Source: Beosin

1. US SEC issues notices of validity of multiple spot Ethereum ETF S-1 applications

On July 23, according to official information from the SEC, it has officially approved the S-1 applications of multiple ETF issuers, and the Ethereum spot ETF has been officially approved for listing and trading. According to the content of the notice, the SEC has notified at least two of the eight companies that applied to launch the first batch of US spot Ethereum ETFs that their products can start trading on Tuesday. Products from BlackRock, VanEck and six other companies will begin trading on three different exchanges on Tuesday morning: the Chicago Board Options Exchange (CBOE), Nasdaq and the New York Stock Exchange, all of which have confirmed that they are ready to start trading.

Another important impact of the approval of the Ethereum spot ETF is the change in the attitude of US regulators towards crypto policies. The curtain of the US election has opened, and the inclinations shown by the Democratic and Republican parties towards the crypto industry are worth paying attention to.

Previously, former U.S. House Speaker Nancy Pelosi was considering supporting a Republican-backed crypto bill FIT21 when the House voted this week. In addition, there is also a cryptocurrency accounting standards bill SAB121 that will be resolved in the near future.

After the Ethereum spot ETF was passed, the mainstream market view is that this has a positive impact on the regulatory environment of cryptocurrencies. Previously, Alex Thorn, head of research at Galaxy Digital, said that the SEC's regulatory attitude towards Ethereum will try to find a balance between the following two: "ETH" itself is not a security, while "pledged ETH" (or more far-fetchedly, "pledged ETH as a service") is a security.

This is very similar to the appeal in the FIT21 bill, which is to clarify which digital assets are regulated by the Commodity Futures Trading Commission (CFTC) and which digital assets are regulated by the Securities and Exchange Commission (SEC). This is important because there are key differences between the definitions of "commodities" and "securities", which will have an impact on how they are regulated. In short, as a crypto asset class with smart contracts, ETH will have a profound impact on the crypto industry when spot ETFs are passed.

2. EU MiCA Act imposes regulation on stablecoins

With the implementation of the EU MiCA (Market for Crypto Asset Regulation), 2024 will be an important milestone for the crypto industry in the EU and beyond. This groundbreaking regulatory framework is regarded as the most comprehensive regulatory framework in the world and will completely change the landscape of the crypto industry. The main implementation dates are June 30 for stablecoins and December 30 for crypto asset service providers (CASPs).

As mentioned earlier, MiCA (1) imposes strict requirements on the reserves that support stablecoins; (2) requires detailed disclosure of information related to collateral/operations/risk management processes; and (3) requires authorization from the competent authorities of the EU country to provide stablecoins in the EU.

Exchanges doing business in the EU may delist non-compliant stablecoins. Stablecoin issuance, both local and global, will either comply with regulations in the short to medium term or eventually disappear from the EU market, as evidenced by recent announcements from exchanges such as Binance, Bitstamp, Kraken, OKX, etc. that they will delist or phase out non-compliant tokens. Over time, the EU will be a market with zero tolerance for loosely regulated “Internet Funny Money”.

According to Patrick Hansen, Circle’s EU policy lead, the subsequent impacts of MiCA include:

Despite certain limitations or excessive regulatory protectionism in the law, MiCA represents an opportunity to develop a unique European crypto asset market, which is expected to be localized, institutionalized, professionalized and potentially integrated (all ecosystem chains);

In the short to medium term, local and global stablecoin issuance will either comply with regulations or eventually disappear from the EU market, as evidenced by recent announcements from exchanges;

Euro-denominated stablecoins are expected to grow and face local competition; foreign unregulated exchanges will face significant restrictions in the EU, making it extremely difficult or even impossible to operate in a reverse solicitation manner;

A large part of the implementation of MiCA remains to be done and remains to be seen; MiCA undoubtedly provides a huge opportunity for the EU, but it will require the joint efforts of the industry, regulators, policymakers and ultimately nearly 450 million consumers to fully realize its potential;

The longer the regulatory vacuum on cryptocurrencies in the two major jurisdictions of the United States and the United Kingdom continues, the greater the impact of MiCA The greater the impact of the standard on the world.

Circle announced that USDC and EURC can now be used under the new EU Stablecoin Act; Circle is the first global stablecoin issuer that complies with the MiCA standard. From July 1, Circle will issue USDC and EURC to European customers.

3. Hong Kong Monetary Authority Launches Ensemble Project Sandbox

In August 2024, the Hong Kong financial market ushered in an important moment-the Hong Kong Monetary Authority and the Hong Kong Securities and Futures Commission officially launched the Ensemble Tokenization Sandbox. This innovative regulatory environment provides a testing platform for the tokenization of financial resources and is expected to revolutionize the traditional financial system. Industry giants including HSBC and the Global Shipping Business Network (GSBN) have begun proof-of-concept (PoC) testing, and HashKey Group also plans to join this project. This sandbox program in Hong Kong is not only a trial, but is more likely to become a standard for the future global financial market.

The HKMA said it has completed the construction of the sandbox, which aims to promote interbank settlement using experimental tokenized currencies and focus on tokenized asset trading. Participating banks in the Ensemble Project Architecture Working Group have connected their tokenized deposit platforms to the sandbox to prepare for future experiments in cross-bank payment simultaneous delivery and delivery-versus-payment settlement.

What is the Hong Kong Ensemble Sandbox?

The Ensemble Sandbox is a platform created by the Hong Kong Monetary Authority to allow financial institutions and technology companies to experiment with the tokenization of assets in a controlled environment. Tokenization refers to the conversion of physical assets or rights into digital forms represented by tokens on the blockchain. This process not only increases liquidity and transparency, but also reduces transaction costs and improves market efficiency.

The move is part of Hong Kong's strategy to become a global leader in financial innovation. Fung-yee Leung, CEO of the Securities and Futures Commission (SFC) of Hong Kong, said the project aims to make the financial system "future-proof", emphasizing the importance of experimenting in a regulated environment to ensure that new technologies can be implemented safely and sustainably.

Leung Fung-yee also said that the sandbox launched on the same day proved that the combination of innovation and regulation can open up a new path for Hong Kong's financial market. As the two major builders of Hong Kong's financial market, the SFC and the HKMA share the same vision and are committed to leading Hong Kong's financial system into the future through innovative market infrastructure.

Major participants

The launch of the Ensemble sandbox has attracted the attention of major financial and technology institutions. HSBC, one of the world's largest banks, is one of the earliest participants. Its participation reflects the growing interest of traditional banks in blockchain technology and tokenization, which are seen as tools to improve operational efficiency and provide new products and services to customers.

Another key participant is the Global Shipping Business Network (GSBN), an alliance of major shipping companies and logistics operators. GSBN sees the sandbox as an opportunity to explore how tokenization can optimize shipping and global trade operations, reduce transaction times and increase supply chain transparency.

Finally, as a leader in the digital asset field, HashKey Group has announced plans to join the sandbox. Their participation highlights the importance of collaboration between the traditional and cryptocurrency sectors to build a strong and inclusive financial ecosystem.

Ensemble Sandbox Objectives

The Ensemble Sandbox is designed with clear objectives: to test the feasibility of tokenization, identify and mitigate associated risks, and develop a regulatory framework that can be adopted on a large scale. The participation of institutions like HSBC and GSBN ensures that the solutions developed are scalable and can be integrated into global markets.

One of the most interesting aspects of the sandbox is the ability to experiment in a real but regulated environment. This approach allows any technical, regulatory or market issues to be identified before the solution is implemented globally. In addition, the sandbox provides Hong Kong's regulators with a unique opportunity to work with companies to create flexible regulations that can quickly adapt to technological changes.

4. Hong Kong Stablecoin Consultation Conclusions Released

According to the consultation conclusions jointly initiated by the Hong Kong Monetary Authority (HKMA) and the Hong Kong Financial Services and the Treasury Bureau, stablecoin issuers will currently be regulated by the HKMA. Although the consultation summary has been completed, no clear legislation and regulatory guidelines have been issued at this stage, and no specific suggestions have been given for anti-money laundering of stablecoins.

Definition of Stablecoins

The definition of stablecoins does not include the following categories:

○ Deposits (including deposits in tokenized or digital form)

○ Certain securities or futures contracts (mainly authorized collective investment schemes and authorized structured products)

○ Any stored value or facility margin stored in a stored value facility

○ Digital legal tender issued by or on behalf of a central bank

○ Certain digital value with limited purposes

Stablecoins issued using a distributed ledger or similar technology that operates in a decentralized manner, where a distributed ledger that operates in a decentralized manner means that no person has the power to unilaterally control or substantially change the function or operation of its ledger, such as TerraUSD (UST), Dai (DAI), and sUSD (Synthetix USD).

Fiat Stablecoins

Regulators consider it necessary to include all fiat stablecoins in the proposed regulatory regime because both single-currency and multi-currency fiat stablecoins are linked to the traditional financial system, both of which may pose risks to financial stability. As fiat stablecoins have the potential to develop into a generally accepted means of payment, they pose a higher and more immediate risk to monetary and financial stability.

Response to the Proposed Criteria and Conditions for Stablecoin Issuers

○ It is illegal for any person (including issuers, agents and intermediaries) to promote the issuance of unlicensed fiat stablecoins.

○ The issuer must set up a separate account with a licensed bank or a custodian approved by the HKMA to manage the reserve assets.

○ The issuer must separate the reserve assets from the issuer's own assets and establish an effective trust arrangement to provide legal rights and priority claims to the reserve assets for fiat stablecoin users.

○ The issuer must demonstrate that its reserve asset investment policy and liquidity management policy are commensurate with the scale and complexity of its business, ensuring that they can meet redemption requests in normal circumstances and during periods of stress.

○ The issuer must meet its redemption request within one business day of the day on which the request is received.

○ The issuer must have sound risk management procedures and internal control procedures to safeguard and manage reserve assets.

○ The issuer must disclose the total amount of stablecoins in circulation, the market value and composition of reserve assets on a regular basis.

○ The issuer shall not pay interest to currency users.

○ The issuer must be incorporated in Hong Kong, and its senior management must be resident in Hong Kong and exercise effective control over its stablecoins.

○ The issuer's minimum paid-up share capital requirement is HK$25 million or one percent of the face value of its stablecoin in circulation, whichever is higher.

○ The issuer needs to publish a stablecoin white paper. The fiat stablecoin white paper must include the issuer's general information, the risks associated with using the fiat stablecoin, the technology used, the issuance, distribution and redemption mechanisms and procedures, the rights and interests of potential fiat stablecoin users, and the applicable conditions and fees for redemption.

○ The issuer must conduct a risk assessment at least once a year. The regulatory authorities will issue clear regulations on the qualifications and scope of relevant auditors in the future.

5. Singapore raises the risk factor of cryptocurrency exchanges in the update of anti-money laundering/anti-terrorist financing regulations

On July 1, Singapore regulators released an updated version of the country's National Risk Assessment (NRA) for Terrorist Financing and the National Strategy for Combating Terrorist Financing.

The move is aimed at preventing terrorist organizations and groups from taking advantage of Singapore's economic openness as an international financial, commercial and transportation hub to provide funding for terrorism.

According to the latest update, the risk rating of cryptocurrency trading platforms or digital payment token (DPT) service providers has been raised from medium-low to medium-high. Cross-border online payments remain at high risk as they are identified as a potential new channel for terrorist financing activities.

The latest challenge facing crypto platforms comes weeks after a report labeled digital payment tokens as high risk. According to Singapore's latest Money Laundering National Risk Assessment (MLNRA), DPT service providers represent serious risks and vulnerabilities in the context of anti-money laundering (AML).

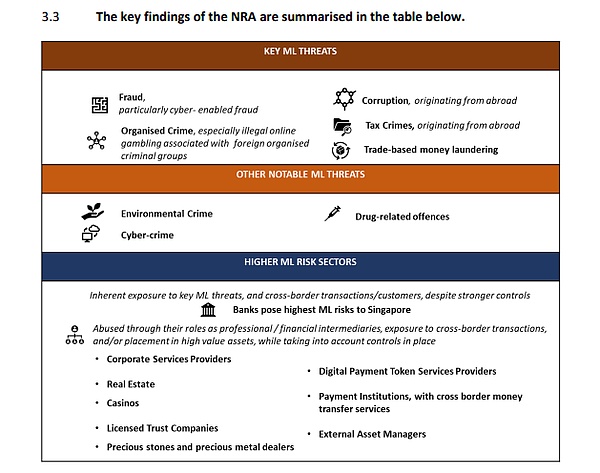

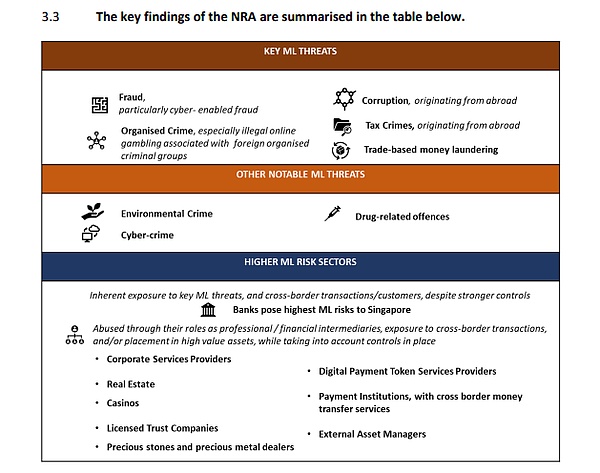

MLNRA's key findings in the AML space. Source: MAS

The Monetary Authority of Singapore has been actively involved in the regulation of the digital asset market. A few months ago, the Singapore regulator expanded the scope of regulated payment services to include digital token service providers, bringing digital assets under user protection laws. There has been news about crypto platforms recently.

The law allows the Monetary Authority of Singapore to impose stricter requirements on DPT service providers in terms of anti-money laundering and counter-terrorist financing, user protection and financial stability.

It also helps DPTs provide custody services and crypto transfer services in the country.

Singapore is seen as a country that supports cryptocurrencies, with a high rate of cryptocurrency adoption. While the global cryptocurrency ownership rate is about 4.2%, Singapore's adoption rate is as high as 11.2%. Under Singapore regulations, digital currencies are called digital payment tokens.

6. Turkey's cryptocurrency regulatory policy "Amendment to the Capital Markets Law"

Since 2021, Turkey has been included in the FATF's gray list due to money laundering risks. In order to get rid of this unfavorable situation and clarify the taxation policy of cryptocurrencies, Turkey began to increase its supervision of the field. Now that Turkey has been successfully removed from the gray list, a new regulatory framework has been introduced, laying the foundation for the standardized development of the cryptocurrency market.

On July 2, 2024, the Capital Markets Board of Turkey (CMB) officially announced the Capital Markets Law Amendment No. 7518, which included the provisions of Crypto Asset Service Providers (CASPs) in the scope of legislation. This marks a new stage in Turkey's cryptocurrency regulation. All crypto asset service providers must obtain a license from the CMB and comply with the standards set by TUBITAK. In addition, bank-related activities must also be approved by the Banking Supervision and Supervisory Authority (BDDK). These regulations not only strengthen supervision, but also provide guarantees for the healthy development of the crypto asset industry.

According to the new regulations, the establishment of a crypto asset platform must meet the following conditions:

1. The platform should be established as a joint-stock company with a minimum paid-in capital of 50 million Turkish liras.

2. All shares should be issued in cash and registered.

3. Founders and managers must comply with the provisions of the Capital Markets Law and other relevant laws and have sufficient financial strength, honesty and trustworthiness.

4. The business scope of the crypto asset platform should be clear, covering activities such as purchase, sale, initial issuance, distribution, liquidation, transfer and custody.

The new regulations require that crypto asset service providers currently operating in Turkey must submit the required documents to the CMB within one month, and companies that fail to submit applications must make a liquidation decision within one month. Temporary operating platforms must submit an application for a platform operating license before November 8, 2024, otherwise they will face liquidation.

During the transition period, a total of 76 exchanges have obtained temporary licenses to continue operating and must comply with the requirements of the new regulations. At the same time, 8 exchanges that failed to meet the conditions have been required to be liquidated.

The new regulations establish severe penalties for individuals and institutions that engage in crypto asset services without authorization. Individuals and legal persons who violate the regulations will face 3 to 5 years in prison and a fine of 5,000 to 10,000 days. The misappropriation of entrusted funds or assets will result in more severe penalties, up to 14 years in prison and a huge fine.

Criminals who commit fraud to conceal misappropriation will face 14 to 20 years in prison and a fine of up to 20,000 days. In addition, individuals who illegally use the resources of a crypto asset service provider whose license has been revoked will also face up to 22 years in prison and a fine of 20,000 days.

Joy

Joy