Author: Ciaran Lyons, CoinTelegraph; Compiler: Baishui, Golden Finance

Market observers said that on Thursday, a total of $1.3 billion in USDC was transferred from whale addresses to the cryptocurrency exchange Coinbase, which could be a "huge buy signal" for Bitcoin and Ethereum.

"USDC transfers to exchanges are a huge buy signal," cryptocurrency trader Blockchain Mane pointed out.

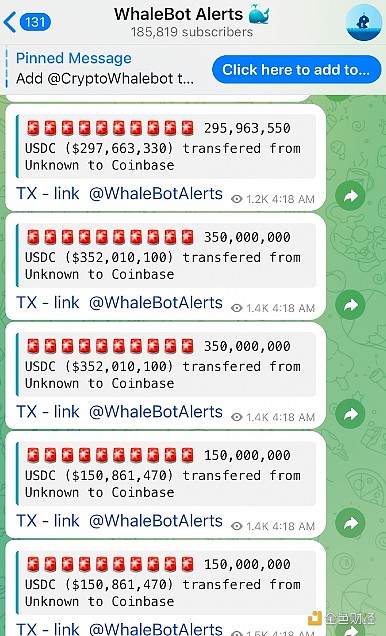

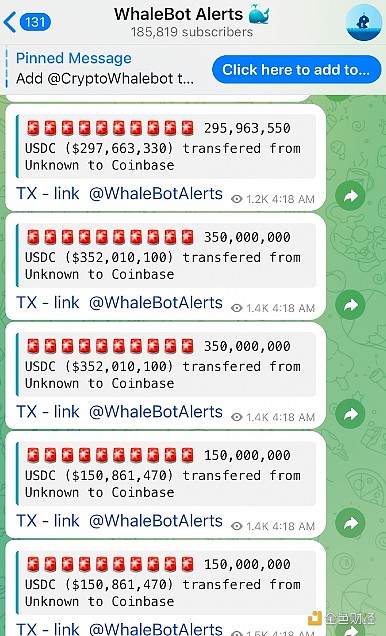

According to Etherscan data, the five transfers totaled $1.3 billion, ranging from $150 million to $350 million, and were transferred to Coinbase at 08:15 UTC on April 25.

5 large amounts of USDC were transferred to Coinbase at the same time. Source: WhaleBot Alerts

Traders often view large deposits of stablecoins on exchanges as a bullish signal, indicating that there may be large buy orders in the near future, while large deposits of cryptocurrencies on exchanges may indicate a potential sell-off, making traders wary of a downturn.

“If this is indeed whale buying, and at current prices, then yes, it could have a significant impact on the price of the assets they purchased, and at this level the only ones almost certainly are Bitcoin and Ethereum,”cryptocurrency commentator Lark Davis aka “Crypto Lark” noted.

As of the time of publishing, Bitcoin is trading at $64,389. Source: CoinMarketCap

However, crypto analysts agree that whale activity is never a guaranteed indicator for crypto markets.

“A lot of attention is paid to whale activity, but we never really know what they are doing,” Davis said.

“$1.3 billion is a nice amount of money, but it depends on how that money is deployed,” added Brian Jung, a crypto trader and YouTuber.

Davis also noted that whales may place limit orders rather than immediately buying assets, which would in turn create stronger support levels for the cryptocurrencies they invest in.

“Limit orders will come in, create buy walls, and provide price support for the asset,” Davis explained.

But he warned that “you can never be sure” about how these large transfers will affect the market.

Meanwhile, Jung believes that the market could “turn positively” if a large amount of money moves into a single crypto token as “we’d see the extra liquidity help push up the prices of other cryptocurrencies.”

Though he doubts investors would see the benefit of doing so, given the risk of overexposure.

“If this money was deployed into a single altcoin with a market cap of $100 million, the price would absolutely surge, but I can’t imagine any whale in their right mind doing so as it would make it nearly impossible for them to make a profit.”

“If it was used to buy Bitcoin, it wouldn’t have a similar effect,” Jung added.

The massive flow of funds occurred despite a slight drop in sentiment in the cryptocurrency market, according to the Fear and Greed Index.

The greed score fell from 64.04 to a neutral level of 59.78 over the past 24 hours, indicating that traders’ attention has shifted away from accumulation.

Catherine

Catherine