By Wilbur Fernandes, Translated by Shaw Jinse Finance

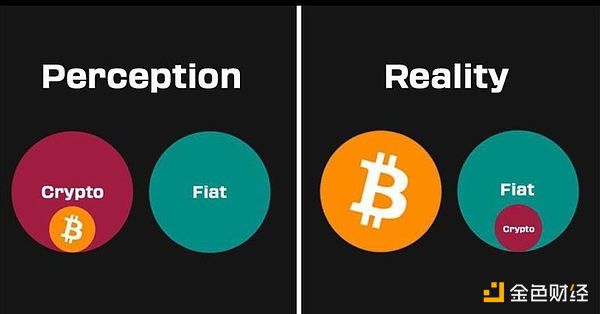

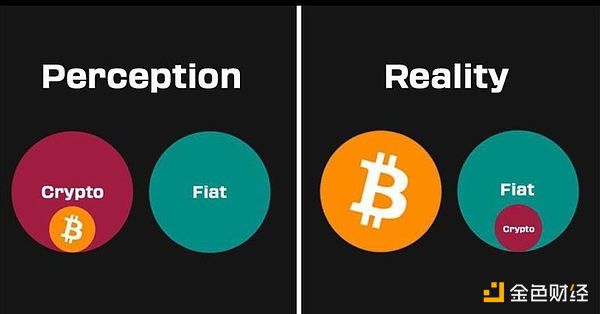

Take a look at the image above. It reveals something that completely changed my perspective on money, investing, and the future. For a long time, I thought Bitcoin was just another "cryptocurrency"—like the thousands you see listed on apps like Coinbase or Binance. Boy, was I wrong.

When you're first getting started, no one tells you this: Bitcoin and "cryptocurrency" are not the same thing. In fact, they're completely opposite. It took me way too long to figure this out, and I really wish someone had explained it to me sooner. So let me explain it in simple, easy-to-understand terms. The Biggest Lie in Finance Right Now When most people hear the word "cryptocurrency," they tend to lump it all together. Bitcoin, Ethereum, Dogecoin, Shiba Inucoin—they all seem like different variations of the same digital currency, right? And that's exactly what the cryptocurrency industry wants you to think. But here's the truth: Bitcoin is trying to replace our existing, flawed monetary system. Everything else? They're just companies trying to profit from our existing, flawed system. Think of it this way. Imagine our existing financial system is a leaky boat. Most cryptocurrency projects are like trying to sell you a better bucket for scooping water, a fancier pump, or more expensive boat decorations. And Bitcoin? Bitcoin is building you a brand new, watertight ship. Why almost everything called "cryptocurrency" is just a wolf in sheep's clothing Let me tell you something that shocked me when I first learned about it. With the exception of Bitcoin, almost all major cryptocurrencies operate exactly like regular companies. They have CEOs, marketing teams, headquarters, and boards of directors who decide where your investment goes. Take Ethereum, for example. It's run by the Ethereum Foundation, whose founder, Vitalik Buterin, regularly announces Ethereum's direction. When they switched from one system to another (from proof-of-work to proof-of-stake), it wasn't because users voted—it was because Ethereum's leadership decided it was best for business. The same is true of Cardano, led by founder Charles Hoskinson. Solana is run by the Solana Foundation. These aren't decentralized networks; they're tech companies that issue tokens instead of stock certificates. This is why so many people lose money in cryptocurrency "scams." When you buy these tokens, you're actually buying shares in a company that has no legal obligation to do anything for you. The founders can make decisions that benefit them, change the direction of the business, or even abandon the project altogether. Remember when Facebook changed its name to Meta? Imagine if Mark Zuckerberg decided to completely pivot and your Facebook shares became worthless. This situation is actually very common with cryptocurrency projects. What does "decentralization" really mean (most cryptocurrencies aren't)? Here's another question that has puzzled me for a long time. Every cryptocurrency project claims to be "decentralized," but what does that really mean? Most cryptocurrency companies believe that decentralization means storing copies of the database on partners' computers, rather than just their own. It's like a group of friends leaving copies of the club rules at each other's houses and calling it "decentralized" because no one has a single copy. But that's not true decentralization; it's just a company with a good backup system. True decentralization means anyone in the world can participate, without anyone's permission. With Bitcoin, you can download the software and start participating in the network instantly, and no one can stop you. You don't need approval from the foundation, you don't need to meet wealth requirements, and you don't need anyone's permission. Like most other cryptocurrencies? Good luck. To validate transactions on Ethereum, you need about $50,000 to $100,000 worth of ETH. That directly excludes 99% of the world's population. Those who can participate are mostly institutions and wealthy individuals—the same people who control our current financial system. Bitcoin: A True and Meaningful Rebel Bitcoin is different. Very different. When someone using the name Satoshi Nakamoto created Bitcoin, they weren't trying to start a company or get rich. They were trying to solve a millennia-old problem: How do you create a currency that's not controlled or manipulated by governments and banks? Here's what makes Bitcoin special: Fixed Supply: There will always be only 21 million Bitcoins. No company can print more Bitcoins to keep operating. No government can issue more Bitcoins to pay its bills. No CEO can dilute your Bitcoin by issuing more. It's mathematically impossible. Accessibility: You can secure the Bitcoin network with hardware cheaper than a smartphone. You can send Bitcoin to anyone in the world without permission from any bank or government. You can store Bitcoin without trusting any company.

No One in Control: Bitcoin has no CEO, no corporate headquarters, and no board of directors. Its founder vanished more than a decade ago, leaving Bitcoin to run on its own. Making changes to Bitcoin requires global user consent—a process so difficult that Bitcoin has remained remarkably stable for over 14 years.

Practically Secure: Bitcoin uses a mechanism called "proof-of-work," which means the network's security is guaranteed by computers solving mathematical problems that consume actual electricity. This isn't just clever programming; it's physics. To attack Bitcoin, you'd need to consume more electricity than you'd gain from the attack.

Why Bitcoin Consumes So Much Energy (and Why That's Actually Beneficial)

You may have heard that Bitcoin "wastes" a lot of energy. I used to think so, too, until someone explained what that energy actually does. Bitcoin doesn't consume energy to speed up payments. It uses energy to create absolute truth in the digital world. Every 10 minutes, computers around the world compete to write the next page in Bitcoin's history. The winner must prove they completed a massive computational effort, and once they do, that page becomes permanent and unchangeable. This is a revolution. For the first time in human history, we have a way to create digital records that cannot be altered, deleted, or manipulated by any authority. When you receive Bitcoin, you can be 100% certain that those coins are real and that the transaction can never be reversed. Compare this to other cryptocurrencies, where a small group of wealthy validators could coordinate to alter transaction records. Or compare it to your bank account, where the bank can freeze your funds, reverse transactions, or even close your account entirely.

Bitcoin's energy consumption isn't wasteful; it's the cost of building the most secure and trustworthy monetary system ever created.

The Scaling Problem: Why Slow and Steady Wins

Another criticism you'll hear about Bitcoin is that it's "slow." Bitcoin processes about seven transactions per second, while newer cryptocurrencies claim to be able to handle thousands.

But here's the thing—Bitcoin's base layer is designed like the foundation of a house. The foundation needs to be strong, not fast. Every Bitcoin transaction is final, like transferring gold bars between bank vaults. It's supposed to be secure and permanent, not fast and convenient.

For everyday transactions, Bitcoin has solutions like the Lightning Network, which enables instant Bitcoin payments. It's like having a solid foundation (the Bitcoin mainnet) with a fast and convenient room built on top (the Lightning Network). Other cryptocurrencies have tried to make their infrastructure faster, but this always comes with trade-offs. Solana can process thousands of transactions per second, but its network has crashed multiple times—something Bitcoin has never experienced. Would you rather have a rock-solid infrastructure that requires you to build extra floors for convenience, or a faster infrastructure that could completely collapse? Why Governments Treat Bitcoin Differently Here's an interesting phenomenon that helps me understand the difference between Bitcoin and other cryptocurrencies: look at how governments around the world regulate them. Most crypto projects are regulated like corporations because they are corporations. The U.S. Securities and Exchange Commission (SEC) could take action against the Ethereum Foundation, subpoena Cardano executives, or shut down Solana's development team. These projects have offices, employees, and decision-makers, and they can be held accountable.

Bitcoin? There's no Bitcoin company to regulate. There's no CEO to arrest. There's no headquarters to shut down.Bitcoin is just software running on computers around the world, just like email or the internet itself.

That's why even regulators skeptical of Bitcoin acknowledge it's unique. They call it "digital gold" or a "commodity," not a security issued by a company. Some countries have even made Bitcoin legal tender, something they would never do with a cryptocurrency company's tokens.

The Problem Bitcoin Really Solves (and Why It Matters)

The more I learn about Bitcoin, the more I realize it's not trying to be a better payment app or a faster way to transfer money.

Bitcoin is trying to solve the problem of money itself.

Think about it—when we step back and look at our current monetary system, it's pretty weird. Governments can print money without limit, which devalues your savings over time. Banks can freeze your account, reverse your transactions, or prevent you from sending money to certain people or places. Financial institutions can exclude entire groups from the banking system. For most of human history, people used currencies that were not controlled by authorities—such as gold, silver, or other scarce commodities. But these physical currencies had limitations. They were difficult to transport, indivisible, and easily stolen. Bitcoin combines the best qualities of traditional currency (scarcity and independence from authority) with the advantages of digital technology (instant global transfers and perfect divisibility). It's like owning digital gold that can be sent instantly to anyone in the world. Network Effects: Why Bitcoin Keeps Winning As I delved deeper into this space, I discovered something. Even though thousands of alternative cryptocurrencies are created every year, Bitcoin continues to grow. It has the most users, the strongest security, the widest acceptance, and the most real-world applications. Historically, this makes sense. People tend to choose the best form of money at the time. Gold reigned supreme for thousands of years not because governments forced it to, but because it simply outperformed other currencies. In the digital world, Bitcoin follows the same pattern. Even as new cryptocurrency projects claim to be faster, cheaper, or more advanced, people choose Bitcoin for long-term savings and real monetary utility. When large institutions, governments, and corporations get involved in the cryptocurrency space, their focus ultimately turns to Bitcoin. They may trade other tokens for speculation, but when it comes to storing significant wealth digitally, they choose Bitcoin. Making the Right Choice for Your Future Understanding all this has completely changed my perspective. I no longer view cryptocurrency as a get-rich-quick scheme or a way to trade the latest hot coin. I've come to understand that Bitcoin may be the most important monetary innovation in hundreds of years. The cryptocurrency industry has spent billions on marketing, partnerships, and hype, trying to convince people that their tokens represent the future. But the future of money lies not in complexity, fancy features, or the latest technological innovations, but in returning to the sound monetary principles that have proven effective for thousands of years, improved upon with the help of modern technology. Every penny you spend chasing the latest cryptocurrency trend is a penny you could have spent acquiring what may be the best form of money the world has ever seen. Every hour you spend researching which altcoin to buy next is an hour you could have spent understanding the monetary revolution taking place. I'm not trying to preach or convince you, but simply sharing my thoughts because I wish someone had explained these concepts to me when I first started. Understanding the difference between Bitcoin and cryptocurrencies has completely changed my financial strategy and given me more confidence in my decisions.

The image at the top of this article represents a choice we all have to make. We can accept the notion that everything digital and monetized is essentially the same, or we can take the time to understand what's actually happening in the world of money and technology.

Whatever you decide, make sure you're making an informed choice, not following the herd or believing marketing hype. Your financial future may depend on it.

Hui Xin

Hui Xin