Author: Jack Inabinet Source: Bankless Translation: Shan Ouba, Golden Finance

On June 5, 2025, Circle went public on the New York Stock Exchange, shocking observers in the crypto and traditional financial fields. Its stock price soared to a high of $103 within 15 minutes of listing, which was three times the issue price of its "25 times oversubscribed and additional" initial public offering.

So, is Circle's IPO a great opportunity to bet on the outbreak of stablecoins, or a high-flying stock that is perfectly priced but ignores potential risks? We will analyze the investment opportunity of CRCL in depth!

CRCL Investment Opportunity Overview

After years of rumors and expectations, USDC stablecoin issuer Circle Internet Group officially submitted a listing application to the U.S. Securities and Exchange Commission (SEC) this spring. These documents give investors an in-depth look at the inner workings of the stablecoin industry for the first time.

The documents show that Circle is a "revenue engine" in a high-growth industry - in 2024 alone, Circle earned more than $1 billion in interest income from stablecoin reserves.

But at the same time, financial statements also reveal that this business is built on many trade-offs - after paying huge partner fees, employee incentives and heavy compliance expenses, Circle barely makes a profit.

Circle currently backs its USDC stablecoin with more than $60 billion in cash and U.S. Treasuries. Although USDC itself is non-yielding, Circle still achieved total revenue of $1.7 billion in 2024. However, the operating costs incurred to attract these reserve assets are equally high.

In 2024, Circle paid $1 billion for "distribution and transaction costs", which became its largest expense item, mainly used to pay partners (especially Coinbase) to distribute rewards to USDC users. In addition, Circle's salary expenses also reached $263 million, and it spent another $137 million on "daily administrative costs" (including travel, office, insurance, legal and tax services).

Despite this, Circle has achieved profitability for the second consecutive year (an important accounting mark that may lead to its inclusion in the S&P 500 index). However, its net profit of $155 million is insignificant compared to the $13 billion reported by its main competitor Tether in 2024.

Catalysts that drive the CRCL narrative

While Circle’s current valuation of more than $20 billion may be slightly aggressive compared to initial expectations, it is relatively conservative when compared to some native crypto projects, such as Ondo. At the end of January 2025, Ondo still achieved a similar FDV of $20 billion with a much smaller asset under management than Circle.

Circle's profits will decline during periods of crypto market turmoil as funds will withdraw from the industry. But if USDC truly achieves real-world payment applications, this risk will be greatly reduced. This is something that Coinbase (which relies heavily on trading volume), crypto ETFs (directly exposed to currency price fluctuations) or crypto vault companies (highly sensitive to market fluctuations) cannot match.

For conservative or regulated financial institution investors who are limited by traditional market channels, CRCL can serve as a practical blockchain "sideline" investment target - providing access to the crypto industry, but with less exposure to its highly speculative risks. Circle's most noteworthy growth factor is its partnership with BlackRock, the world's largest asset management company.

In March 2025, Circle and BlackRock signed a four-year memorandum of understanding (MOU) to increase BlackRock's management share of Circle reserves to 90%. The agreement clearly stipulates that BlackRock must give priority to using Circle's stablecoins for all scenarios related to US dollar payments and must not launch competing stablecoin products.

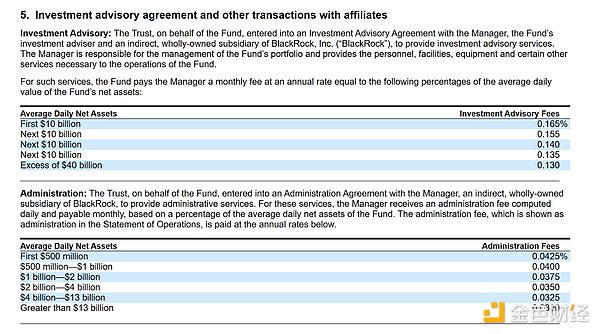

Circle's IPO documents also disclosed the fee arrangement with BlackRock, including "investment advisory fees" and "management fees", giving BlackRock a direct economic incentive to promote USDC.

Signals of Concern

Although many crypto users (especially on Crypto Twitter) criticized Circle’s underwriters for setting the IPO price too low (only one-third of its post-opening trading price), objectively speaking, achieving the initial issue price of $31 per share was considered by many to be a daunting task at the time.

Currently, Circle's market capitalization is still above $20 billion, which means that its stock's price-to-earnings (P/E) ratio is over 130 times. This is an extremely high multiple that is usually only seen in stocks during market bubbles. To justify this valuation, Circle must achieve huge growth in earnings, otherwise its stock price is likely to decline in the future.

Although blockchain technology has high growth potential, once stablecoins become mainstream payment tools, regulation may open the door for traditional financial giants (such as banks) to enter the stablecoin market. These mature institutions may be able to deal with compliance pressure more efficiently than crypto-native companies such as Circle and occupy the market with cost advantages.

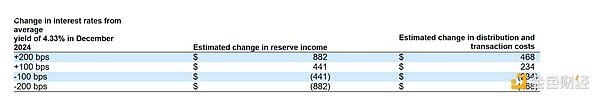

One of Circle's main business models is to invest in short-term debt and continuously renew it at market interest rates. This also means: Falling interest rates are Circle's biggest profit risk. As we all know, the Federal Reserve has recently released a signal of a rate cut. If interest rates are lowered before the USDC supply grows significantly, CRCL investors may face difficulties. Although lower interest rates will also lead to a reduction in "distribution fees" paid to partners, partially alleviating the revenue impact, according to Circle's own interest rate sensitivity forecast (assuming that the total amount of USDC remains unchanged), for every 1% drop in short-term interest rates, Circle's profits will decrease by approximately US$207 million.

If the Federal Reserve cuts interest rates by 1% or more before real-world payment applications become popular, Circle is likely to fall back into a loss-making state, and its stock price is almost certain to be hit.

Summary

Few crypto industry observers or traditional financial professionals foresaw that the CRCL IPO would be so hot, far exceeding market expectations. While the market is never "wrong", Circle still has a lot of uphill battles to fight if it wants to maintain its $20 billion valuation.

Critics may point out that Circle is less profitable than Tether and allocates too much revenue to Coinbase. But this is still the early stage of the stablecoin track. From the perspective of equity investment, CRCL is currently the only pure target that can directly invest in the stablecoin track. Circle's cooperation agreement with BlackRock requires the latter to give priority to Circle stablecoins in all US dollar payment scenarios, which provides a strong boost for the inclusion of stablecoins in the mainstream financial system in the future. However, the participation of traditional banks will also bring severe challenges. These institutions are more relaxed in the face of more complex compliance requirements, and have the ability to suppress the profit margins of crypto-native companies such as Circle with a lower cost structure. In addition, Circle's profits are extremely dependent on the macroeconomic environment. If there is recessionary pressure and interest rates fall further, Circle's profitability is likely to be affected even if the supply of USDC remains unchanged (less realistic in a non-speculative market).

CRCL is a stock with a high profile debut on the New York Stock Exchange and strong growth prospects.CRCL provides investors with a unique investment opportunity at the intersection of stablecoins and institutional cooperation. But before a "brainless rush", you must also carefully assess its core risks:interest rate changes, entry of competitors, rising compliance costs, and uncertainty in profitability.

Miyuki

Miyuki