Recently, the Bitcoin spot ETF that the market has been waiting for for several years has finally been approved. Domestic and foreign media have used the terms "milestone", "recorded in history", and "big official announcement" " and other eye-catching words to describe the sensational nature of this incident, However, the crypto market after learning about it performed mediocrely, and even began to decline two days later. This left many people confused. The Bitcoin ETF passed Is it a positive or a negative? What are the material impacts in the short and long term? Today, let’s analyze one by one the changes you need to know after the adoption of Bitcoin ETF...

Spot ETF: Don’t be too high Don’t underestimate its impact

The market is always affected by the emotions of funds, and all directions are based on overwhelming consensus. . When an event occurs, people tend to overestimate its short-term impact and underestimate its long-term impact, or misjudgment due to information asymmetry. So, rationally look at the impact of spot ETFs from multiple angles.

1) When the good things come true, only the bad things remain? Not necessarily

In the past, there was always a popular saying that "good things will come true" and only bad things will happen. The passage of the Bitcoin spot ETF is a long-awaited big good thing. In fact, in general Generally speaking, most of the expectations have indeed been released before they are implemented, which can also be seen from the strong trend of Bitcoin in the past year.

But if the realization of good things is bad, it is not necessarily true. In addition to short-term profit-taking and callbacks, we have actually seen that the trading volume data of approximately US$4.6 billion on the first day of the opening of spot ETFs is quite impressive compared to various newly opened ETFs. In line with the traditional The expectation of new capital inflows from financial channels has formed a strong new buying order over time.

2) The crypto market has one more indicator

The Bitcoin spot ETF actually has a very similar reference, which is the gold ETF.With the world’s largest Take the gold ETF "SPDR Gold Trust" as an example. Because it has a relatively large share of holdings, whether it increases or decreases its holdings of gold is usually used as a data basis to judge the trend of gold prices, which has a strong indicator.

Judging from GBTC’s hundreds of thousands of BTC holdings in the past, it is expected that the Bitcoin spot ETF will only increase but not decrease, and will gradually become like the gold ETF, with daily position adjustments becoming one of the major indicators of the crypto market. , affecting the direction of the crypto market,The following historical rules of the impact of gold ETF holdings on gold prices have reference significance:

Transactions As trading volume increases, ETF gold holdings decrease and the price rises, it indicates that the price may fall soon;

As trading volume increases, ETF gold holdings and prices fall, the price may Turned to rebound;

Trading volume, ETF gold positions increased, and prices rose, suggesting that prices may continue to rise;

Trading volume, ETF gold holdings increase, prices fall, and prices may fall in the short term;

Trading volume, ETF gold holdings Decrease, the price falls, and the price may continue to fall in the short term;

Trading volume, ETF gold holdings decrease, and the price rises, indicating that the price will rise in the short term and may soon Falling back;

Similarly, when the Bitcoin spot ETF holdings reach a certain share, it will have a similar impact on the encryption market.

3) Pay attention to grayscale GBTC to ETF

Among the 11 approved spot ETFs, most of them are When it first entered the market, it was in a net-buying state, and Grayscale’s GBTC is definitely a counterexample, because in the past, Grayscale GBTC Trust has been at a negative premium for a long time, with more than 600,000 holdings. Some investors held it back for a long time and went through a bear market. It is understandable that many people choose to take profits, so we will see short-term capital outflows from GBTC, and the amount is not small.

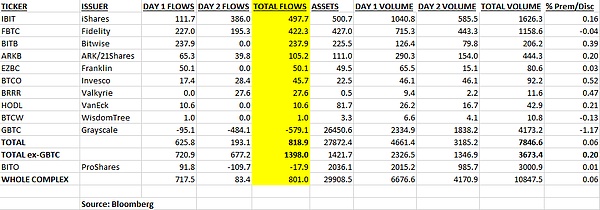

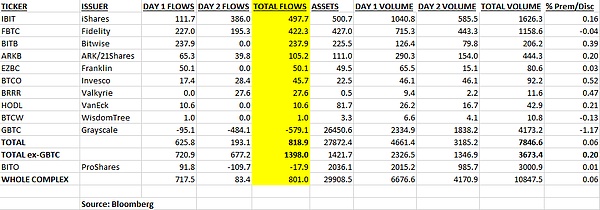

But for now, thankfully, the inflow of other spot ETFs far exceeds the outflow of "anti-bone boy" GBTC, Bloomberg ETF analyst Eric Balchunas said in X The platform issued a statement stating that in the two days since the Bitcoin spot ETF was listed, nine issuers have absorbed US$1.4 billion in funds, exceeding GBTC’s outflow of US$579 million, with a total net inflow of US$819 million.

Translation: Nine Newborns has attracted $1.4 billion in new funds so far, far exceeding GBTC’s $579 million outflow, with net inflows reaching $819 million. Currently, IBIT leads the pack with $5 billion, with Fidelity not far behind. Xinsheng’s trading volume reached $3.6 billion across 500,000 individual trades (total trading volume including GBTC was 1.2 million), an impressive performance with an average premium of 20 basis points.

4) Bitcoin has since become centralized, controlled by Wall Street and hijacked by ETFs?

Some people are opposed to it Spot ETF believes that although it has promoted Bitcoin from an alternative asset to a mainstream asset, it has also weakened the decentralized nature of Bitcoinbecause the huge inflow of traditional capital brought by ETF will dominate the Bitcoin market in the future. , its pricing power is controlled by Wall Street.

The author believes that this concern is reasonable, but it may be that the capacity of spot ETFs is overestimated. Because compared with the billions of trading volumes and positions worth hundreds of millions of spot ETFs, the daily trading volume of Bitcoin on mainstream crypto asset trading platforms is as high as 10 to 20 billion, and the main battlefield for Bitcoin trading is still on the platform. Most of the new funds currently entering through ETFs are not familiar with the characteristics of Bitcoin and are worried about compliance and other reasons, so they do not enter directly from the trading platform. With the approval of ETF, the platform will also be subject to closer monitoring, and the compliance and stability of the Bitcoin trading market will be better guaranteed.

Currently, the funds of spot ETFs are managed by centralized platforms, which are also managed by centralized platforms. Why not just choose an encryption platform with no management fees, lower costs, and more flexible management? Therefore, after some new funds become familiar with the characteristics of crypto assets such as Bitcoin, they are likely to switch and disperse to compliant and regulated crypto asset platforms in various countries around the world. In this way, it is difficult for spot ETFs to actually form an overwhelming Advantages. When these funds are further advanced, you can even get a freer asset management and value-added experience through DeFi.

Of course, the U.S. stock free market itself is a gaming field. Small-volume stocks are often manipulated, but the larger the volume, the harder it is to control at will. Compared with the traditional financial market with strict supervision, the crypto market used to be completely three-dimensional. No matter, under the law of the jungle, it is easier to influence the market by various means without worrying about supervision. Now that there is strict tracking by the SEC, it is much more regulated.

As for the so-called "rich people taking over Bitcoin" in the future, this is not something we can change, but this does not affect the continued operation of Bitcoin in accordance with its original openness and transparency principles, because only in this way, the rich themselves Only then can interests be protected.

There is no absolute decentralization in this world. The word "decentralization" does not appear in the Bitcoin white paper. It is people who add it later. The understanding of "decentralization" is different. Its original meaning is decentralization, sufficient decentralization, anti-fragility, transparency, and a financial system that does not allow centralized power to do evil behind the scenes.

In fact, this is true even for gold that has strong physical properties and is physically decentralized. The main mining of gold relies on concentrated gold mines, and mining rights are often only in the hands of a few institutions. However, due to sufficient global holdings Gold ETFs that are dispersed and have huge holdings have a very limited impact on gold prices. Moreover, gold ETF positions often lag behind the market reaction. In other words, the market is affected by major events such as macroeconomics, which leads to gold prices. After the ups and downs, gold ETFs are sold or bought in large quantities, and positions are adjusted after the market closes that day.

So rather than saying that ETFs affect the market, it is better to say that the market affects ETFs, and ETFs follow the market.

5) The impact of ETFs on the Bitcoin ecosystem

The approval of spot ETFs will undoubtedly give a "reassurance" to the crypto industry, including the Bitcoin ecosystem. Bitcoin assets may become more stable and less volatile in the future.

To put it simply, in the past when there were great fluctuations, the development of ecological projects in bear markets often encountered obstacles. Entrepreneurs and users lacked confidence and tightened their belts. There were problems such as a significant reduction in the amount of financing and a loss of talent.

As a native asset of the Bitcoin ecosystem, the steadily rising price of Bitcoin is beneficial to ecological development and avoids the impact on ecological development under extreme market conditions.

In general, the approval of spot ETFs can give the Bitcoin ecosystem more confidence to develop and gain more recognition.

Next step, will the market focus turn to Ethereum spot ETF?

1) Ethereum ETF expectations

Regarding the sudden rise in Ethereum prices before and after the adoption of the Bitcoin ETF, many people explained that funds began to focus on the next Ethereum spot ETF that has applied for approval and is about to be approved. This includes funds that have already taken profits. As well as those who have not caught up with the expected market prices of this round of Bitcoin ETFs, they hope that the expected market prices brought by the Ethereum ETF can "eat meat".

This type of strategy is very common. When an asset is positive, short-term similar assets are expected to rise immediately. So how long can the Ethereum ETF be expected to last? BlackRock’s application for an Ethereum ETF will receive a response in May at the latest. Will it be delayed like Bitcoin?

Based on the current attitude of the U.S. SEC towards crypto-assets such as Ethereum, it currently treats Ethereum as a vague area between commodities and securities. That is to say, it is neither accurately positioned as a commodity like Bitcoin, nor is it completely concluded that Ethereum is a security. Previously, the SEC had almost made it clear that Ethereum was not a security, but this was mainly due to new changes caused by Ethereum switching from the POW consensus mechanism to the POS consensus mechanism.

In addition, for the Ethereum ETF to pass, it needs to be less susceptible to the control of certain institutions like Bitcoin, and the conditions are relatively strict. The reason why the Bitcoin ETF can pass is that the share of the world’s number one trading platform has declined, and the other is that there are too many institutions (capital) applying for ETFs. If it fails to pass, it may lead to lawsuits.

In general, the good thing about the Ethereum ETF is that there are still a few months left. This period of time is enough for Ethereum to gain market attention. There is no need to worry too early about failure or delay. Negative impact, but the probability of passing may not be high.

The main variable is whether the US SEC has more sufficient understanding and confidence in the POS version of Ethereum, and whether the external pressure from the application of large financial institutions driven by the interest of various investors is in place.This again depends on whether the Bitcoin spot ETF can operate stably. If the crypto market trend is good and brings strong interest from global investors, capital, driven by interests, will be happy to promote the adoption of the Ethereum spot ETF.

2) Ethereum’s mid- to long-term expectations are not ETFs

In fact, compared with the short-term focus on whether the Ethereum spot ETF can pass, Ethereum is more worthy of attention because of its series of upgrades including the latest major upgrade "Cancun". Ethereum is still the largest in the crypto industry An application ecological infrastructure. Compared with the Bitcoin ecosystem, the Ethereum ecosystem has come a long way. It has better infrastructure and better deployment solutions. Now Layer 2 has been successfully implemented and stably adopted, and Layer 3 will also be launched one after another., in general, the Ethereum ecosystem has actually begun to prepare the basis for deploying large-scale applications in various tracks. Large-scale applications are also likely to be one of the main foundations for the arrival of the next big market.

There is a difference between Ethereum and Bitcoin. The most important attribute of Bitcoin is the concept of "data gold" as an asset, so ETF is very important to it, while Ethereum comes from the value empowerment of innovative applications. In the medium and long term, Ethereum’s expectations mainly come from its innovation. After the Cancun upgrade, there will be more important innovative upgrades on the way. Therefore, instead of focusing on the Ethereum ETF, we can actually Pay more attention to its subsequent technological innovation and upgrades.

Summary

After the adoption of the Bitcoin ETF, it is not The end of a good thing is the beginning of a milestone. It has brought many changes and impacts, and we should treat it rationally. Both the Bitcoin ecosystem and the Ethereum ecosystem are one of the main narratives of the future encryption industry. What is certain is that in 2024, we will see the growth of crypto assets accelerate at a speed visible to the naked eye.

JinseFinance

JinseFinance