Optimism (OP) price witnessed a 10% surge over the last 24 hours, indicating a promising trend. However, amidst broader market dynamics, a correction of up to 15% looms, as explained below.

OP Coin Price Surge Triggers Selling Pressure, MVRV Indicator Warns of Potential Market Correction Risk

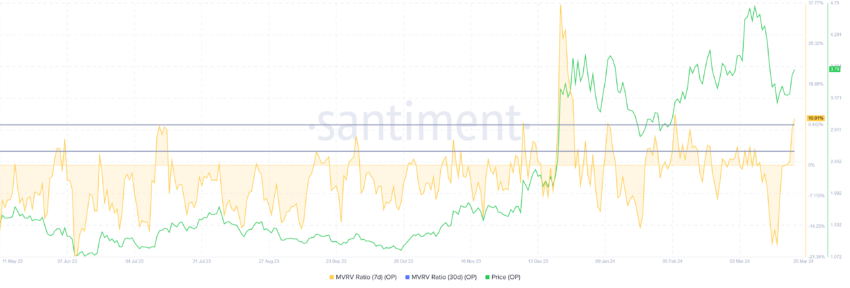

Recent gains in OP price triggered increased selling pressure, as reflected in the Market Value to Realized Value (MVRV) ratio. With the 7-day MVRV at 10.16%, recent buyers may opt to sell, potentially leading to a downturn. The danger zone, indicated by MVRV between 3% and 9%, suggests possible corrections.

OP Token Faces Buying Pressure from $3.87 to $4.85 Zone, $361 Million Supply Could Limit Price Upside

A significant hurdle for OP's rally lies in the 95 million OP purchased by investors within the $3.87 to $4.85 range, amounting to $361 million. This substantial supply may impede further price gains, potentially causing OP to struggle to surpass the $4 resistance level.

OP Coin Price May Face a Pullback to $3.40

Should current conditions persist, OP price could retract to $3.40 initially, with a further decline to $3.20 possible if bearish market cues prevail. Despite this, the observation of a Golden Cross on the 4-hour chart signals a potential bullish reversal, hinting at a price surge akin to the previous 20% rally.

Anais

Anais