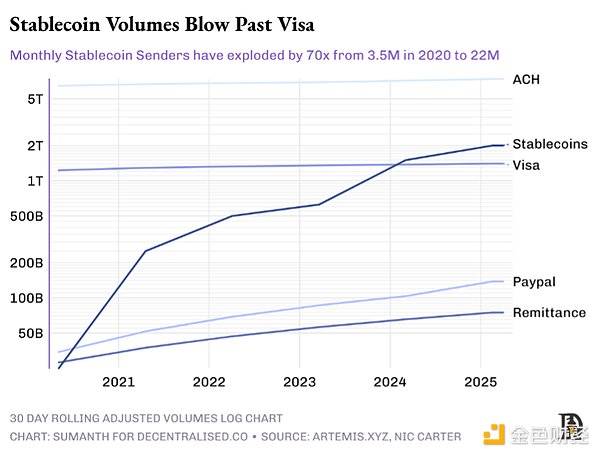

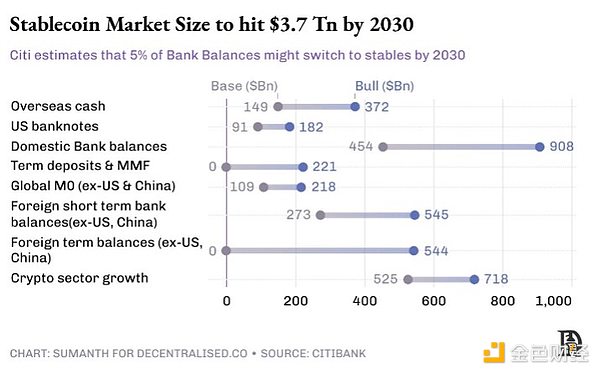

As "US dollar stablecoins" become popular, they will become the liquidity driving the entire token economy. Once cash is tokenized, people will perform regular off-chain operations at Internet speed (not bank speed): savings, lending, and mortgages. This never-ending flow of liquidity will continue to find the next tokenized target, bringing more "real world assets" (RWA) to the blockchain and giving them the same advantages. 24/7 Settlement: Traditional T+2 settlement cycles will become completely obsolete, and blockchain validators will be able to confirm transactions in minutes (not days). For example, a Singaporean trader can buy a tokenized New York apartment at 6 pm local time and get ownership confirmation before dinner.

Programmability: Smart contracts embed behavioral logic directly into assets. This makes complex financial operations possible: coupon payments, distribution rights, and asset-level compliance parameters can all be automatically executed.

Composability: Tokenized treasury bonds can be used as loan collateral and the interest income can be automatically distributed among multiple holders. An expensive beach house can be split into 50 shares and rented out to a hotel operator who manages bookings through Airbnb.

Transparency: The 2008 financial crisis was partly caused by the opacity of the derivatives market. Regulators can now monitor on-chain collateralization rates, track systemic risks, and observe market dynamics in real time without waiting for quarterly reports.

The main obstacle is regulation. The protection mechanisms of traditional exchanges are all painful lessons, and investors know what kind of protection they can get. Take "Black Monday" in 1987 as an example: the Dow Jones Industrial Average plummeted 22% in a single day, just because price fluctuations triggered automatic selling programs, triggering a chain reaction. The SEC's solution is a circuit breaker mechanism - suspending trading to allow investors to reassess the situation. Today, the New York Stock Exchange stipulates that trading will be suspended for 15 minutes if the decline reaches 7%.

Asset tokenization is not technically difficult. The issuer only needs to guarantee the real asset rights and interests corresponding to the token. The real challenge is to ensure that the underlying system can enforce all the rules that apply offline: this includes wallet-level whitelisting, national identity verification, cross-border KYC/AML, citizen holding limits, real-time sanctions screening and other functions that must be written into the code.

Europe's Crypto-Asset Market Regulation Act (MiCA) provides a complete regulatory framework for digital assets, and Singapore's Payment Services Act is the starting point for Asia. But the global regulatory landscape remains fragmented.

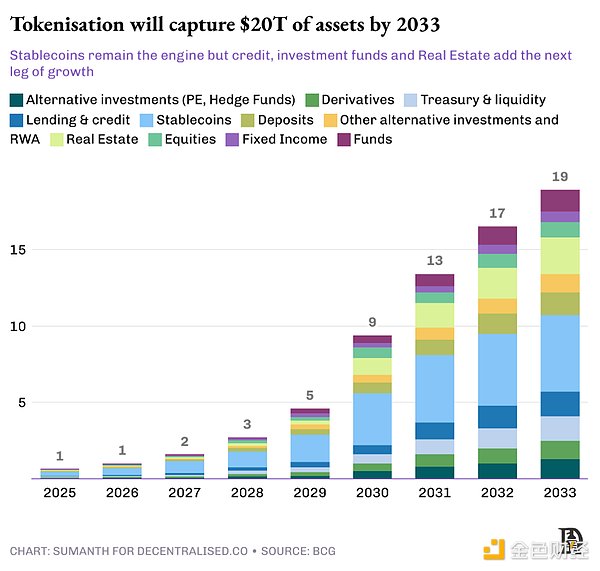

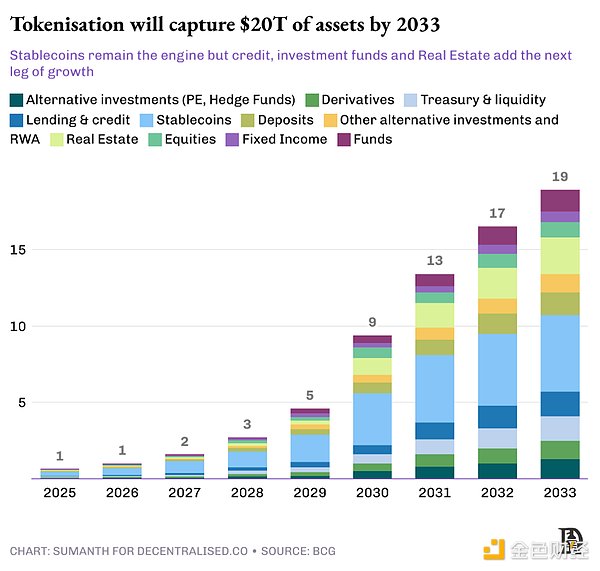

This process is almost bound to advance in waves. The first phase will prioritize the on-chaining of highly liquid, low-risk financial instruments, such as money market funds and short-term corporate bonds. The operational benefits of instant settlement are immediate, and the compliance process is relatively simple.

The second phase will move to the high end of the risk-return curve, covering high-yield products such as private credit, structured financial products and long-term bonds. The value of this phase lies not only in efficiency improvements, but also in unlocking liquidity and composability.

The third phase will achieve a qualitative leap and expand to illiquid asset classes: private equity, hedge funds, infrastructure and real estate mortgage debt. To achieve this goal, it is necessary to achieve universal recognition of tokenized assets as collateral and establish a cross-industry technology stack that can serve these assets. Banks and financial institutions need to custody these real-world assets (RWA) as collateral while providing credit.

Although the pace of on-chaining varies for different asset classes, the direction of development is clear. Each wave of new "stable dollar" liquidity is pushing the token economy to a higher stage.

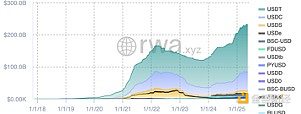

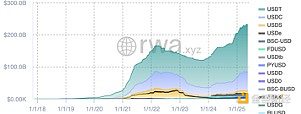

(1)Stablecoin Landscape

The US dollar-pegged token market presents a duopoly, with Tether (USDT) and Circle (USDC) accounting for 82% of the market share. Both are fiat-collateralized stablecoins - the euro stablecoin operates on the same principle, with each token in circulation backed by euros stored in banks.

In addition to the fiat currency model, developers are exploring two experimental solutions to try to achieve decentralized anchoring without relying on off-chain custodians:

Crypto-collateralized stablecoins: Using other cryptocurrencies as reserves, usually over-collateralized to resist price fluctuations. MakerDAO is the flagship in this field, having issued $6 billion in DAI. After the bear market in 2022, Maker quietly converted more than half of its collateral into tokenized treasuries and short-term bonds, which not only smoothed ETH volatility but also earned returns. Currently, this part of the configuration contributes about 50% of the protocol's revenue.

Algorithmic stablecoins: These stablecoins do not rely on any collateral, but maintain their anchors through an algorithmic minting-destruction mechanism. Terra's stablecoin UST once reached a market value of $20 billion, but it triggered a run due to a collapse in confidence during the depegging incident. Although new projects such as Ethena have achieved a scale of $5 billion through innovative models, it will take time for the field to gain widespread recognition.

If Washington only grants "qualified stablecoins" certification to fully fiat-collateralized stablecoins, other types may be forced to abandon the "dollar" logo in their names to comply with regulations. The fate of algorithmic stablecoins is still unclear - the GENIUS Act requires the Treasury Department to conduct a one-year study on these protocols before making a final ruling.

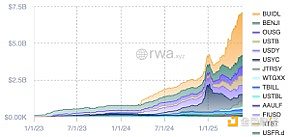

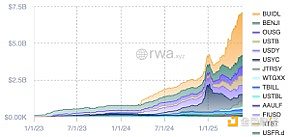

(2) Money market instruments

Money market instruments include highly liquid short-term assets such as government bonds, cash and repurchase agreements. On-chain funds are "tokenized" by encapsulating ownership rights into ERC-20 or SPL tokens. This carrier supports 24/7 redemption, automatic profit distribution, seamless payment docking and convenient collateral management.

Asset management companies still retain the original compliance framework (anti-money laundering/identity verification, qualified investor restrictions), but settlement time is shortened from several days to minutes.

BlackRock's US Dollar Institutional Digital Liquidity Fund (BUIDL) is a market leader. The agency appointed SEC-registered transfer agent Securitize to handle KYC access, token minting/destruction, FATCA/CRS tax compliance reporting and shareholder register maintenance. Investors need at least $5 million in investable assets to qualify, but once on the whitelist, they can purchase, redeem or transfer tokens 24/7 - a flexibility that traditional money market funds cannot provide.

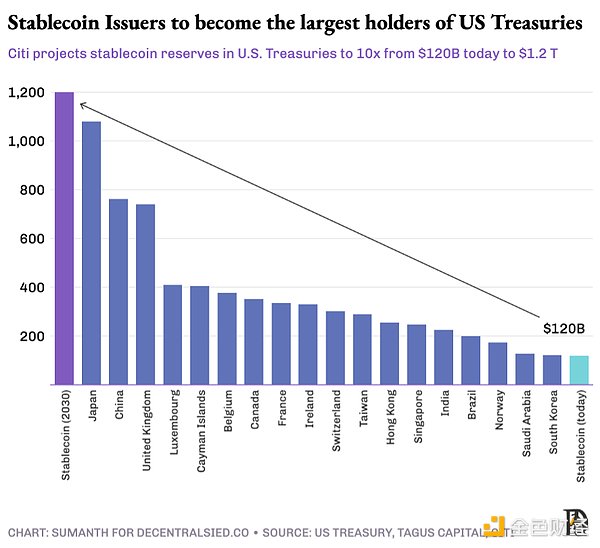

BUIDL's assets under management have grown to approximately $2.5 billion, distributed among more than 70 whitelisted holders on five blockchains. About 80% of the funds are allocated to short-term treasury bills (mainly 1-3 months), 10% are invested in longer-term treasury bonds, and the rest are maintained in cash positions.

Products such as Ondo (OUSG) operate as investment management pools, allocating funds to tokenized money market fund portfolios of institutions such as BlackRock, Franklin Templeton, and WisdomTree, and providing free access to stablecoins.

Although the scale of $10 billion is insignificant compared to the $26 trillion Treasury market, its symbolic significance is extremely significant: Wall Street's top asset management institutions are choosing public chains as distribution channels.

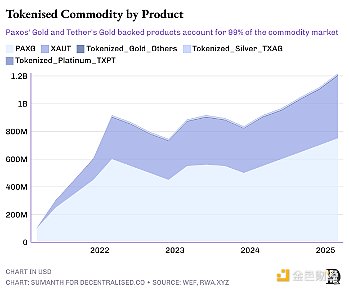

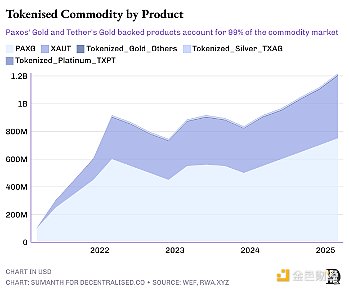

(3) Commodities

The tokenization of hard assets is driving these markets to transform into all-weather, click-and-trade platforms. Paxos Gold (PAXG) and Tether Gold (XAUT) allow anyone to buy tokenized shares of gold bars; Venezuela's 1 PETRO is pegged to 1 barrel of crude oil; small pilot projects have linked token supply to soybeans, corn, and even carbon credits.

The current model still relies on traditional infrastructure: gold bars are stored in vaults, crude oil is stored in tank farms, and auditors sign reserve reports on a monthly basis. This custody bottleneck creates concentrated risk, and physical redemption is often difficult to achieve.

Tokenization not only realizes the division of asset ownership, but also makes traditional illiquid physical assets easy to mortgage financing. The scale of this field has reached US$145 billion (almost all of which is backed by gold), compared with the size of the US$5 trillion physical gold market, the development space is self-evident.

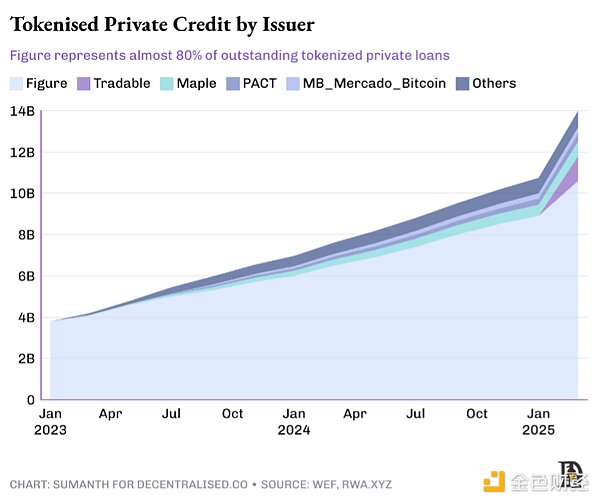

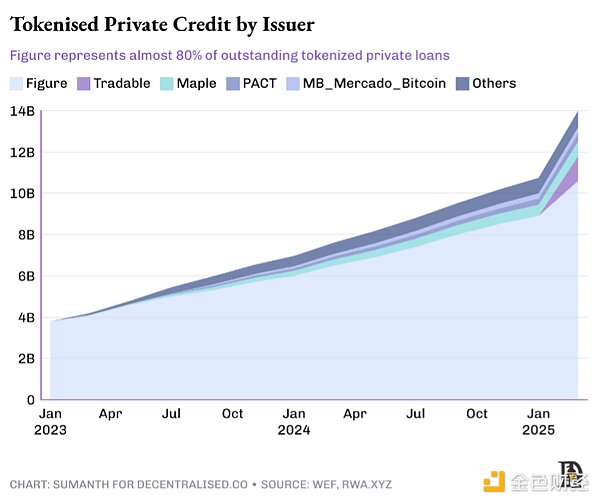

(4) Lending and Credit

DeFi lending initially appeared in the form of over-collateralized cryptocurrency loans. Users pledged ETH or BTC worth $150 to borrow $100, and the operating model was similar to gold mortgage loans. Such users hope to hold digital assets for a long time to bet on appreciation, and at the same time need liquidity to pay bills or open new positions. Currently, the Aave platform has a lending scale of approximately US$17 billion, accounting for nearly 65% of the DeFi lending market.

The traditional credit market is dominated by banks, which underwrite risks through decades-proven risk models and strictly regulated capital buffers. As an emerging asset class, private credit has developed in parallel with traditional credit to a global management scale of US$3 trillion. Companies no longer rely solely on banks, but instead raise funds by issuing high-risk, high-yield loans, which is attractive to institutional lenders such as private equity funds and asset management institutions seeking higher returns.

Bringing this area to the chain can expand the group of lenders and improve transparency. Smart contracts can automate the entire loan cycle: fund disbursement, interest collection, while ensuring that liquidation triggers are clearly visible on the chain.

Two models of private credit on the chain:

"Retailization"Direct lending: Platforms such as Figure tokenize home improvement loans and sell split notes to yield-seeking wallets around the world, which can be called the debt version of Kickstarter. Homeowners get lower financing costs by splitting loans into small shares, retail depositors receive monthly coupons, and the protocol automatically handles the repayment process.

Pyse and Glow package solar projects, tokenize power purchase agreements, and handle the entire process from panel installation to meter reading. Investors can simply sit back and enjoy the benefits, and receive an annualized return of 15-20% directly on their monthly electricity bills.

Institutional Liquidity Pools:Private credit desks are presented in an on-chain transparent form. Protocols such as Maple, Goldfinch, and Centrifuge package borrower needs into on-chain credit pools managed by professional underwriters. Depositors are mainly qualified investors, DAOs, and family offices, who can earn floating returns (7-12%) and track asset performance on a public ledger.

These protocols are committed to reducing operating costs, allowing underwriters to conduct due diligence on the chain and complete loan issuance within 24 hours. Qiro adopts an underwriter network model, where each underwriter uses an independent credit model and is rewarded for analysis work. Due to the high risk of default, the growth rate of this area is not as fast as that of mortgage loans. When a default occurs, the agreement cannot use traditional collection methods such as court orders, and must rely on traditional collection agencies, resulting in rising disposal costs.

As underwriters, auditors and collection agencies continue to go online, market operating costs will continue to decline, and the lender capital pool will also be greatly deepened.

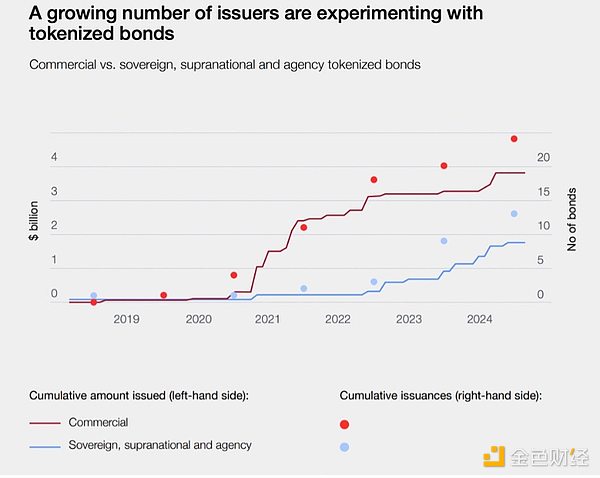

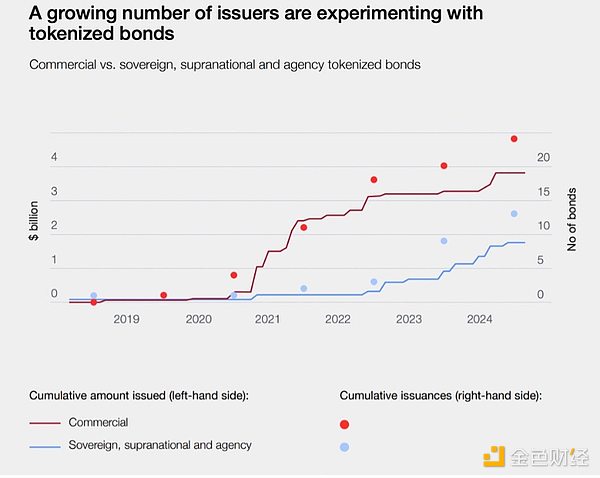

(5) Tokenized bonds

Bonds and loans are both debt instruments, but they differ in structure, degree of standardization and issuance and trading methods. Loans are one-to-one agreements, while bonds are one-to-many financing instruments. Bonds use a fixed format - for example, a 5% coupon bond with a term of 10 years is easier to rate and trade in the secondary market. As a public instrument subject to market supervision, bonds are usually rated by institutions such as Moody's.

Bonds are often used to meet large-scale, long-term capital needs. Governments, utilities and blue-chip companies issue bonds to finance budgets, build factories or obtain bridge loans. Investors receive interest regularly and receive their principal back at maturity. The size of this asset class is staggering: its notional value is about $140 trillion by 2023, equivalent to 1.5 times the total market value of global stocks.

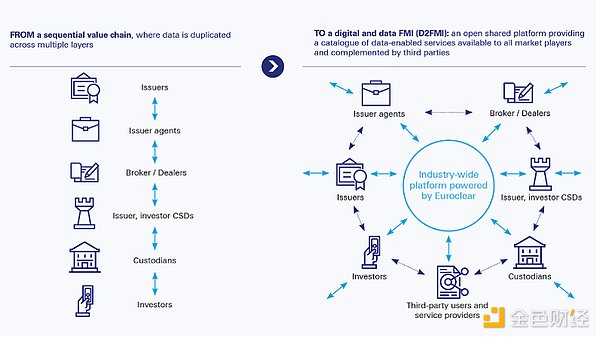

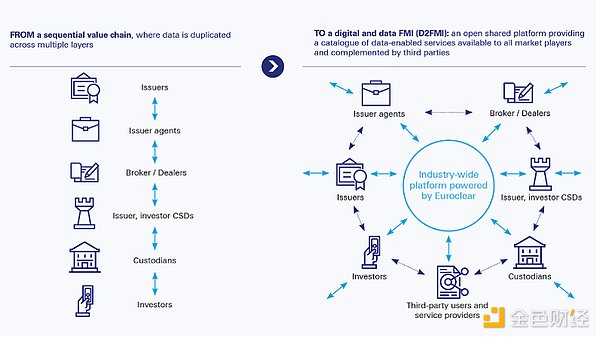

The current market still runs on an outdated infrastructure designed in the 1970s. Clearing institutions such as Euroclear and the Depository Trust & Clearing Corporation (DTCC) in the United States need to transfer through multiple custodians, resulting in transaction delays and a T+2 settlement system. Smart contract bonds can achieve atomic settlement in seconds, automatically pay dividends to thousands of wallets at the same time, have built-in compliance logic, and access to global liquidity pools.

Each bond issuance can save 40-60 basis points in operating costs, and treasurers can also get a 24-hour secondary market without paying exchange listing fees. As the core settlement and custody channel in Europe, Euroclear holds 40 trillion euros in assets and connects more than 2,000 institutions to 50 markets. The agency is developing a blockchain-based issuer-broker-custodian settlement platform that aims to eliminate duplication, reduce risks, and provide customers with real-time digital workflows.

Companies such as Siemens and UBS have issued on-chain bonds as a pilot project of the European Central Bank. The Japanese government is also working with Nomura Securities to test the bond on-chain solution.

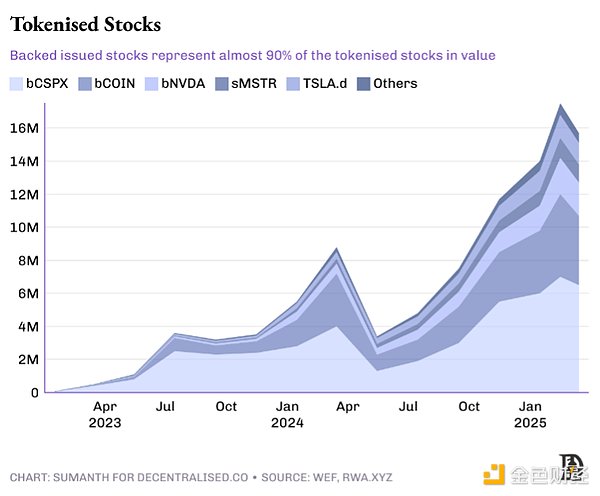

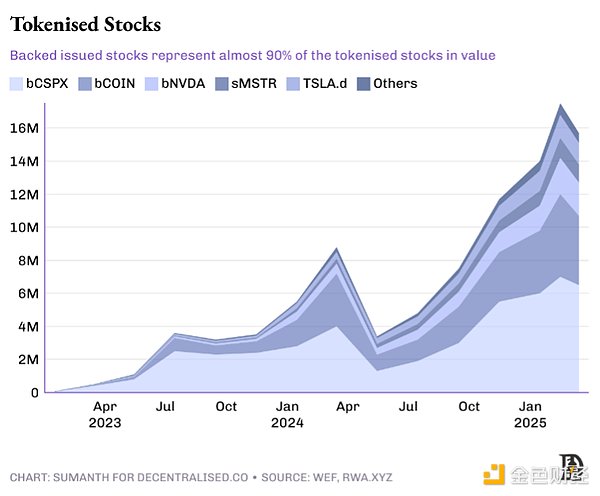

(6) Stock Market

This area naturally has development potential - the stock market itself already has a large number of retail investors participating, and tokenization can create an "Internet capital market" that operates around the clock.

Regulatory barriers are the main bottleneck. The current custody and settlement rules of the US Securities and Exchange Commission (SEC) were formulated in the pre-blockchain era and require intermediaries to participate and maintain a T+2 settlement cycle.

This situation is beginning to loosen. Solana has applied to the SEC for approval of an on-chain stock issuance plan that includes KYC verification, investor education processes, broker custody requirements and instant settlement functions. Robinhood followed closely and filed an application, arguing that tokens representing US Treasury bond strip certificates or Tesla single shares should be considered securities themselves, rather than synthetic derivatives.

Demand in overseas markets is even stronger. Thanks to loose regulations, foreign investors already hold about $19 trillion in U.S. stocks. The traditional path is to invest through local brokers such as eTrade (which need to cooperate with U.S. financial institutions and pay high foreign exchange spreads). Startups such as Backed are offering an alternative - synthetic assets. Backed has completed $16 million in business by purchasing equivalent underlying stocks in the U.S. market. Kraken recently partnered with it to provide U.S. stock trading services to non-U.S. traders.

(7) Real Estate and Alternative Assets

Real estate is the asset class most constrained by paper certificates. Every title deed is stored in the government registry, and every mortgage document is sealed in the bank vault. Large-scale tokenization is difficult to achieve before the registry accepts hash values as legal proof of ownership. Currently, only about $2 billion of the world's $400 trillion in real estate has been put on the chain.

The United Arab Emirates is one of the regions leading the change, with real estate deeds worth $3 billion already registered on the chain. In the US market, real estate technology companies such as RealT and Lofty AI have tokenized more than $100 million in residential assets, with rental income flowing directly to digital wallets.

FiveFunds are eager to flow

Cyberpunks see "dollar stablecoins" as a regression to bank custody and license whitelists, while regulators are reluctant to accept permissionless channels that can transfer billions of dollars in a single block. But the reality is that true adoption is born precisely at the intersection of these two "discomfort zones".

Crypto purists will still complain, just as early Internet purists hated TLS certificates issued by centralized institutions. But it was HTTPS technology that allowed our parents to use online banking safely. Similarly, dollar stablecoins and tokenized treasuries may not seem “pure” enough, but they will be the first silent exposure to blockchain for billions of people—through an application that never mentions the word “cryptocurrency.”

While the Bretton Woods system locked the world into a single currency, blockchain frees money from the shackles of time. Each asset on the chain shortens settlement time, frees up collateral dormant in a clearing house, and allows the same dollar to guarantee three transactions before lunch arrives.

We keep coming back to the same core idea: the velocity of money will eventually become the killer application scenario for crypto, and putting real assets on the chain fits this theme. The faster the value is settled, the more frequently the funds are redeployed, and the bigger the market pie. When dollars, debt, and data all flow at network speeds, the business model will no longer be transfer fees, but profiting from the potential of flow.

Weiliang

Weiliang