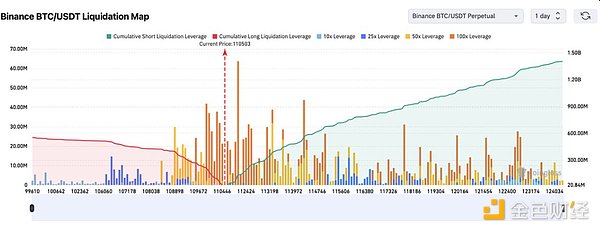

Optimistic Scenario (40% probability): Bitcoin's "investment low" of $104,000 and Ethereum's $3,460 hold, with prices moving toward the maximum pain point range for options ($118,000-120,000 for Bitcoin and $4,100-4,350 for Ethereum). Pessimistic Scenario (35% probability): If trade frictions escalate or liquidity remains tight, prices could retest or even slightly break below previous lows, targeting $95,000-100,000 for Bitcoin and $3,000-3,200 for Ethereum. Baseline Scenario (25% probability): Range-bound trading is expected, targeting $105,000-120,000 for Bitcoin and $3,500-4,200 for Ethereum. 3. Key Price Levels to Watch: Bitcoin: $104,582 (key support); $110,000 (bull-bear watershed); $115,000 (first resistance); $118,000-120,000 (major resistance); $125,000-127,000 (supply zone). Ethereum: $3,460 (key support); $3,750 (bull-bear watershed); $4,000 (psychological barrier); $4,100-4,350 (major resistance); $4,750 (supply zone).

Joy

Joy