Author: Pedro M. Negron Source: IntoTheBlock Translation: Shan Ouba, Golden Finance

This week, we explore Bitcoin's growing dominance in the cryptocurrency market. We examine the key factors driving investors' favor for Bitcoin, including the impact of Bitcoin ETFs and market stability. We highlight the challenges facing Ethereum, such as its declining ETH/BTC ratio and low profit margins, while also discussing the rise of stablecoins and their expanding role in the market.

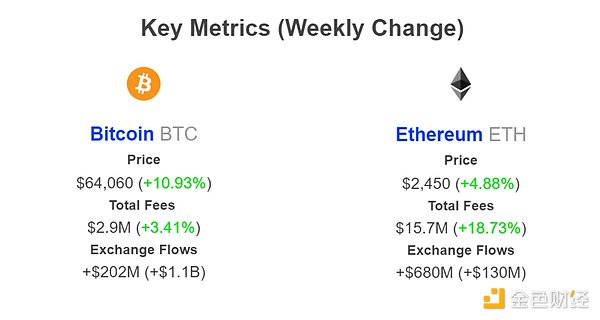

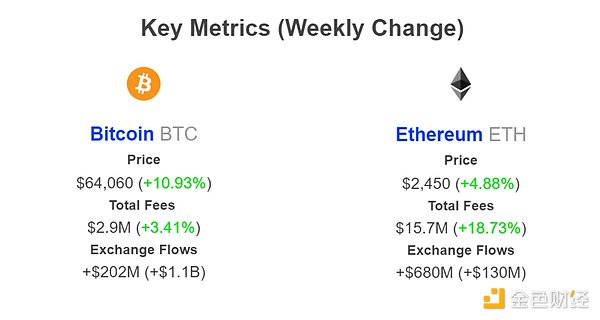

Network Fees - The total sum of fees spent to use a particular blockchain. This tracks the willingness and demand to use Bitcoin or Ethereum

Exchange Net Flows – Net inflows minus outflows of a particular crypto asset into and out of centralized exchanges

Bitcoin Dominance in 2024

Bitcoin is trading near $63,000, up 4.5% in the past 24 hours, following the Fed’s 50 basis point rate cut. Despite the rate cuts, skepticism remains, leading to mixed views on the sustainability of the cryptocurrency rally. ETH continues to underperform, trading at a 40-month low against Bitcoin in 2024. This shift in preference for Bitcoin has been driven by the launch of Bitcoin ETFs, which have seen large inflows, while Ethereum ETFs have seen net outflows. Some traders believe the trend reflects a broader market favoring Bitcoin's stability over Ether's high-risk, high-yield potential.

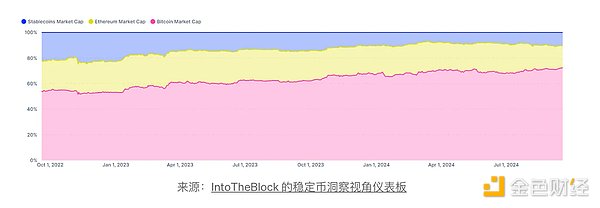

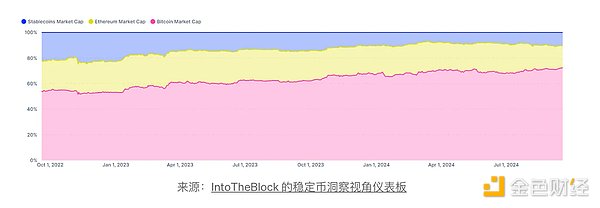

73% market cap dominance - When combined with ETH and stablecoins, BTC's dominance has steadily increased, up 6% so far this year.

The ETH/BTC ratio has fallen below 0.04, its lowest level since April 2021, reflecting that demand for Ether is decreasing as investors shift their preference to Bitcoin.

ETH is up 0.2% from its January 1 level, while Bitcoin is up about 43% in 2024.

In addition, the total market capitalization of stablecoins increased its market share at the expense of Ethereum, growing from 7% to 10% of the total market capitalization of BTC, ETH and stablecoins.

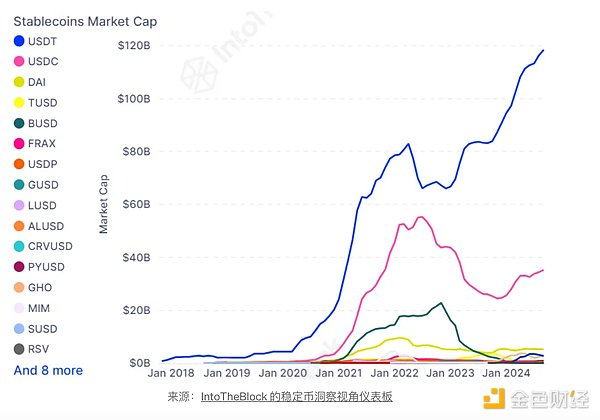

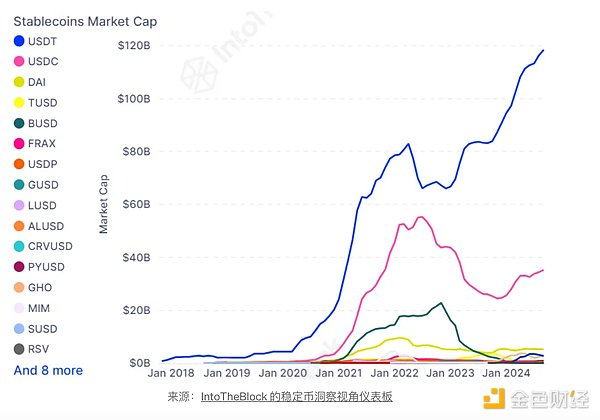

$118 billion - This marks a record high for USDT's market capitalization, which has been the main driving force behind stablecoins taking market share from ETH in the past six months.

After USDT, the market capitalization of the second largest stablecoin USDC has increased from $24 billion to $35 billion so far this year, further driving the overall growth of the stablecoin market capitalization.

Even in the sideways market in recent months, the market value of stablecoins has steadily increased, indicating that investors' confidence in the cryptocurrency space is growing.

As traditional institutions increasingly adopt blockchain technology, stablecoins have become an important bridge between the two worlds.

63% of ETH holders are in profit - the lowest level of profitable holders so far this year.

Although only 63% of addresses are currently in profit, 82% of total ETH trading volume is still in profit. This means that 58.27 million of the 120 million ETH were purchased in the range of $1,900 to $2,350.

In addition, most stablecoins are issued on the Ethereum blockchain, and more than 60% of DeFi assets are locked on the Ethereum blockchain.

Finally, Ethereum is in the lead with the most active developers and the largest user base.

In 2024, Bitcoin continues to maintain its dominance, thanks to the launch of Bitcoin ETFs and investors' preference for Bitcoin stability shifting to Ether. ETH has been struggling, with the ETH/BTC ratio at its lowest level since 2021, and ETH holders have seen a smaller percentage of profits compared to Bitcoin. Meanwhile, stablecoins, led by USDT and USDC, have steadily gained market share, further shaping the changing dynamics of the crypto market.

Xu Lin

Xu Lin