Author: Jack Inabinet, Bankless Senior Analyst; Translation: Golden Finance xiaozou

The decline of Bitcoin is undoing the previous weeks of gains. Meanwhile, the total crypto market cap is facing its biggest decline since the approval of a spot BTC ETF proved to be a sell-off.

Will bulls come to the rescue, or will it continue to decline?

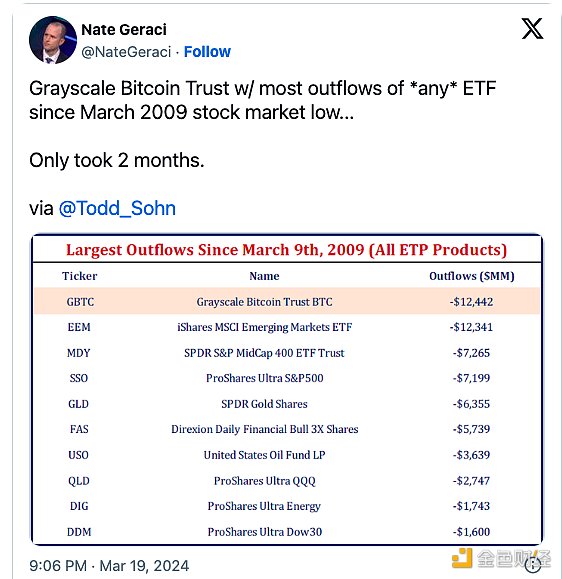

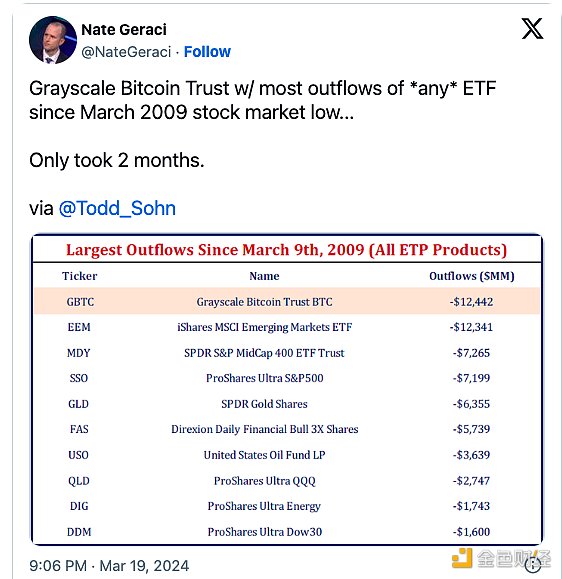

Grayscale Bitcoin Trust (GBTC) ETF outflows accelerated, reaching $642.5 million yesterday, exceeding January 22 The record of US$640.5 million resulted in a net outflow of Bitcoin spot ETFs with a market value of US$154.4 billion.

Yesterday’s performance saw GBTC experience its largest ETF outflow since the stock market hit lows following the global financial crisis in March 2009. Grayscale is now hoping to reverse this bad impression by promising to gradually reduce exorbitant fees.

ETF outflow brings The selling pressure was reflected in crypto prices yesterday, with Bitcoin falling nearly 9% from high to low after U.S. stocks opened on Monday.

With the price drop comes liquidation.

In the past 24 hours, a total of US$635 million in leveraged transactions were forced to be liquidated, 80% of which came from Long, this has allowed funding rates to return to normal across the board and provided a supportive environment for traders seeking new longs.

Despite the decline in Bitcoin prices, Japan’s $1.4 trillion state pension fund (the world’s largest pension fund) announced that it is focusing on Bitcoin to diversify its investment portfolio, This brings new hope for institutional adoption of cryptocurrencies.

The market has shown strong risk appetite, indicating that we We are in a bull market. However, It should be noted that a standard bull correction of 30% would bring BTC down to $51,000, with further downside remaining.

The market has shown strong risk appetite, indicating that we We are in a bull market. However, It should be noted that a standard bull correction of 30% would bring BTC down to $51,000, with further downside remaining.

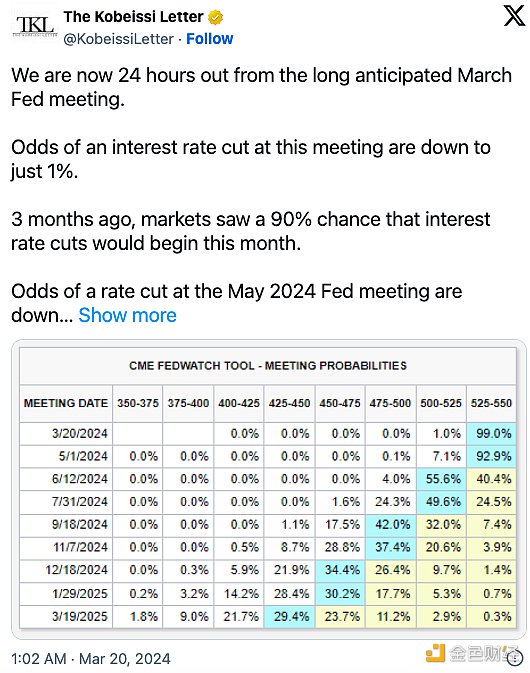

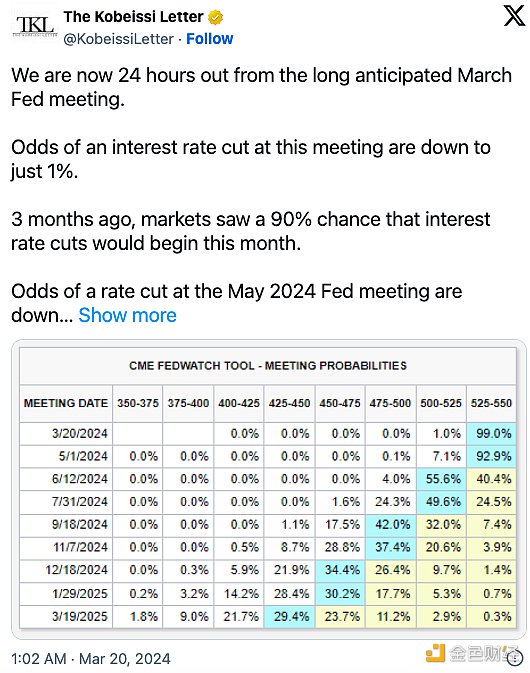

Recent Fed interest rate decisions may be a major catalyst for market volatility, as recent hot inflation data may This will prompt the Federal Open Market Committee (FOMC) to adopt a tougher policy stance than in the past few months. Such a shift would delay market participants' expectations for a rate cut, undoubtedly pouring cold water on the rising risk rhetoric that has continued since October last year.

The probability of a rate cut this month has plummeted to just 1%, in sharp contrast to the 90% probability of a March rate cut expected by the market at the end of last year.

Huang Bo

Huang Bo

The market has shown strong risk appetite, indicating that we We are in a bull market. However,

The market has shown strong risk appetite, indicating that we We are in a bull market. However,