Author: XinGPT; Source: SevenUp DAO

TLDR: Conclusion first: It is theoretically possible, but the actual probability is very small

The leverage ratio is not high, the debt term is long, and there is no obvious debt repayment pressure in the short term

The premise of the financial crisis is: the value of Bitcoin has been at an extremely low level for a long time, and the probability of occurrence is low;

Founder Michael Saylor has 46.8% of the voting rights, which can avoid the early redemption clause in the preferred stock debt and firmly grasp the company's operating direction

I.Micro Strategy's Bitcoin holdings and strategies

MicroStrategy mainly raises funds to buy Bitcoin through four channels:

It is not the main source of funds. MicroStrategy has used no more than 500 million funds to buy Bitcoin.

In order to buy more Bitcoin, MicroStrategy began to use the issuance of convertible bonds to finance the purchase of coins.

Convertible senior notes are a financial instrument that allows investors to convert bonds into company stocks under certain conditions. This type of bond is characterized by a low interest rate, even zero, and a conversion price higher than the current stock price. Investors are willing to buy such bonds mainly because they provide downside protection (i.e., the principal and interest can be recovered when the bonds mature) and potential gains when the stock price rises. The interest rates of several convertible bonds issued by MicroStrategy are mostly between 0% and 0.75%, indicating that investors are actually confident in the rise of MSTR's stock price and hope to earn more income by converting bonds into stocks.

In addition to convertible senior bonds, MicroStrategy has also issued a $489 million senior secured bond with an interest rate of 6.125% due in 2028.

Senior secured bonds are a type of secured bond with lower risk than convertible senior bonds, but this type of bond only has fixed interest income. MicroStrategy has chosen to repay this batch of senior secured bonds in advance.

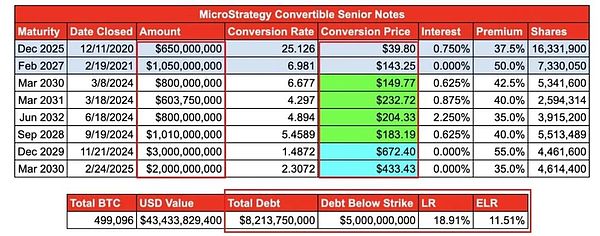

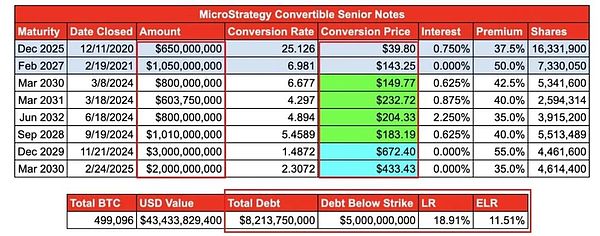

The following figure shows the actual debt situation of MicroStrategy at present:

At-the-Market Equityofferings

MicroStrategy issues additional shares to finance the purchase of Bitcoin, which does not generate debt, but the issuance of shares dilutes the interests of existing shareholders. The reason why existing shareholders agree to this method of additional issuance is that MicroStrategy has proposed a new indicator, BTC Yield, That is, the earnings per share of Bitcoin is the ratio of the Bitcoin holdings to the diluted total share capital. In other words, when the market is rising, the proportion of shares held by users to purchase Bitcoin through additional issuance of stocks will decrease, but the Bitcoin content per share will increase. In general, the amount of Bitcoin held by users may increase.

For example, MicroStrategy's BTC Yield in 2024 is 74%, which means that the number of Bitcoins per share has increased by 74%, while the current BTCYield in 2025 is 6.9%, and the goal is to reach 15% by the end of the year

2.Short-term vs. long-term impact of the decline in Bitcoin prices

1. Short-term impact:

2.Long-term impact:

If Bitcoin enters a long-term bear market, the company may face severe financing pressure. Currently, MicroStrategy's software business is small, with annual revenue of only about US$500 million in 2024, and it is still losing money, so it cannot accumulate a large amount of cash through its own business to cover debts or continue to buy Bitcoin.

The company's current operating model is highly dependent on the capital market. If Bitcoin is in a long-term slump, investors may reduce their financing support for MicroStrategy or require higher financing costs.

If the price of Bitcoin remains below the company's average purchase price of $62,500 per coin for a long time, the book value of MicroStrategy's Bitcoin assets will continue to be lower than the actual cost, which may affect investor confidence and further increase stock price pressure.

Since the company's management highly believes in the long-term value of Bitcoin, even if the financial situation deteriorates, the company is unlikely to actively sell Bitcoin, but will maintain operations through new debt or equity financing. However, if financing is blocked, it may be forced to adjust its strategy.

III.Analysis of key financial data

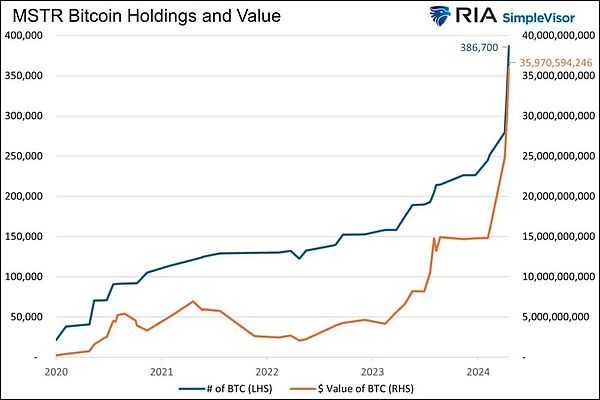

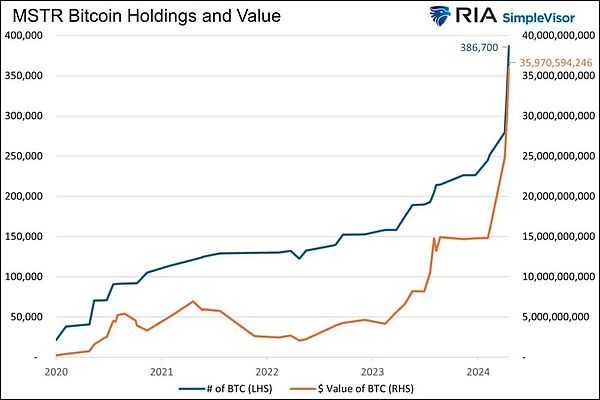

1. Bitcoin holdings and valuation:

As of the end of 2024, MicroStrategy's Bitcoin holdings have a book value of approximately US$23.9 billion (after impairment), but are approximately US$41.79 billion based on market prices.

Due to the accounting standards adopted by the company, if the price of Bitcoin falls below US$30,000, the company will have to make further impairment provisions, which could increase pressure on stock prices.

2.Debt Level:

MicroStrategy's current total debt is approximately $8.2 billion, mainly in the form of convertible bonds, which have low coupons, some of which are even 0%.

Among them: Due in December 2025: $650 million, with a coupon of 0.75%. Due in February 2027: $1.05 billion, with a coupon of 0%. Due in December 2029: $3 billion, with a coupon of 0%.

Since the conversion price of some convertible bonds is lower than the current stock price, these bonds are more likely to be converted into stocks rather than requiring cash repayment, so the short-term debt risk is lower.

However, if the price of Bitcoin continues to be sluggish in the future and MicroStrategy's stock price falls below the conversion price, bondholders may demand cash repayment, which will increase the company's cash flow pressure.

3. Cash flow and liquidity:

In 2024, the company's operating cash flow net outflow of US$53 million, with only US$46.8 million in cash reserves, which means that MicroStrategy has almost no cash buffer.

At the end of 2024, the company raised US$15.1 billion through additional stock issuance, but if the stock price falls, the company's future financing ability may be affected.

In 2025, the company also issued an additional batch of preferred shares with a dividend rate of 10% (previously expected to be 8%), indicating that financing costs have begun to rise.

4. Profitability:

The company's own software business revenue growth stagnated, and software revenue in 2024 fell 3% year-on-year, and the software business only contributed about US$500 million in revenue for the whole year.

The company relies on the book income brought by Bitcoin investment, but due to the impact of impairment rules, the profit fluctuations in the financial report are large, and it is impossible to form a stable profit model.

In the future, if the price of Bitcoin does not continue to rise, the company may be in a state of loss for a long time, further increasing the pressure of financing.

Fourth, Correlation between stock price trend and Bitcoin

In the past few years, the correlation between MicroStrategy's stock price and Bitcoin price has reached 0.7~0.8, almost becoming a Bitcoin leveraged ETF.

At the end of 2024, Bitcoin hit a record high (nearly $100,000), and MicroStrategy's stock price also soared to more than $500. But then Bitcoin pulled back, and the company's stock price plummeted 50% in a short period of time.

Due to the leverage effect of the company's holdings of Bitcoin, MicroStrategy's stock price fluctuations are often greater than Bitcoin itself. For example, Bitcoin fell 40% in early 2025, and MicroStrategy's stock price fell more than 55%.

The current market valuation of MicroStrategy is generally higher than the net value of its Bitcoin holdings, and some investors are willing to pay a premium to indirectly invest in Bitcoin through MSTR. However, if the price of Bitcoin falls, this premium may disappear, or even trade below net value.

V. Possibility of bankruptcy or financial crisis

In the short term, MicroStrategy still has a strong ability to repay its debts, but if Bitcoin enters a long-term bear market, it may cause financial difficulties.

Asset vs. Liability Ratio: The company currently holds $41.79 billion in Bitcoin, which is much higher than its $8.2 billion in debt, and has less pressure to repay debts in the short term. However, if the price of Bitcoin falls to $12,000 to $15,000, the company's Bitcoin assets will be lower than its total debt, and technical bankruptcy may occur at this time.

Debt maturity risk: $650 million of debt in 2025 may be resolved through equity conversion, but more than $4 billion of debt will mature in 2027-2029. If Bitcoin is still at a low level by then, MicroStrategy may find it difficult to refinance through additional stock issuance or new debt issuance and may need to sell Bitcoin to repay debts.

Management position:Michael Saylor controls 46.8% of the voting rights and can prevent the company from selling Bitcoin or changing its strategy. But if the price of Bitcoin falls below a certain critical point, the company may be forced to take emergency measures, including selling some Bitcoin, restructuring debts, and even considering bankruptcy protection.

As shown in the figure below, the convertible bond terms stipulate that if there is a major change in the company, investors can require the company to repay the debt 12-18 months in advance, but the definition of "major change" mainly refers to the company's shareholders deciding to liquidate, and most of the voting rights of the company's shareholders are in the hands of Michael Saylor

Six, Conclusion:

MicroStrategy is still financially stable, but if the price of Bitcoin falls long-term and deeply, its highly leveraged strategy may cause serious financial pressure. The fate of the company completely depends on the future trend of Bitcoin - If Bitcoin is in a long-term slump, MicroStrategy may fall into a debt crisis or even bankruptcy; but if Bitcoin continues to rise, the company will maintain strong growth.

Catherine

Catherine