Compiled by: Liu Jiaolian

After crawling along the 30-day moving average for 5 days and pulling the 7-day moving average back to the 30-day moving average, BTC (Bitcoin) suddenly exerted force and stepped on the left toe. Toes, right toes stepped on left toes, and suddenly flew upwards, quickly breaking away from the "ground" of the 30-day moving average of 65k, and leaping up to the "wall" of $70,000. The onlookers clapped their hands and applauded, as if in their eyes, BTC was like a hero with strong martial arts skills who robbed the rich and helped the poor. With a few light kung fu skills, he jumped up to 6 points and won the applause of the whole hall.

As early as March 9, Jiaolian pointed out that the key position of $70,000 is actually the upper edge (lid) of the large cross-cycle box built since 2021.

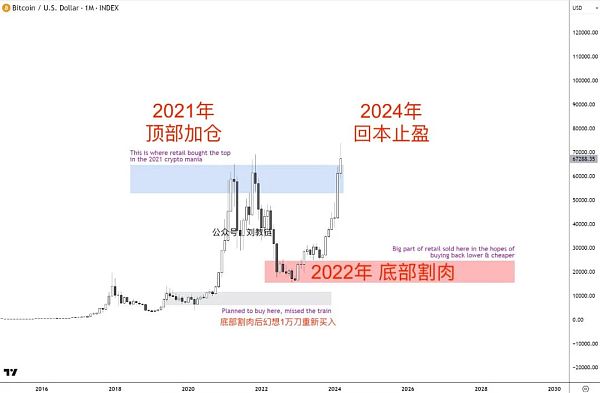

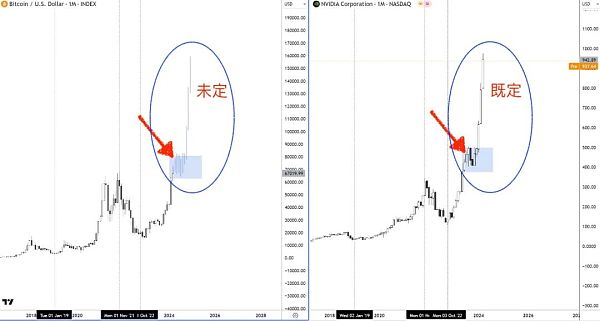

At that time, Jiao Lian also drew the following picture to visually explain the board at that time:

In fact, shortly after Jiaolian drew this chart on the 9th (BTC 68k), 5 days later, on March 14, BTC hit the mid-track 74k (in the picture Purple-red line), and finally touched 73.8k. Regarding the origin of this mid-track, interested readers can read back Jiaolian’s March 25 article " Bitcoin’s time power law model and its cointegration revisited》.

After three years of hoarding money, why not hold on to it?

The 70,000 bits are still there today, but there are no speculators from back then.

Looking back on the past, the research method that Jiaolian insists on is to combine rational cognition and intuition to formulate hypotheses, and then test the hypotheses with facts. This is the practical method of the scientific truth testing principle of Popper's falsification theory, which takes "falsifiability" as the criterion for determining whether it is scientific or not. You may not know Popper, but he had a student, and many of you should know it. This student is the famous Soros.

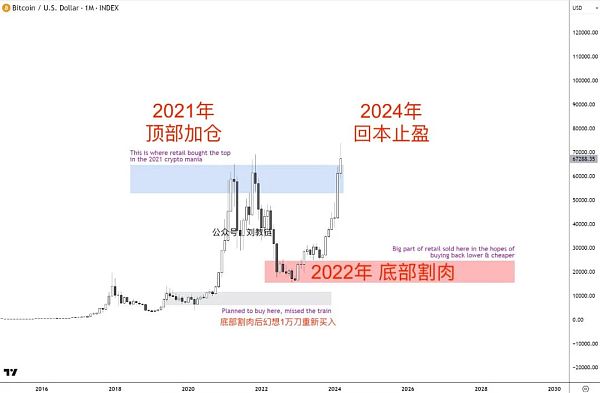

As early as December 18, 2021, that is, in the first third of the box, when BTC was 46k, Jiaolian boldly assumed the "big midfield theory" and believed that 30,000 knives would be the price. With the lower edge and $60,000 as the upper edge, BTC is building a large cross-cycle box. The midfield theory stems from this. Therefore, the midline of 45,000 dollars is the fluctuation center of this large box.

Looking back today, the bull market in 2021 is indeed a box preparation. The deviation is that the estimate of the lower edge of the box is a bit higher, and eventually it fell back to 16k. But the impact on the fluctuation center estimate is minimal: the actual box center is (70 + 16)/2 = 43k, or $43,000. (Please note that the visual distance per 10,000 dollars is different on the logarithmic coordinate system, and you cannot look at the visual center line)

So, since you knew this, what should you do when BTC falls below the center? What is it? Obviously there is only one, "add to positions when prices fall".

Now, BTC is testing the pressure level on the upper edge of the box and reversing the support level. Once the support is confirmed, the box will be completely opened, announcing the end of the three-year box stage and starting a new journey!

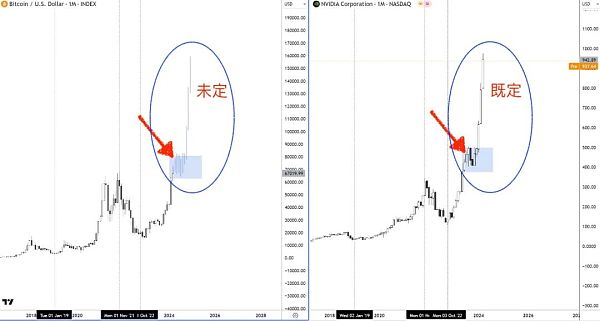

The left side of the above picture is BTC, and the position pointed by the red arrow is where we are now stage. On the right is Nvidia's U.S. stock chart. The red arrow is a step back to test the support level after a stage breakthrough, and then after confirming the support, it soars into the sky. On technical graphics, we can see similarities in speculative patterns.

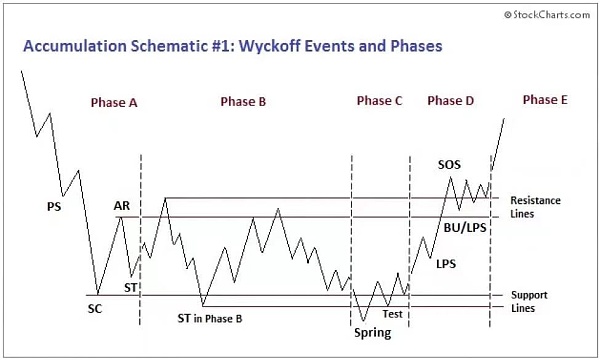

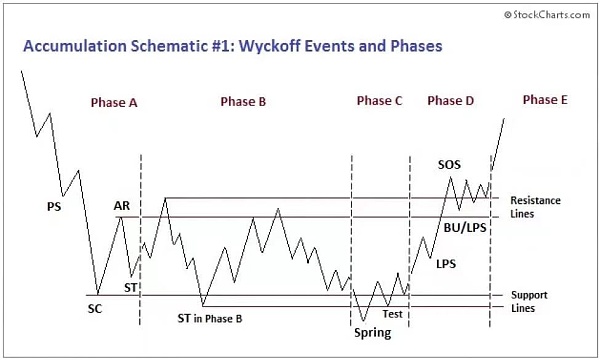

This is very similar to the SOS signal (Signal of Strength) on the right side of the D-stage confirmation pattern in the Wyckoff bottom accumulation pattern!

This is exactly where many retail investors get off the bus and then never get on again. The terminus!

I still remember the "three treasures of leeks" summarized by Jiaolian: add positions at the top; cut the meat at the bottom; and return the capital and stop the profit.

70,000 knives, for leeks that have been standing guard against the wind for 3 years with 60,000 knives in 2021 For us, this is an excellent opportunity to "recover the capital and stop the profit"!

As for the more old leeks who are still waiting for short or half positions (referring to those who have experienced one or two halvings), many are still waiting for the plunge before another halving. Just like the sharp retracement of "312" in 2020.

Based on the above-mentioned psychology, the final change of hands must be carried out at this position, and those who get off the bus and those who get on the bus respect each other.

Who is the tour guide who takes the group on the bus? Yes, it is the spot ETFs: BlackRock, Fidelity, Ark Fund, Bitwise,...

Tour groups come and go, what is the most important thing for a tour guide? Keep tour groups always filled with people and funds flowing. As the saying goes: The tour group is tough, the tourists are flowing. Just like tour guides earn tour guide fees, BlackRock earns management fees. Regardless of whether it goes up or down, as long as there are always customers and the size of the ETF is maintained, BlackRock will just sit back and make money.

A simple calculation shows that if BlackRock manages an ETF fund with a size of 500,000 BTC, with a cost of 200,000 U.S. dollars, it will surely earn 250 million U.S. dollars in management fee income every year.

So, BlackRock will definitely do their best to attract customers, expand the scale of asset management, and try their best to retain customers and not sell off early. They hope that customers will hold it for a long time, for several years or even more than ten years, the longer the better, so that they can pay management fees for a long time until they are soft. (Of course, as an open-end fund, it cannot force customers to lock their positions, so they can only exert influence or develop derivative products based on ETFs to lock customer funds.)

Where are ETFs? In the car? The range is between 50,000 and 70,000.

For them, $70,000 is just the start of the journey.

For them, the fresh and exciting crypto journey has just begun.

Huang Bo

Huang Bo