In the first quarter (Q1) of 2025, the crypto asset market failed to continue the growth trend at the end of 2024, and the total market value fell from the highest level of 3.8 trillion US dollars to about 2.7 trillion US dollars, returning to the level of the first quarter of 2024. Although Bitcoin (BTC), which leads the market value, created an all-time high (ATH) of 109,000 US dollars on January 20 this year, it also closed at 82,000 US dollars at the end of the quarter.

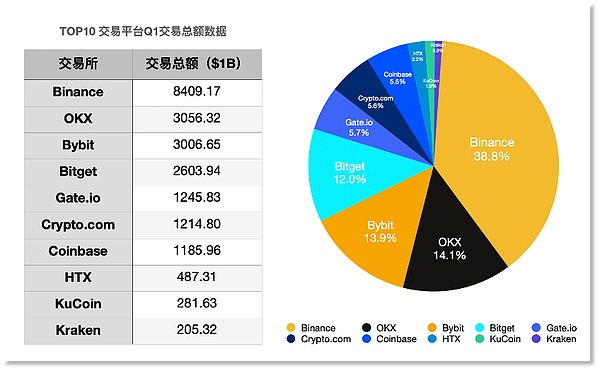

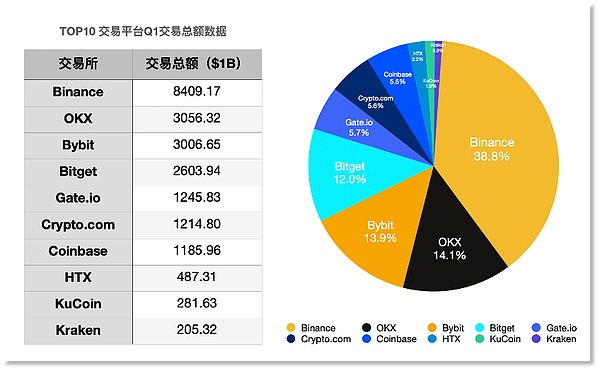

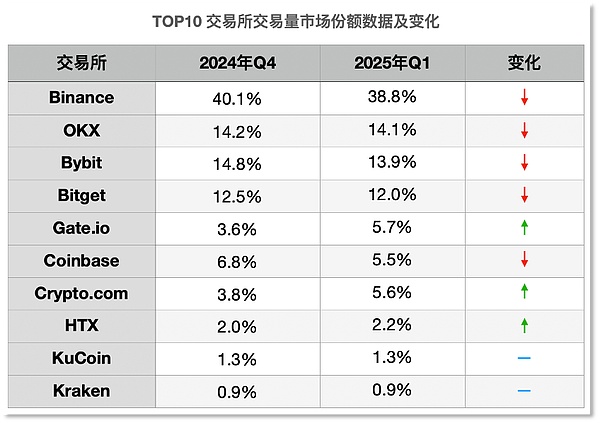

However, in terms of transaction volume in Q1 this year, the total transaction volume of the top ten exchanges in the world was 21.69 trillion US dollars, an increase of 16.84% over the same period last year, but a decrease of 12.29% from the previous quarter. Binance maintained its leading position with a total transaction volume of $8.41 trillion, followed by OKX and Bitget with $3.06 trillion and $3.01 trillion respectively.

However, at the beginning of Q2, Trump's tariff policy was first implemented and then suspended, causing significant fluctuations in global stock markets and crypto assets.

Liquidity risk will bring growth challenges to crypto asset trading platforms, and the top trading platforms are obviously more resistant to risks. Among them, Binance received $2 billion in equity financing from Abu Dhabi state-owned institution MGX in the first quarter, which prepared "food and grass" for it. In addition, its internal reforms such as the upgrade of its Web3 product Alpha and the adjustment of the listing mechanism also paved the way for future market changes in advance.

The unstable start of Q2 has filled the market with uncertainty, which will directly test the long-term resilience of the trading platforms at the top of the industry.

Q1 trading volume shrank year-on-year derivatives trading expanded

The decline in Bitcoin prices after reaching the peak has laid the groundwork for the shrinking trading volume of crypto assets in the first quarter of 2025. The world's top ten exchanges generated a trading volume of US$21.69 trillion in Q1 2025, down 12.29% from US$24.73 trillion in Q3 2024, but up 16.84% from US$18.25 trillion in the same period last year.

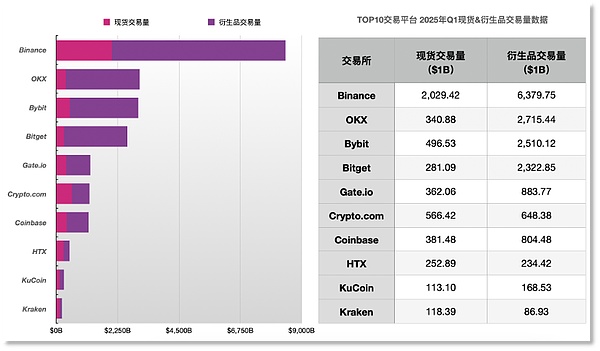

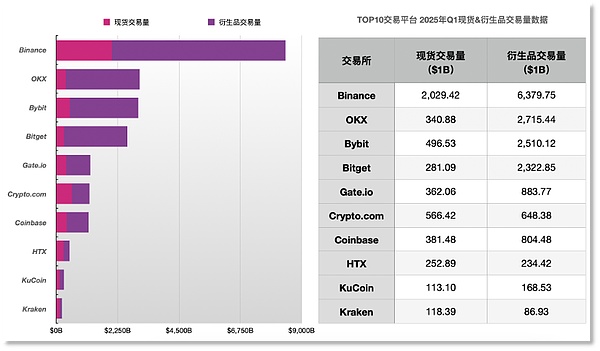

Correspondingly, the spot trading volume and derivatives trading volume contributed by the TOP10 exchanges both declined compared with the previous quarter, reaching US$4.94 trillion and US$16.75 trillion, respectively, down 14.97% and 11.52% from Q4 2024.

Among them, the total trading volume of the crypto asset derivatives market in Q1 was 3.39 times that of the spot market, an increase from 3.26 times in the previous quarter. The leading platforms Binance, OKX, Bybit, and Bitget accounted for more than 80% of the derivatives trading volume.

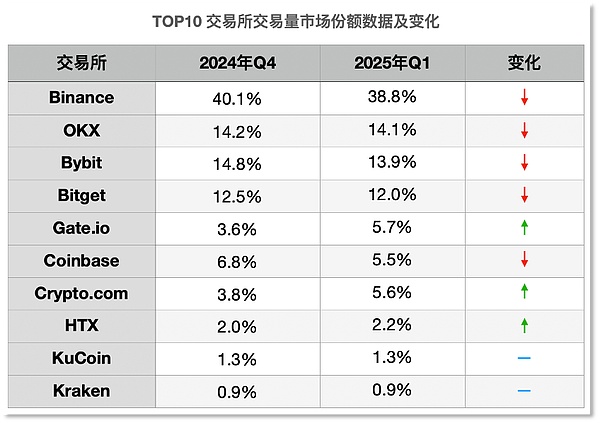

In the first quarter of the year, despite the overall decline in trading volume, Binance still maintained its leading position, topping the list with a total trading volume of US$8.41 trillion. It occupied the largest share in both the spot and derivatives markets, at 41.06% and 38.08% respectively, with an overall market share of 38.8%.

Binance's trading volume dominated in Q1 2025

Compared with the spot market in Q1, derivatives are still the core source of income for most trading platforms, and the scale of transactions has further expanded, which is the 3.39% of the spot market

compared with the spot market in Q1, derivatives are still the core source of income for most trading platforms, and the scale of transactions has further expanded, which is the 3.39% of the spot market

compared with the spot market in Q1, leaf=""> times. Although the leading platforms occupy the majority of the market share, competition is intensifying, especially when the spot market shrinks, downstream platforms are likely to start competing for market share.

In the derivatives market, Crypto.com is at a disadvantage, with its spot trading volume accounting for a significantly higher proportion (11.46%than its derivatives (3.87%), while Coinbase which is only available on the international site is still relatively weak in terms of its derivatives trading business (4.8%

. leaf="">), but it was a significant increase from the previous quarter's 2.72%.

Compared with 2024Q4,Binance's spot share has declined slightly, but still maintains an absolute advantage (accounting for more than 40%); Crypto.com The spot market share has declined significantly, Gate.iois one of the few platforms with an increased share.

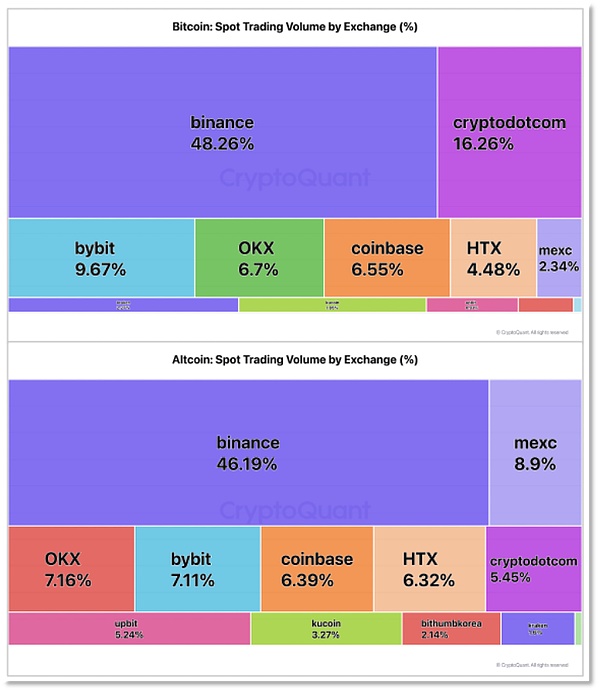

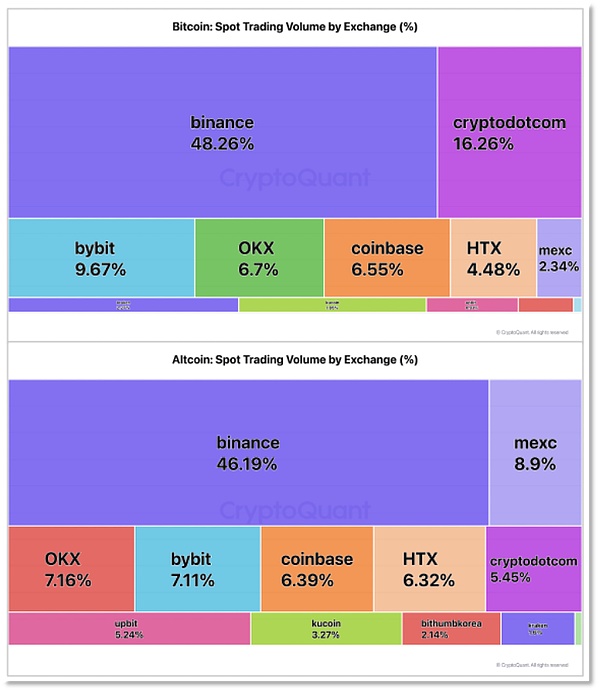

In the first quarter, compared with altcoins, the share and trading volume of the Bitcoin spot market both occupied a dominant position, and the data of various trading platforms also reflected this.

According to CryptoQuant data, Binance's Bitcoin and altcoin trading volumes are both in a clear leading position. As spot trading volumes across the crypto industry fell, Binance’s share of total daily Bitcoin spot trading volume increased from 33% to 49%, while altcoins’ share of daily spot trading volume increased from 38% to 44% from February 3 to the end of the first quarter. This also means that other exchanges’ volumes have fallen much faster than Binance’s.

In the derivatives market, the total share of the top four platforms, Binance, OKX, Bybit, and Bitget, dropped from 87.06% to 11.89%. leaf="">83.13%, the share of small and medium-sized exchanges rebounded slightly, Binance derivatives share declined the most, but the market share still maintained the first place, Bybitand Bitget followed closely, and the competition was intensifying.

Binance's trading volume market share has declined but still maintains first place

AlthoughBinance's overall market share has declined by 1.38% compared with2024 leaf="">, but still maintained an absolute lead, and other leading platforms failed to benefit significantly from it. Compared with the cannibalization of competition, the more obvious signal is that the overall crypto asset market is shrinking, and the industry has accordingly entered a period of adjustment.

External financing and internal upgrades Binance accumulates energy for growth

In early April, Trump's new tariff policy hit the crypto asset market hard, casting a shadow over the second quarter that had just begun, and the time to test the resilience of the market and industry has arrived. Throughout the first quarter, Binance was still the most active in the crypto asset exchange industry, and several major events added heavy chips to it when facing the uncertainty of the future market.

The most concerned thing in the industry and outside is that Binance obtained its first institutional financing.

On March 12, MGX (Mubadala G42 X), a technology investment company supported by the Abu Dhabi government of the United Arab Emirates, announced an investment of $2 billion in Binance, the world's largest cryptocurrency exchange, and acquired a minority stake. This is MGX's "largest single investment in a cryptocurrency company."

The market speculates that Binance's valuation will increase to $20-40 billion as a result. This capital injection will directly strengthen its balance sheet, making it the world's most cash-rich cryptocurrency exchange. However, Binance, with a daily trading volume of nearly $100 billion, did not intend to make this deal for financial reasons - MGX's deep government background has made the "gold content" of this institutional investment obtained by Binance soar.

InsightBehind MGX is a combination of Abu Dhabi sovereign wealth fund Mubadala (Mubadala) and artificial intelligence giant G42 Group. If “G42” represents the core technology, “Mubadala” means wealth and power. This “M” is one of the top ten sovereign wealth funds in the world, with assets under management exceeding US$300 billion. Its CEO Khaldoon Al Mubarak is also the chairman of MGX. leaf="">, reports directly to the Abu Dhabi royal family and participates in the formulation of the national industrial transformation plan.

With the support of the UAE's "state-owned assets" and the endorsement of the sovereign fund,Binance, which has already obtained a virtual asset service provider (VASP license in Dubai, will increase its compliance chips and will also affect the world's change of concept of the crypto asset industry to a certain extent.

In addition,Binance will use the Middle East springboard to break through capital limitations. You should know that Middle Eastern family offices manage approximately US$1.8 trillion in assets worldwide. If Binance is included in the whitelist, it is estimated that it will bring in more than US$50 billion in incremental funds in the next 12 months.

In the long run, the cooperation between Binance and MGX may open a new path for the industry - becoming a "digital central bank" connecting oil capital and the crypto world, redefining the global financial power structure. After this battle, Binance will be upgraded from a crypto asset exchange to a new financial infrastructure institution, bringing new opportunities for its upgrading and transformation.

In addition to the external, Binance's series of internal reforms after the beginning of this year are obviously also preparing for future upgrades and market changes.

On March 18, Binance Alpha 2.0was launched, integrating its Web3wallet's transaction function directly into the platform's main site. This is a major upgrade. Alpha 2.0 directly simplifies the entry for early token transactions, allowing users to purchase newly emerging tokens on the chain directly on the Binance main site without additional settings, enabling users to more conveniently discover opportunities in early projects.

On the security level, Alpha 2.0 also launched "MEV Protection", a feature that enhances transaction security and provides better pricing for traders, helping to reduce the risks associated with market manipulation and front-running to provide safer and more efficient trading conditions.

On the day of Binance Alpha 2.0's launch, the on-chain transaction volume of Binance's wallet reached 90.55 million US dollars, accounting for 54% of the Web3 wallet market transaction volume, which is the largest transaction volume of Binance Q10.2% of the average daily spot trading volume. Calculated in terms of spot trading market, it is more than 2 times the spot trading volume of CEX Deribit, which ranks 70th.

This means that Alpha 2.0will become a supplement to the Binancespot trading market. When the market is down and the overall trading volume is sluggish, the early projects in the Web3market on the chain may still attract users due to their low market value and high liquidity. Some high-quality projects with active trading volume and qualified quality may also have the opportunity to log in to the Binancemain site, continuously increasing the activity of users on the platform.

In addition to products, in the first quarter, Binancealso carried out reforms at the governance level, incorporating "user voting" into the rules for listing/delisting assets to enhance users' voice in the listing of new coins and the delisting of old coins. This is also one of the measures taken by Binanceto continuously listen to user voices and adjust the "coin listing mechanism" since the beginning of the year, and it has become a small tool for it to maintain its activity.

External financing seeks strategic layout, internal innovation responds to the ever-changing market, "coin sea" ups and downs7, already a giantBinance is still leveraging and seeking change. The iron rule of the exchange industry "if you don't advance, you will retreat" has overturned many "new ships", not to mention that all industries have entered an era of great economic shocks, and the "dawn" belongs only to the "long-distance runners" who continue to accumulate strength.

Jasper

Jasper