Author: Gate Research Institute

Abstract

● DeFi Summer Review and the Rise of PayFi: In 2020, DeFi Summer was driven by innovative primitives such as AMM, decentralized lending, and yield aggregators. TVL soared from US$1 billion to US$15 billion in a few months, achieving explosive growth. Five years later, PayFi has quietly emerged as a new paradigm of on-chain payment finance, aiming to apply blockchain technology to daily payments, emphasizing the accessibility and scale of network applications, and heralding a new round of on-chain financial boom.

● PayFi core driving force and business model: The core driving force of PayFi is the time value of money (TVM), which efficiently manages funds and generates income through on-chain mechanisms. Its business model covers interest-bearing payment tokens, RWA payment financing, and payment innovations that integrate Web3 and DeFi.

● The large-scale application and potential of stablecoins: As the core medium of PayFi, the application scale of stablecoins has exploded. As of June 2025, the global circulation of stablecoins has exceeded US$240 billion, the monthly active addresses have exceeded 35 million, and the average daily number of payments has exceeded 40 million. The total transaction volume for the year is close to US$20.5 trillion, which has greatly surpassed PayPal and cross-border remittance systems, and has surpassed Visa many times, becoming the second largest payment system after ACH.

● Global regulatory policies are gradually becoming clear: International organizations (such as FSB, BCBS) have proposed regulatory principles, and regional regulatory bills have been introduced one after another, such as the Hong Kong Stablecoin Bill, the EU MiCA, and the US GENIUS Act, which have cleared policy obstacles for PayFi's compliance and mainstreaming.

● Optimization of technology and user experience: Technological breakthroughs such as Layer 2 expansion (average gas fee is far less than $1), account abstraction (AA) and cross-chain interoperability have greatly improved PayFi's transaction efficiency and user experience, making its operating experience close to traditional Web2 applications.

● Economic incentives drive PayFi's growth: The total market value of income-based stablecoins (such as USDY, sUSDE) has exceeded $11 billion, and the cumulative income has exceeded $600 million. By embedding asset income into the payment link, "paying while earning interest" is achieved. PayFi has significant advantages in cost and efficiency. For example, the pilot of Celo and PayU reduced the handling fee by 60%, and the settlement was realized in real time.

● The fundamental difference between PayFi and DeFi Summer: PayFi's growth path is more robust, and its core driving force is practical application value rather than speculative high returns; the target users are the general public rather than only crypto-native users; the capital structure is mainly long-term strategic capital; and it started in a more stringent regulatory environment. PayFi's "Summer" will be a gentle, lasting and profound innovation of payment infrastructure, rather than a bubble-like climax

1. Introduction

1.1 From DeFi Summer to PayFi's Horizon

In the summer of 2020, DeFi (decentralized finance) ushered in explosive growth in the Ethereum ecosystem, ushering in a chain financial boom widely known as "DeFi Summer". This movement has redefined the possibilities of financial services with its exponential user growth, innovative financial primitives (such as AMM, decentralized lending, yield aggregators), and profound challenges to the traditional financial system. The core logic of DeFi Summer lies in its composability, that is, the Lego-like protocol stacking, which has spawned unprecedented income opportunities and a liquidity mining boom, attracting a large amount of capital and developers to influx, and achieved a leap from concept to large-scale application.

Five years have passed, and DeFi has entered the stage of infrastructure optimization and application landing from primitive accumulation. Stablecoins have become the core asset anchor, and regulatory and compliance issues have gradually surfaced. At the same time, a new paradigm of on-chain finance with "PayFi" (Payment + Finance) as the core narrative is quietly emerging. PayFi focuses on applying blockchain technology to daily payment scenarios, intending to solve the pain points of the current payment system in terms of efficiency, cost, cross-border restrictions, and financial sovereignty. It not only focuses on the combination and capital efficiency of financial protocols, but also emphasizes the accessibility, availability and scale application of on-chain payment networks, and strives to expand Web3 services to hundreds of millions or even billions of user groups.

This article aims to trace the logic of DeFi Summer's outbreak, systematically analyze PayFi's core concepts, protocol ecology, application scenarios and potential catalysts, and explore whether it has the potential to trigger a new round of on-chain financial boom-"PayFi Summer". Is PayFi Summer quietly brewing on the horizon of crypto finance?

1.2 Review of DeFi Summer 2020: Financial Paradigm Shift

DeFi Summer is not an accidental phenomenon, but a historical synergy of years of technological accumulation, crypto culture and the evolution of financial needs. In mid-2020, DeFi protocols in the Ethereum ecosystem (such as Uniswap, Compound, Aave, etc.) quickly gathered capital, users and developers through a new incentive design with their open, transparent and permissionless characteristics, giving birth to an unprecedented on-chain financial experiment.

1.2.1 Core driving force: Composability × Yield Farm × Liquidity Mining

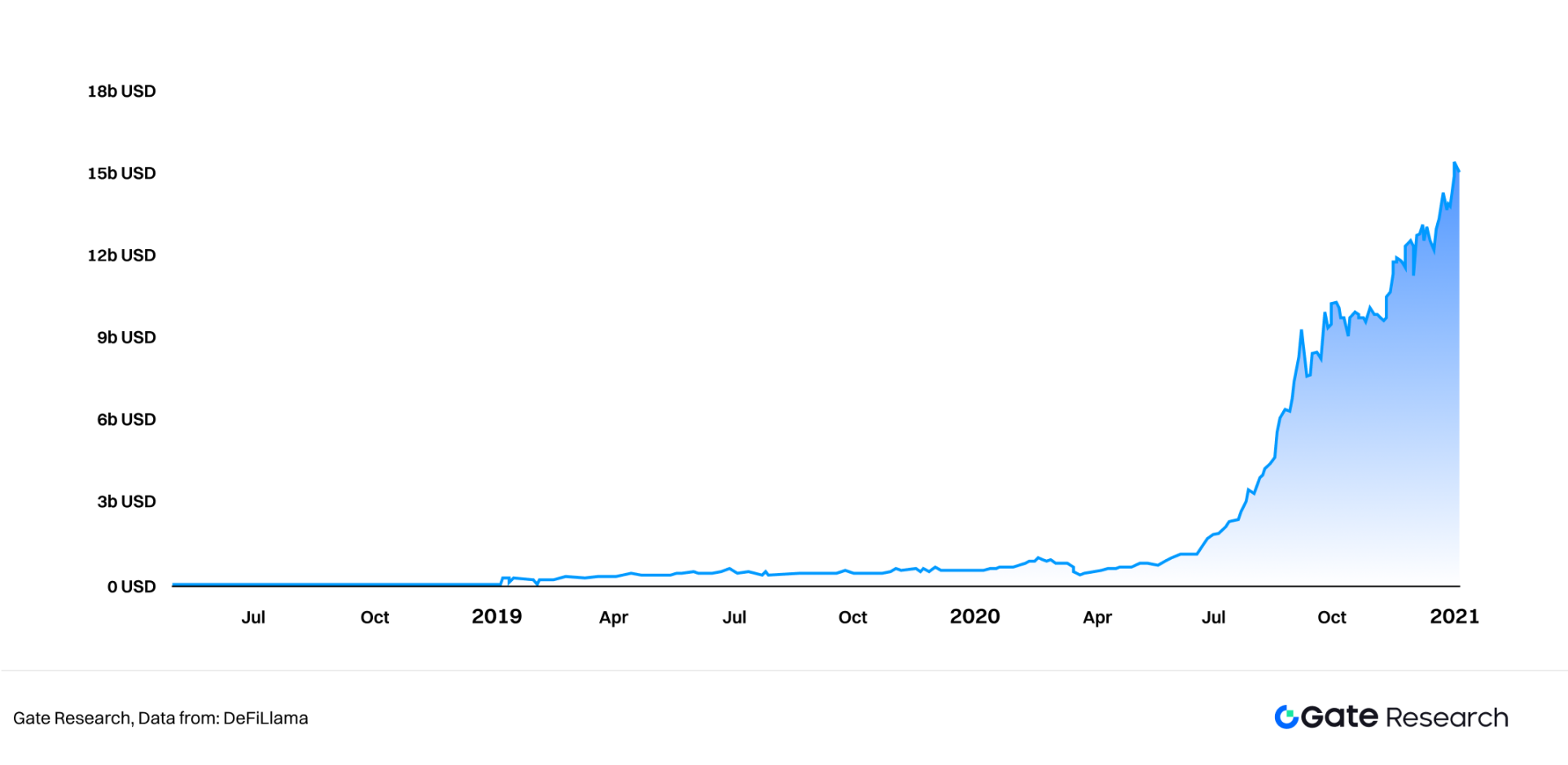

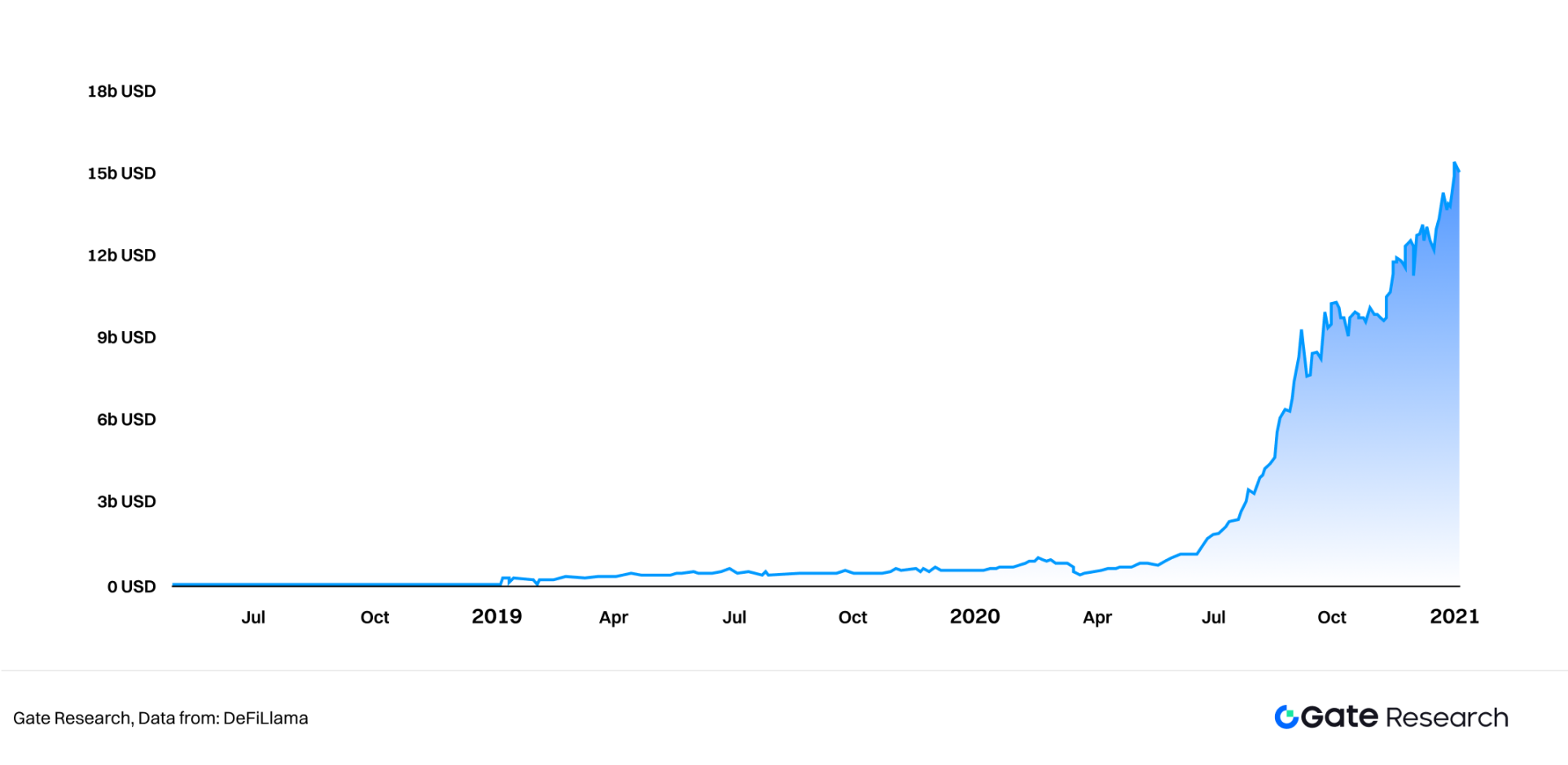

Composability: One of the key innovations of DeFi is the seamless combination of modular protocols. Users can freely shuttle and stack assets in multiple protocols. For example, users pledge ETH to Compound to borrow DAI, and then optimize the yield through Yearn.finance, which in turn deploys these DAI to Curve Finance's stablecoin pool. This "protocol stack" model greatly improves capital efficiency and the speed of financial innovation, forming a strong network effect. Yield Farming: One of the detonating points of DeFi Summer was the liquidity mining launched by Compound in June 2020. In just a few months, TVL (total locked volume) soared from US$1 billion to US$15 billion (at the end of 2020). Users can receive additional token rewards in addition to interest or transaction fees by providing liquidity or lending assets to the protocol. These protocol tokens (such as COMP) usually carry governance rights and have trading value in the secondary market. Yield Farming pushes capital efficiency to the extreme through multi-layer arbitrage and recycling strategies, attracting a large amount of speculative and long-term capital.

Figure 1: DeFi TVL from 2018 to 2020

Liquidity Mining: As a specific form of yield farming, liquidity mining encourages users to inject assets into the liquidity pools of decentralized exchanges (DEX) such as Uniswap and SushiSwap in exchange for transaction fees and additional governance tokens. This mechanism solves the problem of insufficient liquidity in early DEXs, causing decentralized trading volume to rise rapidly and giving rise to the popularity of the AMMs (automated market maker) model.

1.2.2 Structural Legacy: Decentralization, Inclusion, and New Financial Primitives

The impact of DeFi Summer goes far beyond the short-lived market frenzy. It has left a profound and lasting legacy:

● Feasibility verification of decentralized financial services: The DeFi protocol demonstrates the possibility of implementing complex financial functions such as lending, trading, and insurance without a central institution, challenging the logic of traditional financial intermediaries and accelerating the exploration of decentralization and infrastructure reconstruction.

● Progress in financial inclusion: In theory, any user with an Internet connection can access DeFi services without a threshold, skipping traditional financial barriers such as KYC and credit ratings, and providing a path for financial participation for billions of "unbanked" or "underbanked" users around the world.

● Primitive innovation: A series of underlying financial primitives such as AMMs, flash loans, yield aggregators, and liquidity guidance mechanisms have been created and widely adopted, bringing new structures and boundaries to financial product design.

● On-chain transparency and data traceability: All DeFi operations are recorded in the public blockchain, which greatly improves the transparency and auditability of financial activities, and also opens up space for on-chain data analysis and strategy execution.

● Developer dividends and ecological explosion: DeFi Summer attracted a large number of developers to enter the Web3 field, giving birth to a wealth of middleware, interface tools, security frameworks and asset standards, laying the foundation for the subsequent prosperity of the multi-layer ecosystem.

However, DeFi Summer also exposed systemic shortcomings: such as high gas fees, network congestion, complex user experience, regulatory uncertainty, and frequent smart contract security incidents. Although these problems once restricted its scale expansion, they also indirectly promoted the rapid development of infrastructure such as Layer2, cross-chain bridges, and modular design, and provided conditions and inspiration for the landing of narratives such as PayFi that focus more on "usability".

2. What is PayFi?

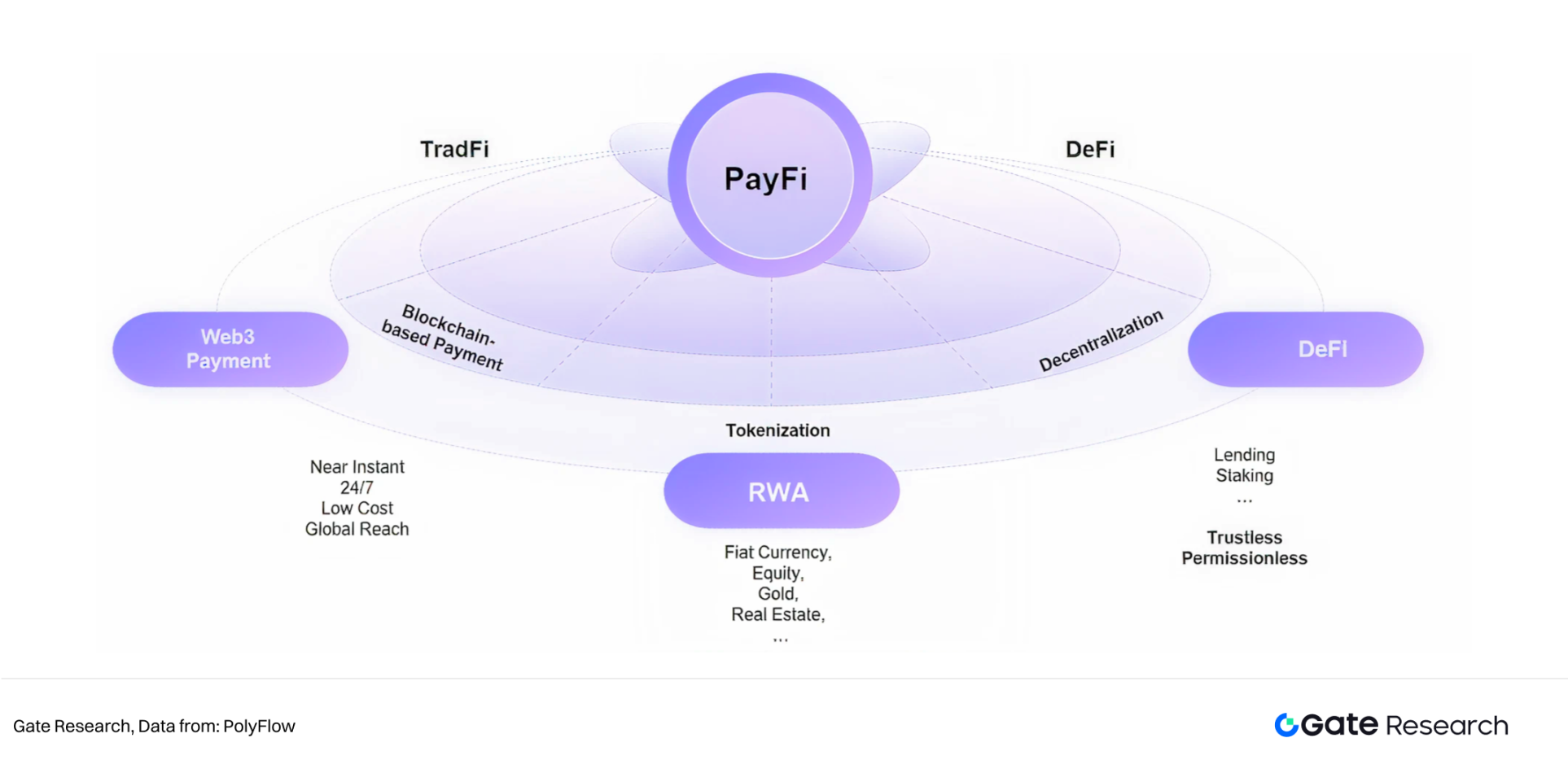

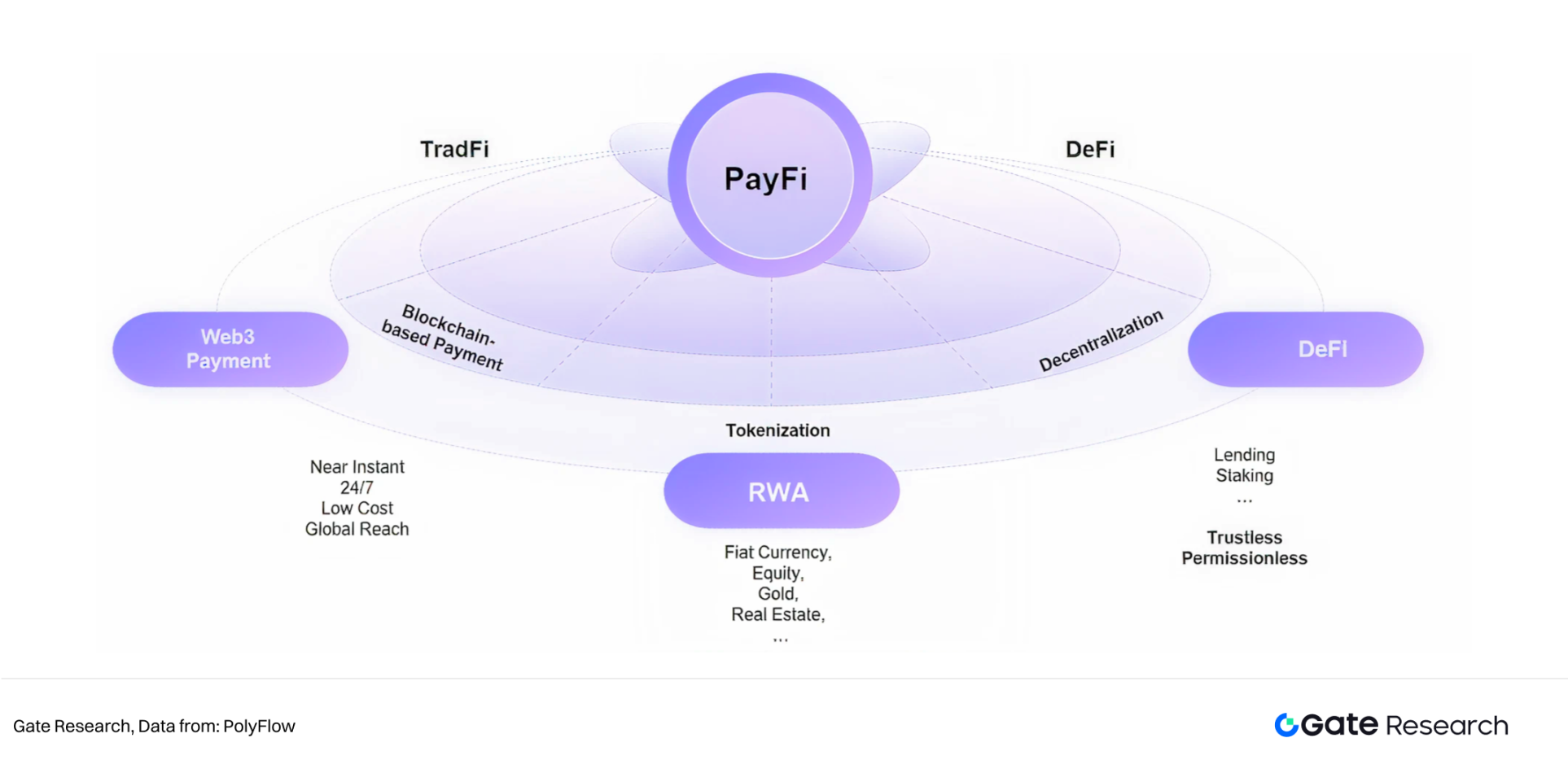

If DeFi Summer focuses on rebuilding traditional financial services on the blockchain, then PayFi (Payment Finance) goes a step further and is committed to deeply integrating the efficiency, transparency, and global accessibility of DeFi into daily payments and commercial settlements, thereby opening up a new financial paradigm.

2.1 Overview of PayFi

PayFi (Payment Finance) is a blockchain application model that deeply integrates payment functions with financial services. It is not limited to cryptocurrency payments, but seamlessly integrates the sending, receiving and settlement processes with lending, financial management, cross-border transfers and other services through blockchain technology. It aims to build an efficient, low-cost, programmable payment and financial system and promote the formation of a new financial value chain.

2.1.1 The core driving force of PayFi: Time Value of Money (TVM)

The theoretical basis of PayFi is derived from the core concept of finance, "Time Value of Money" (TVM): that is, money is more valuable at the present time than in the future because it can be invested immediately and generate income. Lily Liu, chairman of the Solana Foundation, first proposed the concept of PayFi in 2024 and pointed out that the market is built around TVM.

PayFi uses on-chain mechanisms to achieve dynamic management, investment and reuse of funds at extremely low cost and high efficiency, which not only significantly improves capital efficiency, but also provides a feasible path for complex financial applications such as on-chain credit, installment payment and automated investment.

2.1.2 Evolution and core features of PayFi:

The evolution of PayFi can be traced: from the initial exploration of on-chain stablecoins and native payments from 2018 to 2020, to the rise of RWA and off-chain income pledge from 2021 to 2023, and then to the formal proposal of the PayFi concept in 2024, it is becoming a new direction for developers and capital to focus on.

PayFi's core features include:

● Near instant settlement: Greatly shortens capital turnover time.

● Low-cost cross-border payment: Reduces intermediaries and improves efficiency.

● Security and transparency: Transaction records cannot be tampered with, enhancing trust.

● Real-time liquidity and financing: Utilize the time value of funds to achieve immediate use of future cash flows.

● Deep integration with RWA: Introduces real assets into on-chain payments to provide stable returns.

● Inclusiveness: Provide opportunities for people around the world who are not covered by traditional financial services.

2.1.3 PayFi's four business models

1. Payment tokens themselves are interest-bearing: Use tokenized US bonds or interest-bearing stablecoins to capture the time value of money and improve capital efficiency (such as Ondo Finance's USDY).

2. Payment scenario financing RWA: Use DeFi lending funds to solve the financing needs in real payment scenarios and realize the on-chain payment financing yield (such as Huma Finance).

3. Innovative Web3 payment business integrating DeFi: Combine DeFi income with Web3 payment to create novel payment models (such as the "buy without paying" model, using DeFi income to cover payment fees; or Web3 banking models such as Fiat24; and encrypted payment cards such as Ether.Fi's Cash business).

4. On-chaining of traditional payment processes: Tokenize the entire payment scenario and business process and move it to the chain to more efficiently capture the monetary time value in real-world payments.

PayFi essentially reconstructs the value transfer behavior of "payment", which is no longer limited to transaction matching in DeFi, but focuses on the overall optimization of on-chain capital flow, settlement and asset efficiency.

2.2 Current Development Status of PayFi: Accelerated Evolution from Concept to Multi-level Infrastructure Ecosystem

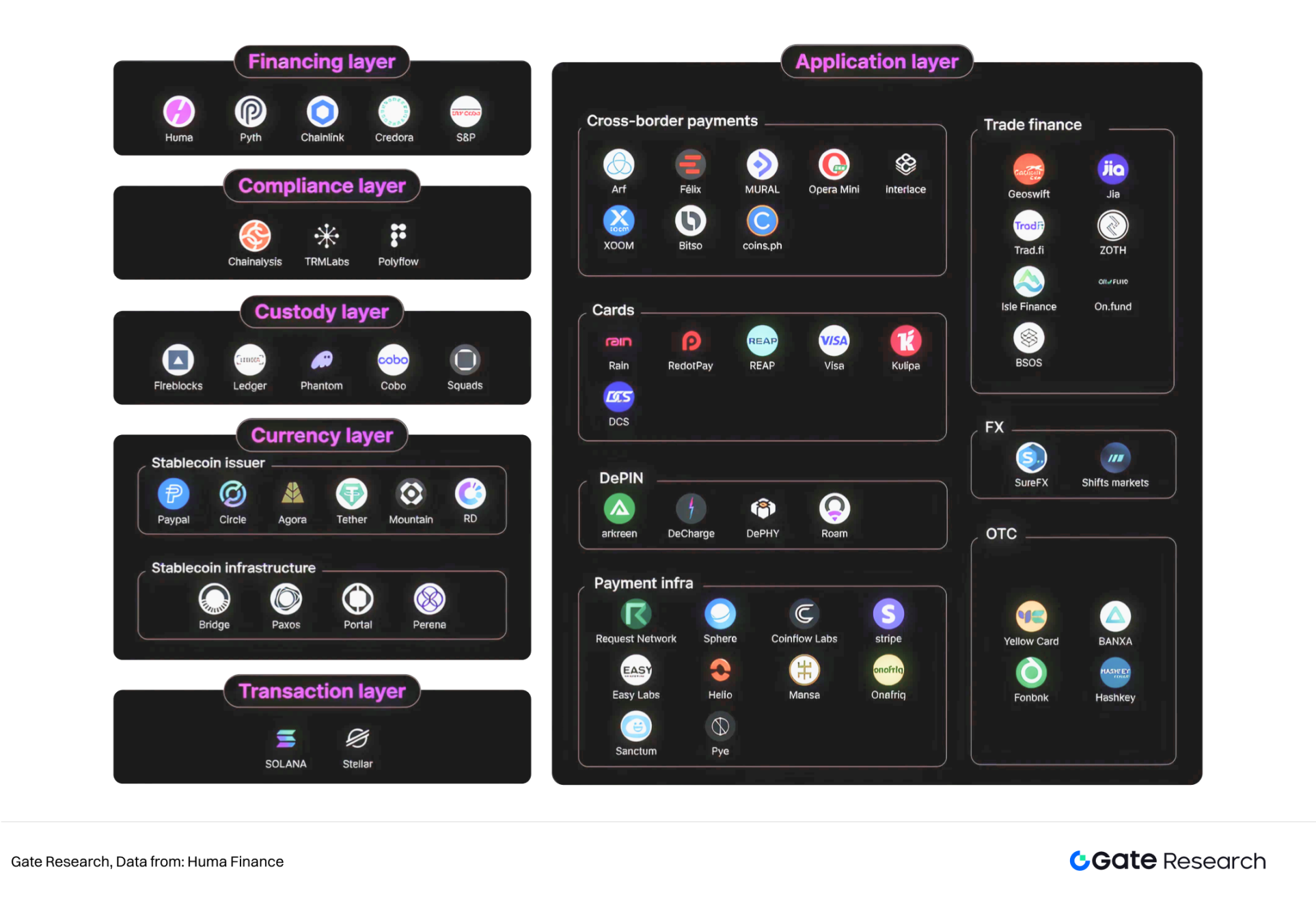

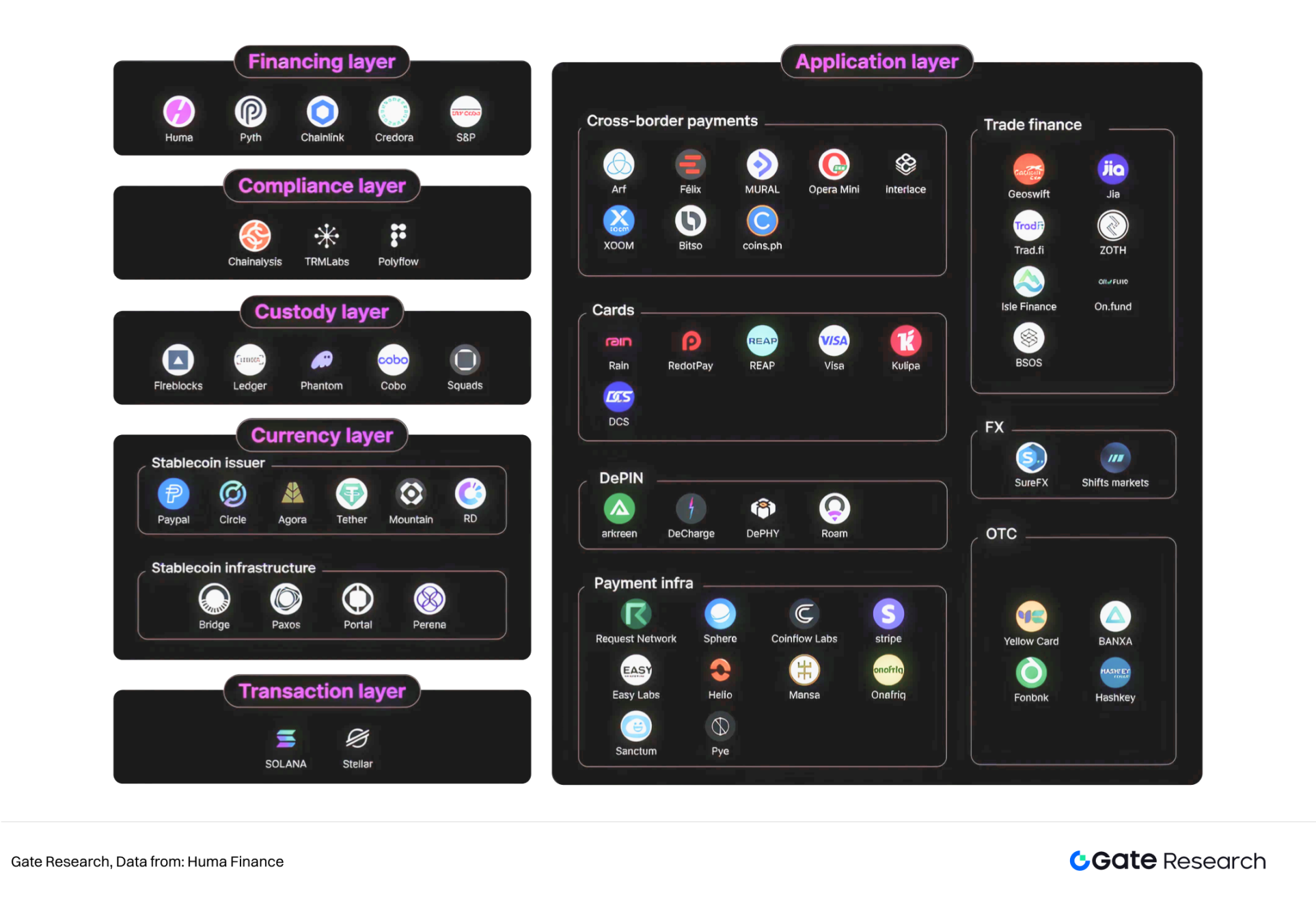

With the growing demand for on-chain payment and financing, PayFi has rapidly evolved into one of the most promising infrastructure directions in Web3. The "PayFi Stack" first systematically proposed by Huma Finance has built a six-layer module architecture similar to the OSI model. Each layer has a clear function and jointly supports the implementation of an efficient, programmable and compliant payment and financial ecosystem.

Figure 2: PayFi Ecosystem Map

2.2.1 PayFi Stack Six-Layer Structure: Modular Collaboration Blueprint

●Transaction Layer: High speed and low cost are the basis of on-chain payment. High-performance blockchain networks such as Solana and Stellar provide a strong infrastructure for PayFi. Solana implements a priority fee mechanism, develops the QUIC protocol and equity-weighted QoS to further improve transaction throughput and fairness; Stellar relies on the SCP consensus algorithm to maintain a balance between decentralization and efficiency in cross-border payments.

● Currency Layer: Stablecoins are PayFi's "universal payment medium". USDC, PYUSD, Tether, etc. are backed by cash and US bonds, combining stability and compliance; emerging projects such as Mountain and Agora provide customized solutions for micropayments, regional supervision and other needs. Infrastructure such as Bridge, which supports multi-chain migration, Paxos, which focuses on compliance and transparency, and Perena, which has a dynamic mortgage mechanism, continue to enhance the scalability and security of the currency layer.

● Custody Layer: Ensuring asset security is the core foundation of the financial system. Fireblocks and Ledger provide institutional-level custody services such as MPC and multi-signature; non-custodial wallets such as Phantom and Squads meet the needs of individual users to independently control their assets; Cobo supports both custody and non-custodial dual-track solutions to ensure that all types of fund users can safely access the PayFi network.

● Compliance Layer: Regulatory compliance is the key guarantee for mainstream adoption. Chainalysis and TRM Labs provide powerful on-chain risk identification and anti-money laundering tools; Polyflow embeds compliance logic into the custody architecture, promotes the deep integration of on-chain services and regulatory requirements, and provides institutional users with a credible basis for compliance.

● Financing Layer: The core of payment and financing innovation. The PayFi network built by Huma Finance realizes financing based on future accounts receivable; Credora provides decentralized credit assessment to improve credit transparency; Pyth Network and Chainlink provide accurate oracle services, providing exchange rates, asset pricing and proof of reserves in real time; S&P Global enters tokenized ratings to provide traditional credit extension for the financing market.

● Application Layer: From DePIN to cross-border payments, real applications have reached scale. Visa, Reap, DCS, etc. promote the popularization of encrypted payment cards; DeCharge and Roam lead the construction of decentralized infrastructure; Jia and BSOS focus on the on-chain of trade financing; Helio, Sphere, and Request provide programmable payment interfaces; Onafriq, Arf, Bitso, etc. reduce the threshold of global remittances and settlement delays, giving PayFi global momentum.

The "Open PayFi Stack" built by Huma Finance provides an open blueprint for the entire ecosystem. Compared with the closed platform of the traditional financial system, PayFi's modular architecture encourages more projects to carry out professional innovation around different functional levels and form a diversified collaborative system:

●Traditional/crypto giants such as Visa, Solana, and Circle promote the integration of basic layer protocols;

●Service providers such as Fireblocks, Ledger, and Chainalysis build a security and compliance foundation;

●Entrepreneurial teams such as Jia, Arf, and Reap focus on rapid verification of niche scenarios;

●The ecological map continues to expand, gradually forming a multi-path landing pattern represented by DePIN, stablecoin payments, and financing tools.

2.2.2 PayFi practice trends and representative cases

With the gradual maturity of the underlying infrastructure (such as stablecoins, Layer 2, and interoperability protocols), PayFi is moving from narrative concepts to real applications. Its core value lies in improving payment efficiency, optimizing the efficiency of fund use, and connecting Web3 with the real world's capital flow. Its implementation process shows three major integration trends:

●Web3 payment upgrade: from "on-chain payment" to "on-chain fund intelligent scheduling", which is not only used for settlement, but also can capture asset returns and flexibly combine strategies.

●DeFi tool reality embedding: with the help of lending and income mechanisms, it provides users with "unconscious cost coverage" and "income compensation" capabilities for payment.

● RWA module empowerment: through tokenized treasury bonds and payment financing structures, provide stable anchoring, income sources and collateral assets for transactions.

Figure 3: PayFi integration trend

The following three types of innovation paths and representative cases constitute the current mainstream direction of PayFi landing:

1. Tokens as payment media: "income-generating stablecoins" that capture the time value of money

Against the backdrop of high interest rates, tokenized products based on U.S. debt have become a new generation of payment media. This type of token can not only stably denominate the US dollar, but also continuously generate income. Its essence is to encode the "time value of money" into the payment asset.

Case | Ondo Finance: USDY, a stable currency for payments with embedded income

Ondo Finance is committed to chaining US Treasury assets. One of its core products, USDY, is an interest-bearing stablecoin designed for non-US residents and institutional investors around the world, providing a stablecoin alternative that is denominated in US dollars and can generate income.

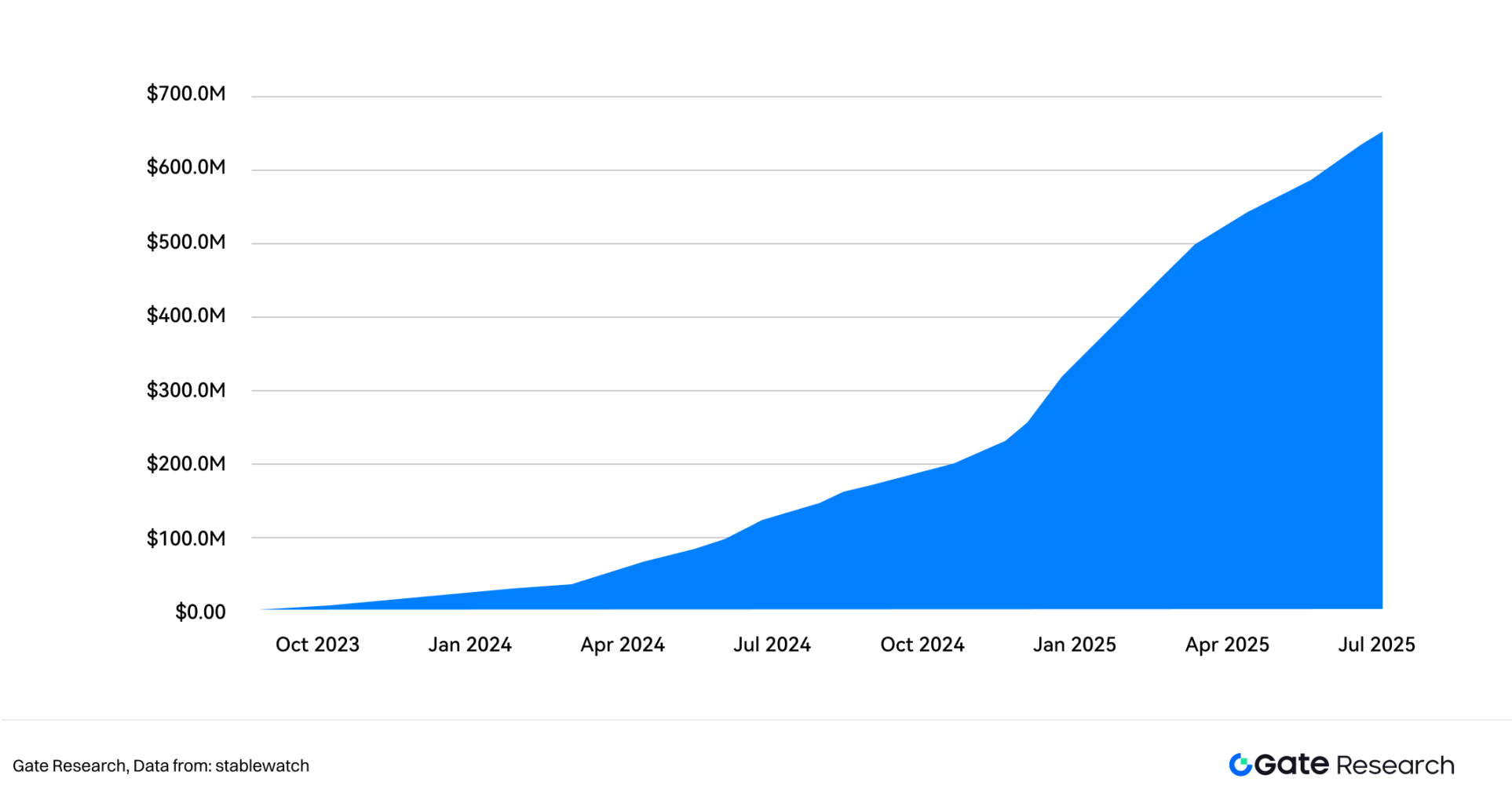

As of June 2025, the total locked value (TVL) of USDY has exceeded US$680 million. Its biggest feature is that it can automatically accumulate income every day, combining the stability of the US dollar with interest returns. The annualized yield of USDY refers to the Secured Overnight Financing Rate (SOFR). After deducting a management fee of about 0.5%, the current annualized yield (APY) is about 4.29%.

USDY can be converted into a stable value token rUSDY with a rebase function. For users holding rUSDY, the number of their tokens will automatically increase as their income increases. This mechanism is similar to Lido's stETH, which can more intuitively reflect the growth of income.

In addition, USDY has good composability and has been connected to eight blockchain network ecosystems such as Ethereum and Solana as collateral for lending, becoming one of the most realistic and penetrating basic payment tokens in the PayFi ecosystem.

2. Payment Financing RWA: On-chain funds support real transaction needs

Payment financing (such as credit card settlement, trade credit, prepayment, etc.) is the blood of traditional financial transactions. PayFi integrates the RWA mechanism and uses DeFi lending funds to connect payment financing scenarios, "moving" short-term, high-frequency, and predictable funding needs to the chain, taking into account liquidity, security, and yield.

Case | Huma Finance: On-chain support for offline payment financing

Huma Finance has built an RWA market for financing real-world payment scenarios, focusing on cross-border advance payment, supply chain finance and other scenarios. Its core paths are:

●Raising on-chain capital: Funds provided by DeFi investors;

●Serving offline merchants: used to support the cross-border advance payment and payment needs of small and micro merchants;

●Structured income path: providing investors with tiered income from low risk (trade credit) to medium and high risk (merchant loans).

This type of payment financing asset has a short liquidity cycle and a low default rate, which is an ideal form of on-chain bonds. Through projects such as Huma, PayFi is no longer just a "settlement method", but also a "financing tool", expanding the boundaries of DeFi in the real world.

3. Native payment integration of Web3 and DeFi: income-driven payment paradigm

In the Web3 scenario, PayFi innovators are exploring the "income payment model": users do not need to pay cash, but authorize their DeFi income to automatically deduct transaction costs. This not only reduces the actual burden on users, but also builds new payment models such as "streaming payment" and "income as payment".

Case Study | Fiat24: On-chain banking protocol connects real-world fiat currency payments

Fiat24 is an on-chain banking protocol deployed on Arbitrum, licensed by Swiss regulators, and provides services including savings, transfers, fiat currency exchange, lending and securities investment. The core of its model lies in:

● "Fiat currency protocol layer": as a compliant fiat currency payment interface for DApp, it connects on-chain DeFi and off-chain banking systems;

● DeFi calls payment services: supports on-chain protocols to call Fiat24 to initiate operations such as US dollar lending, asset redemption, and fiat currency securities investment;

● Strong composability: build a universal banking service interface to open up the payment/financial closed loop between the crypto world and the real economy.

Case Study | Ether.Fi’s Visa Crypto Card: Use Staking Income to Offset Consumption

Ether.Fi focuses on Ethereum staking and liquidity re-staking. Its Cash card integrates the Visa network and DeFi income logic to build an “income payment” model:

●Users stake/re-stake ETH to generate income;

●Use this income to exchange USDC for card top-up;

●There is no need to sell assets or exchange fiat currency to use the card for consumption, realizing the triple experience of “holding warehouse + consumption + income deduction”.

This model effectively reduces the payment friction of crypto users and circumvents the regulatory bottleneck of fiat currency exchange, providing PayFi users with a collaborative path of asset compounding and consumption freedom.

3. The key catalyst that gave birth to "PayFi Summer"

The outbreak of DeFi Summer is the result of multiple factors such as technological maturity, user demand and speculative boom. For PayFi, whether it can usher in a similar "Summer" also depends on the joint action of a series of key catalysts. These catalysts cover the macro-regulatory environment, the evolution of underlying technologies, user experience optimization, and market economic incentives.

3.1 Large-scale application of stablecoins and the release of policy windows

The rise of any large-scale payment system is inseparable from an efficient and stable value transmission medium and a strong underlying infrastructure. In the PayFi system, stablecoins are not only payment tools, but also a key bridge connecting traditional finance and the on-chain world, and the core prerequisite for realizing daily payment functions.

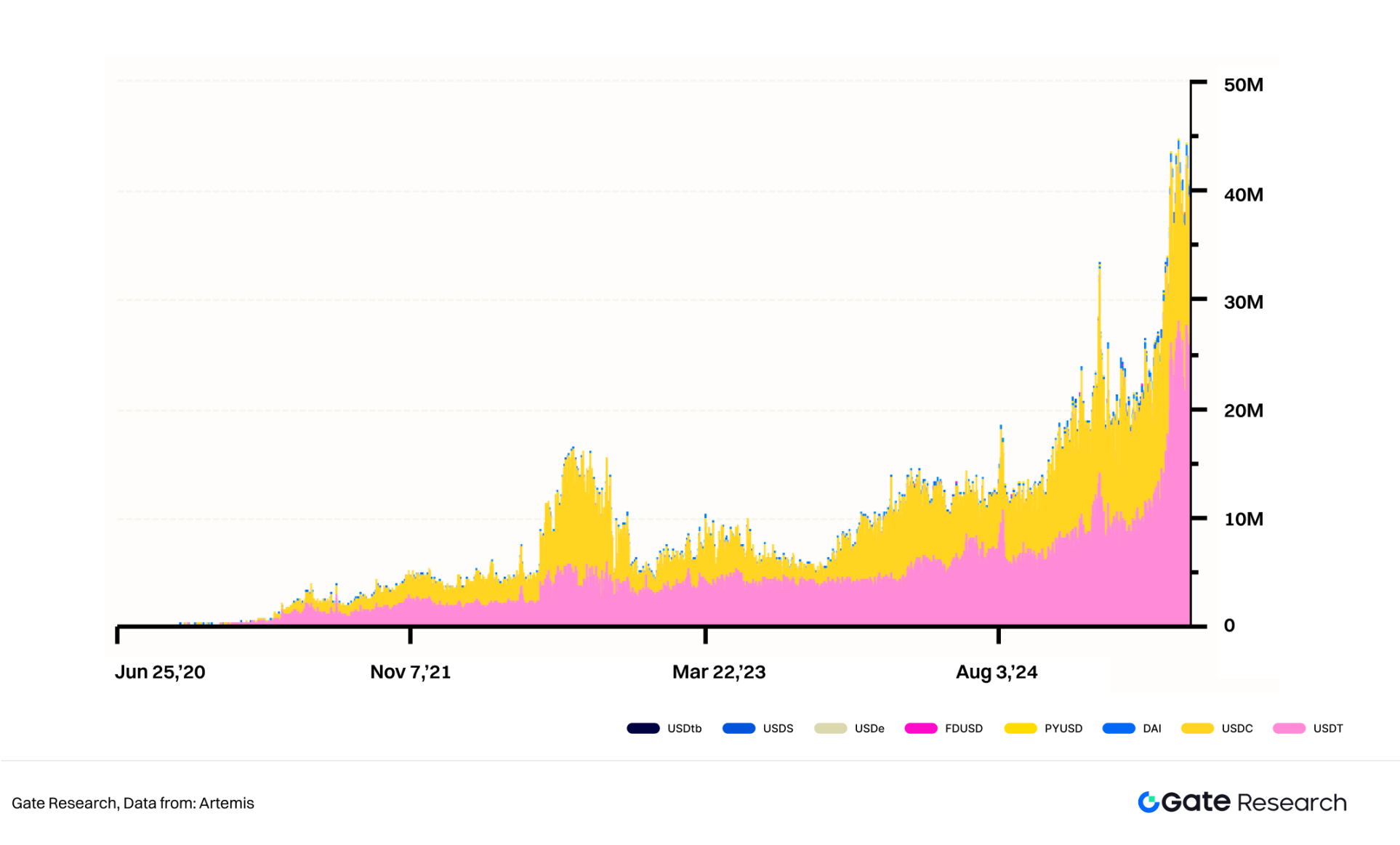

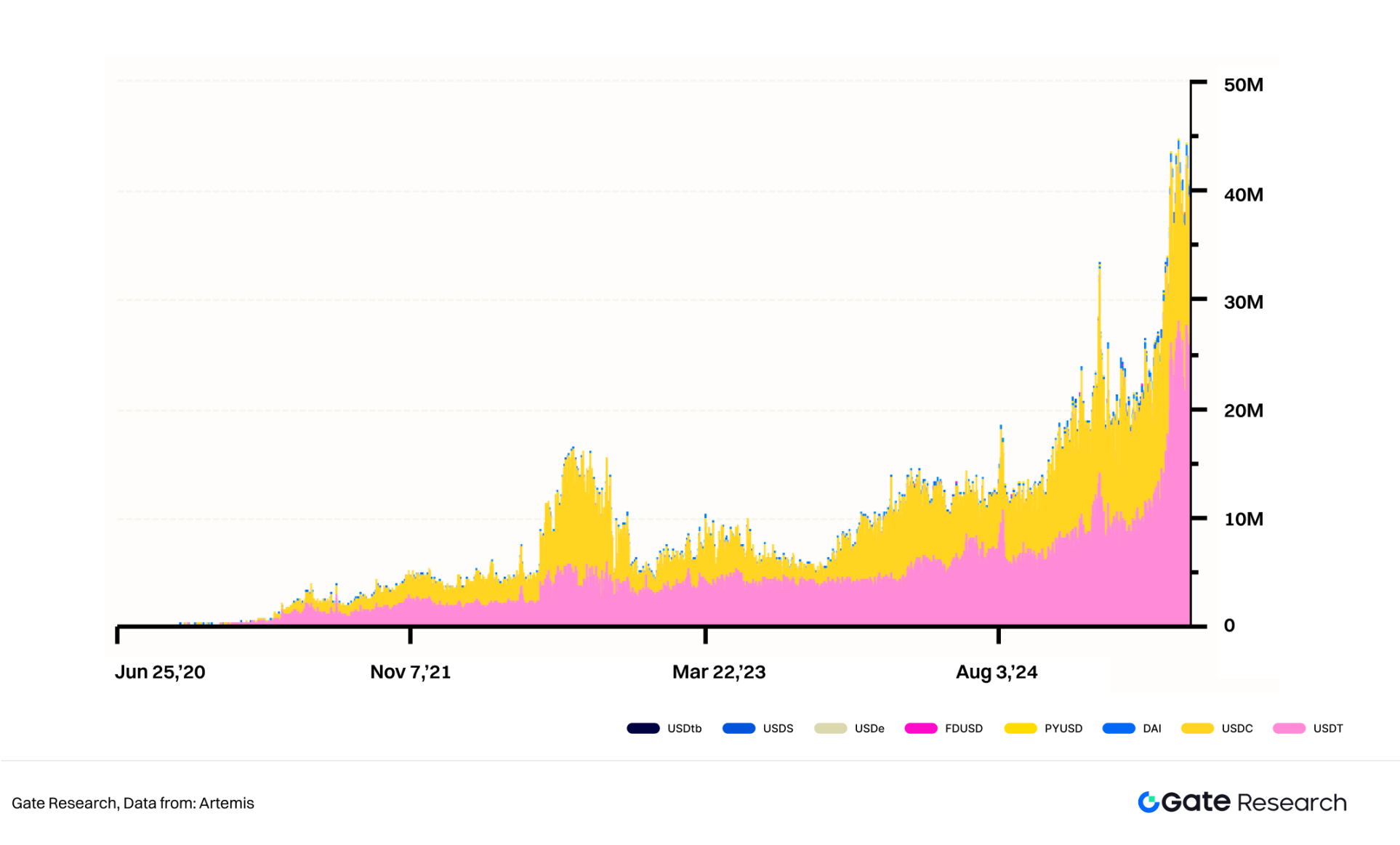

3.1.1 Explosive Growth in the Use of Stablecoins

As of June 2025, the global circulation of stablecoins (tokenized currencies) has exceeded US$240 billion, with USDT and USDC dominating. The number of stablecoin users continues to grow, with more than 35 million monthly active addresses, almost doubling from 2023. In 2025, the average daily number of on-chain stablecoin payments has exceeded 40 million, and compliant stablecoins such as USDC, USDT, and PYUSD are becoming the default payment options for businesses and users. Traditional payment giants such as Visa and PayPal have been connected to the on-chain settlement system, further enhancing the acceptance of stablecoins by off-chain merchants and forming a real closed loop of capital flow.

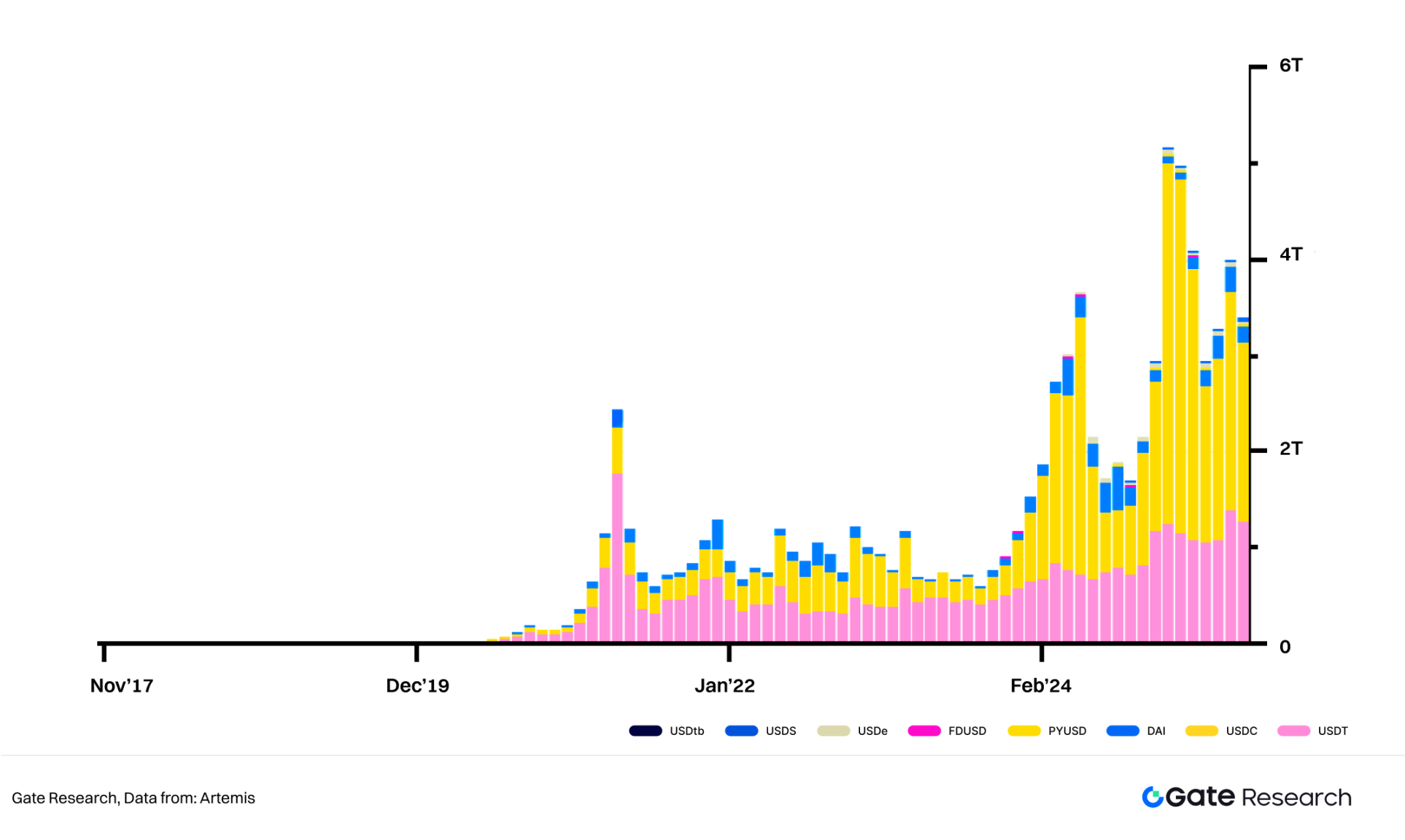

Figure 4: Daily Transaction Volume of Stablecoins

As of June 25, 2025, the total volume of stablecoin transactions in the year has approached 20.5 trillion US dollars, approaching the 2024 annual transaction volume of 31.1 trillion US dollars, which is much higher than the total transaction volume in 2023 (about 10 trillion US dollars). It is worth noting that although the market value of USDC is smaller than that of USDT, its share in on-chain transfer transactions is higher (54.5% vs 37%), indicating that USDC is more commonly used in high-frequency, large-amount payment and settlement scenarios, especially highly consistent with the usage needs of PayFi.

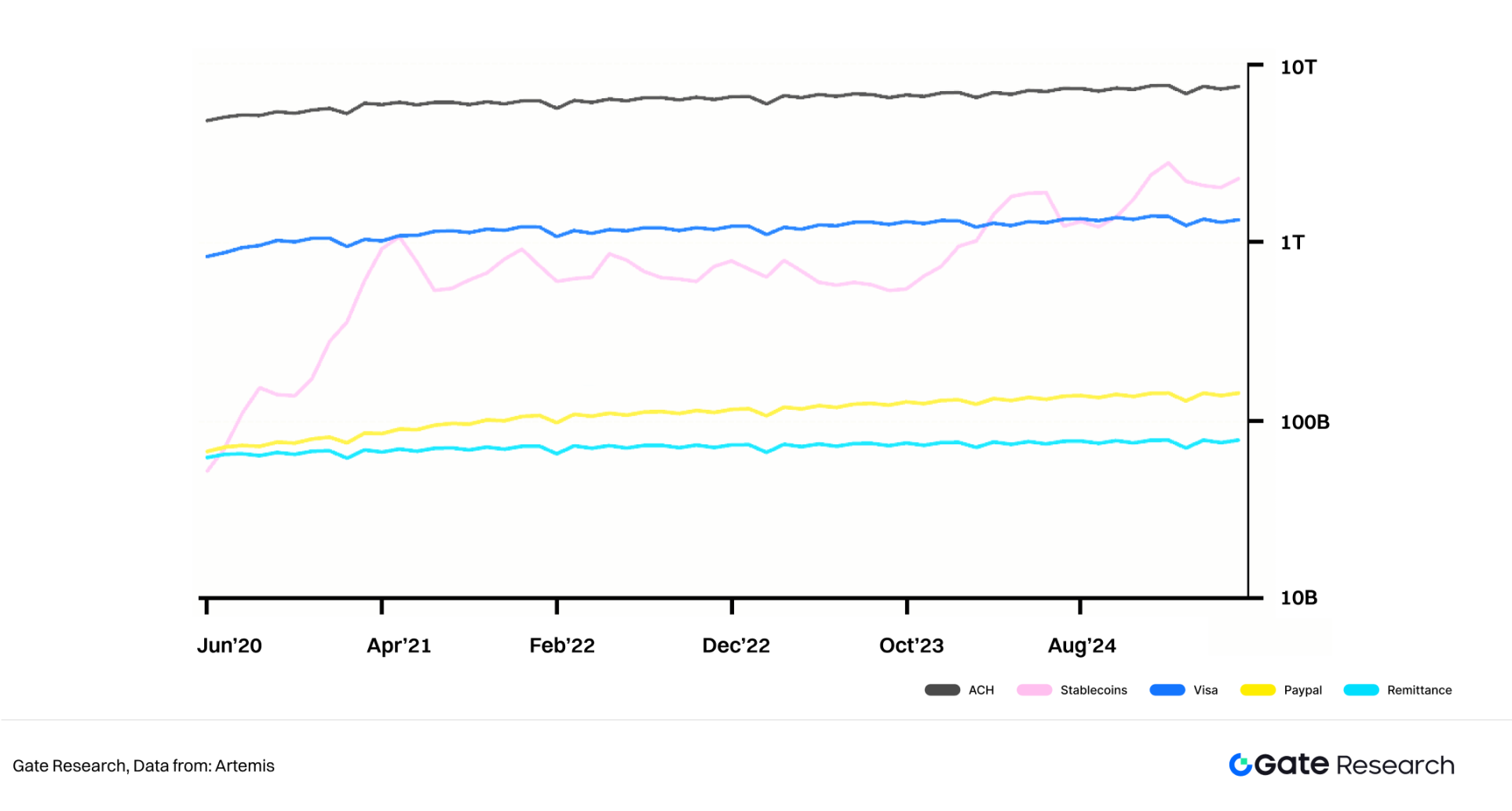

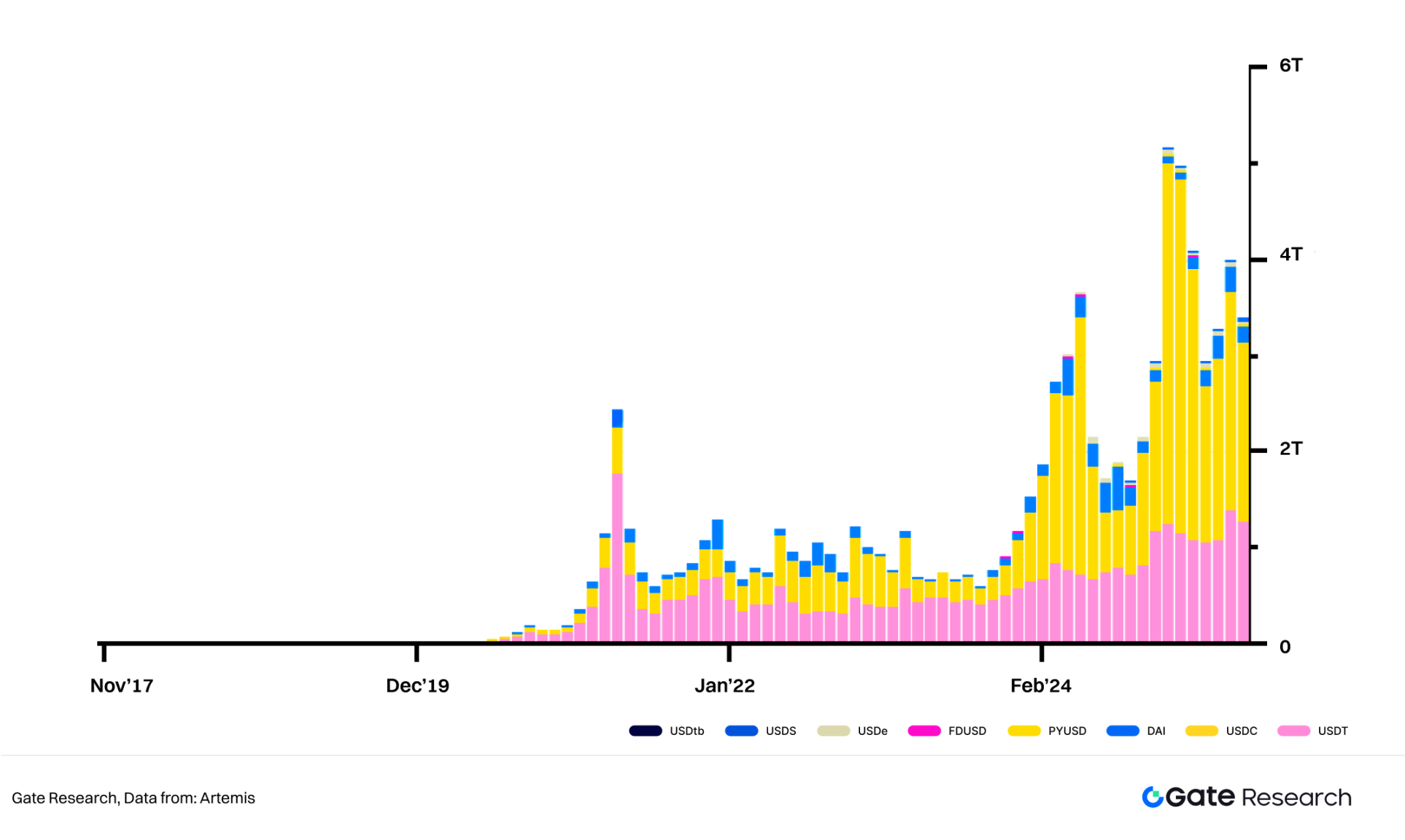

Figure 5: Monthly stablecoin trading volume

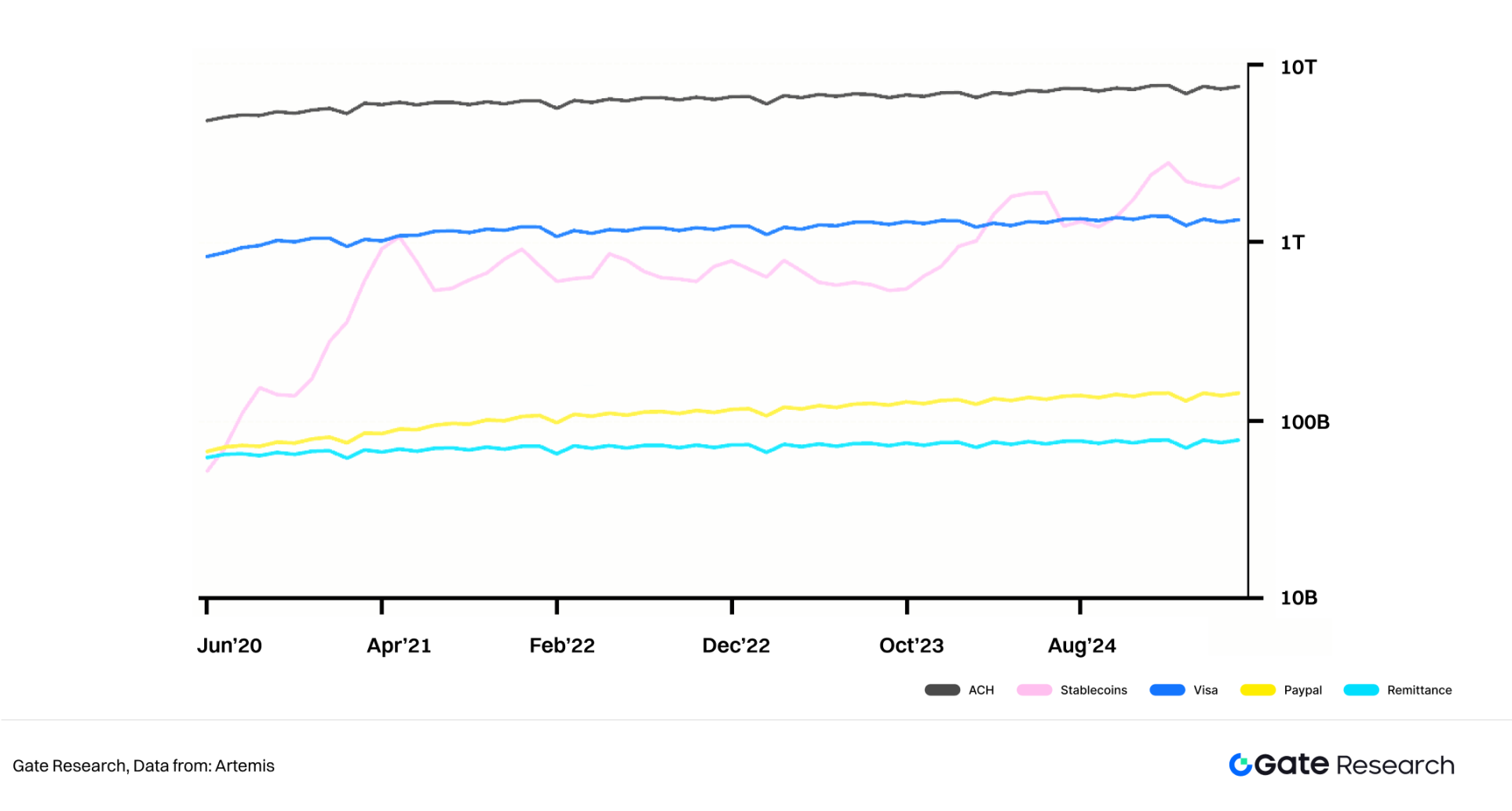

According to Artemis data (30-day rolling average adjusted trading volume, excluding MEV activities and internal settlements of centralized exchanges), stablecoin trading volume has been growing exponentially since mid-2020. It has continued to rise since 2022, increasing by about 2.5 to 3 times from October 2022 to mid-2024. The adjusted stablecoin transaction volume has far surpassed PayPal and cross-border remittance systems, surpassed Visa many times, and even approached the transaction volume of ACH, becoming the second largest payment system after ACH (by transaction volume).

Figure 6: Stablecoin transaction volume vs. other financial system transaction volume

Currently, the currency layer of PayFi DApp is mainly built on USDC, and supports PYUSD and USDP. In the future, PayFi plans to further integrate USDT, USDM, and non-US dollar stablecoins such as EURC, XSGD, GYEN, and HKDR to enhance the accessibility of funds for cross-border payments and expand the scope of international transactions and legal currency settlement.

Infrastructure providers such as Portal and Perena focus on stablecoin asset management. Portal aims to connect traditional finance with decentralized finance and provide users with efficient and secure stablecoin transaction support.

3.1.2 Global stablecoin regulatory policy window released

As the core payment medium of PayFi, the compliance and regulatory clarity of stablecoins are the key prerequisites for their large-scale implementation. With the accelerated promotion of stablecoin applications, major global regulators are actively promoting the research and legislation of the operating framework.

At the international level, standard-setting bodies such as the Financial Stability Board (FSB) and the Basel Committee on Banking Supervision (BCBS) have proposed a series of global regulatory principles. For example, the policy recommendations of the Global Stablecoin Arrangements issued by the FSB clarify the basic requirements of stablecoins in terms of redemption mechanism, governance structure, liquidity management, etc. BCBS sets prudent regulatory standards for crypto assets (including stablecoins) held by banks. Stablecoins that meet certain conditions can be classified as "Group 1b crypto assets" and enjoy relatively loose capital requirements. The standard requires that stablecoins must be fully backed by high-quality and liquid reserve assets to ensure full redemption capabilities even in extreme market environments.

In terms of regional supervision, Hong Kong officially passed the Stablecoin Bill on May 21, 2025, establishing a legal currency stablecoin issuance license system. This marks that Hong Kong's regulatory framework has shifted from preventing risks to encouraging innovation, and will provide clear operational guidance for compliance projects such as PayFi.

In the EU, the Crypto-Asset Market Regulation Act (MiCA) has been fully implemented in 2024, setting complete regulatory requirements for the issuance, reserves, governance and transparency of stablecoins. The implementation of MiCA provides compliance guarantees for the application of stablecoins in the EU, and is expected to promote the rapid expansion of PayFi in the European market.

The United States also passed the GENIUS Act on June 17, 2025, which was passed by the Senate with a vote of 63:30. This is the first bill in the United States to establish a federal regulatory framework for stablecoins, filling the previous regulatory gap in the stablecoin market, sending a strong compliance signal, and clearing policy barriers for mainstream financial institutions to enter the stablecoin field.

As the regulatory environment gradually matures, PayFi's related businesses (such as stablecoin exchange, decentralized payment gateways, and on-chain remittance services) will also gradually obtain a clear licensing framework and compliance support. This will significantly reduce operational risks, prompting more licensed institutions and large technology platforms to join the ecosystem, thereby accelerating PayFi's progress towards the mainstream payment system.

3.2 Technological breakthroughs and enhanced user experience

Similar to DeFi, the outbreak of PayFi also requires breakthroughs in technology and extreme optimization of user experience. New paradigms such as high-performance chains, account abstraction, and interoperability protocols have opened up new possibilities for Web3 payments.

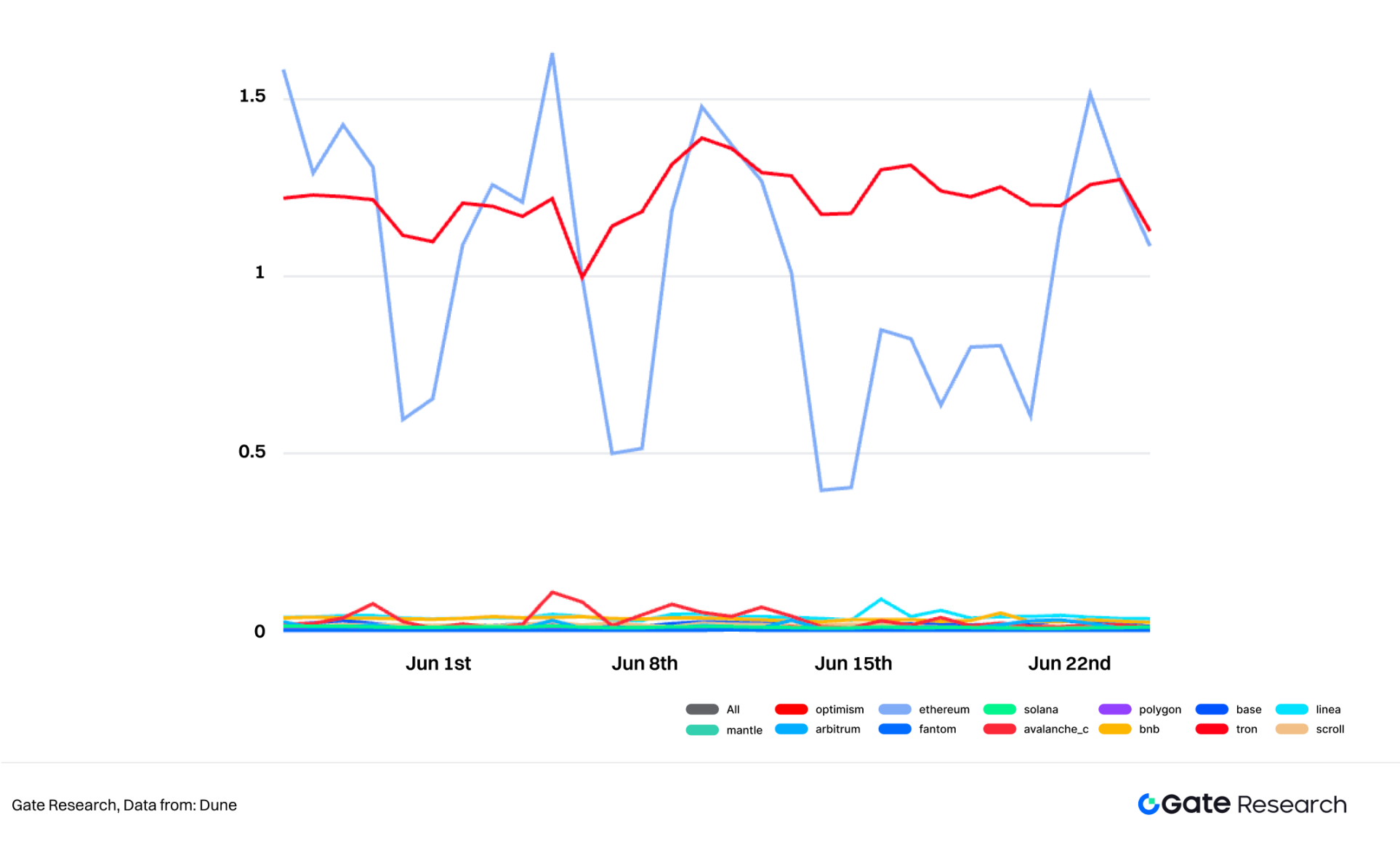

3.2.1 Scalability breakthrough

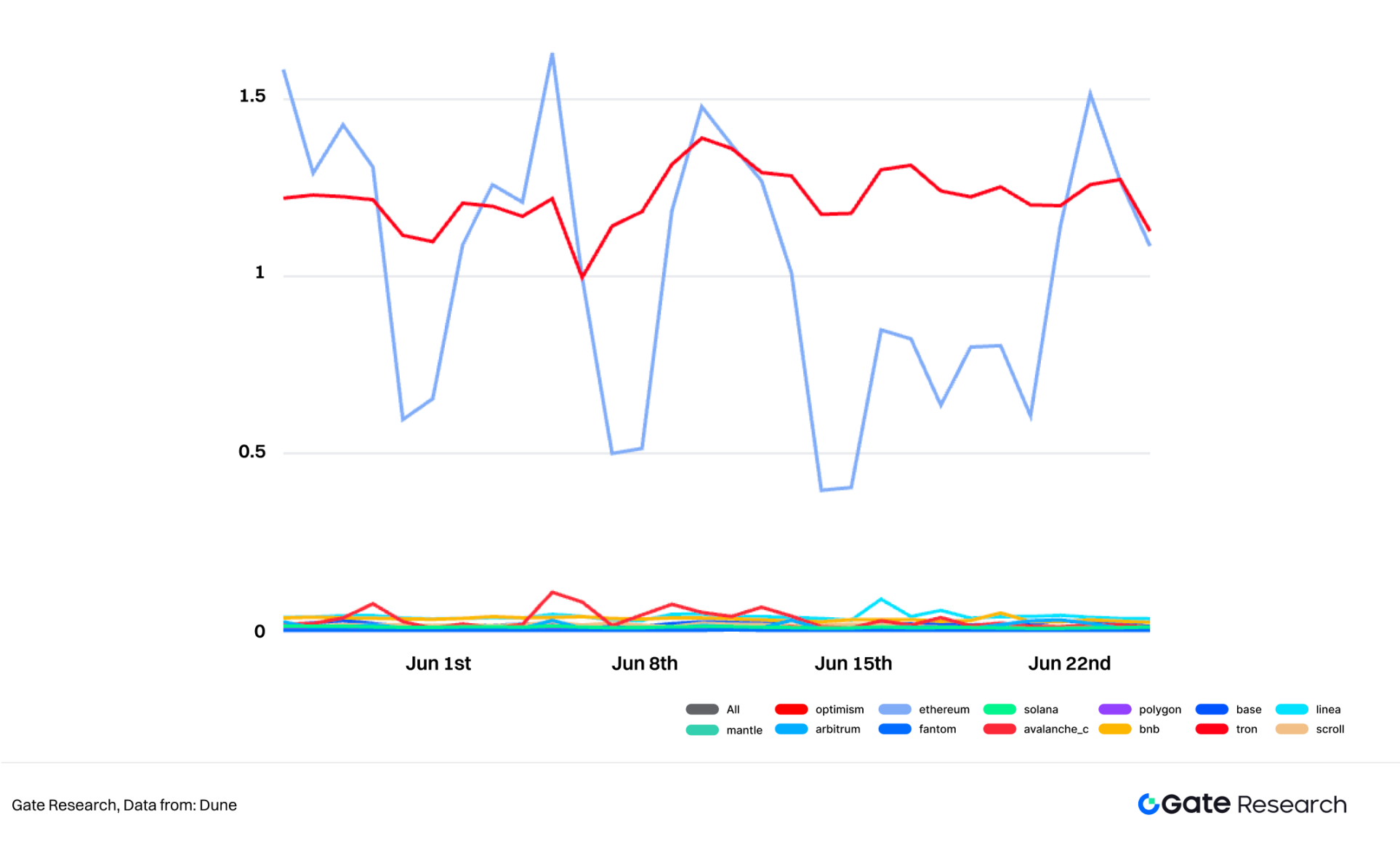

● In the past few years, Ethereum Layer 2 and emerging public chains have made significant progress in transaction throughput and fee optimization. These L2 networks have carried a large number of DeFi activities, and the maturity of their infrastructure has laid a solid foundation for high-frequency, low-cost PayFi applications. Except for Tron and Ethereum mainnet, the average gas fee of other mainstream L2 networks is far less than $1, which significantly reduces the transaction cost of users.

Figure 7: Average daily gas fee of the chain

●Rollup-as-a-Service (such as Conduit, AltLayer) simplifies the Rollup deployment process, making it easier for customized payment applications to run on dedicated chains.

●Modular blockchains (such as Celestia) separate the execution layer, consensus layer, and data layer, providing more flexible architectural support for large-scale payment applications.

3.2.2 Wallet experience upgrade

●Account abstraction (AA): Supports Gas payment, social recovery, multi-signature control and session keys, greatly reducing the user entry threshold. Uniswap's launch of the AA smart wallet is a representative of this trend.

●Embedded wallet and MPC technology: Users can complete payments without leaving the application interface, taking into account convenience and independent asset management.

●Web2 interface design: PayFi applications are evolving in the direction of "no need to understand blockchain to use", with simplified payment processes, intelligent paths, and experiences close to WeChat Pay or Apple Pay.

3.2.3 Cross-chain interoperability: breaking the liquidity island

● The maturity of cross-chain protocols such as IBC and CCIP allows value to flow freely between multiple chains;

● Cross-chain asset standardization promotes the unification of payment scenarios;

● Users can seamlessly switch payment environments between different public chains or Layer 2, greatly improving payment experience and capital efficiency.

3.3 Web2 integration and mainstream user adoption

To truly usher in the "PayFi Summer", PayFi must jump out of the crypto-native circle, deeply integrate the Web2 world, and achieve extensive connection and interaction with mainstream users.

3.3.1 Strategic entry of traditional payment giants

●PayPal introduces PYUSD: PayPal has issued the official stablecoin PYUSD and plans to deeply integrate it into the global payment network, including Venmo and Hyperwallet, covering 200,000 merchants for cross-border and B2B payments.

●Stripe cooperates with Bridge: In 2024, Stripe acquired the stablecoin payment platform Bridge, and the transaction volume has reached the level of US$5 billion, indicating its firm investment in stablecoin payments.

●Visa and Mastercard are gradually deploying: Visa supports banks to issue stablecoins through the VTAP platform; and Mastercard is working with Fiserv to promote the integration and use of FIUSD, covering 150 million merchants worldwide.

These traditional payment giants will significantly accelerate PayFi's penetration into the mainstream market with their huge user base, mature merchant network and compliance experience.

3.3.2 Deep participation of banks and financial institutions

● Fiserv, Circle and PayPal collaborate: This year, Fiserv launched the FIUSD program with Solana, Circle and PayPal to provide stablecoin services to more than 3,000 regional banks and their millions of merchants.

● Many banks (such as Bank of America, Standard Chartered, and Revolut) are developing their own or co-issuing stablecoins to promote the further integration of on-chain payment infrastructure and traditional finance.

The participation of these financial institutions not only broadens the fiat currency channel, but also enhances PayFi's compliance and access convenience.

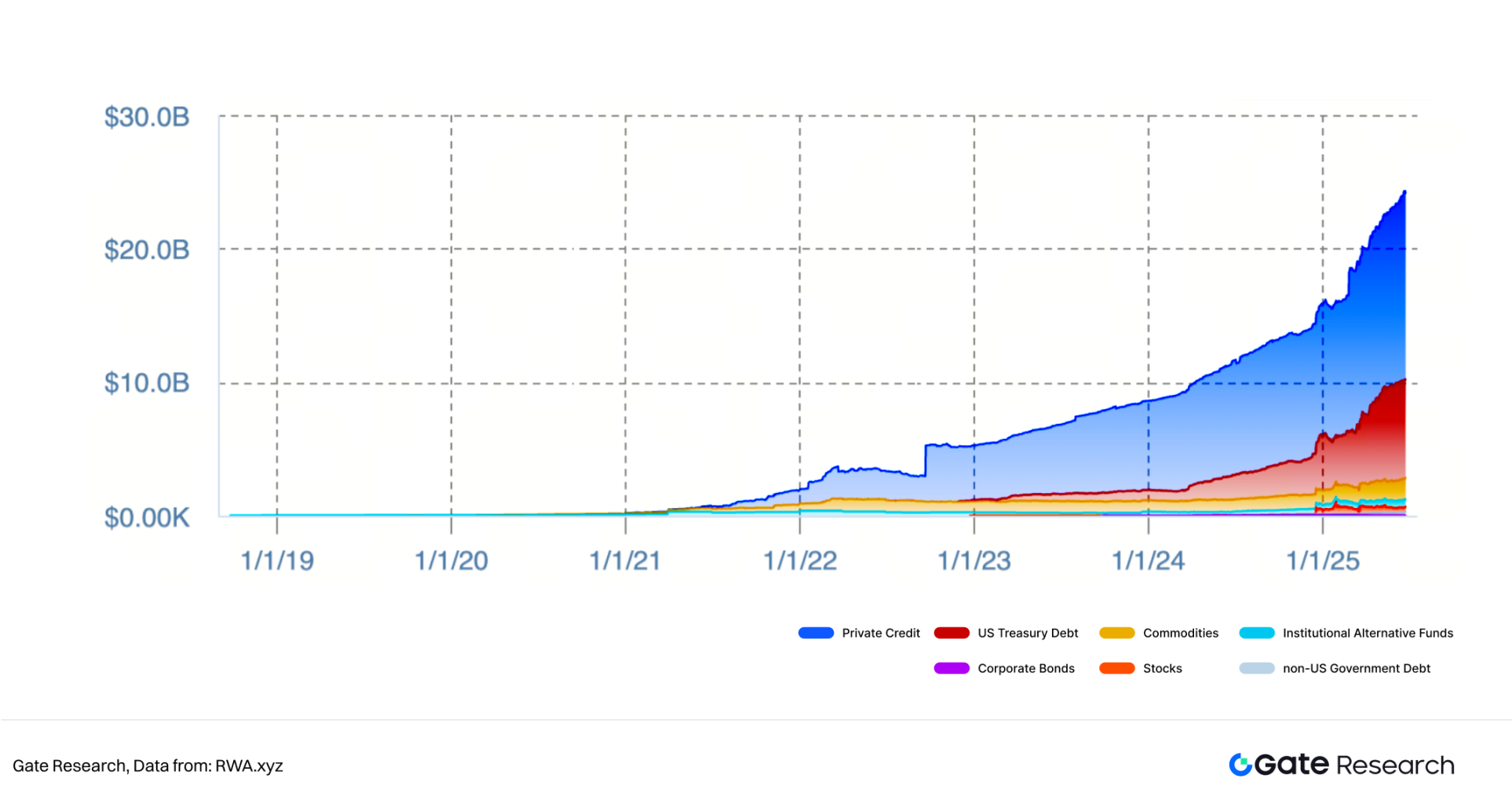

3.3.3 Asset Tokenization Drives Payment Demand

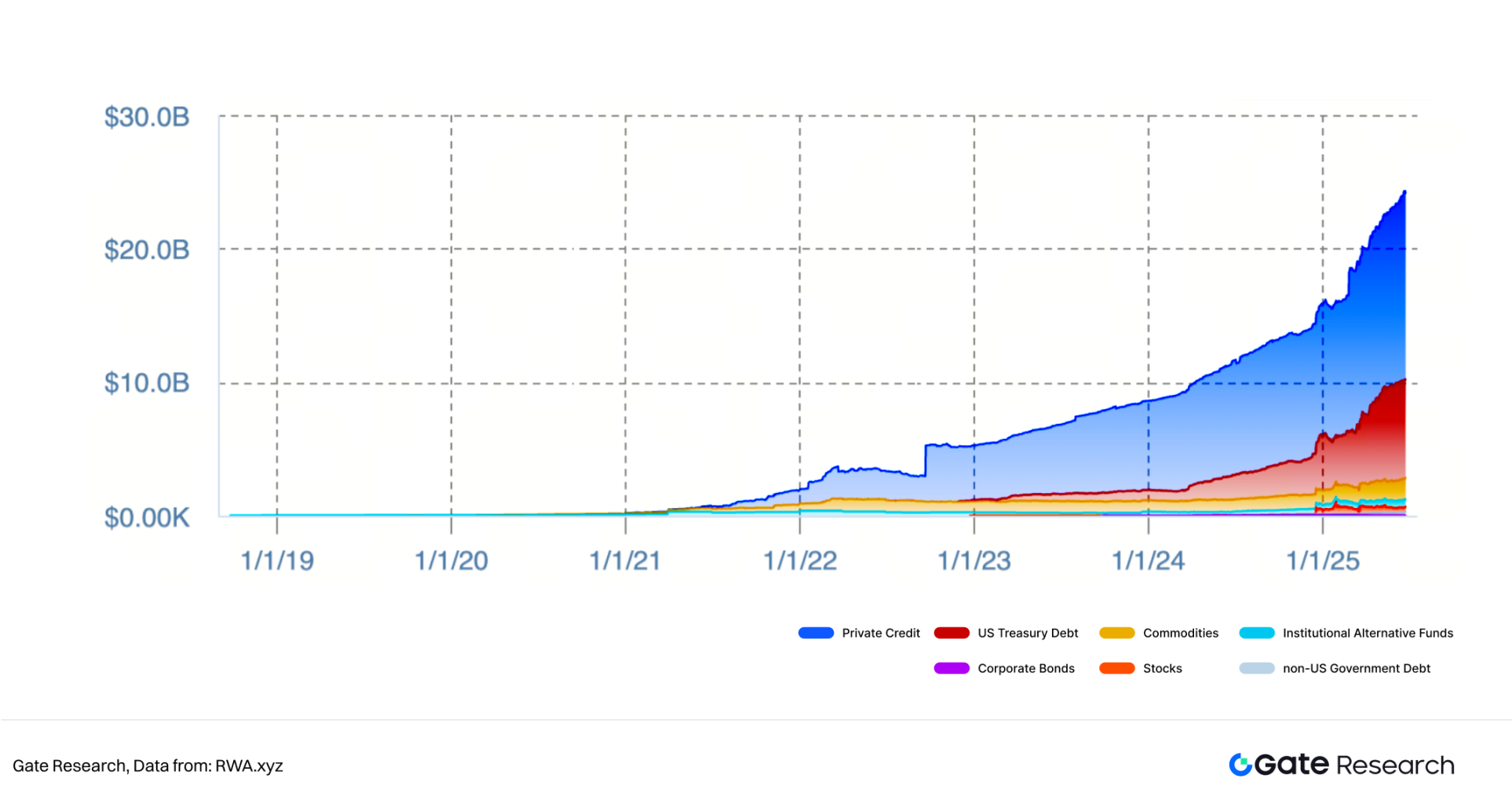

With the accelerated tokenization of physical assets such as real estate, bonds, and stocks, the demand for on-chain holding and trading has surged. This directly amplifies the demand for efficient and programmable on-chain payment and settlement systems. Currently, the total RWA (real world assets) on the chain is worth more than US$24.5 billion, and the total number of asset holders has exceeded 200,000. In terms of practical applications, PayPal cooperated with EY to use PYUSD for B2B enterprise-level settlement; and after Stripe acquired Bridge, its stablecoin payment service has been launched in more than 70 countries around the world, aiming to meet the cross-border transaction needs of global merchants.

Figure 8: Total RWA Value on Chain

This series of phenomena shows that when assets are on-chain, the basic payment mechanism must be upgraded to adapt to new usage scenarios and scale requirements. PayFi has a natural advantage in this trend and can provide a protocolized payment infrastructure.

3.4 Economic Incentives and Network Effects

Economic incentives are the core driving force behind the outbreak of DeFi Summer. If PayFi wants to quickly cold-start network effects, similar incentive designs are also indispensable.

3.4.1 Profit capture path in payment

In the traditional payment system, users are often just "cost bearers"; in the PayFi model, the stablecoins held by users can generate income before payment, which effectively improves the efficiency of fund use and retention willingness.

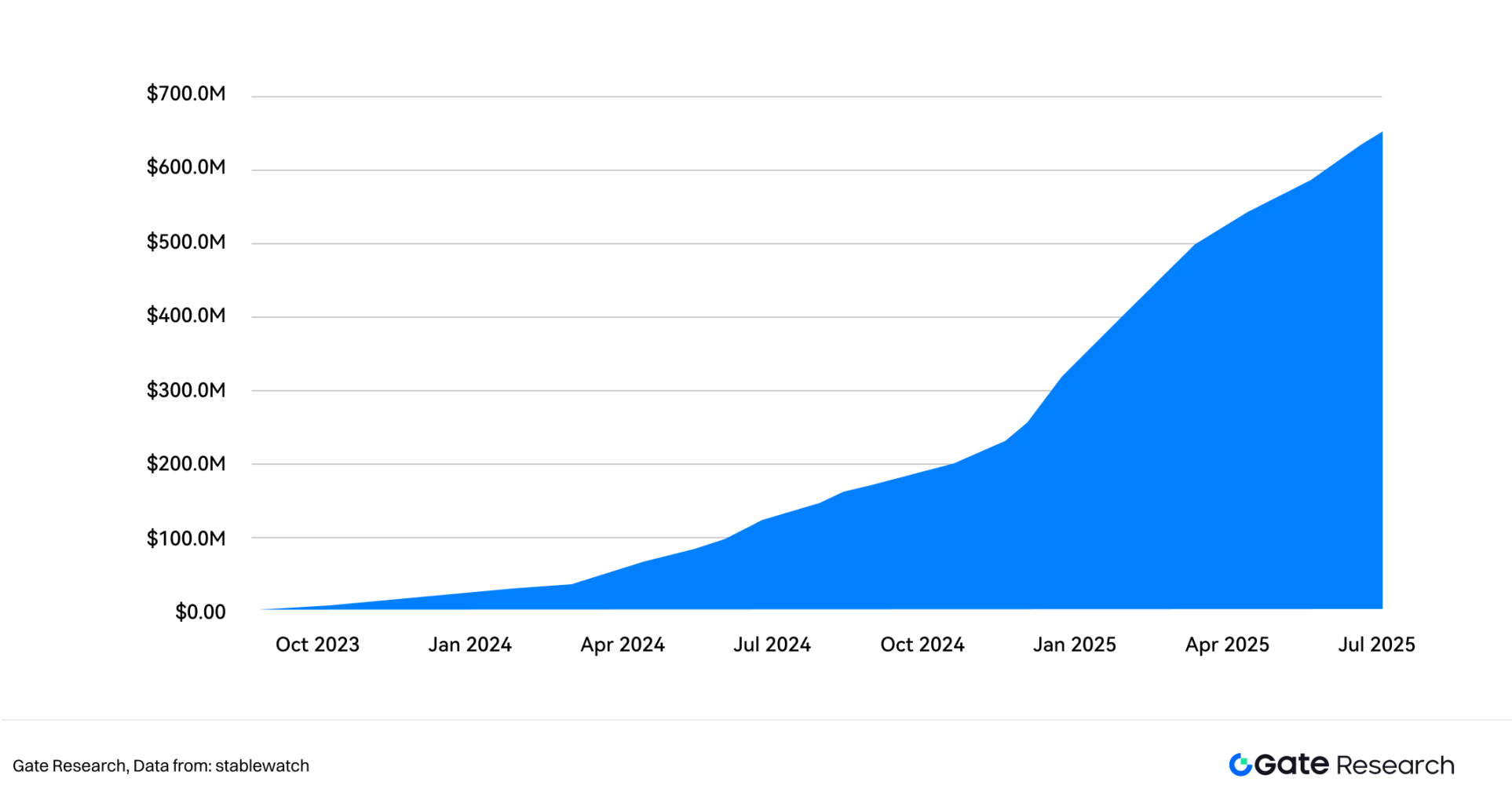

According to the Gate Research Institute's report "Gate Research Institute: In-depth Analysis of Stablecoin Alpha Income Strategy: Capturing Logic and High-yield Operation Path", as of Q2 2025, the total market value of "income-generating stablecoins" such as sUSDE, USDY, sUSDS, and USDL has exceeded US$11 billion. The main sources of income include RWA U.S. Treasuries (4%-5.5%), lending markets (2%-8%), and market neutral arbitrage (5%-20%+) and other strategies:

● sUSDE (Ethena) Generates an annualized return of approximately 7.39% through perpetual contract hedging, which can reach 9%-11% after adding ENA airdrops;

● USDS (Sky Protocol) Obtain the highest return through the SSR savings mechanism and SKY staking 14.91% reward, and the SparkFi airdrop strategy further enhances the return;

● USDY (Ondo Finance) is supported by short-term US Treasury bonds, with a basic APY of about 4.29%. Through DeFi staking and revolving lending strategies, the total return can reach 12%-17%.

Figure 9: The income range of income-generating stablecoins

This type of "interest-generating" stablecoin provides PayFi users with clear economic incentives, effectively enhancing their willingness to use; the cumulative income distributed has exceeded US$600 million. Typical scenarios for using the income include: after users bind their PayFi wallets on e-commerce platforms, they can pledge stablecoins to the liquidity pool in advance, and the daily income will be automatically accumulated; when making payments, the protocol will immediately unlock the funds to complete the deduction, ensuring that the income is not interrupted. This "payment and interest earning" mechanism is becoming a new paradigm for the circulation of stablecoins.

Figure 10: Cumulative distribution of income-generating stablecoins

In addition, to promote merchant access, multiple protocols provide incentives through subsidies, cashback and airdrops:

●Checkout.com + USDC linkage: The USDC settlement service launched by Checkout.com and Fireblocks has helped merchants complete more than US$300 million in transactions during the pilot period, supporting "24/7" uninterrupted settlement (including weekends and holidays), greatly improving the efficiency of capital circulation.

● Flexa Network: Provides merchants with a transaction cashback mechanism and enhances participation motivation through the AMP mortgage model.

Furthermore, the PayFi protocol is actively exploring the "Pay-to-Earn" model, using token release to drive early transaction activity and repeat the cold start logic verified by "transaction mining".

In terms of developer incentives, some protocols introduce API profit sharing and data rebate mechanisms:

● Superfluid + Safary: Each matching flow payment transaction can obtain 0.1%-0.3% of the revenue share;

● Paymagic SDK: Open traffic and payment data return interface, support profit sharing function, and has been integrated by hundreds of wallet plug-ins.

This series of mechanisms jointly promotes the construction of modular and composable payment infrastructure, and builds a positive cycle of developer ecology with continuous appeal.

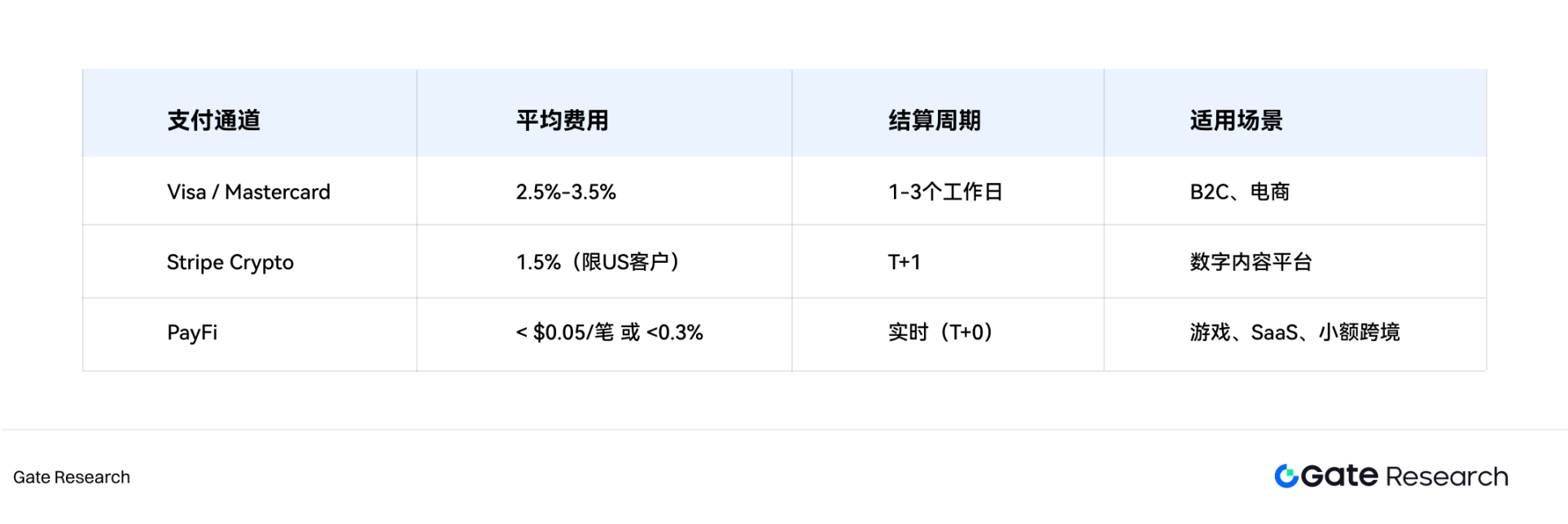

3.4.2 Reduce costs and improve efficiency: direct benefits for merchants and users

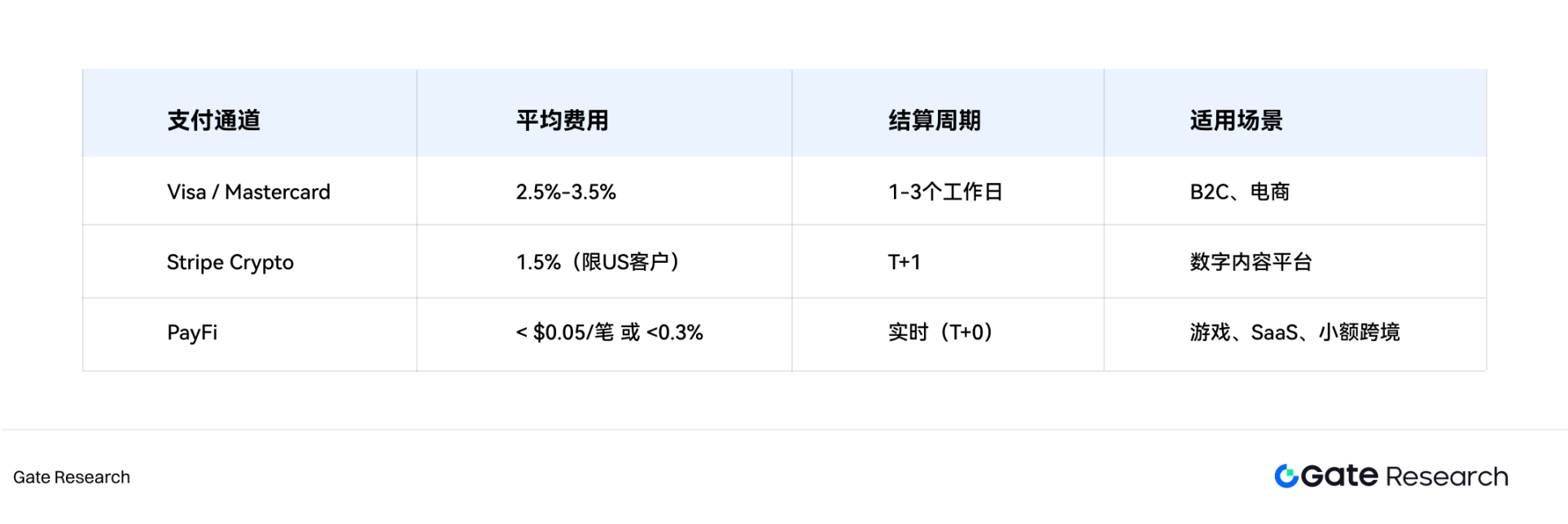

PayFi protocol has significant advantages over traditional payment methods in terms of cost structure and settlement efficiency, and is particularly suitable for high-frequency small-amount transaction scenarios such as micropayments and cross-border settlements.

Figure 11: Settlement fees and cycles of different payment channels

For example: In the pilot cooperation between Celo and PayU in Latin America, e-commerce merchants saved more than 60% of the handling fees through stablecoin payments, and the settlement cycle was shortened to real-time arrival. In addition, Arbitrum's batch payment has an average fee of less than $0.02 per transaction, which is very suitable for distributed payment needs such as advertising alliances and freelancers.

PayFi's economic incentive logic is building a sustainable growth flywheel: high returns → user growth → merchant access → network activity → developer ecology → continuous incentives → enhanced network effect. By designing a three-dimensional incentive system for users, merchants and developers, PayFi is leveraging the maximum network growth effect at a very low incentive cost, becoming the core pillar of the new round of on-chain economic infrastructure.

4. Comparative Analysis: PayFi and DeFi Summer - Different Paths to "Summer"

The gradual clarification of the regulatory framework has cleared the way for financial institutions and payment giants to enter. The maturity of the underlying technology has greatly reduced the entry threshold for users and merchants, and the deep integration of Web2 has brought hundreds of millions of potential users. These key catalysts interact with each other to form a powerful flywheel that drives the rise of PayFi. As conditions continue to mature, the so-called "PayFi Summer" may come naturally and become an important transition node for the Web3 world to connect to the real economy.

Although both PayFi and DeFi represent a wave of blockchain financial innovation, they differ significantly in the background of their rise, internal driving force, market environment and user base. Through comparative analysis, we can more clearly grasp the development path, potential and boundaries of PayFi, and judge whether it has the market potential to detonate a similar DeFi Summer.

Figure 12: DeFi Summer vs. PayFi Summer

4.1 Similarities in growth trajectory and innovation cycle

PayFi and DeFi Summer show several commonalities in their development paths, which may indicate similar evolutionary logic:

●Technology-driven innovation explosion: The arrival of the two "Summers" is inseparable from the maturity of the underlying technology. DeFi Summer relies on the programmability of Ethereum smart contracts, the AMM mechanism, and the emergence of early oracles; PayFi Summer relies on the compliant issuance of stablecoins, the efficient expansion capabilities of Layer 2, and the progress of cross-chain interoperability technology to promote the implementation of high-frequency, small-amount payment experiences.

● Evolution of new financial primitives: DeFi Summer has spawned a series of new financial primitives such as yield farms, flash loans, and decentralized lending pools. PayFi is also developing its own primitives, such as streamed payments, programmable settlements, and on-chain identity and reputation systems, which are innovations that traditional payments cannot match.

● "Experimental" in the early stages: Before large-scale adoption, both DeFi and PayFi went through an experimental phase led by crypto-native developers and early adopters. PayFi is now at a similar stage, with various innovative payment solutions emerging one after another, but not yet fully popularized.

● The potential power of network effects: The PayFi protocol that successfully attracted early users will theoretically attract more users by reducing costs, improving efficiency and providing incentives, just like the DeFi protocol, forming a strong network effect.

● Challenges to the existing system: DeFi mainly challenges centralized lending and asset trading, while PayFi is more infrastructure-oriented, trying to replace interbank clearing and global payment systems.

4.2 Key differences in market dynamics, users and capital structure

Although PayFi and DeFi have certain commonalities in their development paths, they show fundamental differentiation in key variables such as the nature of driving forces, target user structure and capital support model, which determines their respective evolutionary rhythms and growth boundaries.

Driving force: speculation-oriented vs. practical pull

●DeFi speculation first, practicality follows: The outbreak of DeFi Summer mainly relies on the strong speculative incentive mechanism driven by high returns from liquidity mining and governance token airdrops, which attract users to pursue short-term excess returns on the premise of assuming smart contract risks and impermanent losses. After the user base and asset pool gradually settled, DeFi gradually demonstrated its underlying financial value in the fields of transaction matching, lending and clearing.

● PayFi is practical first, and incentives are secondary: PayFi's core driving force is to solve the practical pain points of the traditional payment system, focusing on reducing transaction costs, speeding up settlement and improving global accessibility. User demand is essentially oriented towards "use value" and has rigid characteristics, so its growth path is more robust and sustainable. Although it lacks the DeFi-style "wealth effect" of short-term outbreaks, it has a solid foundation for long-term expansion. Although some PayFi protocols will also design token incentives to promote early adoption, the overall proportion and sustainability of the incentive mechanism are far less than DeFi, and it focuses more on auxiliary guidance. Therefore, PayFi's user growth depends more on the actual utility and user experience of the product itself, rather than on the speculative boom driven by capital.

User structure: crypto native vs mass consumption

● The main user groups of DeFi Summer are crypto native participants, including professional traders, DeFi Farmers and speculators with high risk preferences. These users usually have strong technical capabilities and blockchain awareness.

● PayFi is aimed at a wider mainstream group, including hundreds of millions of ordinary consumers, small and medium-sized enterprises, cross-border individual merchants and even people without bank accounts around the world. Such users are sensitive to technical barriers, have low risk tolerance, and have extremely high requirements for security and user experience. Therefore, the PayFi protocol must significantly reduce the complexity of on-chain interactions and provide a seamless experience close to Web2. Its service scenarios are also more diverse, extending from cross-border remittances, on-chain salary payments, and daily consumption to medium and large financial scenarios such as bulk settlement, supply chain finance, and tokenized asset liquidation.

Capital structure: Liquid "hot money" vs. strategic capital

● The capital structure of DeFi is dominated by "hot money" with high frequency in and out, mainly from retail investors and crypto-native funds. Its investment logic focuses on arbitrage opportunities and high APY returns, with fast capital inflows and exits, short investment cycles, and the goal is arbitrage and value capture.

● PayFi is dominated by long-term oriented strategic capital, including Web2 investment institutions, compliance funds, and even multilateral organizations and regional development banks (such as IFC and Asian Development Bank's pilot of Arf). This type of capital pays more attention to infrastructure construction and actual usage scenarios, and accepts a longer return cycle. The strategic entry of payment institutions such as Visa and PayPal not only provides financial support, but also opens up compliance channels and real business ecosystems for PayFi, greatly enhancing its popularization potential.

4.3 The double-edged effect of the regulatory environment

The impact of regulation on DeFi Summer and PayFi is completely different. It is more like a double-edged sword for PayFi.

● DeFi Summer: Growing in a regulatory vacuum or ambiguity. In 2020, most regulators had limited understanding of DeFi and lacked a clear regulatory framework. This "regulatory vacuum" provided space for the free innovation of DeFi protocols, but also led to frequent subsequent security incidents and the risk of running away.

● PayFi: Started under the spotlight of regulation. PayFi involves payment settlement, cross-border transfers and stablecoin issuance, and is naturally in a highly regulatory sensitive area. Although compliance requirements bring increased costs and entry barriers, they also bring legitimacy, user trust and institutional endorsement, which is conducive to promoting its mainstream implementation. Therefore, PayFi has faced stricter and more proactive regulatory review than DeFi Summer from the very beginning.

○ "Pros": Clear regulation can provide legitimacy, compliance and market trust for PayFi, attract large financial institutions and traditional enterprises to enter, thereby accelerating its mainstreaming.

○ "Cons": Overly stringent, lagging or fragmented regulation may stifle innovation, increase the compliance costs of PayFi services, and limit its decentralized nature.

PayFi may not replicate the explosive growth driven by high speculative returns in DeFi Summer. Its evolution is more like the construction of early Internet infrastructure. When users can complete low-cost, high-frequency payments, clearing, income collection and fund distribution without the need to perceive the existence of blockchain, it is the real "Summer" moment of PayFi.

5. Conclusion

Whether PayFi can usher in its own "Summer" depends on whether it has the ability to solve real problems and the conditions for large-scale growth. Unlike DeFi Summer, which relies on high returns and speculative incentives, PayFi emphasizes practicality and sustainability, and is committed to improving payment efficiency, reducing costs, speeding up settlement, and expanding the accessibility of global financial services through blockchain technology.

PayFi targets the structural pain points of the traditional payment system, has broad market potential, and its target users include ordinary consumers, small and medium-sized enterprises, and people without bank accounts. With the maturity of technologies such as Layer 2, cross-chain communication, and account abstraction, the on-chain payment experience has been significantly optimized. At the same time, the gradual clarification of stablecoin regulation has also opened up a clear compliance path for PayFi, attracting traditional giants such as Visa and PayPal to actively deploy.

By combining with RWA (such as US bonds), PayFi introduces off-chain income into the payment system to achieve the unity of liquidity and profitability. This compound model of "payment + finance" not only improves user stickiness, but also creates more attractive conditions for institutional participation.

At the same time, PayFi has the opportunity to learn from the overheated cycle of DeFi, and deploy earlier in security audits, risk control, user education, etc., and establish a more robust trust mechanism. However, challenges still exist: cross-border payments and stablecoin-related regulation are still uncertain; the volatility of encrypted assets may affect user confidence; wallet operations are complex and education costs are high, which is still the entry threshold for ordinary users; the monopoly and closed ecology of traditional payment institutions also constitute strong competition.

The development path of PayFi may be different from the rapid outbreak of DeFi. Instead, it will steadily expand its scope of application through gradual penetration in rigid demand scenarios such as cross-border remittances, corporate settlements, and supply chain finance. Its revenue model relies on stable returns supported by real assets, rather than simple on-chain incentives. At the same time, the in-depth collaboration between the compliance process and centralized institutions will also help connect traditional finance with Web3 infrastructure.

Overall, PayFi is unlikely to repeat the speculative frenzy of DeFi Summer, but is more likely to be a payment infrastructure innovation driven by real needs, supported by technological evolution, and catalyzed by institutional forces. Its "Summer" may unfold in a gentle and lasting way, profoundly reshaping the global payment landscape and laying a solid foundation for the connection between Web3 and the real economy.

Clement

Clement