Author: David C, Bankless; Compiler: Deng Tong, Golden Finance

Sui is one of the most watched L1s in this cycle, with its roadmap plans generating excitement and gaining a lot of attention, helping it stay ahead during periods of price volatility.

Even compared to other Move-based chains, Sui has had a stellar season as it has built a solid foundation for its ecosystem that looks poised for future growth in 2025 with a series of major releases coming this quarter.

Let's examine these upcoming catalysts for Sui that are designed to enhance its DeFi suite, drive liquidity, grow its user base, and unlock support for new applications.

1. Upgrading DeFi

While Sui's DeFi is about to undergo a series of upgrades, such as the launch of Aftermath's perpetual contract market and the continuation of the network's institutional push, the top-level Suilend's upcoming automated market maker (AMM) Steamm may inject vitality into Sui DeFi this quarter, attracting liquidity seeking efficient returns.

Traditionally, in AMMs, liquidity is provided within a range of prices for trading pairs. For example, if you provide liquidity for the USDC/SUI pool, your funds will be distributed across all possible prices where transactions may occur. However, trading only occurs at specific price points, so a large amount of liquidity is "idle" outside of active trading ranges. By introducing a "bank" function, Steamm brings these idle funds into Suilend's lending pool, allowing liquidity providers to earn interest on capital that is not actively used for market making. This dual-purpose approach improves capital efficiency because providers can collect income from trading fees and lending. In addition to increasing the returns of liquidity providers, Steamm will also issue yielding LP tokens, which other DeFi protocols on Sui can use to develop other strategies, effectively recycling liquidity throughout the network.

2. Increase liquidity

A series of releases will bring a lot of liquidity to Sui in the coming quarter, such as the release of the BTCfi protocol Babylon Labs (and the protocols built on it), and the mainnet deployment of the multi-computation network Ika.

This cycle once again attempts to unlock the trillions of dollars in Bitcoin, as whichever chain accounts for only a portion of it will receive a large capital injection. Given Move's security advantages, these chains provide an attractive environment for bridging liquidity, and Babylon and Lombard (a liquid Bitcoin staking protocol built on Babylon) announced a strategic move to bring BTC to Sui. As Babylon’s largest protocol, Lombard has launched LBTC wrapped Bitcoin tokens, which account for approximately $2.2 billion of Babylon’s approximately $5.3 billion TVL. LBTC will allow Bitcoin holders to stake and earn yield while maintaining ownership of BTC. Given Sui’s current TVL of approximately $1.8 billion, even a modest redistribution from Lombard or other Babylon-based protocols (such as SatLayer, which also intends to launch on Sui) could significantly increase Sui’s overall liquidity. In addition, because Babylon is still working on the “demand-side” mechanisms of its protocol, for now, BTC holders who stake through it or any application built on it can only receive “points” for future airdrops.

The second avenue for adding liquidity on Sui is Ika, a new network that takes multi-party computation (MPC) to another level. Unlike traditional bridges, which typically rely on centralized trust points, Ika uses a “2PC-MPC” model that disperses control across hundreds or even thousands of nodes, making it nearly impossible for any single entity to tamper with funds. By broadcasting messages rather than relying on one-to-one communication, Ika keeps transaction times low and can scale to thousands of signatures per second while remaining decentralized. This means that assets such as BTC, ETH, or SOL can enter Sui with fewer security concerns and less congestion, allowing developers to take advantage of more cross-chain lending, staking, or trading options. The result is a more liquid, interconnected DeFi ecosystem, and Ika can connect Sui to the broader cryptocurrency world without sacrificing speed or security.

3. Expand the user base

While increasing liquidity is critical, attracting new users is equally important, which is where the recently announced integration features of Phantom and Backpack wallets come into play.

Phantom, known for its clean interface and wide support (Solana, Ethereum, and Bitcoin), has 7 million monthly active users, almost matching Sui’s total active accounts in the past 30 days. By adding Sui to Phantom, it will not only provide these users with a direct entry point into the chain, but will also provide a stamp of approval to the network with Phantom’s reputation. Meanwhile, Backpack Wallet, which serves over 150 countries and also owns an exchange that has processed $60 billion in trading volume, will support Sui functionality.

In addition, both wallets offer mobile support, in line with the trend of more and more crypto users who prefer to trade via their smartphones. With the rollout of these integrations, the barrier to using Sui will be lowered, increasing its distribution and making it possible to acquire more users.

IV. Extended Use Cases

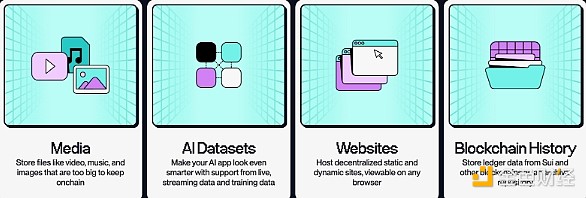

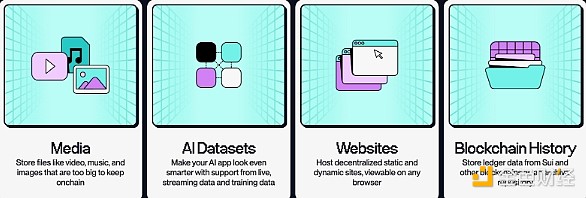

Walrus, developed by Sui founder Mysten Labs and expected to be launched this quarter, will be a blockchain-independent decentralized storage protocol that can expand Sui's functionality beyond the financial field by storing large-scale rich media data in a distributed manner.

Walrus works through a process called Red Stuff erasure coding, which splits and disperses data across multiple nodes, reducing reliance on traditional centralized hosting. Therefore, instead of having each Sui node save large files, Walrus offloads these blobs to its own network, keeping Sui's core ledger lean. By coordinating incentives and node management with the Sui blockchain, Walrus can operate efficiently without duplicating consensus or overloading storage.

This design opens up a wide range of possibilities. It will increase the capabilities of blockchain-based AI applications, which, through Walrus, can easily use decentralized data to train models for any use case. For media, Walrus provides a solution for storing content in a resilient, durable environment, which remains a problem for digital content. In addition, with Walrus Sites, developers can also build fully decentralized front-end websites that load their code and assets directly from Walrus, reducing reliance on traditional hosting. Even broader use cases, such as storing transaction history for high-speed chains or acting as an aggregated data availability layer, are possible on Walrus.

By handling the storage layer in a way that is both cost-effective and highly scalable, Walrus paves the way for diverse applications beyond the typical DeFi and NFT focus, further expanding what can be achieved within Sui’s growing ecosystem.

V. Major upgrades in the future

While Sui’s current focus is on catalysts such as Steamm’s capital-efficient AMM, Babylon/Lombard’s BTCfi liquidity, Ika’s cross-chain MPC, and Phantom/Backpack wallet integration, the network’s development does not end here.

Deeper upgrades such as Mysticeti v2 and SIP-45 are also coming. Mysticeti v2 improves Sui’s parallel transaction model, potentially unlocking faster confirmation speeds for DeFi, games, and other resource-intensive applications. Meanwhile, SIP-45 addresses the issue of transaction fees during periods of peak demand by proposing higher gas price limits and allowing users to pay extra for fast processing. This ensures that important operations don’t stall when network activity surges.

All in all, these developments are indicative of Sui’s broader ambitions. From increasing DeFi liquidity and user adoption to supporting large-scale data storage and advanced AI, Sui is laying the foundation to go beyond basic finance. As these protocols and upgrades come online, they will solidify Sui’s position as a versatile platform powered by the Move language — one that can host not only crypto’s current use cases, but also the next generation of high-throughput, decentralized services.

Alex

Alex