Author: David C Source: Bankless Translation: Shan Ouba, Golden Finance

Unichain is quietly rising to become one of the most high-profile Ethereum Layer 2 (L2), but it has hardly attracted widespread attention from the outside world.

While L2 projects such as Base dominate the discussion of Superchain, Unichain has been steadily expanding behind the scenes since the launch of its mainnet in early February. It brings a better DeFi experience with its deep integration with Uniswap, especially in terms of yield generation.

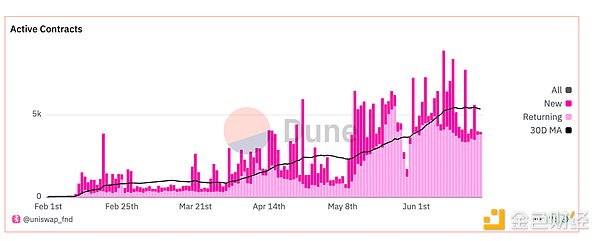

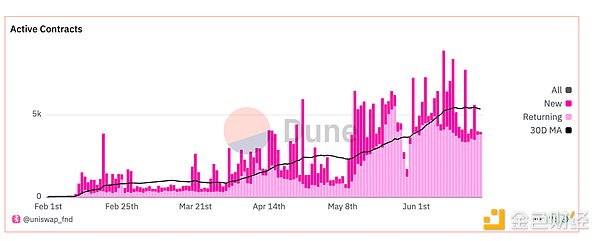

Let's take a look at its growth momentum:

Network Growth

Unichain's current total locked value (TVL) of DeFi and stablecoins is about $1.3 billion, up 41% in the past month, ranking fourth among all Ethereum Rollups.

According to L2Beat data, it ranks third in total user transaction volume among all L2s, up 42% month-on-month in June, processing 2.2% of the total weekly transaction volume of all-chain DEXs, ranking fifth overall among all blockchains.

Of the $1.3 billion TVL, about $860 million comes from DeFi, and the remaining about $440 million comes from stablecoins, which are highly concentrated in a few lending protocols and their third-party curated vaults.

Uniswap | TVL: $641M— Unsurprisingly, Uniswap accounts for the largest share of on-chain TVL, with the vast majority of funds concentrated in version v4.

Euler | TVL: $330M — Next is Euler, a permissionless lending protocol with MEV-resistant liquidations, dynamic interest rates, and multi-collateral stable pools. Euler’s instance on Unichain has grown to become the fifth-largest lending protocol across the entire Superchain.

Morpho | TVL: $67M — Morpho is a non-custodial lending protocol that offers customized lending markets and optimized yield vaults curated by third-party DeFi companies such as Gauntlet and RE7.

These protocols account for the vast majority of Unichain’s TVL, clearly demonstrating that this chain is first and foremost a home for “yield generation” rather than a hotbed of hype. Interestingly, no single MEME coin on the chain has a market cap of more than $1 million, with most of the liquidity concentrated in blue-chip assets such as $ETH (or its wrapped version), $wBTC, and stablecoins.

Next steps for Unichain

Unichain is continuing to build its core infrastructure to become the best chain for DeFi. There are already several key mechanisms in its architecture that drive this goal:

Flashblocks — Developed in conjunction with Flashbots, it splits each block into four sub-blocks, resulting in a 1-second block time. This compression mechanism improves execution speed, arbitrage efficiency, and reduces MEV-related losses, resulting in higher capital efficiency and usage experience.

Trusted Execution Environments (TEEs) —Unichain’s sequencer uses TEE technology to sequence transactions in a private and tamper-proof environment, supporting fairer MEV outcomes and reducing the risk of predatory behavior.

Unichain’s next major upgrade will be the launch of its Verification Network (UVN), which is intended to reduce reliance on a single sequencer and improve the chain’s overall level of decentralization.

Current sequencers can delay, reorder, or even submit invalid transactions, undermining user trust and slowing cross-chain finality. UVN introduces a group of independent validators to verify blocks before they are finalized.

It is worth noting that validators must stake $UNI to participate in the network. After launch, 65% of Unichain's net on-chain revenue will be distributed to these validators and $UNI stakers. Currently, Unichain is the second-highest L2 in terms of net revenue on Superchain.

UVN's testnet is expected to be launched in the next few months, and the mainnet deployment will follow. Over time, UVN may also introduce more protection mechanisms - such as monitoring the memory pool to ensure that transactions are packaged fairly, or requiring validator consensus before accepting a block.

Summary

Although Unichain is a "general-purpose" L2, its architecture is tailor-made for DeFi and is designed around execution speed, MEV-friendly fairness, and liquidity alignment.

From Flashblocks, TEEs to the upcoming verification network, each component is supporting deeper capital efficiency and composability. Its DeFi-first orientation — underpinned by lending protocols like Euler and Morpho — has quietly propelled it to the top of the L2 revenue charts, accompanied by strong TVL growth and active users.

Furthermore, combining Unichain, Uniswap, and Uniswap Wallet, it’s clear that Uniswap Labs is building a vertically integrated DeFi stack — controlling the application, wallet, and execution layers, with the intention of becoming the preferred source of liquidity for the crypto market.

While Unichain still has a long way to go, it has demonstrated a compelling long-term potential: cross-chain interoperability issues may soon be history, and the next phase of DeFi will come from an environment defined by execution speed, revenue alignment, and deep liquidity control.

Catherine

Catherine