Author: Alexander Osipovich

Why did Bitcoin hit a record high this week? Fans of the world's largest cryptocurrency say it's down to the traditional laws of supply and demand.

Like the price of any commodity - whether it's gold, oil or soybeans, the price of Bitcoin is very sensitive to fluctuations in demand. After the launch of a U.S. ETF that directly holds the digital currency, the spot Bitcoin ETF, in January this year, demand for Bitcoin surged.

Since then, investors have poured billions of dollars into these ETFs. The above inflows prompted these funds to purchase Bitcoin to meet related demand, thereby pushing the price trend higher.

But Bitcoin differs from other commodities in that its supply is tightly constrained, a dynamic that could lead to significant price spikes.

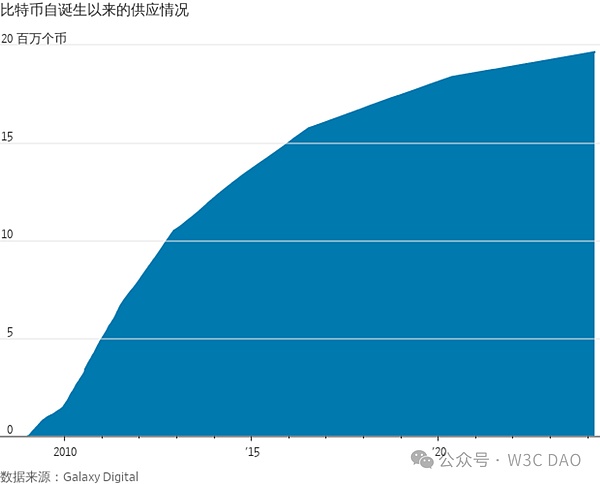

The computer code that underpins Bitcoin imposes a hard upper limit of 21 million Bitcoins. More than 90% of this supply has already been mined. To expand the supply, number-crunching computers run algorithms to "mine" new coins.

But only about 900 new Bitcoins are mined every day, a rate expected to increase after next month's cyclical event known as the "halving" will drop. Around 2140, when the last Bitcoin is mined, its supply will eventually stop growing.

Alex Thorn, director of research at Galaxy Digital, said: "Bitcoin is one of the scarcest assets in the world, and it is becoming increasingly scarce."

No one can guarantee that Bitcoin will continue to rise. The current high price may encourage holders to sell their Bitcoins and lock in profits. Previous Bitcoin bull markets have been followed by devastating plunges: After the last peak in November 2021, Bitcoin fell by more than 70% in the following year.

Sceptics, including government officials and Wall Street executives who have stayed on the sidelines during the rally, still believe Bitcoin is a speculative asset , has no intrinsic value.

In economic terms, Bitcoin's supply is extremely inelastic, meaning it does not respond to price changes. Commodities with this characteristic are prone to sudden and large price shocks. For example, natural gas producers cannot significantly increase natural gas production in the short term to take advantage of high prices.

But in the long term, continued rise in natural gas prices will encourage drillers to explore new sources of natural gas. Likewise, when gold prices remain high for long periods of time, gold miners can launch costly new mining projects to search for gold in more remote locations.

This is not the case with Bitcoin. Rules in the Bitcoin code limit the rate at which miners can introduce new coins to the market, and this rate is periodically halved.

In the past, Bitcoin's price would climb ahead of such a "halving" as cryptocurrency investors expected tighter supply. The creator of Bitcoin, who goes by the pseudonym Satoshi Nakamoto, proposed the idea that Bitcoin should have a fixed maximum supply, writing that such a design would keep the value of Bitcoin from being affected by inflation.

Steven Lubka, head of private client services at investment firm Swan Bitcoin, said: "Fundamentally, Bitcoin does not have the ability to bring additional supply to the market."< /p>

This makes Bitcoin very sensitive to increases in demand, and the new Bitcoin ETF has been buying Bitcoin aggressively since its launch on January 11.

On that day, nine new spot Bitcoin ETFs were listed for trading for the first time, and an existing fund, Grayscale Bitcoin Trust, was also converted into an ETF. Since then, net inflows into these ETFs have reached nearly $8 billion, with inflows into the nine new funds exceeding Grayscale’s outflows.

According to investment research firm ByteTree, as of Tuesday, global Bitcoin holdings in ETFs or other investment funds accounted for 30% of the total global supply. 5%, up from 4.4% when the new U.S. ETF began trading on January 11.

When ETFs buy new Bitcoin to meet investor demand, they often rely on proprietary trading firms such as Cumberland, a unit of Chicago-based trading giant DRW Holdings Or Jane Street Capital in New York. The crypto-trading arms of these companies scour the digital currency market for large amounts of Bitcoin to satisfy the fund’s buying orders.

Billions of dollars are expected to flow into the market as the U.S. Securities and Exchange Commission approves exchange-traded funds that invest directly in Bitcoin for the first time.

Some analysts say it has become increasingly difficult to obtain Bitcoin from investors who hold large amounts of it. Public blockchain data shows that most of the world’s supply of approximately 19.6 million Bitcoins is held in digital wallets, which rarely touch these Bitcoins, possibly because they are long-term Bitcoins that refuse to be sold. Coin holders may also be unable to obtain their Bitcoins because they have lost their passwords.

Manuel Villegas, an analyst at Swiss private bank Julius Baer, said in a research note last week thatIn the past six At mid-month, approximately 80% of the Bitcoin supply was not changing hands. That, combined with ETF inflows and data showing exchanges have limited Bitcoin inventory available for sale, “could exacerbate supply constraints,” Villegas wrote.

There are also people saying that there are a large number of sellers willing to sell Bitcoin when it rebounds, which may be the reason why Bitcoin briefly breaks through the 2021 record this week One reason why momentum stalled later.

Rob Strebel, director of relationship management at DRW, said that Cumberland is looking for Bitcoin to meet the demand for Bitcoin from ETFs amid heavy inflows into ETFs in recent weeks. No difficulties were encountered. He saidthe company received large amounts of Bitcoin from large cryptocurrency investors who bought the currency when its price was low and took the opportunity to take profits.

"When you see a market going parabolic, like Bitcoin, it's a natural opportunity to sell," Strebel explain. "Especially when people recall the last bull market in 2021, it takes some chips off the table."

JinseFinance

JinseFinance

JinseFinance

JinseFinance Coinlive

Coinlive  Beincrypto

Beincrypto Beincrypto

Beincrypto Bitcoinist

Bitcoinist Nulltx

Nulltx Nulltx

Nulltx Nulltx

Nulltx Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph