Author: Moulik NageshSource: Binance Research

In 2025, U.S.-led protectionism is back in force. Since Donald Trump was re-elected as president in January 2025, the U.S. has raised concerns about a global trade war by imposing a series of massive new tariffs—both on specific countries and on specific industries. In the past week alone, the U.S. has introduced a new round of “reciprocal” tariffs, and other countries have announced countermeasures.

This report will analyze how these tariffs—the most aggressive tariff measures since the 1930s—are affecting the macroeconomy and crypto markets. We will examine the level of tariffs, macroeconomic trends (including inflation, growth, interest rates, and the Fed’s outlook), and their impact on crypto asset performance, volatility, and correlations based on data. Finally, we will also explore key observation points in the future and the market prospects that crypto assets may face in an environment of stagflation and protectionism.

Tariff Resurgence in 2025

After several years of relative trade peace, 2025 saw a rapid reversal. Within the first few days of returning to the White House, President Trump began to fulfill his campaign promise to impose tariffs on a wide range of imports under emergency authorization - covering specific countries and industries.

Trade tensions escalated further on April 2. On that day, the United States announced the introduction of comprehensive "reciprocal" tariffs and named the day "Liberation Day", which became the latest turning point in this round of global trade wars. What many countries had previously regarded as normalized trade relations with the United States has now undergone a fundamental change. Major events from the past week include:

●Base tariffs: The United States announced a new 10% flat tariff on all imports, reversing decades of trade liberalization. The base rate went into effect on April 5.

●Targeted tariffs: On top of the base rate, higher country-specific tariffs are added. President Trump calls these "reciprocal" tariffs, which are aimed at countries that have set up high barriers to American products. Notably, Chinese goods will be subject to an additional 34% tariff - which, when added to the original 20%, brings the combined tariff rate to 54%. Targeted tariffs for other countries include: 20% for EU goods, 24% for Japan, 46% for Vietnam, and 25% for auto imports. Canada and Mexico were not included in the new list because they were already subject to a 20% tariff in February.

●Global Countermeasures: America’s trading partners responded quickly. As of mid-February, several countries that were hit with tariffs early on had announced countermeasures. Canada, having failed to successfully seek an extension of U.S. tariffs, decided to impose a 25% tariff on all U.S. imports. China also responded early, and on April 4th it further escalated, announcing a 34% tariff on all U.S. imports.

As “reciprocal” tariffs take effect and trade tensions intensify, more countries are expected to introduce their own countermeasures. The European Union has made it clear that it will respond soon, and several other major economies have also developed relevant countermeasures. Although the full extent of the global response is still unclear, all signs now point to a broad trade war involving multiple fronts being formed.

Chart 1: April 2, 2025 “Liberation Day” tariffs cover up to 60 countries, including several major U.S. trading partners Note: This table reflects the “reciprocal” tariffs imposed by the United States on its top 10 import sources on April 2.

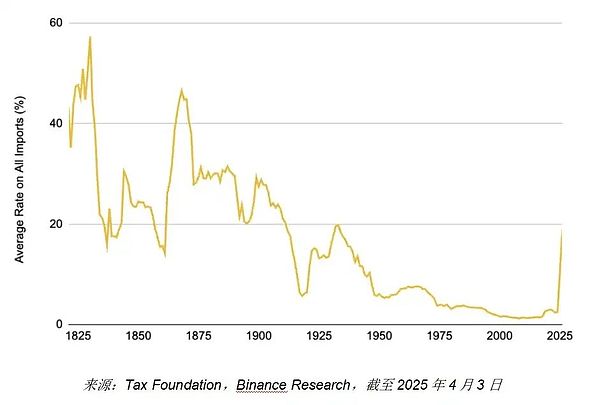

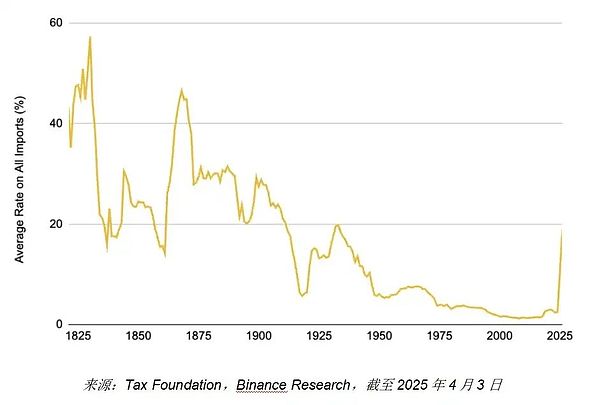

These policies have caused U.S. import taxes to soar to the highest level since the Smoot-Hawley Tariff Act of 1930, which imposed comprehensive tariffs on thousands of goods during the Great Depression. Based on available data, the average U.S. tariff rate has risen to about 18.8%, with some estimates as high as 22% - a dramatic jump from 2.5% in 2024.

For reference, in the past few decades, the average tariff rate in the United States has generally remained between 1–2%; even during the Sino-US trade friction that broke out in 2018-2019, it only rose to around 3%. Therefore, the 2025 measures constitute an unprecedented tariff shock in modern history - almost equivalent to a return to the protectionism of the 1930s.

Chart 2: The rebound in US tariffs has raised import tax rates to the highest level in nearly a hundred years

1.Market impact:

Cooling demand, risk aversion and soaring volatility

1. Cooling demand and rising risk aversion

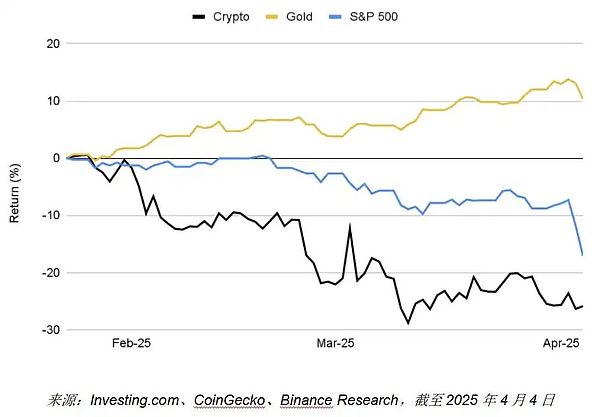

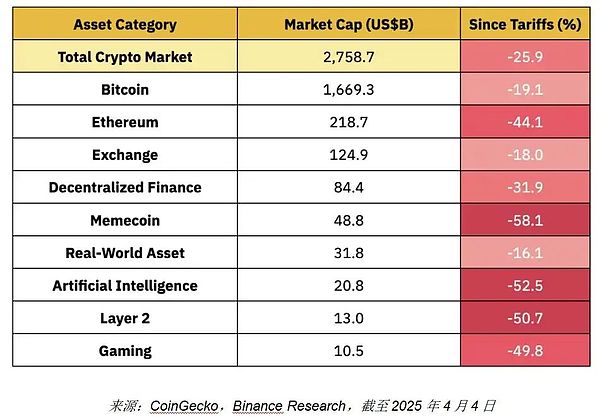

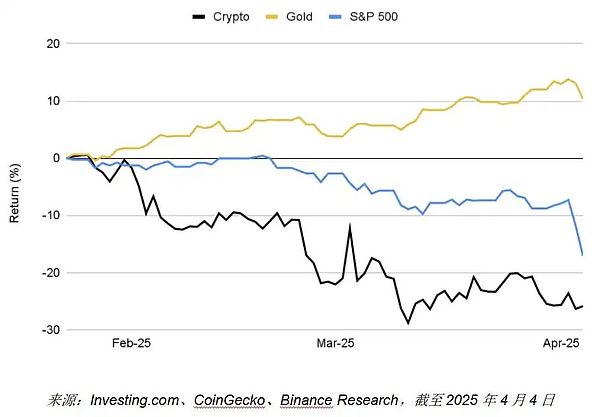

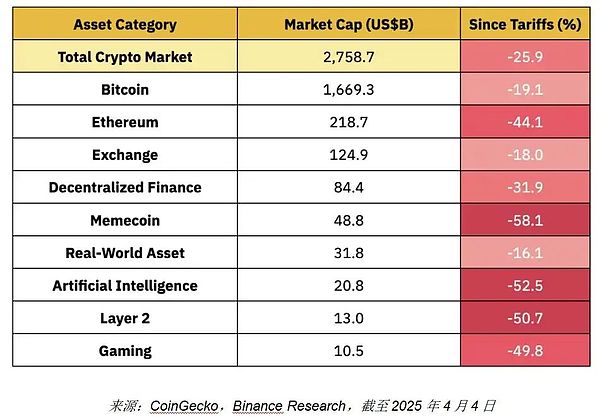

Market sentiment has clearly turned cautious, and investors have responded to the tariff announcement with typical "risk aversion" behavior. The total market value of the crypto market has fallen by about 25.9% since its January high, with a market value loss of nearly $1 trillion, highlighting its high sensitivity to macroeconomic instability.

Crypto assets and stock markets have moved in line with each other, both facing cooling demand, widespread selling and entering correction territory. In contrast, traditional safe-haven assets such as bonds and gold have performed well, with gold hitting record highs in a row, becoming a safe haven for investors when macro uncertainty rises.

Chart 3: Since the initial tariff announcement, the crypto market is down 25.9%, the S&P 500 is down 17.1%, and gold is up 10.3% and hitting new all-time highs

The violent market reaction also highlights the performance characteristics of crypto assets during periods of intense "risk aversion": Bitcoin (BTC) fell 19.1%, and most major altcoins fell as much or more. Ethereum (ETH) fell more than 40%, and high-beta sectors (such as meme coins and AI-related tokens) plummeted more than 50%. The sell-off has wiped out most of the crypto market’s gains since the beginning of the year, and as of early April, even BTC’s year-to-date (YTD) returns have turned negative—despite its strong performance in 2024.

Chart 4: Under the macro panic caused by tariffs, altcoins have fallen significantly more than Bitcoin, exacerbating market pessimism

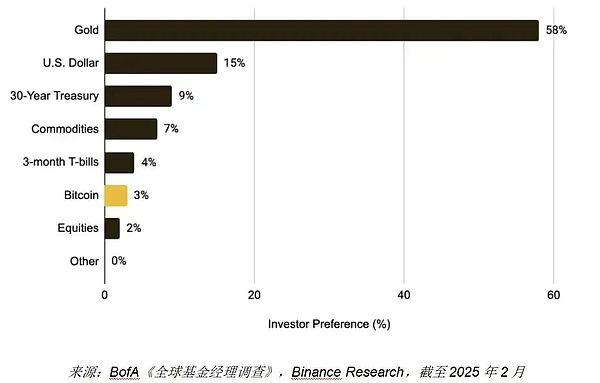

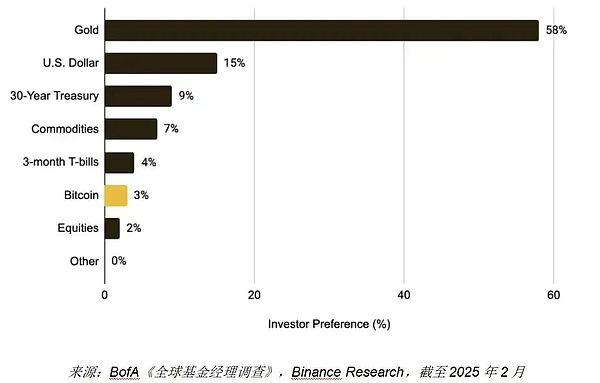

As the crypto market increasingly exhibits risk asset characteristics, if the trade war continues, it may continue to suppress capital inflows and suppress demand for digital assets in the short term. Funds may continue to wait and see, or switch to assets such as gold that are considered safer. This sentiment is also reflected in the recent fund manager survey, where only 3% of respondents said they would allocate Bitcoin in the current environment, while 58% preferred gold.

Chart 5: Only 3% of global fund managers see Bitcoin as a preferred asset class in a trade war scenario

2.Volatility surge

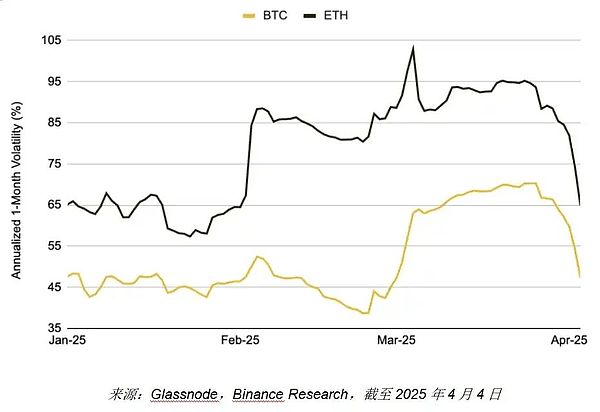

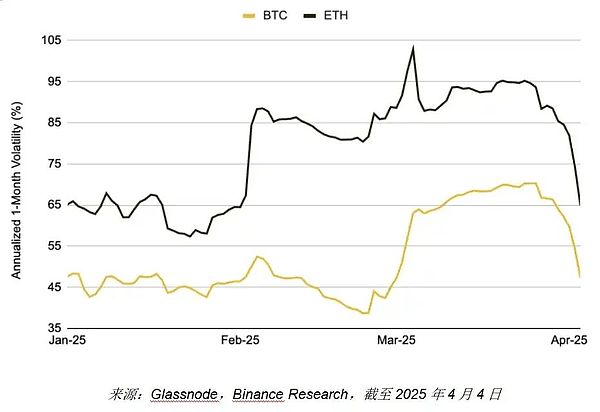

The market's sensitivity to tariff policies is very obvious, and every major announcement will trigger violent price fluctuations. BTC has experienced several major price shocks in the past few months - including one of the largest single-day drops since the 2020 COVID-19 crash. At the end of February 2025, when Trump suddenly announced plans to impose tariffs on Canada and the European Union, BTC fell by about 15% in the following days, while its realized volatility rose sharply. ETH's trend was similar, with its one-month volatility soaring from around 50% to over 100%.

These market behaviors highlight that in the current high-uncertainty macro environment, the crypto market is extremely sensitive to sudden policy changes. In the future, if the policy direction remains unclear or the trade war escalates further, the market will maintain high volatility. Historical experience also shows that volatility can only gradually decline after the market has fully digested and priced in the new tariff policy.

Chart 6: During this period, BTC's January realized volatility rose to more than 70%, and ETH exceeded 100%, reflecting the sharp market fluctuations after the announcement of tariffs

II.Macroeconomic impact:

Inflation, stagflation concerns, interest rates and the Federal Reserve's outlook

1. Inflation and stagflation concerns

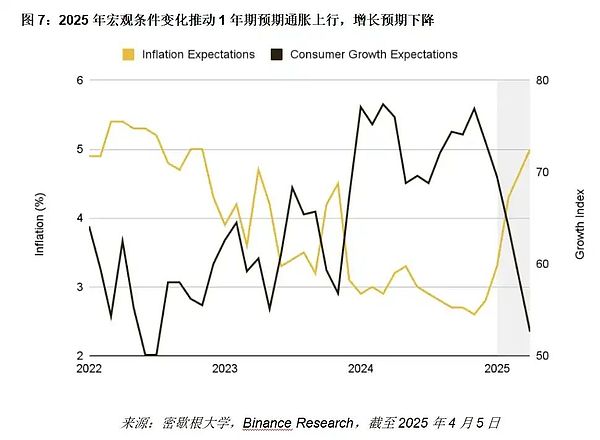

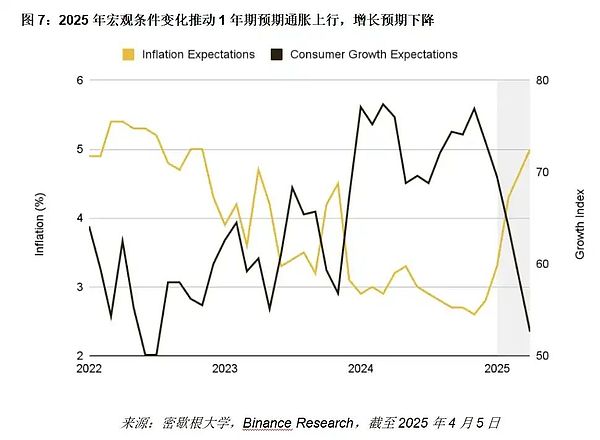

The new tariffs amount to a large additional tax on imported goods, adding fuel to inflationary pressures just as the Federal Reserve is trying to curb price growth. Markets have shown concerns that the measures could derail the process of inflation retreating. Market-based indicators such as one-year inflation swaps have soared to more than 3%, while expectations in consumer surveys have risen to around 5%, both showing that people generally expect prices to continue to rise over the next 12 months.

Meanwhile, economists warn that if the trade war escalates fully and triggers a global retaliatory response, global economic output losses could be as high as $1.4 trillion. U.S. real GDP per capita is expected to fall by nearly 1% in the initial stage. Fitch Ratings pointed out that if the comprehensive tariff system persists, most economies may enter a recession, and said that "the current high level of U.S. tariffs has invalidated most economic forecasting models."

Under the dual pressure of rising inflation expectations and growth concerns, the risk of the global economy sliding into stagflation (economic stagnation and price increases) is becoming increasingly prominent.

2. Interest rate outlook and Fed stance

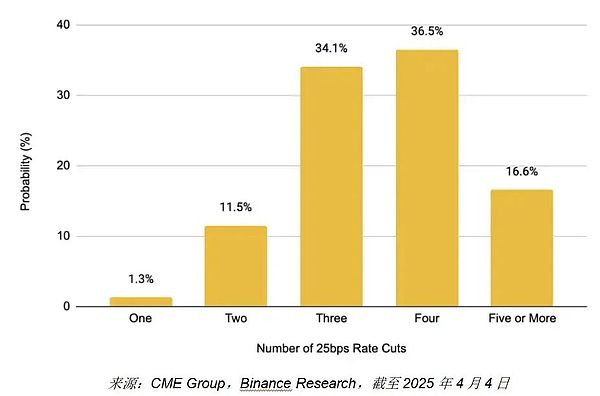

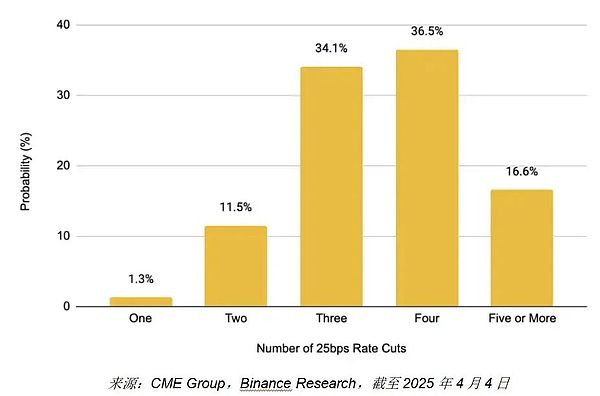

Federal Reserve funds rate futures data show that market expectations for rate cuts in the coming months have risen sharply. This marks a clear shift in attitude - just a few weeks ago, the Fed was still firmly committed to curbing inflation, but now, due to rising concerns about economic growth prospects, the market has begun to expect that monetary policy may turn to easing to support the economy.

Figure 8: Market expectations for rate cuts in 2025 continue to rise, with four 25 basis point cuts now expected - much higher than the previous expectation of only one

Reflecting this shift in sentiment are public statements by Fed officials who have expressed concern and stressed that the new round of tariffs runs counter to previous economic policy guidelines. The Fed now faces a difficult choice: tolerate the additional inflation caused by tariffs, or stick to a hawkish stance and risk further depressing growth?

"The scale of tariffs announced in recent weeks has been larger than expected, and their impact on inflation and growth - especially the cumulative effects - needs to be monitored closely." - Jerome Powell, April 4, 2025In the short term, the Fed appears to remain committed to keeping long-term inflation expectations stable. However, monetary policy decisions will continue to be data-dependent, depending on whether inflation or growth signals are weaker. If inflation exceeds the target far, the stagflationary environment may limit the Fed's policy response. This uncertain policy outlook has also exacerbated market volatility.

III.Outlook

1. Correlation and Diversification

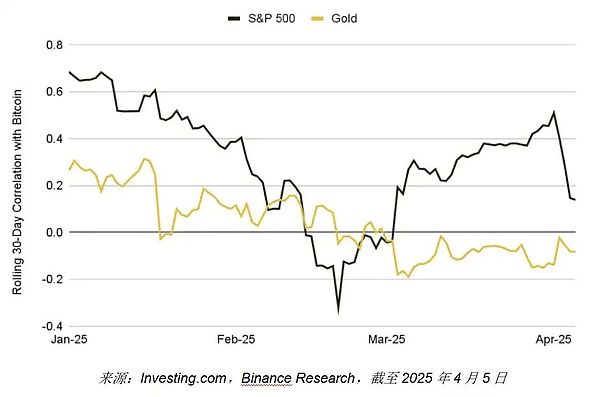

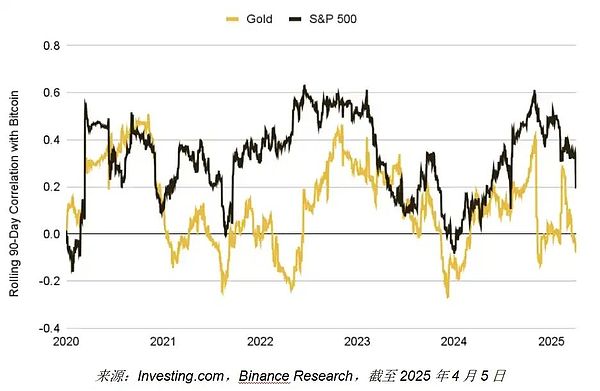

The evolving relationship between crypto assets and traditional markets is becoming a focus - and Bitcoin, as the market's dominant asset, is the best window to observe this change. This round of "risk-off" events caused by the trade war has significantly affected the correlation structure between BTC and the stock market and traditional safe-haven assets.

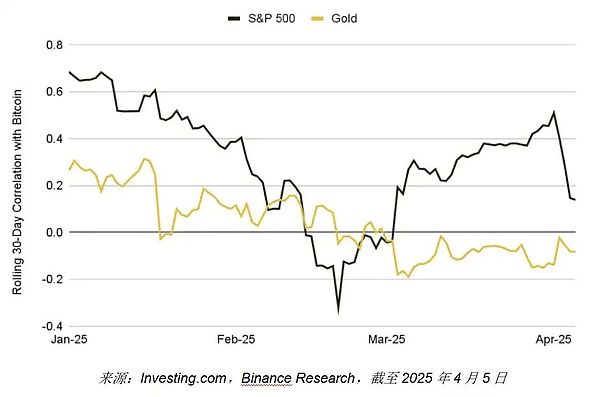

Since the first mention of tariffs on January 23, the initial market reaction has been inconsistent - Bitcoin and stocks have moved slightly independently, causing their 30-day correlation to fall to -0.32 on February 20. However, as trade war rhetoric escalated and risk aversion continued to spread, this value rose to 0.47 in March, showing that Bitcoin's linkage with overall risk assets has increased in the short term.

In contrast, Bitcoin's correlation with traditional safe-haven assets such as gold has weakened significantly - the original neutral to positive relationship turned into a negative correlation of -0.22 in early April.

These changes show that macroeconomic factors, especially trade policy and interest rate expectations, are increasingly dominating crypto market behavior, temporarily suppressing the market structure originally driven by supply and demand logic. Observing whether this correlation structure persists will help understand Bitcoin's long-term positioning and its diversified value.

Figure 9: Initial reactions diverged. As the trade war escalated, BTC’s linkage with the S&P 500 strengthened, while its correlation with gold continued to weaken

2. Regaining the narrative of safe-haven assets

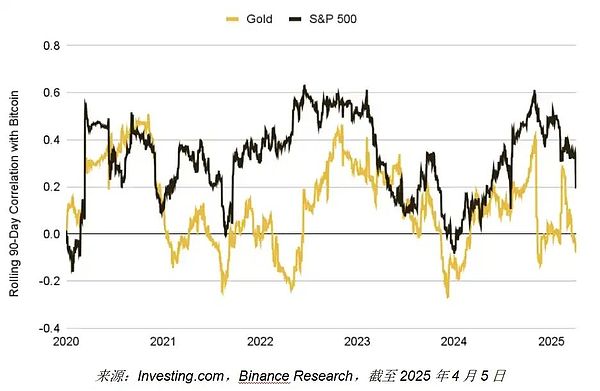

Although recent macro and liquidity shocks have highlighted the “risk attributes” of crypto assets, the long-term trend remains unchanged: the correlation between Bitcoin and traditional markets usually rises under extreme pressure, but gradually declines after the market stabilizes. Since 2020, BTC’s 90-day average correlation with the stock market is about 0.32, and with gold is only 0.12, indicating that it has always maintained a certain separation from traditional asset classes. Even under the impact of the recent tariff announcement, BTC has shown some resilience on trading days when some traditional risk assets have weakened. At the same time, the supply of long-term holders continues to rise - indicating that core holders have not significantly reduced their positions during recent fluctuations, but instead have shown strong confidence. This behavior suggests that despite the increase in short-term price volatility, Bitcoin may still be able to re-establish a more independent macro identity.

Figure 10: Since 2020, Bitcoin's long-term correlation with traditional assets has remained moderate: 0.32 with the S&P 500 and 0.12 with gold

The key question is whether BTC can return to its long-term structure of low correlation with the stock market. A similar trend was seen during the banking crisis in March 2023, when BTC successfully decoupled and strengthened during the stock market downturn.

Now, as tariff wars intensify and global markets begin to adjust to a long-term pattern of trade fragmentation, whether Bitcoin can once again be viewed as a “non-sovereign, permissionless” safe-haven asset will determine its future macro role. Market participants will closely watch whether BTC can retain this independent value proposition.

One potential path is to regain its appeal during periods of monetary inflation and fiat currency debasement, especially if the Fed turns to easing. If the Fed begins to cut rates and inflation remains high, Bitcoin may regain favor as a “hard asset” or inflation-resistant asset.

Ultimately, this process will determine BTC’s long-term positioning as an asset class—and its diversification utility in a portfolio. The same applies to other major altcoins, which present stronger risk attributes in the current environment and may continue to rely on BTC-led market sentiment.

3. Crypto Markets in a World of Stagflation and Protectionism

Looking ahead, crypto markets will face a complex macro environment dominated by trade policy risks, stagflationary pressures, and global coordination breakdowns. If global growth continues to be weak and crypto markets fail to develop a clear narrative, investor sentiment could decline further.

A prolonged trade war will test the resilience of the entire industry—it could lead to a drying up of retail capital flows, a slowdown in institutional allocations, and a reduction in venture capital financing. Macro variables to watch closely in the coming months include:

●Trade developments: Any new tariff lists, unexpected easing measures, or major bilateral changes (such as U.S.-China negotiations or re-escalation) will directly affect market sentiment and inflation expectations.

●Core inflation data: The upcoming CPI and PCE data are crucial. If the unexpected upward trend is driven by import costs, it will increase concerns about stagflation; if the data is weak, it may ease the pressure on the central bank and increase the attractiveness of risky assets (including crypto).

●Global growth indicators: Declining consumer confidence, slowing business activity (PMI), weak labor market (rising unemployment claims, slowing non-farm payrolls), corporate profit warnings and inverted yield curves (common recession signals), etc., may further trigger risk aversion in the short term. However, if macro weakness accelerates expectations of monetary easing, it may also provide support for the crypto market.

●Central bank policy path: How the Federal Reserve and other major central banks seek a balance between inflation and recession will determine the liquidity of various assets. If they still refuse to cut interest rates against the backdrop of slowing growth, risky assets will continue to be under pressure; if they turn to easing, it may bring a comprehensive boost. If real interest rates fall (whether due to policy or continued inflation), long-term assets such as Bitcoin may benefit. The divergence of central bank policies (such as the Fed turning dovish and the ECB remaining hawkish) may also stimulate cross-border capital flows, further exacerbating volatility in the crypto market.

● Crypto's own policy events: ETF approval, strategic BTC reserves, key legislation advancement, etc., may become independent catalysts under the current macro background, and are expected to break the "macro binding" state of crypto assets and re-highlight their uniqueness. However, we should also be wary of reverse risks, such as regulatory delays or unfavorable litigation progress, which may produce negative feedback.

Fourth, Conclusion

The most radical round of tariff policies since the 1930s is having a profound impact on the macroeconomy and the crypto market. In the short term, crypto markets are likely to continue to be highly volatile, with investor sentiment swinging on trade war news.

If inflation remains high and growth slows, the Fed’s response will be a key turning point: if it turns to easing, crypto markets may rebound due to the recovery of liquidity; if it remains hawkish, risk asset pressure will continue.

Markets are expected to recover if the macro environment stabilizes, new narratives emerge, or crypto assets regain their long-term safe-haven status. Until then, markets may remain volatile and highly sensitive to macro news. Investors need to pay close attention to global developments, maintain diversified asset allocations, and look for opportunities in potential market dislocations caused by the trade war.

Joy

Joy