Author: Martin Young, CoinTelegraph; Compiler: Wuzhu, Golden Finance

According to several new research papers from major traditional financial institutions, The tokenization of real-world assets (RWA) will see explosive growth in the next five years, and assets under management may exceed $600 billion by 2030.

Global consulting firm Boston Consulting Group called RWA tokenization "the third revolution in asset management" in a paper on October 29.

“We are seeing growing investor demand for the tokenized fund space,” said David Chan, managing director and partner at BCG.

The paper, co-authored by Aptos Labs and Invesco, predicts that in just seven years, tokenized fund assets under management will reach 1% of global mutual fund and exchange-traded fund (ETF) assets under management.

“This would imply assets under management of more than $600 billion by 2030,” the researchers noted.

Reports suggest the industry could grow as much as 50 times by 2030.

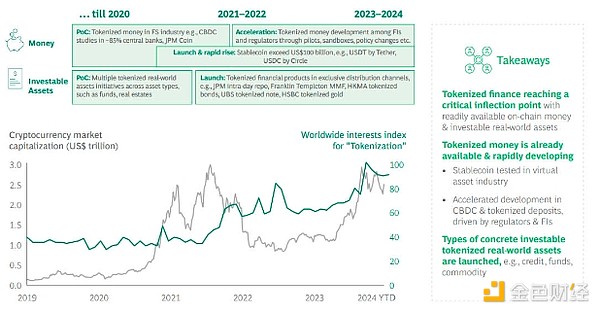

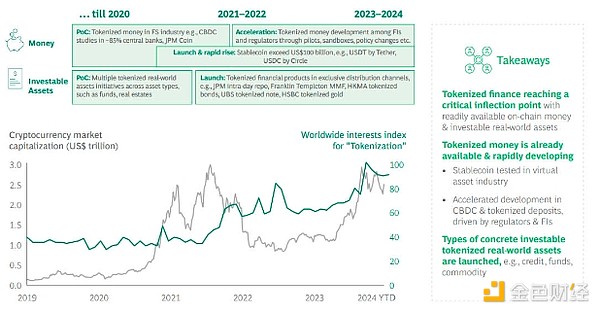

Chan added: “For some time to come, we expect this trend to continue, especially when regulated on-chain currencies such as regulated stablecoins, tokenized deposits, and central bank digital currency (CBDC) projects become a reality.”

The development of tokenized real-world financial assets. Source: BCG

In addition, according to another paper from State Street Global Advisors, the mass adoption of tokenized real-world assets is expected to be led by bonds, as their structural characteristics make them ideal for blockchain issuance.

“The bond market is ripe for adoption,” State Street researchers wrote in an October report on the tokenization of capital market assets.

“The complexity of these instruments replicates the nature of issuance costs, and the intense competition among intermediaries supports rapid adoption and room for significant impact,” said Elliot Hentov, head of macro policy research, and Vladimir Gorshkov, macro policy strategist.

Blockchain technology could play an important role in markets “where transaction speed is valued, such as repo and swaps,” they added.

The report explains that bonds are essentially debt instruments with a fixed maturity date and have three main characteristics that make them well suited for tokenization: recurring costs that can be reduced through tokenization, complexity that can be automated through smart contracts, and collateral that can be transferred on-chain to facilitate usage.

The bond market is where tokenization is already visible. Source: State Street

The report also noted that private equity funds show high transformative potential, but public equities have lower adoption potential as current systems work well.

Real estate and individual private equity tokenization face significant challenges, the researchers said, with commodities offering the potential for direct ownership but facing regulatory constraints.

The Financial Stability Board also released a research paper on asset tokenization this month. It said RWA tokenization adoption is low but growing, with the majority of government debt tokenized, followed by equity in debt funds, payment tokens and commodities.

The platform shared that the total off-chain value of RWAs is $13.25 billion, up 60% year-to-date.

Joy

Joy