Source: Bitcoin Magazine; Compiled by Wuzhu, Golden Finance

At a time when Bitcoin and the global economy are shrouded in a vortex of pessimism and macroeconomic uncertainty, it may be surprising that miners remain so optimistic. This article will analyze some data that shows that Bitcoin miners are not only sticking to their original strategies, but also accelerating their development, doubling down on their bets at a time when many miners are retreating. What information do they know that the broader market may be ignoring?

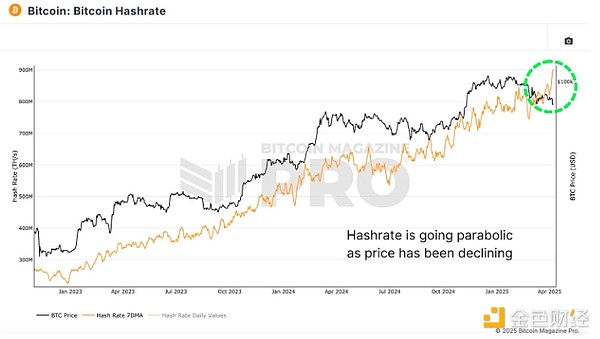

Bitcoin hash rate rises parabolically

Despite Bitcoin's recent price performance, Bitcoin's hash rate has soared to all-time highs, seemingly unaffected by macroeconomic headwinds or low prices. Typically, the hash rate is closely correlated with Bitcoin's price; when the price drops sharply or stagnates, the hash rate tends to level off or decline due to the economic pressures faced by miners.

However, Today, in the face of rising global tariffs, a slowing economy, and a consolidating Bitcoin price, the hash rate is accelerating. Historically, divergences of this magnitude between hash rate and price are extremely rare and often quite significant.

Figure 1: There is a significant divergence between hash rate and price at the moment.

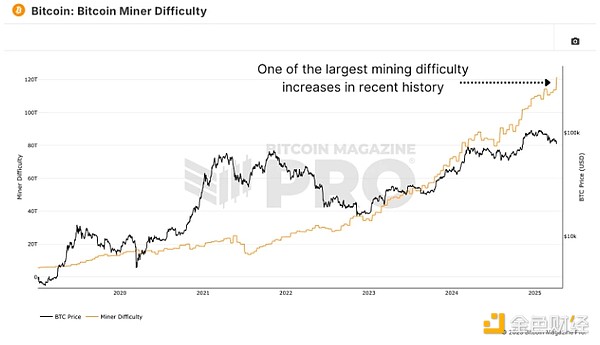

Bitcoin miner difficulty (which is closely correlated to hash rate) just experienced one of the largest single increases in history. The metric automatically adjusts to keep Bitcoin's block times consistent, and only increases when more hashrate is added to the network. A difficulty spike of this magnitude, especially in the context of poor price performance, is virtually unprecedented.

This is yet another sign that miners are investing heavily in infrastructure and resources even when Bitcoin prices don't appear to be supporting their decisions in the short term.

Figure 2: The recent spike in mining difficulty.

Of more interest, the Hash Ribbons Indicator — an indicator that blends short-term and long-term hash rate moving averages — recently flashed a classic Bitcoin buy signal.

When the 30-day moving average (blue line) recrosses the 60-day moving average (purple line), it signals the end of miner capitulation and the beginning of a renewed rise in miner power. Visually, when this crossover occurs, the background of the chart changes from red to white. This typically marks a strong inflection point for BTC price. Figure 3: Mining machine prices have strengthened again recently, triggering a buy signal. What is striking this time is that the 30-day moving average has deviated sharply from the 60-day moving average. This is not just a mild recovery, but also a reflection of mining companies betting big on the future.

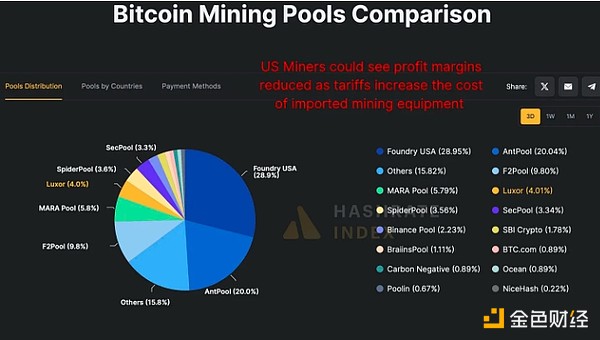

Tariff Factors

So what is fueling this mining frenzy? One plausible explanation is that miners, especially American miners, are trying to get ahead of the upcoming tariffs. As a major producer of mining machines, Bitmain is now at the center of trade policy, and equipment prices may soar by 30% to 50%, or even more than 100%!

Figure 4: Bitcoin hash rate distribution among various mining pools.

Given that more than 40% of Bitcoin hash rate is controlled by US mining pools such as Foundry USA, Mara Pool and Luxor, any cost increase will significantly reduce profit margins. Miners may be actively expanding capacity now because hardware is still (relatively) cheap and available.

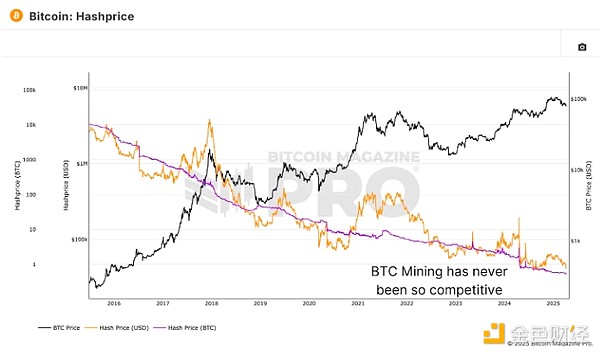

Bitcoin Miners Keep Mining

Hash prices (revenue per terahertz of hashing power denominated in BTC) are at historical lows. In other words, the revenue per terahertz of hashing power to operate a Bitcoin mining machine has never been so low in BTC terms. Typically, we usually see hash prices rise at the end of a bear market as competition tapers off and weaker players exit the market.

Figure 5: Miners’ profitability per terahertz of hashing power continues to decline.

But that didn’t happen. Despite poor profitability, miners are not only continuing to operate, they are also deploying more hashrate. This could mean one of two things: either miners are competing against declining profit margins to accumulate Bitcoin in advance, or, more optimistically, they are confident in Bitcoin’s future profitability and are actively buying on dips.

Conclusion

So, what exactly is going on? Either miners are desperately trying to get a head start on hardware costs, or, more likely, they are sending one of the strongest signals of collective confidence in Bitcoin’s future in recent years. We will continue to track these indicators in future updates to see if this confidence from miners proves to be correct.

Miyuki

Miyuki

Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Alex

Alex Miyuki

Miyuki