Author: Anne

The Rise of Prediction Markets: About Polymarket

In today's digital age, prediction markets are gradually becoming an emerging "public product" with accuracy that even surpasses traditional opinion polls. Among them, Polymarket, as the world's largest blockchain prediction market platform, has rapidly emerged since its launch in 2020 and has become a leader in this field.

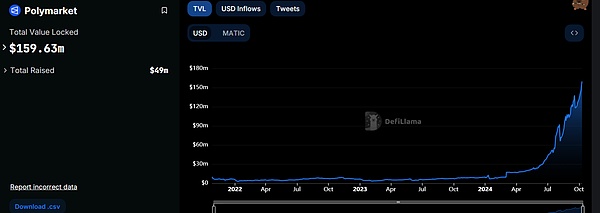

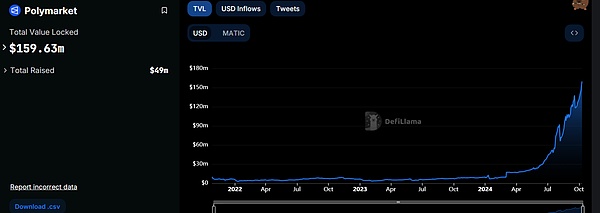

Polymarket allows users to predict and bet on the outcomes of future events in multiple fields such as sports, politics, business and science. The platform first gained significant attention during the 2021 US election, facilitating 91% of the total betting volume during the election cycle alone, worth $3.5 million. Currently, according to defillama data, Polymarket has secured a total locked value (TVL) of $153 million, with more than 150,000 followers and an active Discord community.

Image source: defillama

Despite the challenges Polymarket has experienced, including a $1.4 million civil penalty agreement with the U.S. Commodity Futures Trading Commission (CFTC), it has still received financing support from well-known blockchain stakeholders such as Vitalik Buterin and Peter Thiel's Founders Fund.

Prediction Markets vs Polls: The Battle of Accuracy

Prediction markets, especially cryptocurrency-backed platforms such as Polymarket, are increasingly seen as more accurate indicators of public sentiment than traditional polls. Research by Harry Crane, a professor of statistics at Rutgers University, found that the betting prediction market was more accurate than the well-known polling data aggregator FiveThirtyEight in the 2018 and 2020 US elections.

There is a key difference between prediction markets and polls: polls ask people who they hope to win, while the market asks people who they think will win through an economic incentive model. This distinction allows prediction markets to better reflect reality rather than just people's wishes.

Grant Ferguson, director of public advocacy at the Department of Political Science at Texas Christian University, also pointed out that prediction markets may be better than polls because real money will guide individuals to put aside personal preferences and "think logically about what is real, not what they hope to be real."

In addition, prediction markets have two main advantages: hedging and information aggregation. They allow individuals and businesses to hedge the risks of one-time, isolated results, such as the results of important elections. At the same time, economic incentives promote the participation of informed traders who share their information with the market in exchange for profits from correct predictions.

However, prediction markets also face some challenges and criticisms. A major issue is participation and liquidity. Compared with large-scale opinion polls, prediction markets usually have fewer participants, which may affect their representativeness. For example, the Iowa Electronic Markets in the 2008 US presidential election had only a few hundred active traders, compared to traditional poll samples that usually have thousands of people.

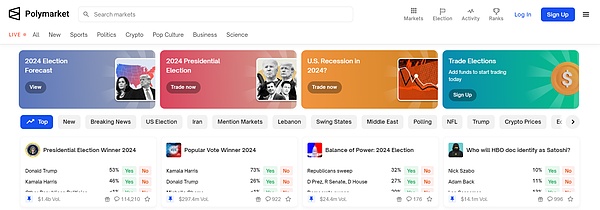

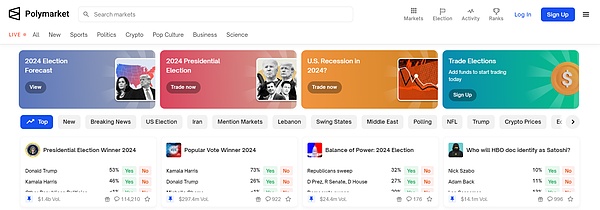

Image source: Polymarket

Another concern is the possibility of market manipulation. Individuals or groups with financial strength may try to influence market prices by buying or selling in large quantities, thereby distorting predictions. Although research shows that such manipulation is generally difficult to sustain, it remains a potential problem.

The legal status of prediction markets is also a complex issue. In many jurisdictions, they may be considered a form of gambling and therefore strictly regulated or banned altogether. This limits their widespread application and development.

Overall, while prediction markets show great potential, they may be better suited as a supplement to traditional opinion polls rather than a complete replacement. Combining the advantages of both may provide more comprehensive and accurate information to decision makers and the public. "

Regulatory Challenges and Legal Controversy

Although prediction markets show great potential, they also face severe regulatory challenges. In May 2024, the U.S. Commodity Futures Trading Commission (CFTC) proposed a rule to ban derivatives used to bet on the outcomes of the U.S. election and other major real-world events. The proposal has sparked a fierce legal dispute.

Kalshi, a regulated prediction market platform based in the United States, took the CFTC to court. District of Columbia Judge Jia Cobb ultimately rejected the CFTC's proposal, saying that "Kalshi's contracts do not involve illegal activities or games." Although the CFTC attempted to appeal the decision, the appellate court ultimately rejected the CFTC's proposal on October 2, 2024, allowing the platform to resume trading.

However, supporters such as Elon Musk believe that prediction markets may provide more accurate predictions of events than traditional polls. Musk pointed out that in these markets, "real money is at work," which may lead to more accurate predictions.

There is still a lot of uncertainty about the future development of prediction markets. On the one hand, they show higher accuracy than traditional polls and may provide the public with valuable information and risk management tools. On the other hand, they face severe regulatory challenges and concerns that they may undermine the democratic process.

As technology advances and the regulatory environment evolves, prediction markets may continue to expand their influence. However, balancing its potential benefits against possible risks will be an ongoing challenge. In the future, we may see more regulatory measures targeting prediction markets, as well as how these platforms adapt and evolve to meet changing legal and ethical requirements.

Conclusion

Prediction markets, especially cryptocurrency-backed platforms like Polymarket, are reshaping our understanding of political forecasting and public opinion. They demonstrate greater accuracy than traditional polls and provide the public with new sources of information and risk management tools. However, this emerging field also faces serious regulatory challenges and ethical controversies.

As prediction markets continue to develop, we need to carefully weigh their potential benefits against possible risks. Regulators, platform operators, and the public need to work together to ensure that these markets can operate in a responsible and beneficial manner without causing damage to the democratic process or public trust.

The future development of prediction markets will depend on how we respond to these challenges and whether we can find a way to strike a balance between innovation and regulation. In any case, it is certain that the prediction market has become a force that cannot be ignored and is profoundly affecting the way we understand and predict political and social events.

Miyuki

Miyuki