Author: Ares

On October 29, BTC returned to above $71,500, setting a new high since June 7 this year, and has a strong momentum to break through the previous historical high of $73,777.

At the same time, the total market value of cryptocurrencies also rebounded to exceed $2.5 trillion. Many analysis agencies believe that the biggest driving force behind the hot market is Trump's victory, but there is still about a week before the final result of the US election is released, and it is still unknown who will win. Judging from the current financial market reaction, the "Trump transaction" market is very obvious, but investors still need to be vigilant about potential market risks.

1. The US election is imminent, who will have the last laugh?

Bitfinex Alpha report shows that Bitcoin volatility has increased, and election factors have become a key influence. Driven by geopolitics and Trump's election transactions, Bitcoin rebounded after a volatility of 6.2% last week. The election expectations have led to active option trading, and the implied volatility after the election day may reach 100 per day. But despite the increase in short-term volatility, Bitcoin has risen 30% since its September low, and has risen to more than $71,500 as of the time of writing.

Data-wise, Deribit data shows that the number of Bitcoin call options expiring on November 8 is twice that of put options.

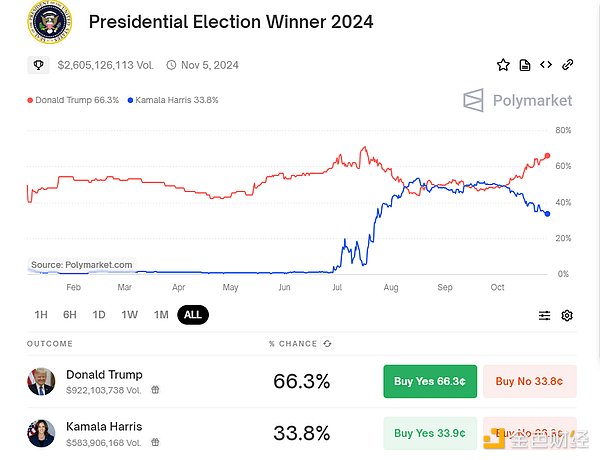

Currently, the probability of Trump winning the US presidential election on the prediction market Polymarket has risen to 66.3%, while Harris's probability of winning has dropped to 33.7%, with Trump leading by 32.6 percentage points.

Recently, Trump's poll support rate has surpassed Harris for the first time since early August.

The average poll of the RealClearPolitcs platform as of October 28 showed that Trump had formed a slight advantage of 0.2 percentage points over Harris. The two had support rates of 48.6% and 48.4%, respectively. As of October 23, Harris was still leading Trump by 49.1% to 48.5%.

In addition, according to the calculation results published on the website of Florida State University, more than 43.3 million American citizens have voted in advance in the presidential election to be held on November 5. In the remaining time before the election, if there is no major "October surprise", the main theme of the final stage of the election will continue to be stalemate.

However, the "Trump transaction" in the financial market has been very obvious, especially in the crypto market, where BTC was the first to stand at $71,500.

On October 29, the three major U.S. stock indexes closed up collectively, and cryptocurrency concept stocks rose generally, among which MARA Holdings rose 11%, Riot Platforms rose nearly 10%, and MicroStrategy rose nearly 9%. In addition, Trump Media Technology Group (DJT.O) rose as much as 21.6%.

In the field of encryption, Trump concept meme coins have achieved a general rise. The Trump family encryption project World Liberty Financial (WLFI) also announced plans to issue stablecoins.

At the same time, legendary analyst Martin Armstrong predicted that Trump would win the election with an overwhelming advantage, and Harris's "real support rate" has actually dropped to 6.5% to 7.5%. The Democratic Party's "Deep State" has entered panic mode.

In terms of trading, large amounts of funds also chose to bet on Trump. On October 29, a giant whale once again invested 1 million USDC to bet on Trump to win the US election. In the past 4 days, the whale has spent 5 million USDC to buy 754 10,000 "shares" of Trump's victory in the US election.

2. A historic week: long and short views are fighting fiercely

At present, Bitcoin has returned to above $70,000 again, only $2,000 away from its historical high. Many investors generally expect that the previous high will be broken before the US election and the historical record will be refreshed. However, there are also some opposing institutional views that believe that there are still many uncertainties in the current market, especially after the election, the market may face a correction.

1. Stable bullish

Bloomberg ETF analyst: SOL and XRP ETF listing applications are "call options for Trump's victory." In addition, if Trump wins... he will definitely appoint a more liberal SEC chairman.

Arthur Hayes: Family office Maelstrom invested 5% of its funds in USDe and maintained a large long position in cryptocurrencies. Using Ethena Lab's USDe Stablecoins hedge against uncertainty while maintaining a large number of bullish bets on Bitcoin, Ethereum and other cryptocurrencies.

Matrixport: The US election may become a key catalyst for the crypto market. South Korea is known for its active altcoin trading, but current trading volume remains sluggish, and the possibility of a sharp rebound in altcoins is not high. Bitcoin's funding rate has always been consistent with South Korea's trading volume trends. Higher funding rates usually attract hedge funds to buy ETFs to earn price differences.

However, the current Bitcoin funding rate, South Korea's trading volume and Bitcoin spot ETF purchases are all lower than the levels in March 2024. Next week's US presidential election may become a key catalyst to ignite new market momentum.

Trader Eugene: The market will continue to rise after the election. Solana is optimistic. The speculative long positions in October have been basically wiped out.

DWF Labs Lianchuang: The next two quarters will be a bullish cycle. The market is still unstable but the overall direction is positive. October (Uptober) is from the fourth quarter of 2024 to The first month of the bullish cycle in the first quarter of 2025. The market is still very volatile, but the direction is positive.

As an action-oriented person, BlackRock has bought an additional 34,085 bitcoins worth about $2.3 billion in the past two weeks alone. The company currently holds more than 400,000 bitcoins, worth nearly $26.98 billion.

2. Bearish: There may be a sell-off after the election

Chief Investment Officer of Temasek International: If Trump returns to the White House, it may not have a positive impact on the global economy and financial markets. He pointed out that the policies of the Trump administration will lead to slower global economic growth, which will eventually affect American companies. He also warned that higher interest rates and a stronger dollar will have an adverse impact on emerging markets.

Nomura: If there is a "Harris election deadlock/divided Congress", all types of assets are at risk of reversal, there will be some upside for US Treasuries and short-term interest rates, as well as the risk of liquidation of stocks betting on Trump's sweep of "economic overheating" deregulation; gold/cryptocurrency will be squeezed under Harris' "deadlock" trading; if there is a blue sweep where the Democrats win Congress, the stock market may fall 7-10% in the next one to three months.

Columbia Business School professor: Trump's presidency may have a "negative" impact on Memecoin because they are a "form of economic populism and a statement against unfairness." "U.S. regulation is not good for Memecoins, and most people have lost money on Memecoins." Greeks.live Macro Researcher: The market's attention to this U.S. election is lower than expected. Friday's non-farm data and unemployment data are worth paying attention to. The last important economic data before the election, the Federal Reserve officials have almost no speeches scheduled. The election is approaching, and the market's attention to this election is lower than expected, but there is still strong uncertainty. "Federal Reserve Megaphone": The U.S. may face new inflation risks after the election. The Fed's two and a half years of fighting to reduce inflation seems to have been successful, but the U.S. election may change this situation. Both candidates are Supports policies that promote economic growth, which could prevent inflation from falling further. However, economists and even conservative advisers worry that the ideas supported by Trump are particularly likely to fan the flames of inflation. These include his proposals to impose comprehensive tariffs on imported goods, deport workers, and rely on the Federal Reserve to lower interest rates.

Taken together, these policies are moving in the direction of inflation. Trump's proposals may plunge him into a new battle with the Federal Reserve, which is tasked with keeping inflation low. Any factors that reignite inflation may cause officials to slow down or even stop their plans to cut interest rates.

Economist Peter Schiff: Bitcoin may fall due to the "Trump sell-off". As Trump's approval rating rises, Bitcoin has not risen with other Trump-related assets, possibly because speculators have bought in in advance, resulting in weaker demand. It is predicted that Bitcoin may face a "Trump sell-off" and believes that under inflationary pressure, gold's safe-haven advantage is more prominent and is entering a bull market.

Tyr Capital Chief Investment Officer: Bitcoin may face selling pressure after the US election. Bitcoin prices may rise sharply before the US election on November 5, but selling pressure may appear due to profit-taking after the election results are announced.

International Monetary Fund (IMF): The world faces low growth and high debt risks. The world is in danger of falling into a low-growth, high-debt path, which will reduce the resources that governments use to improve opportunities for their people and address climate change and other challenges.

The upcoming US presidential election on November 5 has raised concerns that Americans, who have been stimulated by high inflation during the administration of Democratic President Biden, may Let Republican candidate Trump return to the White House, thus ushering in a new era of trade protectionism and trillions of dollars in additional US debt.

Summary

From the current crypto market, BTC is only one step away from its all-time high. As the US election approaches, the expectation of Trump's victory has also prompted the crypto market to continue to rise. So based on the current financial market and signs from all parties, Trump has a higher probability of winning. However, there is still a week before the election results, and the economic situation is volatile. While investors are optimistic about the start of a new round of bull market, they must also be wary of the risk of market volatility.

Jixu

Jixu

Jixu

Jixu Hui Xin

Hui Xin Kikyo

Kikyo Jasper

Jasper Hui Xin

Hui Xin Jasper

Jasper Catherine

Catherine Hui Xin

Hui Xin Alex

Alex Clement

Clement