Author: He Hao Wall Street News

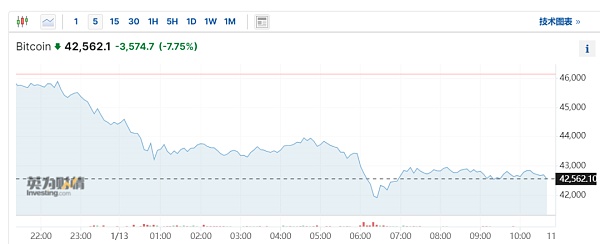

On the second day of the listing of the spot Bitcoin ETF, the digital currency experienced another sell-off. Bitcoin once fell below US$42,000 per coin, falling more than 7% during the day to US$42,562.1 per coin.

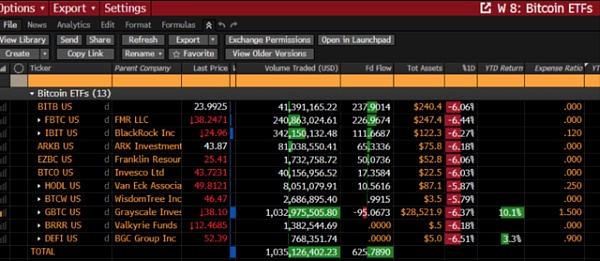

Spot Bitcoin ETFs generally fell by about 6%. Among them, DEFI fell by more than 6.6%, FBTC fell by 6.4%, HODL and BRRR fell by 6%, BTCO fell by 5.9%, and BITO fell by 5.9%.

Blockchain concept stocks generally fell sharply. Among them, Yibang International ADR fell 13.6%, Hut 8 fell 10.7%, The9 ADR fell 10.2%, Micro Strategy Investment fell 8.5%, Canaan Technology ADR fell 8.3%, Riot Platforms fell 7.4%, and the digital currency exchange Coinbase It fell 6.2%, and Robinhood, an internet celebrity brokerage, fell 5.3%.

According to the Securities Times, CoinGlass data showed that as of the morning of January 13, Beijing time, more than 100,000 investors had liquidated their positions in the entire cryptocurrency market in 24 hours, with the total liquidation amount reaching US$342 million. (approximately RMB 2.45 billion).

Bitcoin "bungee jumped" the day after the ETF was listed

The U.S. Securities and Exchange Commission (SEC) approved on Wednesday that the first batch of spot Bitcoins will begin trading on Thursday, January 11. Bitcoin fluctuated sharply throughout the day.

On Thursday morning, Eastern Time, Bitcoin rose through $49,000, setting a new high since December 2021, with an intraday increase of about 6.8%. However, the enthusiasm soon subsided, and Bitcoin turned lower during the day, returning to below $46,000. Related ETFs also fell.

After the Bitcoin spot ETF was listed in the United States, South Korea’s financial regulatory agency issued a formal response, warning domestic brokerage firms that it may be illegal to engage in any brokerage activities for foreign-listed Bitcoin spot ETFs.

Bitcoin accelerated its decline after the opening of U.S. stocks on Friday, falling below $44,000 during the session. It fell more than $5,000 from the two-year high hit on the first day of ETF listing on Thursday, wiping out the previous few trading days this week. The gains brought about by optimism about the listing of Japanese ETFs. Currently, Bitcoin has fallen by more than 7% to US$42,562.1 per coin.

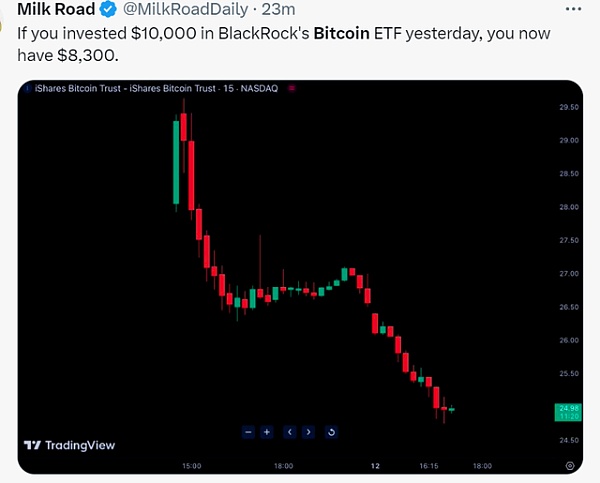

After two consecutive days of poor performance, investors who rushed in on the first day of Bitcoin’s listing suffered considerable losses. Calculated based on BlackRock’s ETF, they invested US$10,000 on Thursday and $10,000 on Friday. Only $8,300 remains.

Why did it plummet? What's the outlook for Bitcoin?

Peter Schiff, a well-known American financial critic, said:

The sell-off in Bitcoin, Bitcoin ETFs, and other Bitcoin-related stocks has been surprisingly orderly so far. I wonder when the selling will become more aggressive.

From the perspective of capital flow data, in addition to some people directly selling Bitcoin to cash out, Bitcoin ETFs are also facing extremely fierce competition with each other. Funds were transferred from ETFs with expensive fees to those with cheaper fees:

Although nearly half of the trading volume of Bitcoin ETF yesterday came from Grayscale ETF, this ETF of Grayscale also ranked among the highest trading volume on record. It is the ETF with the third largest volume, but the trading volume does not represent the inflow/outflow of investors’ funds. The funds of Grayscale ETF are actually outflows.

As previously mentioned by the Wall Street News website, after the fund’s initial launch preferential period, Bitwise’s BITB only charged a fee rate of 0.20%, the lowest among all ETFs, and its capital inflows were the largest. Other ETFs also had net inflows of funds to varying degrees.

In fact, Bitcoin has performed poorly in the past two days, which is a bit "selling the fact" ” move, some people are not surprised.

Some analysts have warned earlier that market excitement may be premature. Although the U.S. SEC has approved the launch of Bitcoin spot ETFs, the majority of the investment community still believes that cryptocurrencies are risky. Cryptocurrency in 2022 Scandals such as the collapse of currency exchange FTX have heightened investors' vigilance.

CryptoQuant, an encryption data service provider, said last month that the long-awaited approval of a Bitcoin spot ETF would trigger a sell-off because Bitcoin has risen by more than 60% in the past three months and the market has already digested it. This is a great benefit. Bitcoin is expected to correct back to $32,000 next month after spot ETF approval.

Bitcoin fell again, which is also related to the fact that many institutions have not yet entered the market. Considering the investment risks of Bitcoin itself, other large institutions such as Vanguard, Goldman Sachs, and Bank of America will not join the battle for the time being. Due diligence reviews and platform approvals take time before different institutions can purchase these ETFs.

In addition, although the U.S. SEC has "capitulated and compromised," not all trading platforms can trade these Bitcoin ETFs. Part of the reason may be that the funds have not yet been approved by brokerage compliance departments. A Citi representative reportedly said the bank was evaluating products for retail investors. The famous Vanguard is no exception. Yesterday, some netizens couldn't stand it anymore and said they would transfer their pension money from Vanguard to Fidelity just to buy Bitcoin ETFs.

But on the other hand, there are Investors pointed out that because there are currently not many institutions on the market and some market participants want to buy but cannot, this means that the potential incremental funds in the future will be large. If more institutions join in the future, there may be Detonating a new round of long-lasting market conditions.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo JinseFinance

JinseFinance Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph