Author: Anthony Pompliano; Translated by: Shaw Jinse Finance

Bitcoin's adoption is unique. Most technologies are first adopted by militaries and governments, followed by businesses, and eventually, ordinary people gain access to them. This was the case with the internet, mobile phones, computers, and many other innovations of the last century.

But Bitcoin is different.

People were the first to embrace Bitcoin. Governments believed it should be banned. Businesses considered it too risky. It was ordinary people who worked hard to understand this asset, recognized the market opportunity, and mustered the courage to buy and hold the world's first decentralized digital currency.

For taking this risk, people have been richly rewarded.

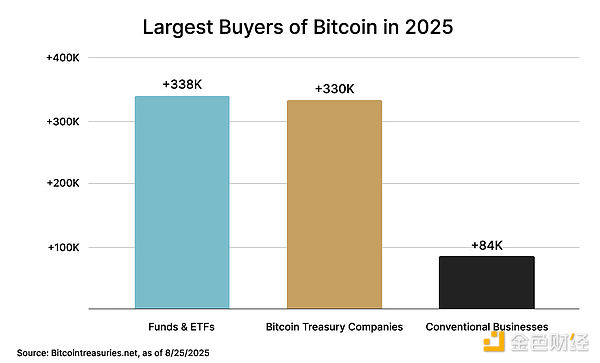

Today, businesses are trying to catch up. Bitcoin platform River has just released an excellent report showing that a large portion of Bitcoin buyers are now businesses, not individuals. Sam Baker and Vincent Lee wrote: "Corporate assets have become the primary driving force behind Bitcoin's ongoing bull run. In the first eight months of 2025, the amount of Bitcoin flowing onto corporate balance sheets exceeded the $12.5 billion total for all of 2024." A key reason for the massive increase in corporate Bitcoin holdings is the recent rise of publicly listed Bitcoin treasury companies. The report states that these treasury companies "accounted for 76% of all corporate purchases since January 2024 and 60% of publicly reported corporate holdings." Since Microstrategy became the first public company to hold Bitcoin on its balance sheet, we have seen more and more companies follow suit. It is estimated that there are now more than 50 public companies holding at least 10 Bitcoins. And these companies aren't just in the US. In fact, the Bitcoin treasury company phenomenon has become a global phenomenon almost overnight. Publicly listed companies in nearly every market are continually converting their local currencies into this digital form of sound money. So, it’s clear that these treasury companies are a big reason for the continued bull run in Bitcoin. But it’s important to note that while these companies have been buying a lot of Bitcoin, they’re still slightly behind funds and exchange-traded funds (ETFs), which have been the largest category of buyers of Bitcoin so far this year.

In a bull market, it's healthy to have a variety of buyers, so seeing demand coming from funds, ETFs, treasury firms, private companies, and individuals is a good thing.

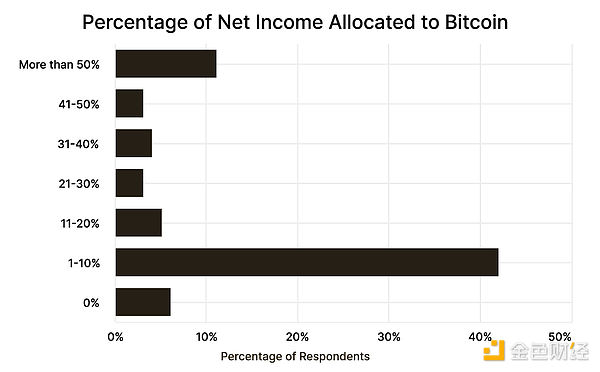

But let's get back to the question of companies holding Bitcoin. Most companies will never put a large portion of their balance sheet into Bitcoin, at least not in the short term. Therefore, a more realistic scenario is that companies have 1% of their balance sheet in this digital asset. 1% may not sound like much, but look at the difference that 1% allocated to Microsoft, Google, and Apple would have made since 2020. Since 2020, these companies have seen their balance sheet purchasing power shrink from $14 billion to $21 billion. Think about that, that's crazy. In just five years, the hidden tax of inflation has wiped out over $14 billion in shareholder value. It's incredible. If these firms had allocated just 1% of their funds to Bitcoin in 2020, they would have each seen increased returns by $14 billion to $29 billion over the same five years. We're talking about swings of over $25 billion per firm. And they would have only risked a 1% allocation. In hindsight, it seems like a no-brainer. This brings me to my final point about the actual performance of firms in terms of Bitcoin allocations. River's data shows that many firms allocate far more than the assumed 1% to Bitcoin. According to a July 2025 survey, River clients allocated an average of 22% of their net profits to Bitcoin, with a median allocation of 10%.

So here's the thing. Even a 1% allocation since 2020 would have a significant impact on most companies' balance sheets, but the average allocation is a whopping 22% of net income, and the median is 10%.

My intuition tells me those percentages will rise over time.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin Cheng Yuan

Cheng Yuan Hui Xin

Hui Xin Samantha

Samantha Others

Others Nulltx

Nulltx Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist