At present, the biggest downtrend in this cycle has not yet been fully digested by the market, so investors in the digital asset market are still on the sidelines. But under the surface of the downturn, the decision to hold coins for the long term and continue to increase holdings seems to be returning significantly.

Summary

After several months of heavy distribution pressure, the behavior of Bitcoin holders has begun to turn to long-term holding and continued holdings.

The activity in the spot market shows that the market has clearly turned to net sellers recently, and this trend is still continuing.

Compared with the situation after the Bitcoin price broke through the historical peak in the past cycle, the proportion of assets held by long-term holders in the entire network is relatively large.

Overall, on-chain indicators suggest that the Bitcoin holder community remains confident.

Investors Return to Holding

Although the market has begun to slowly recover from last week's sell-off, digital asset investors remain generally hesitant. Even so, when analyzing investor reactions to these turbulent market conditions, we can still see that the trend of holding firmly is beginning to rise among the investor community.

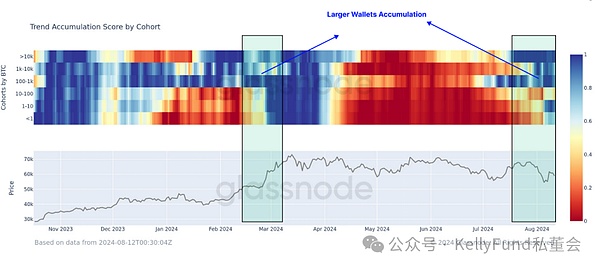

Since Bitcoin's price hit an all-time high in March, the market has experienced a period of broad supply distribution, with wallets of all sizes participating. However, in the past few weeks, this trend has begun to reverse, which is particularly evident among large wallets associated with ETFs. We have noticed that these large wallets appear to be starting to accumulate again.

Figure 1: Bitcoin asset accumulation of different investor groups

The cumulative trend score (ATS) indicator evaluates the weighted changes in the entire market. Currently, it shows that the dominant behavior in the market is becoming a firm hold on Bitcoin and continues to increase holdings.

This shift has caused ATS to reach a new high of 1.0 recently, indicating that investors have continued to increase their holdings of Bitcoin over the past month.

Figure 2: Bitcoin holding trend score

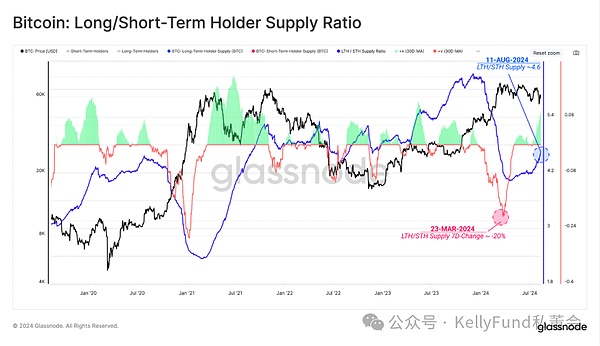

This trend is particularly evident among long-term holders - they sold a lot before the price hit a record high, but as the market cooled, their investment strategy turned back to long-term static holding. In the past three months, a total of 374,000 bitcoins have been put into static holding.

From this, we can infer that for investors, holding has become a more mainstream trading strategy than continuing to sell.

Figure 3: Long-term holders' supply

We can evaluate the 7-day change in the long-term holders' supply and use it as a tool to evaluate the rate of change of their total balance.

From this, we can see that the influence from long-term holders is significant, which is a typical feature of the market's macro peak. Since the coin price broke through the historical peak in March, the market has encountered greater distribution pressure in less than 1.7% of trading days. Recently, this indicator has returned to positive territory, indicating that long-term holders have begun to firmly continue to hold Bitcoin<span yes'; mso-bidi- font-size:10.5000pt;mso-font-kerning:1.0000pt;">.

Figure 4: Long/Short Holder Supply Ratio

Active Investor Cost Basis This indicator refers to the average transaction price of active Bitcoin in the market, and the spot price has been above this indicator since April to July this year.

Active Investor Cost Basis is a broad indicator of whether investors are bullish or bearish. At present, the market has successfully found support near this level, which shows that the market still has potential, and investors are also generally optimistic about the market direction in the short to medium term.

Figure 5: Found Price-Market Vitality Ratio

Assessing Spot Market Price Bias

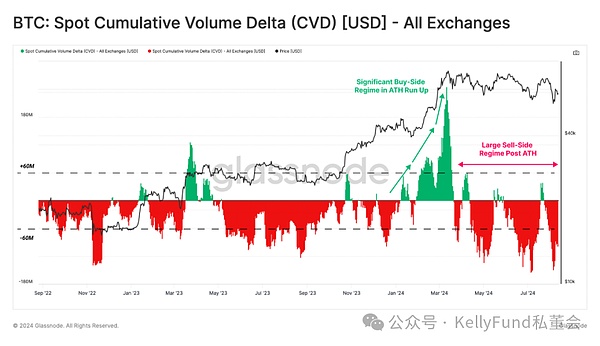

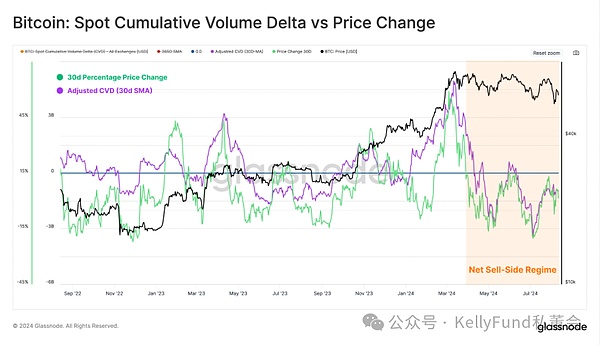

When the market is in a technical downtrend, we can use the CVD indicator to assess whether the current spot market buying/selling pressure is balanced.

This indicator can also be used to assess the market trend in the middle of the cycle and determine whether the price is currently in a tailwind or headwind state. Since the recent high of Bitcoin price, we have found that the market has been on the net selling side.

A positive CVD value indicates that the market is on the net buying side, while a negative value indicates that it is on the net selling side.

When we analyze the annual median of spot CVD, we can see that in the past two years, this indicator has fluctuated between -22 million US dollars and -50 million US dollars, indicating that the market is clearly biased towards net sellers.

Figure 7: CVD vs Price Change

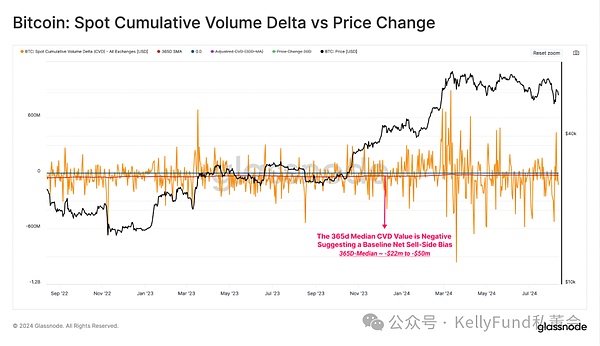

If we consider this long-standing median as a baseline for CVD equilibrium, we can generate an adjusted indicator to correct for the statistical bias that may be caused by this long-term seller's market.

If we compare the adjusted spot CVD (30-day simple moving average) with the monthly price change percentage, we will find that the two indicators can confirm each other to a certain extent.

From this perspective, the recent failure of Bitcoin price to break out of the $70,000 range can be partly attributed to weak spot demand (adjusted CVD value is negative). We believe that the real signal of spot market demand recovery will come when the adjusted CVD indicator turns positive

Figure 8: Adjusted CVD (30-day simple moving average) vs. price changes

Tracking market cycles

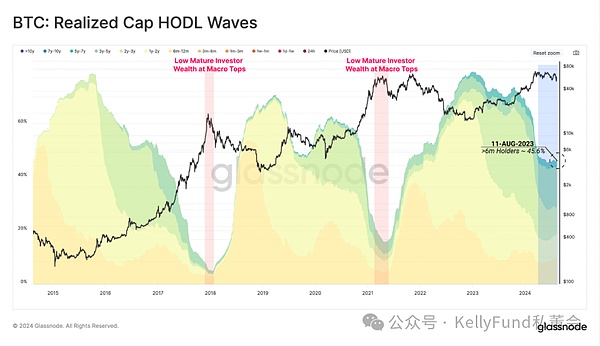

As price fluctuations have been largely sideways in recent months, the pressure on long-term holders to allocate has slowed significantly. This has caused the percentage of network assets they hold to stagnate, and then, only recently, to start growing again.

Despite the huge selling pressure they exerted on the market after Bitcoin prices hit new highs, the assets held by long-term investors are still at a historically high level compared to the previous historical highs when the price of the currency was at an all-time high.

This suggests that long-term holders may continue to sell Bitcoin to seek profit if the price of Bitcoin appreciates in the future. But at the same time, since the price trend has been weak recently and even fell overall, they tend to continue to hold their Bitcoin and wait for appreciation.

Despite the unsatisfactory market conditions, both observations show that the long-term holder group is more resilient and patient in the face of headwinds.

Figure 9: Long-term static band

Finally, we can see that the long-term holder's seller risk ratio also supports our assertion. We use this indicator to measure the sum of the absolute value of realized profits and losses locked in by investors, relative to the size of assets (only calculated realized market value). We can think of it in the following framework:

High values of this metric represent when investors sell their Bitcoins at a profit or loss relative to their cost basis. This situation indicates that the market is in urgent need of re-balancing, and it usually occurs after a sharp price movement.

Low values of this metric represent when investors sell their coins at a breakeven point. This situation usually indicates that the "breakeven potential" within the current price range has been exhausted, which means that the current market is basically stagnant.

Compared to previous price breakthroughs to all-time highs, the seller risk ratio of long-term holders is still at a lower level at present. This means that the profit margins made by their group are relatively small compared to previous market cycles. In other words, they are still waiting for prices to rise before they take action and make a lot of money.

Figure 10: Sell-side risk ratio of long-term holders

Summary

Despite the turbulent and challenging market environment, the confidence of long-term holders remains unwavering, and they continue to seize opportunities to increase their holdings of Bitcoin.

Compared with the situation at the high point of the previous cycle, the proportion of Bitcoin they hold is higher, which shows that they are waiting for higher prices with amazing patience. In addition, when the price plummeted during the cycle, they did not panic sell Bitcoin, which fully demonstrates that they are still optimistic and firm in their belief in the future of Bitcoin.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Kikyo

Kikyo Olive

Olive Coinlive

Coinlive  Coinlive

Coinlive  Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist