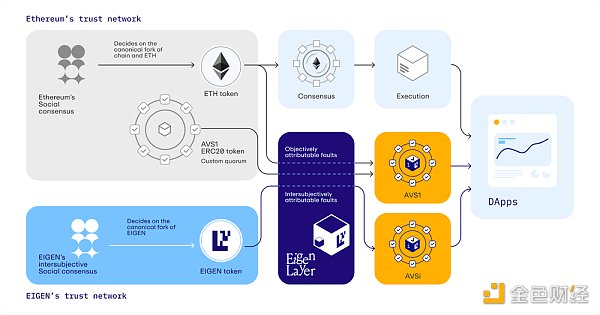

Upon launch, the EIGEN token will be imbued with intrinsic utility, enabling recipients to stake their tokens to secure the EigenDA network. Additionally, if other Active Validation Services (AVS) choose to accept EIGEN and other tokens as eligible collateral to secure their networks, then EIGEN staking has the potential for further integration.

At the heart of the EIGEN token will be a governance mechanism that facilitates “inter-subject forks,” which allows token holders to challenge incorrect slashing behavior that cannot be objectively identified on-chain, but for which rational observers would agree to be punished.

This process allows EigenLayer applications to fork themselves at the token level, allowing control of assets inside the protocol smart contracts to be transferred without involving Ethereum’s social consensus.

To create a fork in response to an improper slashing event, a challenger must pledge a "significant portion" of their EIGEN tokens as a bond; EigenLayer's social consensus will vote on whether the fork is legal.

If the proposed fork is validated, the challenger will recover their bond and receive a challenger reward, while tokens belonging to voters who voted against the fork will be penalized. Alternatively, if the consensus votes against the fork, the challenger's tokens will be burned.

While EIGEN will be available for claiming next Friday and will come with some form of utility and staking at launch, the token will be locked for an initial "non-transferable period" until the token fork is enabled, meaning recipients will not be able to sell their tokens indefinitely.

In addition, the Eigen Foundation claims that the creation or trading of EIGEN derivatives will be detrimental to the community and warns that participation in such activities will affect eligibility for future EIGEN airdrop seasons.

At launch, EIGEN will have a supply of 1,673,646,668.28466 tokens, a number derived by encoding the phrase "Open Innovation" onto a classic telephone keypad.

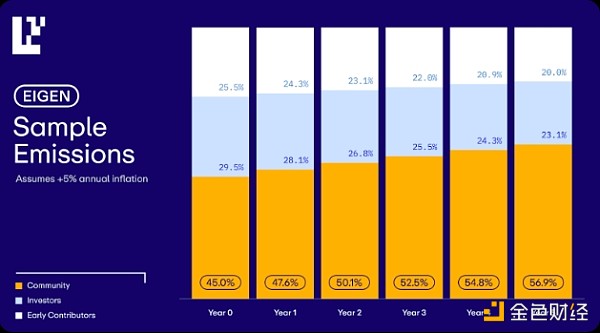

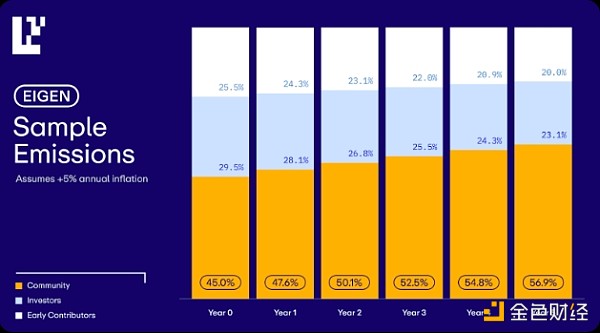

In addition to the 15% of the total supply designated for staking, 30% of the initial token supply is reserved to fund EigenLayer development and included in the community allocation, split 50/50 between the Eigen Foundation and direct community control.

Private investors in EigenLayer will receive 29.5% of the EIGEN supply, and the core team will receive the remaining 25.5%, both with a one-year lockup period, followed by a linear unlock of 4% of the total allocation per month over the next two years.

In order to maintain ongoing deposits, EigenLayer anticipates the need to adopt inflationary token economics in the future; giving control of these allocations to the community, allowing them to decide how to best distribute them among the different stakeholder groups of EigenLayer.

ZeZheng

ZeZheng