Author: David Hoffman Source: bankless Translation: Shan Ouba, Golden Finance

EIGEN's airdrop has sparked a discussion about the gap between private and public markets. The trend of airdrops based on points, large private rounds of financing, and high FDV is creating structural problems for the crypto industry.

Turning a points program into a multi-billion dollar token with extremely low circulation is not a stable equilibrium, yetwe still find ourselves trapped by this trend due to a combination of factors: excess venture capital, a lack of new players, and heavy-handed regulators.

The narrative around how tokens are issued is constantly changing, and here are the major eras we’ve seen:

2013: The Proof-of-Work (PoW) Fork and Fair Launch “Metaverse”

2017: The Initial Coin Offering (ICO) “Metaverse”

2020: The Liquidity Mining Era (Summer of DeFi)

2021: NFT Minting

2024: The Points and Airdrops “Metaverse”

Each new token distribution mechanism brings advantages, but also disadvantages. Unfortunately, this particular “metaverse” starts from a structural retail disadvantage, which is the inevitable result of the regulators’ heavy oversight of the industry.

VC Abundance vs. Retail Investor Dilemma

Currently, the cryptocurrency industry is awash with excess VC money. Although 2023 was a bad year for VC fundraising, there is still a lot of money left from the 2021 financing, and in general, raising funds from venture capital firms in the cryptocurrency industry has been an ongoing activity.

Currently, a large number of well-funded VCs are still willing to continue to lead financing rounds with valuations of billions of dollars, which means that cryptocurrency startups can stay private for longer. Of course, this makes sense, because if tokens are currently being issued at multiples of their last funding, then even late-stage VCs can find suitable investment opportunities.

The problem is that when a startup issues a public token at a price of $1-10 billion, most of the potential gains have already been mined by early adopters, that is, no one will get rich overnight by buying a $10 billion token.

By structurally weakening public market capital, the overall atmosphere of the crypto industry is deteriorating.

People want to get rich with their online friends and build strong online communities and friendships around this activity. This is the promise of cryptocurrency, but it has not been fulfilled so far.

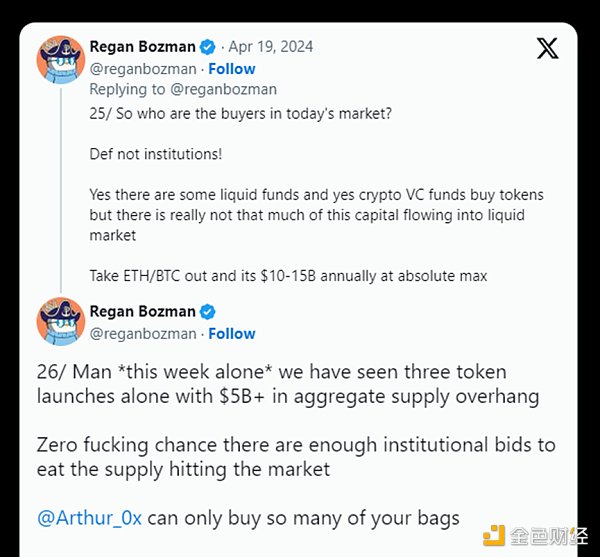

Massive unlocking, weak new entrants

Here are some data points worth thinking about:

Vance's estimates show that venture capital unlocking will bring $200-300 billion in selling pressure in 2024 and 2025

Coinbase's second quarter report further proves that new market participants do not exist, at least in small quantities

Without a slew of new entrants this cycle, VC money far outstrips demand for returns

With retail investors primarily holding non-mainstream crypto assets, institutional liquidity flowing in through Bitcoin ETFs will not drive up quotes in these markets. The circulation of funds from crypto native holders dumping their $14k purchases on Larry Fink may temporarily support these assets, but these are just internal funds from gamers who are well versed in unlocking operations and circumventing them.

SEC Impact

By limiting the ability of startups to raise funds and issue tokens more freely, the SEC is encouraging capital to flow to private markets where regulatory restrictions are less restrictive.

The corrupt and overbearing nature of the SEC’s token regulation is undermining the value of public market capital as startups cannot exchange tokens for public market capital without triggering a massive panic among their legal teams.

Crypto’s Path to Compliance

As they evolve, cryptocurrencies gradually become more compliant.

When I first got into crypto during the ICO craze in 2017, ICOs were touted as a way to democratize investment and access to capital. ICOs certainly turned into a scam that was exploited, but it was still a story that attracted me and many others to the cryptocurrency industry and its potential. However, the ICO model ended when regulators viewed ICO transactions as clear unregistered securities sales.

Then the industry turned to liquidity mining, which went through a similar process.

With each cycle, cryptocurrencies find ways to obfuscate their methods of issuing tokens to the public, and with each cycle, it becomes more difficult to hide this process - a process that is critical to the decentralization of projects and the nature of our industry.

This cycle faces the most intense regulatory scrutiny we have ever seen, and as a result, the legal teams of venture-backed startups face the greatest compliance challenge in the industry's history: issuing tokens to the public without being sued by regulators.

Public-private imbalance and regulatory dilemma

The cryptocurrency industry is suffering from tremendous pressure from regulation, forcing startups to rely more on venture capital rather than public market financing. This compliance cost tilts the market's balance heavily toward the private market.

Ideally, the balance between public and private market financing depends on the strength of regulation:

If there is no investor suitability system, the public and private markets will be more balanced.

If token issuance had a clear and compliant path, the difference between public and private markets would be narrowed.

If the SEC stopped its regulatory battle against cryptocurrencies, we would have a more fair and orderly market.

Because the SEC refused to provide clear regulatory guidance, we ended up in a complex and confusing "points" model that made everyone unhappy.

The Disadvantages of "Points"

The "points" system is extremely opaque to retail investors. Due to the rigor and corruption of regulators, if the project party clearly stated the nature of the points (i.e. the right to obtain tokens), it might violate securities regulations.

"Points" also do not provide any investor protection, because the premise of providing such protection is the legitimacy of regulation.

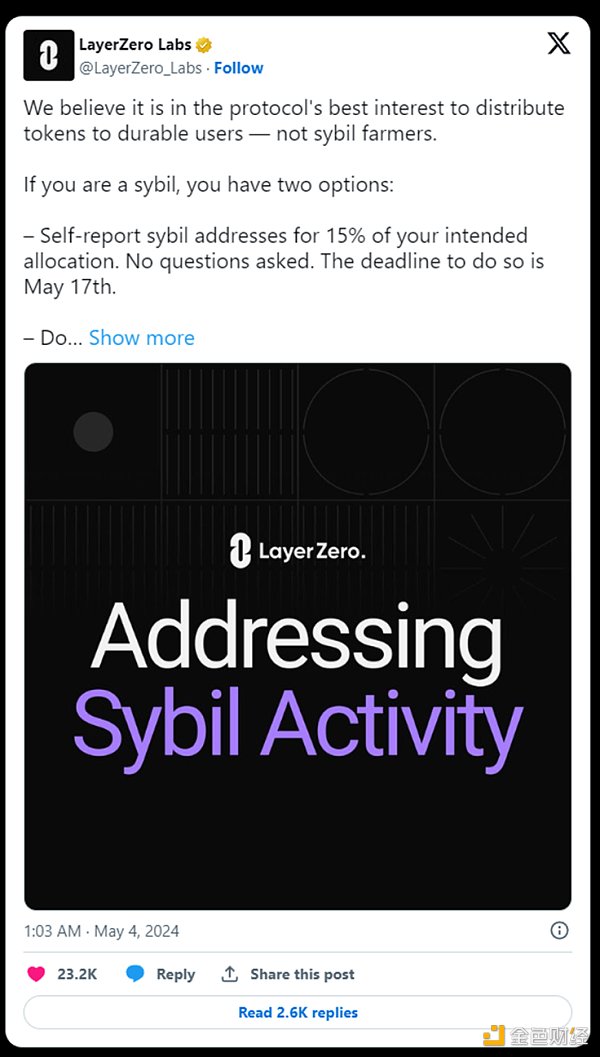

In a bad regulatory environment, we are caught in the debate of Sybil attacks vs. community governance, and projects such as LayerZero are facing a dilemma.

LayerZero recently announced a plan to encourage Sybil attackers to self-report by airdropping Sybil tokens. This incident prompted Kain Warwick to post a post defending the Sybil group, arguing that they have made significant contributions by significantly improving LayerZero's relevant data indicators and market position.

However, in reality, there is no clear boundary between community members and Sybil attackers. Since ordinary cryptocurrency participants cannot enter the private market, the only way for them to gain token exposure is to actively participate in the activities of the platform they are optimistic about.

Since the current mainstream token issuance method excludes retail investors from participating in early financing, users are forced to obtain the tokens of the optimistic project through Sybil. Therefore, unlike the LINK airdrop in 2020 or the SOL airdrop in 2023, this cycle did not see the phenomenon of the community joining hands to get rich. The current token issuance method hinders the community's opportunity to gain early exposure when the project valuation is low.

In response, Twitter mob attacks on airdrop projects have become more and more common. This is also the inevitable result of the community's inability to express its reasonable demands as a stakeholder in the project, reminiscent of the slogan "No representation, no taxation!"

To make matters worse, some profit-seeking funds are taking advantage of the system to make profits by swiping tokens and then selling them. Since retail investors cannot participate in early investment in projects, these investors with highly aligned interests have to compete with malicious swipers for airdrops, with no clear distinction between the two.

Unstable Balance

The “points airdrop” model has become too obvious to be sustainable. Regulators and malicious operators will target it and try to profit from it.

We must turn to a different strategy, one that more carefully benefits early community stakeholders without incurring the wrath of regulators. Unfortunately, without special regulations for token issuance from regulators, this will be just an unattainable dream.

The era of “points airdrop” is over, and we look forward to new ways of issuing tokens.

Sanya

Sanya

Sanya

Sanya Joy

Joy Kikyo

Kikyo Alex

Alex TheBlock

TheBlock Catherine

Catherine Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph