Author: Climber, Golden Finance

Recently, many altcoins have surged due to the announcement of Binance's contract launch. The highest increase of the representative currency RARE after the contract launch was 356.5%, while some other tokens immediately soared after the announcement was issued. Binance can be said to have driven a wave of wealth effect.

In this regard, many community members said that Binance was artificially creating hot spots to drive the sluggish market of altcoins, and some analysts listed potential projects that were not listed on Binance contracts in an attempt to seize the next wave of wealth. Judging from a series of recent actions by Binance and the remarks of the new CEO, the top management is more likely to show off the strength of the world's largest exchange before expanding into the global market.

Binance contract announcement staged "Medalism"

In the past, the Binance platform was well known to investors for its deep launch effect, but in recent times, the contract trading of Binance's project tokens has also had a type function. Golden Finance statistics show that since August this year, Binance contracts have launched as many as 10 tokens. Almost without exception, every token has risen to varying degrees after the announcement.

As can be seen from the above figure, starting from August 14, Binance has intensively launched multiple currencies, almost one per day on average. Among the currencies after the launch of the contract, the minimum increase is 21.50%. This is a relatively objective return in the current situation where Bitcoin is sideways and altcoins are generally falling.

Among these 10 currencies, half of them have increased by more than 90%, namely ALPACA, VOXEL, SYS, SYN, and RARE. Among them, RARE has the largest increase of 356.5%.

In the past, Binance generally listed tokens on contracts when a token suddenly soared several times or was a star project. However, among the 10 projects listed on Binance recently, only SUN increased by more than double before the announcement of the contract was issued. Most of the others are tokens that are already at the bottom of the market and have low market capitalization.

The market capitalizations listed above are all data after the tokens have risen, and BRETT and POPCAT, which have the highest market capitalization, are both popular MEME currencies. Binance has not yet given the reason for choosing to list the above-mentioned token contract transactions, but we can see from this that Binance seems to be interested in acting as a market maker to help low-popularity and low-liquidity projects gain market attention.

At present, the wealth creation effect is good, and many tokens immediately rose after the announcement of the contract was issued. For example, on August 20, VOXEL rose nearly 65% in a short period of time due to the news that Binance launched 1-50 times U-based perpetual contracts; on August 22, ALPACA rose nearly 65% in a short period of time due to the news that Binance contracts would launch 1-75 times USDT perpetual contracts.

Compared with the contract tokens launched by Binance in June and July this year, we can see a huge contrast.

In July, Binance launched the following tokens for contracts: RENDER, WIF, and CRV.

In June, Binance launched the following tokens for contracts: ZRO, LISTA, MEW, ZK, and IO.

From the above-listed currencies, it can be seen that from July to mid-August, Binance only launched 3 tokens. In June, most of the tokens on Binance contracts were popular new projects. However, judging from the subsequent market performance of the above tokens, none of them experienced a surge in a short period of time.

In late August, the contract tokens on Binance Exchange had a great wealth effect, which also attracted the attention of the community and investors.

The wealth-creating effect of contracts has aroused heated discussions in the community, and the top management may be making a global strategic layout

The current crypto market seems to have returned to the bear market stage of last year. Apart from the hot speculation of MEME concept currencies, it is difficult to see many more certain wealth opportunities, but Binance contracts have continuously demonstrated to the market the wealth-creating strength of the world's largest crypto exchange.

The community also gave different opinions on Binance's behavior similar to that of market makers forcibly pulling the market.

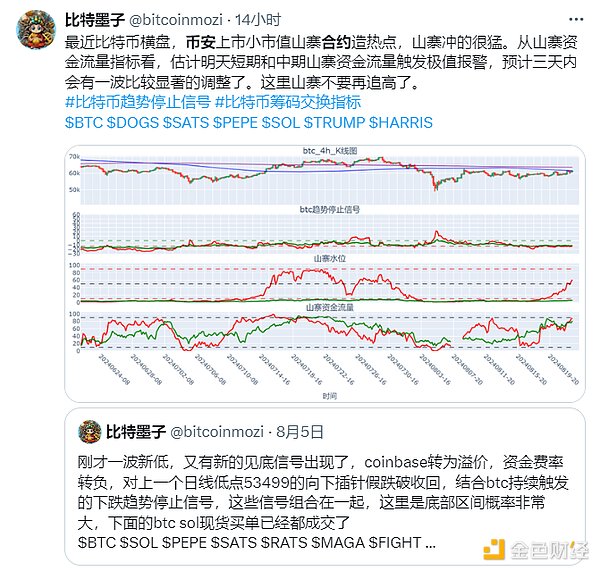

KOL @bitcoinmozi said that Bitcoin has been trading sideways recently, and the listing of small-cap alt contracts is creating hot spots to drive the rise of altcoins and revitalize the crypto market. But in the short term, there are still great risks.

KOL @lianyanshe said that the value of several projects listed on Binance contracts is not great, and there may be dealers behind it who treat projects with poor liquidity as MEME coins. In addition, he believes that the standard for Binance contracts is that the trading volume exceeds 10 million for three consecutive days.

Another KOL @zhuanfgghjnb also said that under the influence of the small-cap currency pull on Binance contracts, he also tried to buy other altcoins.

Trader @allincrypto2011 believes that this is a partially copycat carnival driven by Binance, mainly to enhance market liquidity, and secondly to make money as a banker. However, judging from the current trading volume and market value changes, its impact on the market is relatively weak.

In addition to community discussions, many investors and analysts have listed potential currencies with low market value and no online contracts, in an attempt to bet on the next token that may be online on Binance contracts.

From the recent data and actions released by Binance, it seems that the world's largest exchange is not just for making money. First of all, the currencies of the above-listed contracts have all experienced a sharp decline. Secondly, the increase alone is not as great as the endless pull of market makers and dealers in the past. On the contrary, Binance has been increasing its efforts in compliance.

In terms of data, Coingecko disclosed the trading volume share of the top ten cryptocurrency exchanges in the second quarter of 2024. Binance's trading volume accounted for 45%, ranking first among CEX.

In terms of global layout, Binance recently announced that it has successfully registered as a reporting entity with the Indian Financial Intelligence Unit (FIU-IND). Although Binance faces a tax demand of $86 million from the Indian authorities, it still has the intention to return to India.

At the same time, Binance announced that it would pay 9.6 million reais (about $1.76 million) to the Brazilian Securities and Exchange Commission (CVM) to end CVM's investigation into its failure to obtain the necessary licenses for providing derivatives trading services in Brazil.

Last month, a US court also relaxed restrictions on Binance's US company BAM and allowed it to invest customer funds in US Treasury bonds.

In addition, Binance CEO Richard Teng also said that Binance will not rush to return to the US market, and will no longer be a "founder-led" model, but will transform into "a more decentralized company" led by the board of directors.

Teng also made it clear that Binance is currently in good financial condition and has no plans to seek an IPO. Instead, it focuses on business development in the global market and currently has 19 regulatory licenses around the world.

Recent news also confirms this. On August 22, Binance announced that it would recruit 1,000 people this year, many of whom were designated as compliance positions to meet regulatory requirements, and annual expenditures are expected to exceed US$200 million.

Summary

At the time of writing, Binance announced that it would launch a VIDT/USDT perpetual contract with a maximum leverage of 75 times, and VIDT rose by more than 54% in a short period of time. This once again shows that the launch of new coins on Binance contracts does have a certain wealth-creating effect at this stage, but it is still difficult to predict the next currency to be launched. As for Binance, the exchange’s pursuit of reputation is obviously far greater than its desire for short-term business revenue.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Xu Lin

Xu Lin Xu Lin

Xu Lin Clement

Clement Coindesk

Coindesk Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph