Author: Nick Shaheen Source: Bankless Translation: Shan Ouba, Golden Finance

For a long time, the mainstream narrative of cryptocurrency has revolved around speculation, price volatility, and regulatory difficulties. But under the shadow of these hypes and fears, real changes are happening: cryptocurrencies are quietly solving one of the world's biggest financial problems - the difficulty of accessing financial services.

More than 1.4 billion people in the world do not have bank accounts. It's not because they don't want to, but because where they live, financial infrastructure is a privilege rather than a universal existence. They face corrupt financial institutions, outrageous remittance fees, unstable currencies, and even outright financial censorship. In many emerging markets, the traditional banking system not only does not help people, but is against them.

This is where cryptocurrency comes into play. The value of cryptocurrency is not just in the ETF narrative or the Federal Reserve meeting, but in the real world, people really need a permissionless, borderless, and censorship-resistant financial alternative. What they need is “de-banking.”

Lebanon, Nigeria, and Turkey: The Collapse of Banking Systems and the Rise of Cryptocurrencies

Lebanon and Turkey present two equally compelling stablecoin use cases.

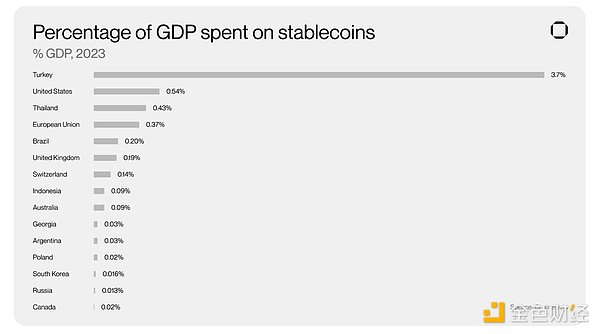

Turkey’s chronic currency devaluation has led to one of the highest stablecoin trading as a percentage of GDP in the world (3.7%).

Many Turkish citizens have adopted USDT as their primary store of value, rather than the Turkish Lira (TRY). Key trends include:

• 57% of Turkish stablecoin users have increased their usage over the past year, and 72% expect it to increase in the future.

• Exchanging stablecoins for dollars is the most common use, followed by cross-border payments, purchasing goods, and receiving wages in USDT.

• Ethereum is the most used blockchain by Turkish users, followed by Binance Smart Chain, Solana, and TRON.

• USDT dominates the market due to its trust, liquidity, and long-term stability.

The Turkish government’s attitude towards cryptocurrencies has fluctuated between restriction and acceptance, and capital controls have made it difficult for people to obtain US dollars through traditional banking channels. As a result, USDT (especially on the TRON chain) has become an unofficial parallel financial system, providing financial stability for Turkish citizens in an environment where the local currency is rapidly depreciating.

Lebanon, once the financial center of the Middle East, has become a classic case of the collapse of the fiat currency system. The country's banking industry collapsed in 2019, deposits were locked, withdrawals were restricted, and depositors' life savings were trapped in frozen accounts.

Lebanese citizens discovered overnight that their US dollar deposits were converted into "Lollar" (local US dollar deposits) by banks at an artificial exchange rate, which was worth much less than the actual US dollar. Inflation soared and the banking system became a financial "hijacking" mechanism.

That’s when stablecoins came to the rescue. Tether (USDT) and USD Coin (USDC) usage surged as Lebanese citizens needed a way to store wealth and conduct transactions that would circumvent a collapsing banking system.

Today, Lebanon’s per capita cryptocurrency usage ranks among the highest in the world, and stablecoins are no longer a speculative tool, but a survival tool.

These cases show that stablecoins are more than just hedging tools or speculative assets, they are increasingly becoming a necessity in regions with financial instability, authoritarian control, or limited global banking access.

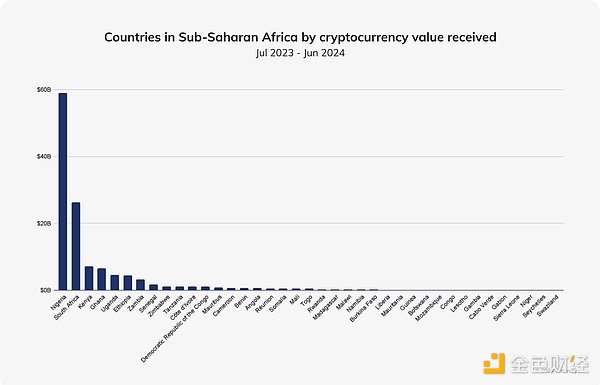

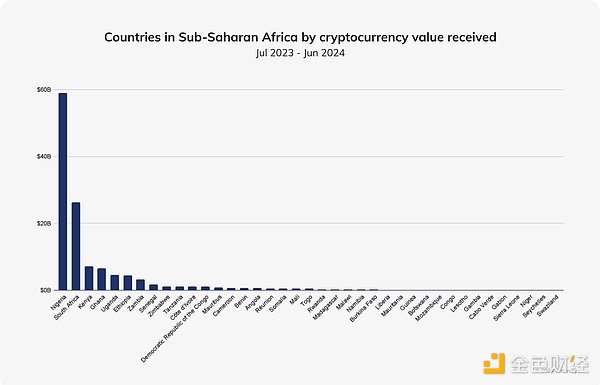

Meanwhile, Nigeria has become a pioneer in stablecoin adoption. Nigerians have turned to USDT in record numbers due to severe foreign exchange shortages and banking restrictions. Nigeria leads all emerging markets in stablecoin penetration, with users frequently using stablecoins for remittances, trade settlements, and savings.

Platforms such as Yellow Card and Binance have made USDT an important part of Nigeria's financial system, helping individuals and businesses bypass the dilemma of lack of access to US dollars.

The popularity of stablecoins: the real entrance to cryptocurrency

Globally, the use of stablecoins far exceeds DeFi and NFT trading volume. In emerging markets such as Lebanon, Nigeria, and Argentina, people are not buying ETH for yield farming, but converting funds into stablecoins to escape the broken financial system.

Stablecoins are the "Trojan horse" for cryptocurrencies to enter the global financial system. Where the banking system is unstable or even hostile to citizens, people are finding ways to take custody of their own dollars without relying on traditional banks.

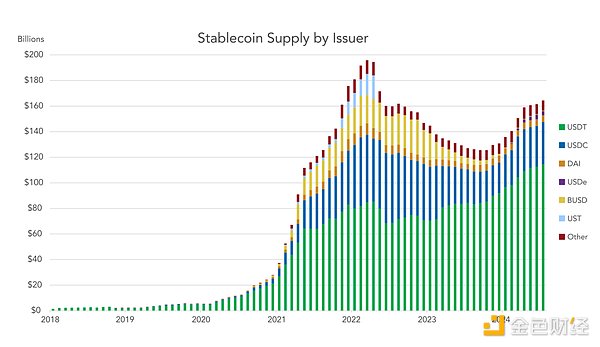

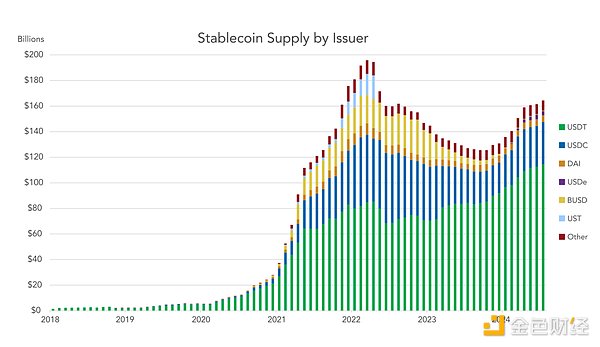

Stablecoins are crypto’s greatest success story — a market that settles $5.28 trillion a year and continues to grow regardless of Bitcoin’s cycles. They’re being used as digital dollars, alternatives to bank accounts, and tools to gain financial freedom in regions where monetary systems have collapsed.

If crypto can solve real problems for billions of people, its narrative will shift from a speculative asset to a necessity. And that’s the path to true adoption.

Jasper

Jasper