Ethereum has risen very strongly in the recent period. After breaking through 3500U in the past few days, setting a new high since May 2022, it has exceeded 4000U in the past two days, and has increased from 3500U in the past 30 days to a new high in May 2022. Judging from the increase,Ethereum surpassed Bitcoin with an increase of 62%, which was indeed unexpected by many people.

But taking a closer look at the ecological development of Ethereum, from the growing deflation data, to the Cancun upgrade that is about to be launched on the main network smoothly, to the current increase in the amount of pledged and re- pledged ETH, and the subsequent The expected approval of the ETH spot ETF in May is indeed a combination of multiple benefits, and it is reasonable for the ETH price to soar.

So, will these benefits really be realized one by one? What is the current ecological development of Ethereum? Let’s look at the data.

Ethereum deflation situation

Past 532 Daily Bitcoin and Ethereum inflation/deflation data trend chart, source: ultrasound.money

Ethereum starting from January 16, 2023, Officially entering the deflation stage, that is, the amount of newly generated ETH every day is less than the amount of ETH being burned. Specifically, ETH’s current annual deflation rate is 0.239%.

Compared with Bitcoin, the industry leader, the annual inflation rate is 1.716%. Although the total amount is limited, new Bitcoins are continuously produced every day. Therefore, when we say "the total amount of Bitcoin is limited, so every Bitcoin is very precious", it can better highlight the value of ETH in the current deflationary state.

With the vigorous development of the Ethereum ecosystem, the total amount of Ethereum burned continues to increase, which increases the deflation rate of Ethereum, resulting in less and less Ethereum circulating in the market.

The re-staking track is developing rapidly

Not only The increase in the deflation rate of Ethereum has reduced the amount of Ethereum in circulation. With the development of liquidity staking and re-staking on Ethereum, a large amount of Ethereum is locked on the chain, resulting in a further increase in the number of Ethereum in circulation. Drastic reduction.

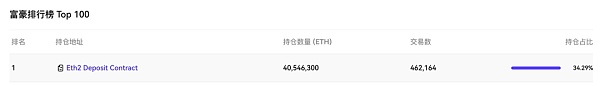

OKLink Ethereum pledge contract related data shows that the current total pledged amount of Ethereum has exceeded 40 million, accounting for more than 34% of the circulating market value of Ethereum, and the total number of validators has exceeded 1.26 million. Although Most validators come here for the appreciation and staking yield of Ethereum, but no matter what, it is a great benefit to the security of the entire Ethereum network.

The number of Ethereum pledge contracts, data source: OKLink

Moreover, according to Stakingrewards related data, as the public chain with the largest amount of pledges, Ethereum’s pledge traffic has been a net inflow in the past seven days, which is significantly compared with the public chains at the bottom. At this stage, Ethereum pledges The appeal to investors is obvious.

A list of the top five public chains by staking market value, data source: stakingrewards

Of course, the recent surge in the amount of Ethereum pledged is inseparable from the development of the restaking track.

Re-staking was first proposed by the founder of Eigenlayer. Its core is to allow ETH that has been pledged on the Ethereum main chain to be pledged again on other protocols, so that other protocols can share the security of Ethereum. , thus reducing the security cost of its chain itself. Investors who participate in re-pledge can not only obtain the income from staking Ethereum, but also the income from re-pledging.

So, re-pledge creates a win-win result for all three parties:

For agreements that use re-pledge Said, While enjoying almost the same level of security as Ethereum, it also reduces security costs, and attracts a large number of ETH holders to enter the ecosystem and participate in its ecological development;

For ETH stakers, not only enjoy the benefits of Ethereum staking and re-staking, but also expect a large number of Airdrops;

In addition, for the Ethereum main chain, the re-pledge mechanism allows its own assets to have more enabling scenarios and stimulates holders to lock ETH to bring greater appreciation. space.

Therefore, the re-staking track led by Eigenlayer has developed rapidly in the past few months, and it has also attracted more and more institutions. Capital enters the game. Take Eigenlayer as an example. In less than two years from May 2022 to now, it has completed four rounds of financing. The latest round of financing was injected by a16z, with a single financing reaching US$100 million. The current four rounds of financing have accumulated Reaching more than 160 million US dollars, as an emerging track, re-pledge has indeed come to the forefront.

Currently, Eigenlayer’s total TVL has exceeded US$11 billion, ranking third among all DeFi projects in TVL after Lido and AAVE. The TVL of projects related to the liquidity re-pledge track has grown significantly, with an increase of more than 10% in the past 7 days.

TVL growth of projects related to the liquidity re-staking track, data source: defillama

The rapid development of the re-pledge agreement and the expectation of ecological Airdrop have stimulated more ETH holders to participate in the pledge and re-pledge of ETH, which can be seen from the rapid growth of the ETH pledge ratio and the TVL of the re-pledge agreement. These have further reduced the amount of ETH in circulation, giving ETH new room for growth.

Cancun Upgrade

Of course, Cancun Upgrade is for For Ethereum, it is naturally a very big positive factor.

For the Ethereum main network, the Cancun upgrade is an important hardware upgrade, which mainly improves the scalability, security and Availability.

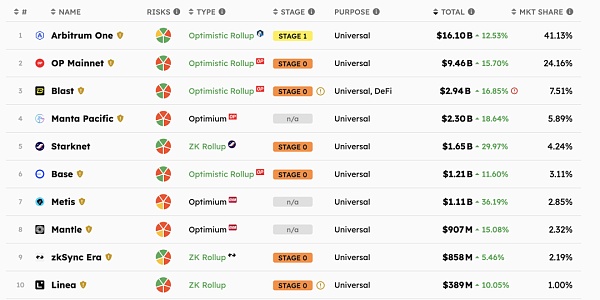

Of course, the biggest perception for users is that after Ethereum undergoes the Cancun upgrade, its Layer 2 fees will It has been reduced a lot. On the current basis, the reduction may reach more than 14 times, which is roughly equivalent to the gas fee level of public chains such as Solana, and will also greatly increase the throughput of Layer 2. This is mainly because the EIP-4844 in the Cancun upgrade has greatly reduced the cost of data on the ETH main chain in the Layer 2 protocol, and promoted the progress of the Ethereum sharding plan.

Overview of the TVL growth of each Layer 2 project on the Ethereum chain, data source: L2BEAT

In addition, another important upgrade in this Cancun upgrade is EIP-4788, which optimizes the exchange of information between the Ethereum consensus layer and the execution layer. This improvement is very beneficial to liquidity. Staking, re-staking tracks and cross-chain bridge related projects have improved their security and operational efficiency.

So, in general, the Cancun upgrade not only greatly reduces the rate of Layer 2 and increases the throughput, but also benefits the Layer 2 on Ethereum. development, it is convenient to attract a large amount of new funds to enter Layer 2 to participate in ecological construction, and it is also a great benefit for the liquidity staking and re-staking track. The success of the Cancun upgrade will bring about another breakthrough in the Ethereum ecology.

Currently, the Cancun upgrade has been successfully deployed on all Ethereum testnets (including Georli, Sepolia and Holesky) and is scheduled to go online on March 13 this year. The mainnet launch date is just around the corner, and the prices of Ethereum and ecological related projects also reflect the expectations of the Cancun upgrade to a certain extent.

The probability of Ethereum spot ETF passing

Since SEC After 10 Bitcoin spot ETFs were approved on January 10 this year, people began to turn their attention to Ethereum spot ETFs.

After all, the approval of the Bitcoin spot ETF is a great benefit to Bitcoin and the Bitcoin ecosystem. The short-term increase in Bitcoin is the best proof.

But will the Ethereum ETF pass as planned?

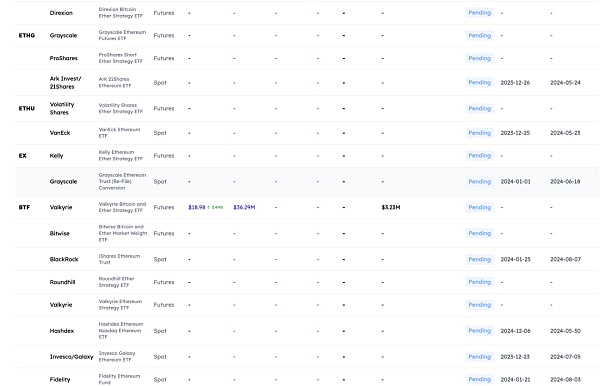

Currently, 7 institutions, including BlackRock, Hashdex, ARK 21Shares, VanEck, etc., have applied for Ethereum spot ETFs. After the SEC has delayed approval several times, it will be approved by May this year at the latest. Decide whether to approve the Ethereum spot ETF application from the relevant institution (see figure below).

Ethereum spot/futures ETF application status tracking chart, source: blockworks

Of course, the key to whether the Ethereum spot ETF passes lies in whether the SEC recognizes Ethereum as a commodity or a security. The current disagreement is that the entire mechanism of Ethereum is very different from Bitcoin. Ethereum does not have a fixed total amount, and holders of Ethereum can stake it in exchange for income.

This has led many people to believe that Ethereum is at risk of being recognized as a security.

However, in the SEC’s case against Ripple in June last year, the SEC listed 67 tokens that were securities, and ETH was not among them. Moreover, the SEC has sued a number of CEXs because they listed some tokens that the SEC recognized as securities, and ETH was not included. In other words, the SEC has not publicly or clearly stated that ETH is a security.

More importantly, the U.S. securities regulator has approved an Ethereum futures ETF last year. This approval implies that ETH is a commodity rather than a security. , so the approval of ETH spot ETF is likely to be a matter of time.

The passage of the ETH spot ETF in the future will surely bring a large amount of funds and resources to Ethereum and the Ethereum ecosystem, just like the Bitcoin spot ETF, and open up the entire ecosystem. development pattern and ceiling.

Summary

If last year was Bitcoin and Bitcoin The currency ecology has occupied the spotlight of the entire crypto industry in a year. Then, the Ethereum ecology in 2024 will definitely write a significant chapter due to the multiple benefits of Cancun upgrade, spot ETF expectations, continued deflation, and soaring number of pledges. .

Is the protagonist of this bull market the inscription and infrastructure of the Bitcoin ecosystem, or the staking and re-staking track of the Ethereum ecosystem? We'll see.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Sanya

Sanya JinseFinance

JinseFinance Beincrypto

Beincrypto 链向资讯

链向资讯 Ftftx

Ftftx Cointelegraph

Cointelegraph