Authors: Alex Thorn, Gabe Parker and Simrit Dhinsa@ Galaxy, Translated by: Liam

Bitcoin Halving Overview

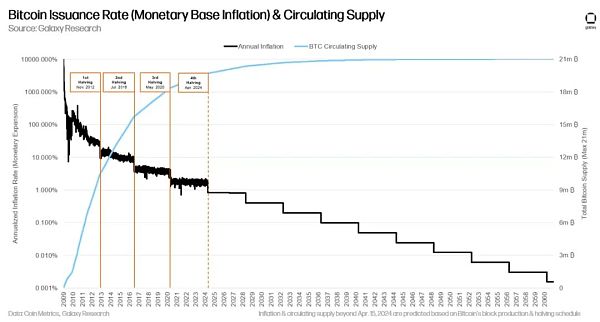

The transparency and predictability of Bitcoin issuance are key features that distinguish this asset from any other asset or currency in the world. No other asset has a calculable inflation schedule, nor is there a known supply event that reduces daily issuance by 50% overnight. Bitcoin's creator, Satoshi Nakamoto, built the halving feature into Bitcoin to counter the continued devaluation of fiat currencies.

"The fundamental problem with traditional currency is that it requires trust to operate. You have to trust that the central bank will not debase the currency. But the history of fiat currency is full of violations of this trust." - Satoshi Nakamoto, February 11, 2009

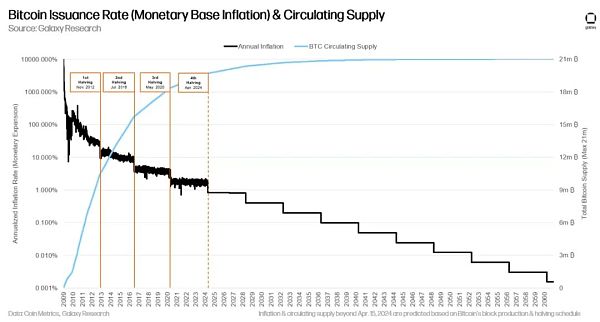

On April 20, 2024, Bitcoin will undergo its fourth halving at block 840,000. During each halving, the block reward (also known as the block subsidy) is reduced by half, and the block reward represents the number of newly issued bitcoins paid to miners for each mined block. After Bitcoin's fourth halving, the block reward will drop from 6.25 BTC to 3.125 BTC (equivalent to a drop from about 900 BTC to about 450 BTC per day). As a result, Bitcoin's annualized issuance rate will drop from about 1.7% to about 0.85%. According to Coin Metrics data, by the time of the fourth halving, 93.7% of the total supply of Bitcoin will enter circulation.

A halving occurs every 210,000 blocks (approximately every 4 years), and after Bitcoin's 4th halving, the network will undergo another 30 halvings. The halving schedule will continue until the last Bitcoin is mined, which is expected to occur sometime after 2140. Once all Bitcoins are mined and in circulation, miners will no longer receive block subsidies and will rely entirely on transaction fees and other forms of off-chain payments.

Bitcoin's plan to reduce issuance approximately every 4 years is the backbone of its transparent, predictable monetary policy and makes Bitcoin a provably scarce asset. Most importantly, Bitcoin's monetary policy is an immutable code executed through consensus among network stakeholders (miners, nodes, developers). Bitcoin’s scarcity and the predictability of its monetary policy, in stark contrast to the significant devaluation of global fiat currencies, are why Bitcoin has been called “digital gold.”

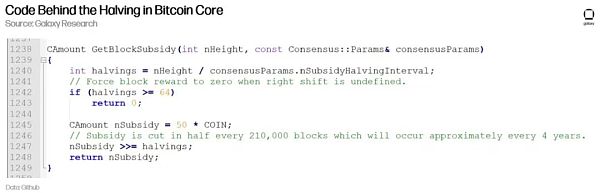

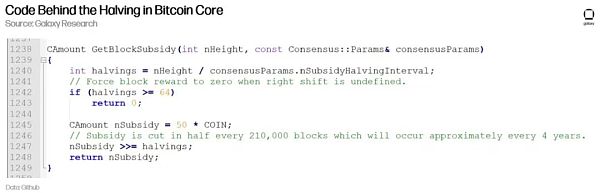

Visualization of the halving in Bitcoin Core

Bitcoin Core is the open-source software created by Satoshi Nakamoto that provides the foundation for the Bitcoin protocol. Bitcoin Core is recognized by developers as the primary reference implementation of Bitcoin (although other software implementations are compatible with the network). As such, all of the functionality and logic that defines Bitcoin resides in Bitcoin Core.

The code that implements the halving in Bitcoin Core consists of 7 lines of code written in C++. Breaking down the code line by line is beyond the scope of this report, however, it is important to visualize the code responsible for determining the block reward at the current block height:

Line 1240: Calculates how many halvings have occurred.

Lines 1245-1248: Determine the miner's block reward.

Understanding Bitcoin Mining

Mining is a key component in the Bitcoin network. When a person wants to send Bitcoin to another wallet, the transaction is first broadcast to the network and checked for validity by nodes. Before being added to a block, the transaction sits in a queue within the "mempool", a pool of unconfirmed transactions waiting for miners to add them to a block. The block subsidy is both a means of incentivizing miners to contribute computing power to the network to process and settle transactions, and a method of allocating the newly minted Bitcoin supply. As the price of Bitcoin rises, the incentive to mine blocks for these rewards will also increase significantly.

Miners generate blocks by calculating the correct hash value of the next block. Therefore, the miner with the highest hash rate, or the computing power of the application-specific integrated circuit (ASIC) machine, has the highest probability of finding the next block hash value. The first miner to calculate the correct hash value will receive the block subsidy and the transaction fees in the block. Usually, the time to calculate the correct hash value is about 10 minutes (Bitcoin's block time). The network ensures that miners' block time is always around 10 minutes through difficulty adjustments. These adjustments are made every 2016 blocks (about every two weeks) and change as the network hash rate increases or decreases. The higher the hash rate, the more difficult it is to mine a block. Therefore, difficulty adjustments enforce consistent block production and Bitcoin's monetary policy.

"By convention, the first transaction in a block is a special transaction that starts a new coin owned by the creator of the block. This provides an incentive for nodes to support the network and a way to initially distribute circulating coins, since there is no central authority to issue them. The steady increase in the number of new coins is similar to gold miners expending resources to add gold to circulation. In our case, the expended resources are CPU time and electricity." - Satoshi Nakamoto, Bitcoin Whitepaper, October 31, 2008

The impact of halving on Bitcoin mining

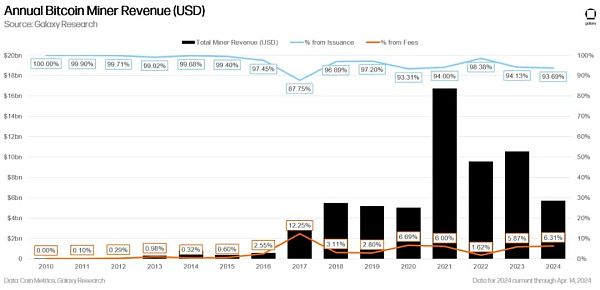

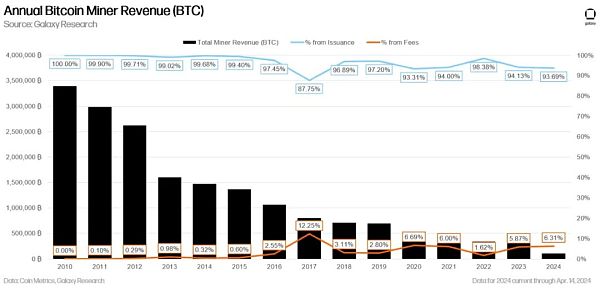

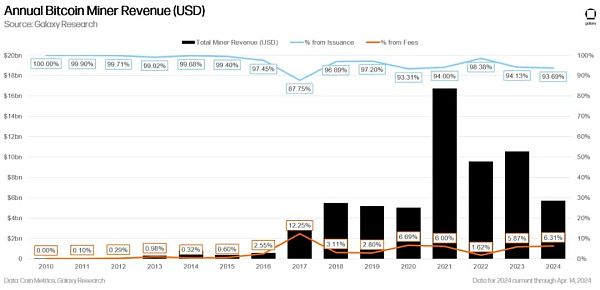

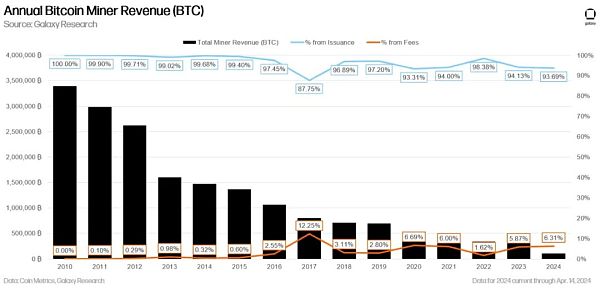

Bitcoin miner rewards are made up of block subsidies and transaction fees. After the halving, Bitcoin's block subsidy will be halved from 6.25 BTC to 3.125 BTC. With the Bitcoin price and network hash rate remaining constant, this will result in a near halving of Bitcoin miners' revenue, as block subsidies currently make up the majority of total rewards.

For miners, this means that the same computing power will generate about half the revenue it did before the halving event. Therefore, the cost of mining one Bitcoin is expected to increase by about double after the Bitcoin halving, which will make some less efficient miners unprofitable and forced to stop mining. As a result, the network hash rate is expected to decline in the short term. Hash rate refers to the total computing power contributed by miners to the Bitcoin network. The severity of the decline in network hash rate depends on factors such as Bitcoin price and transaction fees at the time of halving.

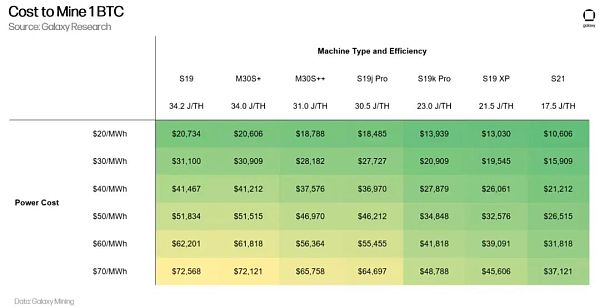

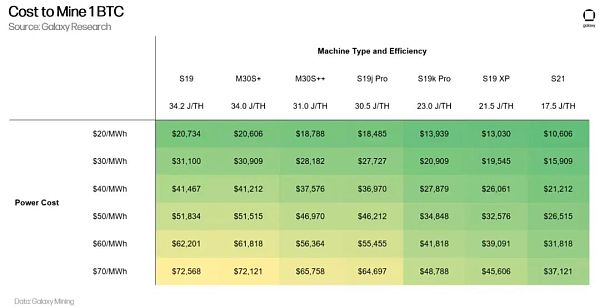

The following table outlines the expected cost of mining one Bitcoin for various commonly used ASICs (ranked from least efficient to most efficient) under different post-halving electricity cost scenarios. These calculations assume a network hash rate of 625 EH and transaction fees account for 10% of the block reward.

In preparation for the halving, miners have been working to improve operational efficiency by reducing costs and upgrading equipment. Many miners have announced large ASIC purchase orders and strategic site acquisitions to position themselves well before the halving. As shown in the previous table, at an electricity cost of $50/MWh, the mining cost of the S21 miner is 50% lower than that of the S19 miner, which illustrates the importance of improving mining machine efficiency.

Before the Bitcoin price halving, miners have strengthened their cash reserves, maintaining a sizable balance as "dry powder" to take advantage of discounts to purchase infrastructure in the event that the Bitcoin price may rise. As assets transition to more efficient operators, merger and acquisition activities are expected to surge after the cap, consolidating the industry landscape and driving further optimization.

Overall, the upcoming Bitcoin halving is a critical moment for miners. As the industry prepares for a significant reduction in block rewards, miners face an urgent need to adapt and innovate in order to remain profitable and sustainable in a changing environment.

The Impact of Halving on Bitcoin Price

The impact of each halving on Bitcoin price is an ongoing debate. Historically, market participants have viewed halving as a bullish event for Bitcoin prices, while opposing views have argued that halving has a negligible impact on prices. Here is a breakdown of the current bullish, bearish, and neutral views on the impact of halving on BTC price in the market.

Bullish View:A 50% reduction in Bitcoin’s block reward makes Bitcoin more scarce as an asset overall, while also reducing the absolute amount of selling by miners. Miners are considered to be the consistent forced sellers of Bitcoin, as these operations are extremely capital intensive and selling BTC is the main source of income for miners. Therefore, miners always sell a portion of their block rewards for fiat to pay for operational expenses such as energy, labor, debt, and new machines. Many believe that after the Bitcoin halvings in November 2012, July 2016, and May 2020, the reduction in supply growth corresponded with a reduction in selling pressure from the mining community, leading to an increase in the value of Bitcoin, and the same will happen after the 4th halving. Market participants who view halvings as bullish price sentiment also use the widely circulated "stock-to-flow model", which quantifies the impact of Bitcoin's supply reduction schedule on price. Supporters of this view generally believe that investors are not properly factoring in the halving in their current Bitcoin valuations.

Bearish View: As Bitcoin price approaches all-time highs before a halving for the first time in history, market participants who view the halving as bearish sentiment for Bitcoin believe that the market has adjusted to the first 3 halvings and has already priced in the event. Prior to the first two halvings, Bitcoin fell 42%+ from its previous all-time high. In fact, at this stage in Bitcoin's supply timeline, the bull runs of 2017 and 2020 have not yet begun. The impact of each halving event on Bitcoin's supply dynamics necessarily halves, and the impact declines over time. For example, going from 900 BTC per day to 450 BTC per day is much smaller in absolute terms than going from 7,200 BTC per day to 3,600 BTC per day (the first halving). Considering that Bitcoin's current issuance of 900 BTC per day is negligible compared to the asset's daily circulation, the impact of 450 BTC per day of new issuance after the halving will be minimal on Bitcoin's price. Additionally, bears argue that reduced miner revenue could lead to mining chaos and reduce the security of the Bitcoin network.

Neutral View:The efficient market hypothesis states that past and future Bitcoin halvings are the opposite of "new information" and cannot be considered a supply shock. Bitcoin's transparent, predictable issuance schedule should always be priced in by the market. Post-halving bull runs may have more to do with changes in demand than supply, and may even have more to do with global market liquidity, central bank interest rates, and other macro conditions.

Historically, Bitcoin enters a bull run during the hype phase after a halving, which lasts 0-600 days. After the first halving in 2012 (Cycle 1), Bitcoin prices reached the cycle top 367 days after the halving. During the second halving in 2016 (Cycle 2), post-halving price discovery was slower, reaching the cycle top 525 days after the halving. The third halving in 2020 (Cycle 3) reached the cycle top 546 days after the halving.

If history repeats itself, we are currently at the end of the accumulation phase and will slowly enter the hype phase sometime in 2024.

For the first time in history, the price of Bitcoin has exceeded its previous all-time high before the halving. During Bitcoin's previous two halvings in 2016 and 2020, the price of Bitcoin fell 42.5% and 52.8% from its previous all-time highs, respectively. While Bitcoin's strong price action before the halving cycle can be seen as a prelude to the hype phase that the market usually sees after the halving cycle, the driving force behind this round of Bitcoin price increases are new developments that have not been seen in previous halving cycles - specifically, the launch of a spot-based Bitcoin ETF in the United States in January 2023.

After the launch of the spot Bitcoin ETF, Bitcoin's 4th halving will occur against the backdrop of a major shift in the "asset model". Since the launch of the ETF on January 10, 2024, the Bitcoin spot ETF has accumulated a net inflow of more than $12.5 billion. Bitcoin has returned to the focus of macro investor discussions and is now seen as an important macro hedge asset along with gold and Treasury bonds. The emergence of a Bitcoin ETF in the United States represents a huge shift that will overturn traditional ideas about Bitcoin price cycles, holder behavior assessments, and rotation dynamics within cryptocurrencies.

Block Activity Halving

Block 840,000, also known as the halving block, will be a block with high trading demand due to its historical significance and rarity. The halving block only occurs once every 210,000 blocks, and there have only been 34 halving blocks in Bitcoin's history. Users and miners may trade or mine within the block, and the competition is very fierce.

The core factors that drive the transaction fee surge in the halving block include the launch of the new alternative token standard Runes and rare sat hunting. Runes are a new alternative token standard on Bitcoin that is more efficient than the BRC-20 token standard. Runes will be launched in the halving block, and it is expected that many Rune token collectors will pay high transaction fee rates to ensure that they are included in the block. For reference, sat is the smallest unit of Bitcoin - one Bitcoin is divisible by 100 million sats. Rare sats are a new collectible asset on Bitcoin that will be created when Ordinals appear in December 2023. The collection of rare Bitcoins requires the purchase of Bitcoins mined in historically significant blocks, such as halving blocks or the block mined by Satoshi Nakamoto (block 9). Each sat in block 840,000 has significant historical value, so collectors of rare sats charge high fees on their transactions to ensure they are included in the block.

Another potential factor driving up transaction fees during the halving is if mining pools attempt to reorganize (re-organize) Bitcoin's historical blockchain state. A reorganization occurs when another version of the blockchain is agreed upon among nodes, effectively rewriting part of the blockchain's transaction history. While the chances of a successful reorganization are slim, mining pools may attempt to reorganize the blockchain in order to successfully obtain high-fee blocks. It is worth noting that mining pools that attempt to reorganize the chain but are unsuccessful will still drive up transaction fees because the hashrate used to reorganize the chain is diverted away from the longest chain tip. This will slow down block times and cause fees to naturally increase as there is more time to accumulate mempool pressure.

Why the Halving Matters

The halving is a manifestation of Bitcoin's transparent, predictable, and deflationary monetary policy. The halving event reinforces Bitcoin’s fundamental value proposition, including an open peer-to-peer network, competitive mining, a distributed network of nodes, and an active open source development community. The halving itself is the mechanism that differentiates Bitcoin from other assets in terms of scarcity.

Bitcoin’s immutable monetary policy coupled with a hard capped supply of 21 million is a revolutionary concept for a macro asset. The transparency of Bitcoin’s daily issuance schedule allows anyone in the world with a computer to verify for themselves that Bitcoin issuance is proceeding as planned, without having to rely on or trust an intermediary. Furthermore, every node in the Bitcoin network can confirm that the 21 million hard capped supply remains constant.

The predictability and transparency of Bitcoin’s fixed supply makes this emerging asset a viable alternative to fiat currencies as a store of value. Unlike Bitcoin’s fixed supply, fiat currencies are subject to the discretion of central banks, which have the power to adjust the money supply to manage economic stability or stimulate economic growth. This discretion results in an uncapped total supply of all fiat currencies and an unpredictable issuance schedule. The impact of this unpredictability is evident when evaluating the actions of central banks. In response to the global economic turmoil caused by the COVID-19 pandemic, the Federal Reserve printed $5 billion out of thin air, more than doubling the central bank's balance sheet. These printing presses, along with the U.S. government's fiscal spending, helped mitigate the negative effects of the lockdown and COVID-19 measures through the trickle of the U.S. economy, stimulating the economy, but ultimately leading to the worst inflation in decades. Even gold, which is known as the oldest scarce monetary asset, lacks a clear total supply, and its output, while influenced by market dynamics rather than central bank policy decisions, remains unpredictable.

The resilience shown by Bitcoin during numerous bear markets highlights the market's renewed appreciation for the value of Bitcoin as a decentralized macro asset that is characterized by transparency, predictability, and scarcity. Bitcoin's monetary policy is fixed, and each halving proves its durability again. Halvings will continue to occur, and stakeholders will never be bailed out by the system. The upcoming halving on April 20, 2024 will reinforce these facts and will remind the market of Bitcoin's unique properties.

XingChi

XingChi