2023 will definitely be a saving grace for Bitcoin miners.

It provides a necessary second chance for an industry weakened by the 2022 downturn, but as 2024 approaches, miners are beginning to face another A huge challenge, the fourth halving. Bitcoin’s fourth halving will reduce Bitcoin’s block subsidy from 6.25 BTC to 3.125 BTC, which means miners’ income will be reduced by 50%.

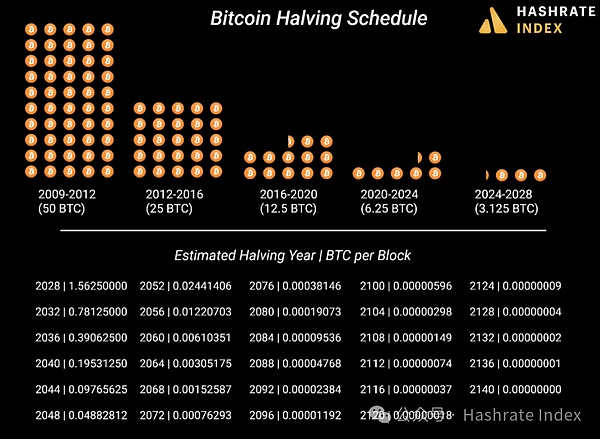

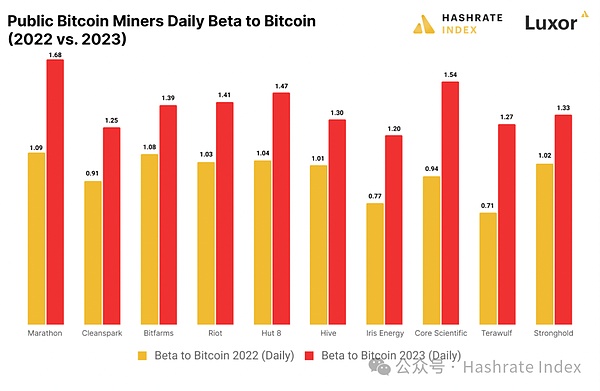

Figure 1: Bitcoin halving events over the years

Compared with past events Like the halving, the Bitcoin halving in 2024 will undoubtedly leave an indelible mark on the current Bitcoin mining market.

Although the third halving (2020-2024) is not a direct trigger, it will be accompanied by China’s Bitcoin mining ban in 2021 and The ensuing large-scale migration of computing power has created conditions for the formation of a mining market that is completely different from the second halving period (2016-2020).

We believe that the fourth halving will bring greater changes and may be accompanied by the redistribution of Bitcoin computing power to new geographical areas. For 2024 and the next few years, we (roughly) predict the following:

A more globalized distribution of Bitcoin computing power< /p>

North America’s computing power dominance will weaken. During the second halving period, China dominated the Bitcoin network’s computing power share, accounting for 70-90% of the total computing power at its peak. After China imposed a ban on Bitcoin mining, this balance of power shifted to North America, with the United States and Canada together accounting for about 50% of the world's hash power share (fluctuating left and right) from the summer of 2021 until now.

North America's share of global hash power share is expected to have peaked and will gradually decrease after the halving in April 2024, as miners Margins will be squeezed, they will continue to search for cheaper power, and there will be significant growth opportunities in South America, Africa and other untapped regions.

The retail hosting services industry will take a major hit

In In North America (and elsewhere), the retail custodial services industry is headed for a downturn as lower mining profits squeeze both custodians and customers.

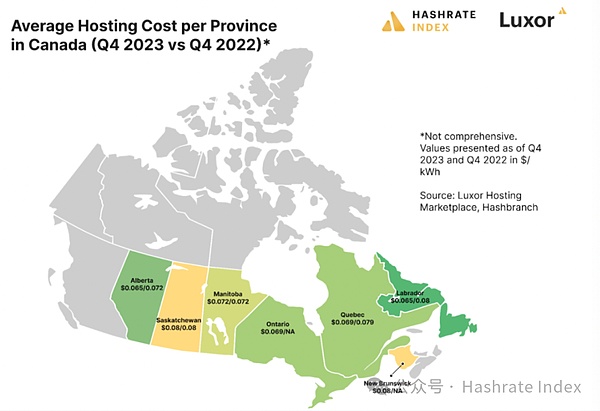

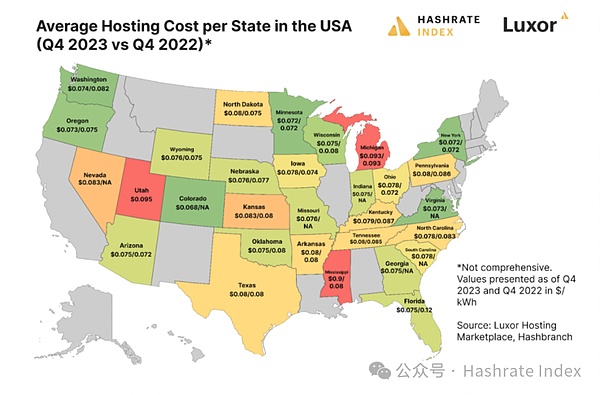

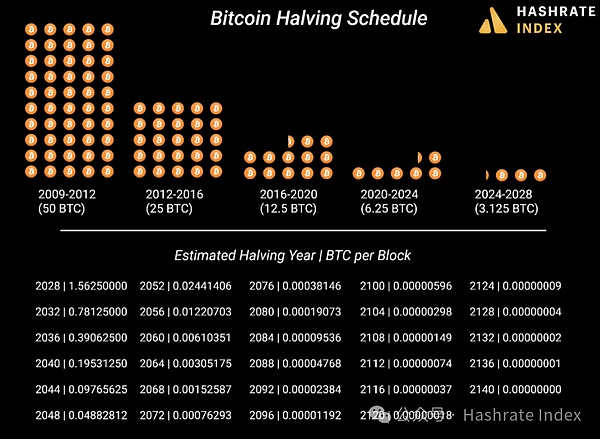

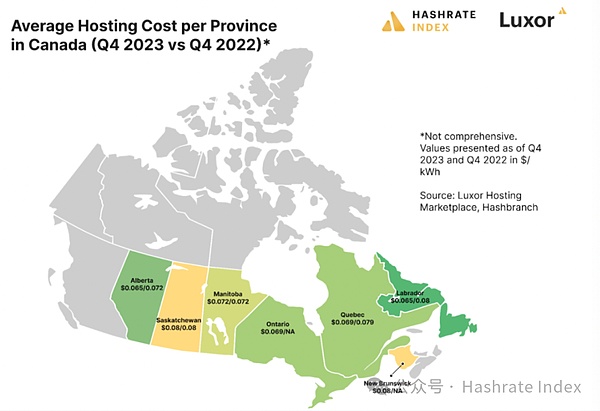

The average all-inclusive hosting fee will be $0.078/kWh in the United States and $0.072/kWh in Canada in 2023; by the fourth quarter of 2023, the average All-inclusive rates are $0.078/kWh and $0.071/kWh respectively.

Figure 2: Average hosting costs in Canadian provinces (Q4 2022 VS Q4 2023)

Figure 3: Average hosting costs in US states (Q4 2022 VS Q4 2023)

Mining after halving is taken into account Economically, miners with hosting costs that are average or above will most likely not remain profitable, meaning that only those miners with favorable rates will survive in 2024.

2024 will spawn more mergers and acquisitions

In an environment of compressed computing power prices, there will be more mergers, acquisitions and asset sales in 2024 and 2025.

2022 has actually already begun. As the price of computing power plummeted and reached an all-time low in Q4, Compute North, one of Bitcoin's largest custody service providers, declared bankruptcy and liquidation, while Argo and other mining companies conducted asset sales.

Figure 4: List of asset sales and purchase activities of major listed mining companies

Financial distress in 2023 did not see much asset buying and acquisition activity, but it saw the largest merger in Bitcoin mining history - Hut 8 and US Bitcoin. Asset acquisition activity in 2024 is expected to match or exceed 2022 levels.

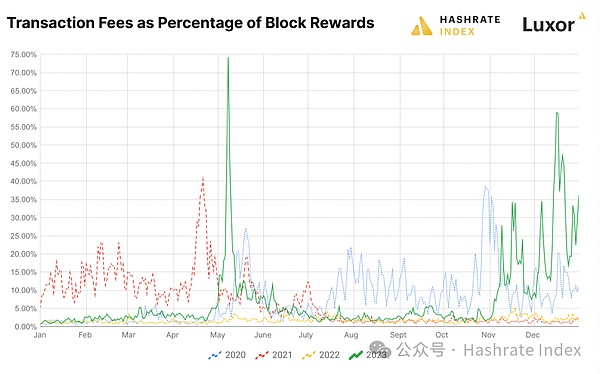

Inscriptions and other block space utilization activities will continue to increase transaction fee income

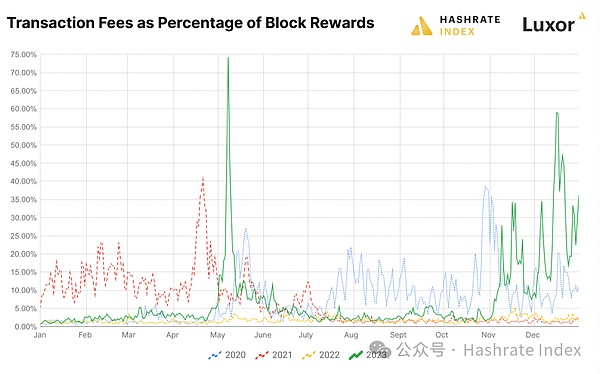

Inscription activity and alternative uses of block space in 2024 will bring transaction fee levels to levels comparable to or higher than the average in 2023.

The biggest dark horse in 2023 is to enter behind Bitcoin’s new technical standards based on non-fungible tokens (NFT) – ordinal numbers and inscriptions. Marketing. This new method of creating digital art and artifacts on Bitcoin makes transaction fees an important source of mining revenue.

In fact, the total amount of Bitcoin transaction fees in 2023 is only the second to last in Bitcoin history; miners earned $797,867,915 in transactions in 2023 Fees, second only to 2021’s record high of $1,019,725,113. Transaction fees will account for 7.6% of block rewards in 2023, compared with only 1.5% in 2022.

Figure 5: Changes in block rewards as a proportion of transaction fees

Inscription Activity generated $188 million in transaction fees between December 2022 and the end of 2023, with miners earning $129.5 million in Q4 2023 (69% of total fees). In addition, miners’ earnings in the fourth quarter of 2023 were 63% of the total transaction fee rewards in 2023 ($501.8 million).

If Bitcoin continues to rise this year, it is expected that Inscription activity transaction volume will continue to increase in 2024.

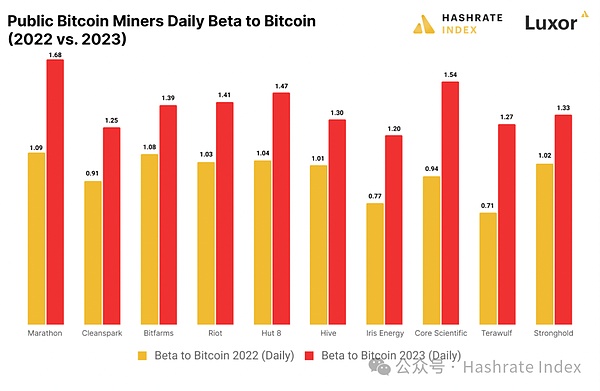

Bitcoin mining stocks may lose their price premium

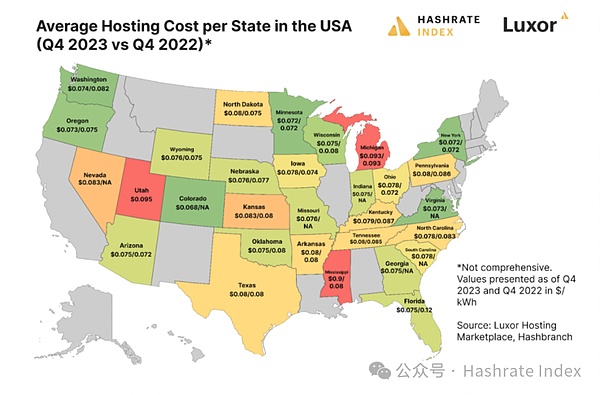

Historically, investors have traded Bitcoin mining stocks as high-beta plays on Bitcoin, both as Bitcoin alternatives and as assets capable of generating outsized returns when Bitcoin rises.

According to the beta chart analysis below, Bitcoin mining stocks show their correlation trends in bull or bear markets. In a bear market, stock price fluctuations are more closely related to daily currency price fluctuations. In a bull market, stocks have strong upside returns relative to Bitcoin because they have a strong beta correlation with Bitcoin. Traders can get a better handle on returns by observing Bitcoin miners' closer correlation with daily fluctuations in Bitcoin's spot price. When this trend is up (> 1.15 beta), Bitcoin miners are shifting to stronger reward periods.

Figure 6: Comparison of Bitcoin Beta coefficients of listed mining companies

In view of With the recent approval of various Bitcoin ETFs, Bitcoin mining stocks are expected to lose some of their investment premium as alternatives to Bitcoin, as investors can now gain direct income exposure through a variety of Bitcoin ETFs. Investors may still view them as high-beta vehicles for exposure to Bitcoin prices, but ETFs may take a cut of their price premium.

JinseFinance

JinseFinance