Author: James Van Straten, CoinDesk; Translator: Baishui, Golden Finance

Summary

While pure miners continue to gain market share, investors continue to pay a premium for miners that are moving into artificial intelligence and high-performance computing data centers.

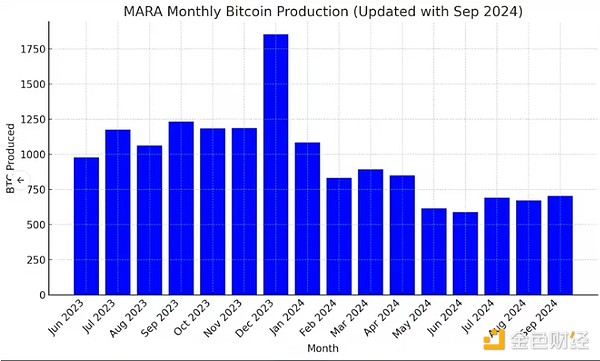

Marathon, Riot and CleanSpark all produced more bitcoin in September than in August.

Marathon produced more bitcoin in September than in any other month since the halving in April.

In an era of razor-thin margins, Bitcoin (BTC) miners are facing the strangest existential threat: They can pivot to power artificial intelligence (AI) or high-performance computing (HPC) and watch their stocks soar, or they can stick around and dominate their old turf but see share prices languish.

Anyway, that was the story of mining in September, in terms of stock returns.

The largest miners by market cap — MARA Holdings (MARA), Riot Platforms (RIOT), and CleanSpark (CLSK) — all mined more total bitcoin last month compared to August. These companies have stronger balance sheets and larger mining operations, which helped them weather the drop in mining profitability caused by April’s Bitcoin halving.

And yet, investors aren’t paying a premium for their shares as they continue to underperform in September. Meanwhile, miners focused on AI and HPC computing, such as Core Scientific (CORZ), TerraWulf (WULF), and IREN (IREN), beat Bitcoin in September.

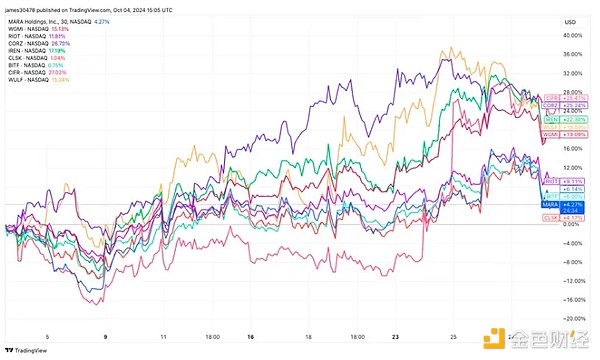

Bitcoin Miner Stock Prices in September (TradingView)

The shift in investor sentiment is not surprising, as April’s halving, which reduced BTC mining rewards by 50%, made mining more competitive and less profitable. Adding to the negative sentiment, the U.S. recently approved a spot Bitcoin exchange-traded fund (ETF), which has reduced investor interest in mining stocks.

Instead, investors are rewarding miners who are now using part of their data centers to host AI and HPC-related machines to diversify their revenue. AI and HPC calculations require a lot of electricity, which Bitcoin miners already have access to, making them an attractive resource for AI and HPC companies looking to grow their businesses quickly.

In fact, looking at the share prices of listed miners in September, the larger market capitalization miners have seen share prices rise between 4% and 9%. Miners related to AI and HPC have risen as much as 25% this month. Bitcoin’s price is up about 7%, while the CoinDesk 20, a broad cryptocurrency market benchmark, is up about 12%.

Despite relatively flat trading for bitcoin, miners have also surged in October. Riot is up 12%, and Cipher Mining (CIFR) is up 8%. Historically, October is also one of bitcoin’s strongest months, earning it the nickname “Uptober.”

September Wrap-up

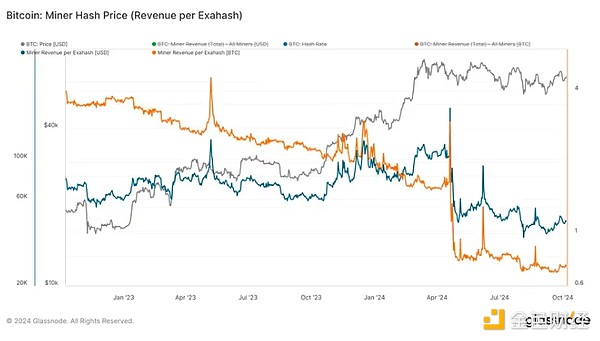

Mining economics are tough after the halving.

The bitcoin network’s hash rate, measured on a seven-day moving average, rose to a new all-time high of 693 EH/s, while maintaining an average hash rate of 630 EH/s. Hash rate is an indicator of mining competition, measuring how much computing power is online on the network.

September also saw bitcoin difficulty, a measure of how hard it is to mine new blocks on the network, hit a new all-time high. Bitcoin difficulty is a measure of how hard it is to mine new blocks on the network, and it adjusts every 2,016 blocks based on computing power, ensuring that blocks are mined consistently every 10 minutes. Meanwhile, hashrate, a measure of miner profitability, hit a one-month high of $48.0/hour/second, according to Glassnode, although it remains near all-time lows.

Diving deeper into the monthly data for individual miners, MARA (market cap $4.8 billion, the largest publicly traded miner, formerly known as Marathon Digital) appears to have had a successful September, increasing its powered-on hashrate by 5% to 36.9 EH/s in September. MARA also mined 705 BTC, up 5% from the previous month and the most mined in a single month since the halving in April. The company also increased its BTC holdings to 26,842, the second-largest Bitcoin reserve among publicly traded companies, behind only MicroStrategy. Meanwhile, it remains on track to reach 50 EH/s by the end of 2024.

Marathon Monthly Bitcoin Production (Farside Investors)

The third-largest miner by market value, Riot Platforms, also increased its Bitcoin mining output by 28% in September as the company increased the computing power of its facilities. Riot expects its hashrate to reach 36.3 EH/s by the fourth quarter of 2024 and 56.6 EH/s by the second half of 2025. Riot currently holds 10,427 BTC on its balance sheet.

Hurricane Helene shuts down some infrastructure

Other notable trends in September include the impact of Hurricane Helene. CleanSpark, the fourth largest miner by market cap, was one of the companies affected. The company said it did not suffer any major damage to its infrastructure but had to shut down some operations due to the hurricane.

As the capital markets for Bitcoin miners have been tough, these companies have started using creative ways to raise funds to expand their operations. One of the companies, Cipher Mining, stood out in September, mining 155 Bitcoins that month and selling 923 Bitcoins to buy a 300MW mining site that will be used for HPC hosting. The miner now owns 1,512 Bitcoins.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Catherine

Catherine Davin

Davin Kikyo

Kikyo Hui Xin

Hui Xin Joy

Joy Aaron

Aaron Jasper

Jasper Clement

Clement Clement

Clement