Author: [email protected]; Data source: Public Chain Research - Footprint Analytics

January 2024, with With the launch of the U.S. Bitcoin ETF, the cryptocurrency field has experienced a major breakthrough. Against this backdrop, despite the market enthusiasm, Bitcoin and Ethereum prices have shown significant stability. The development of the public chain field this year is not limited to these two giants. There are also key events such as the Bitcoin halving and the Ethereum Dencun upgrade. At the same time, potential public chain projects such as Sui, Ronin and Manta Pacific have also attracted much attention. .

The data in this report comes from the public chain research page of Footprint Analytics. This page provides an easy-to-use dashboard containing the most critical statistics and indicators for understanding the public chain field, updated in real time.

Key Points Overview

Crypto Market Overview

Public chain overview

Bit The prices of Bitcoin and Ethereum remained relatively stable during the month, while other altcoins performed less well.

At the end of January, the total value locked (TVL) in the public chain field reached US$75.1 billion.

In January 2024, SUI saw significant growth in value, jumping from $0.78 to $1.52, an increase of 94.9%. At the same time, Sui’s DeFi sector has also achieved significant growth, with its TVL reaching more than $500 million.

Layer 2

Manta Pacific’s TVL Achieving a staggering 164.3% growth, it quickly emerged as the third largest Ethereum Layer 2 solution.

Blast’s TVL also experienced significant growth, rising 20.5% from $1.1 billion to $1.4 billion.

Blockchain Games

2024 In January, the average number of active users (number of wallets) in the blockchain gaming sector surged 54.7% compared to the 2023 full-year average.

In terms of transaction volume, BNB Chain, Ronin and Ethereum are at the top, accounting for 32.8%, 15.9% and 15.8% of the total transaction volume of 377 million respectively. .

NFT

In January, Ethereum Leading the NFT market with a trading volume of US$900 million, the market share is 89.1%, but this is the lowest level since 2021.

Polygon saw a significant increase in trading activity in January, with its trading volume reaching $110 million, a 97.2% increase from the previous month.

Investment and Financing Situation

In January, a total of six financing events occurred in the public chain field, raising a total of US$34 million in funds.

Polymer Labs recently successfully raised $23 million in Series A funding.

Key news

Etherscan has supported zkSync Transaction inquiry and other services.

Solana’s monthly trading volume reached its highest level in the past year or two.

On-chain data shows that the Starknet network has supported the use of STRK to pay gas fees.

Klaytn, a Korean public chain project, and Finschia, a subsidiary of LINE, jointly proposed an on-chain merger.

Crypto Market Overview

January 2024 marks a pivotal moment for the crypto market with the debut of U.S. spot Bitcoin ETFs, which are as high as The daily trading volume of $210 million quickly captured the attention of investors and reflects the deeper integration of cryptocurrencies into the traditional financial ecosystem. Despite the heightened excitement, Bitcoin and Ethereum prices have remained relatively stable, suggesting traders remain cautious following the ETF approval.

At the same time, the focus of the broader crypto market has turned to exploring synergies between the crypto industry and AI. In addition, against the background of the Federal Reserve's decision to maintain interest rate stability, the market value of stablecoins has steadily increased.

The crypto space is undergoing a subtle evolution, both in terms of institutional adoption through the approval of a Bitcoin ETF and in balancing considerations with continued expectations for macroeconomic and technological developments.

Public chain overview

By the end of January, the total market value of public chain cryptocurrencies reached US$1.32 trillion, among which mainstream public chains such as Bitcoin, Ethereum, BNB chain and Solana Occupying a dominant position, the market shares accounted for 63.3%, 20.8%, 3.5% and 3.1% respectively.

Data source: Public chain token market value share - Footprint Analytics

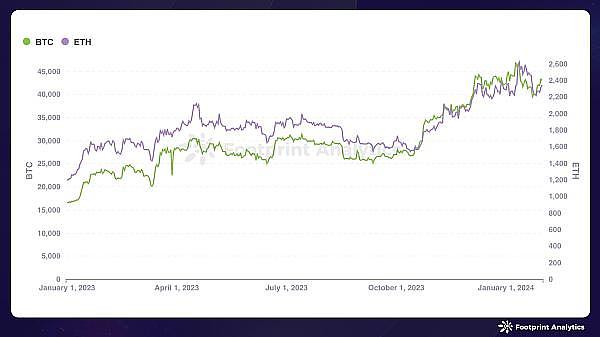

Bitcoin and Ethereum continued to grow in January, albeit at a slower pace. Bitcoin edged up 1.65%, starting the month at $42,303 and ending at $43,001. Ethereum, on the other hand, rose 2.77%, from $2,283 to $2,346. January became the highest price month for Bitcoin and Ethereum since 2023 as the U.S. launched a spot Bitcoin ETF.

Data source: Bitcoin and Ethereum currency prices - Footprint Analytics

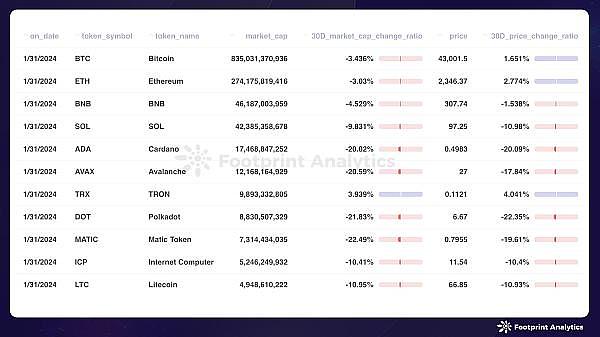

Bitcoin and Ethereum prices remained relatively stable during the month, while other coins underperformed. Among the top ten cryptocurrencies by market capitalization, TRX was an exception, with its price rising by 4.0%, while tokens such as BNB, SOL, ADA, and AVAX all saw prices fall in January. Cryptocurrency prices previously experienced a surge in December, driven by expectations of the adoption of a Bitcoin ETF, but the market subsequently pulled back.

Data source: Public chain token price and market value - Footprint Analytics

End of January , the total value locked (TVL) in the public chain field reached US$75.1 billion. Among them, Ethereum leads with a market share of 73.2% and a TVL of $54.9 billion. Tron and BNB chains followed, accounting for 10.0% and 4.46% of the market respectively, corresponding to TVL of US$7.5 billion and US$3.4 billion.

Data source: Public chain TVL- Footprint Analytics

October 2023, Sui A $50 million incentive program was launched to attract developers by providing financial incentives (grants) and set user rewards to attract investors. This strategy has significantly boosted DeFi activity within the Sui ecosystem. As a result, in January 2024, SUI saw a significant increase in value, jumping from $0.78 to $1.52, an increase of 94.9%. At the same time, Sui’s DeFi sector has also achieved significant growth, with its TVL reaching more than $500 million.

Layer 2

Arbitrum’s TVL achieved a 10.3% growth in one month, jumping from US$8.5 billion to US$9.3 billion, further consolidating its lead in the Layer 2 market status. At the same time, Manta Pacific’s TVL also achieved a staggering 164.3% growth, quickly emerging as the third largest Ethereum Layer 2 solution. Blast’s TVL, on the other hand, also experienced significant growth, increasing by 20.5% from $1.1 billion to $1.4 billion. It is worth mentioning that Linea’s TVL achieved a 41.8% growth, from US$180 million to US$250 million.

In contrast, Optimism’s TVL fell from $5.4 billion to $4.7 billion, a decrease of 13.1%. Base also underperformed, falling 6.7%, while zkSync Era also saw its TVL slip by 10.8%.

Data source: Layer 2 Overview - Footprint Analytics

(Note: The " TVL" refers to the cumulative amount stored and locked in Layer 2 smart contracts.)

Layer 2 solutions are committed to diversified development to cope with competition and challenges within the blockchain ecosystem.

Manta Network’s successful New Paradigm event significantly boosted the growth of its online events. The network then further strengthened this momentum by airdropping 50 million MANTA, giving strong impetus to Manta Pacific TVL’s meteoric growth. This achievement is particularly notable considering that its mainnet will only be officially launched in September 2023.

On January 17, Blast announced the launch of its testnet and simultaneously launched a developer competition called "Blast BIG BANG" to encourage more dApps to log on to its platform. . In addition, Blast also announced an airdrop distribution plan to distribute shares to dApp developers and users who participate in token staking. Despite recent controversies about its "use of manipulative marketing tactics to raise over $1 billion" and "alleged plagiarism of Optimism code", Blast's TVL has still achieved rapid growth.

On the other hand, Starknet has established a partnership with Celestia to jointly improve the data availability of Layer 3 application chains. The two parties will use Celestia's core component "Blobstream" to build a data availability layer to achieve secure storage of off-chain data and provide verifiable proof of existence to ensure data integrity and reliability.

Blockchain Games

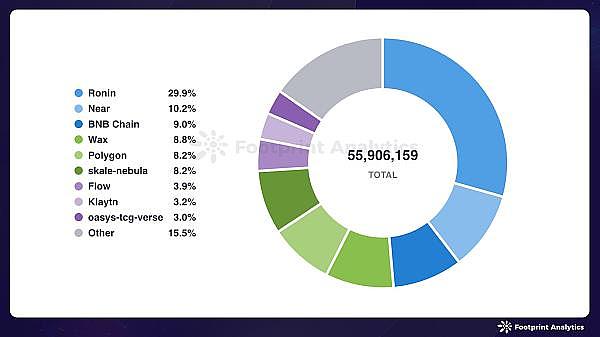

In January 2024, according to Footprint Analytics, the average number of active users (number of wallets) in the blockchain game field surged compared to the full-year average in 2023 increased by 54.7%, and the growth trend will begin to appear from November 2023. Ronin, Near and BNB chains have become the blockchain platforms with the largest number of active users, accounting for 29.9%, 10.2% and 9% of the total respectively.

Data source: Active Gamers Shared by Chain - Footprint Analytics

In terms of transaction volume In terms of one indicator, BNB Chain, Ronin and Ethereum are at the top, accounting for 32.8%, 15.9% and 15.8% of the total transaction volume of 377 million respectively.

In January, Ronin’s trading volume and number of active users increased dramatically, with trading volume soaring by 213.41% compared to December. This growth is driven by continued improvements to the platform and the expansion of its ecosystem. Ronin’s game wallet has added support for mainstream blockchains such as Ethereum, Polygon and BNB chains. This month, it also activated the platform’s activities through airdrops of projects such as Pixels and Apeiron.

You can read the Blockchain Game Monthly Report from Footprint Analytics to get more data insights: "Web3 Game Industry Overview in January: The Market Achieves Unprecedented Growth".

NFT

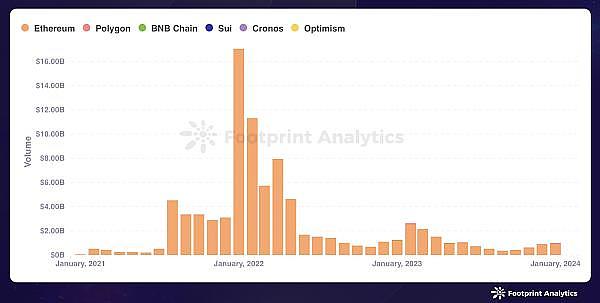

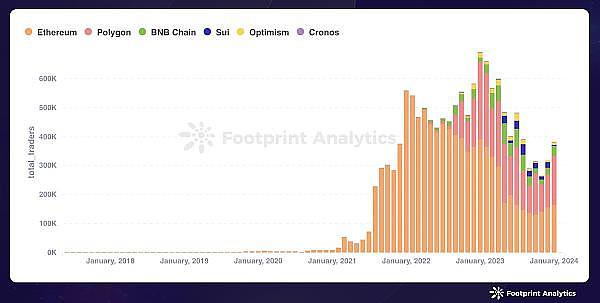

In January, Ethereum led the NFT market with $900 million in trading volume and a market share of 89.1%, but this is its lowest level since 2021. Conversely, Polygon saw a significant increase in trading activity in January, with its trading volume reaching $110 million, a 97.2% increase from the previous month. The significant growth boosted Polygon's market share to 10.4%, nearly double December's 6.0% share.

Data source: Monthly Volume by Chain - Footprint Analytics

Unique users of Ethereum The number continued to grow, reaching 163,000, an increase of 4.9% from December, but its proportion of total users dropped from 49.0% to 42.7%. In contrast, Polygon’s user base has grown significantly, from 50.5% to 170,000, and its share has also increased from 35.5% to 44.5%, successfully sitting on the largest user base in January. Meanwhile, BNB’s user share increased slightly, from 7.5% to 8.6%.

Data source: Monthly Unique Users by Chain - Footprint Analytics

More about 1 For interpretation of the monthly NFT industry, you can read the NFT monthly report from Footprint Analytics: "January NFT Market Trends: Polygon Growth, Mooar Rise, and TinFun Set off a Cultural Wave."

Investment and Financing Situation

In January, a total of six financing events occurred in the public chain field, raising a total of US$34 million in funds. The financing amounts of three other events have not been disclosed.

Financing situation in the public chain field in November 2024

Polymer Labs recently successfully raised The $23 million Series A round was co-led by Blockchain Capital, Maven 11 Capital and Distributed Global. Polymer Labs plans to use the funds to further improve security and interoperability within the Ethereum ecosystem by focusing on the Ethereum Layer 2 network through the use of the Inter-Chain Communication Protocol (IBC).

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian JinseFinance

JinseFinance JinseFinance

JinseFinance Beincrypto

Beincrypto Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph