Source: Jishi Communication

Abstract

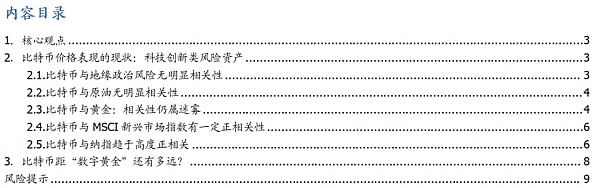

What is the asset attribute of Bitcoin? Since the 2008 Satoshi Nakamoto white paper named Bitcoin as "electronic cash", new visions such as "digital gold" and "global currency" have gradually been raised. This article analyzes the correlation between the price of Bitcoin since 2010 and typical asset price indexes, including: Geopolitical Risk Index (GPR), Crude Oil (WTI) Index, Gold Price (GC.CMX), MSCI Emerging Markets Index and Nasdaq Index, trying to study the current status of Bitcoin's asset attributes, and further explore what is missing from Bitcoin's representative vision of "digital gold"?

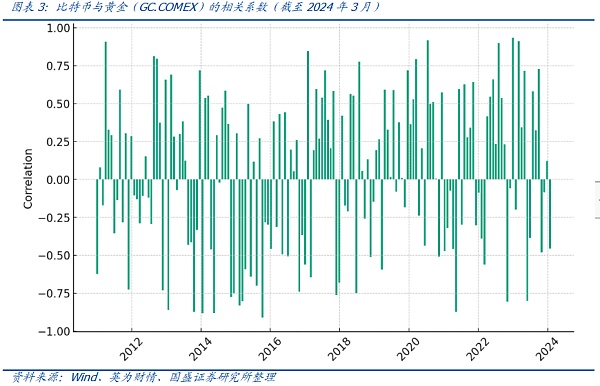

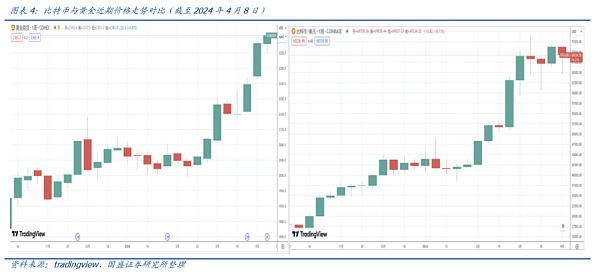

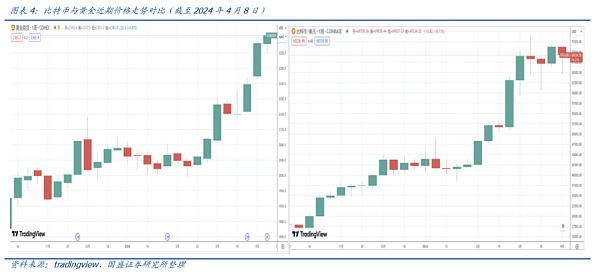

From the correlation coefficient since 2010, there is no obvious correlation between Bitcoin price and geopolitical risk and crude oil, and the correlation coefficient between the two shows irregular positive and negative fluctuations. From the correlation coefficient since 2010, the correlation between Bitcoin price and gold price is unclear. In the early days, the Bitcoin market was not mature enough, and its market performance was more inclined to high-risk, high-return assets, while market participants were more fans of cryptocurrencies, which seemed to have little connection with traditional capital market investors (especially institutional investors) - and they were also different groups from the risk-averse gold buyers. After 2020, the positive correlation between the two gradually increased. However, from the perspective of trading logic, volatility, and short-term price response to macroeconomic policies, the two are not positively correlated with internal logic. After 2017, the global financial market faced many uncertainties, including trade wars and geopolitical tensions. Considering the loose monetary policy of the Federal Reserve, gold and Bitcoin have their own logic of rising. From the perspective of prices for a period of time, they show a certain trend in the same direction. However, if we observe the price trend in the past month, we will find that gold has continued to rise for 4 weeks, while Bitcoin has shown obvious fluctuations in the past 4 weeks. This divergence may suggest that the two have different internal logics.

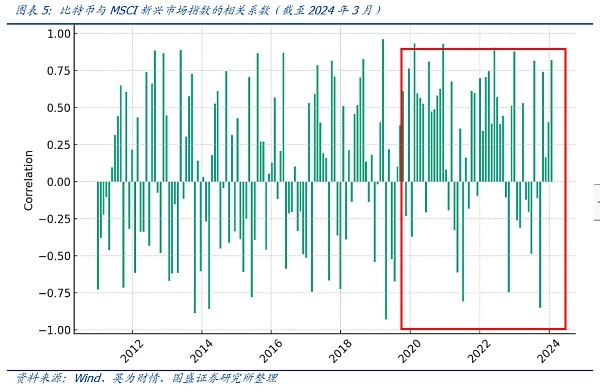

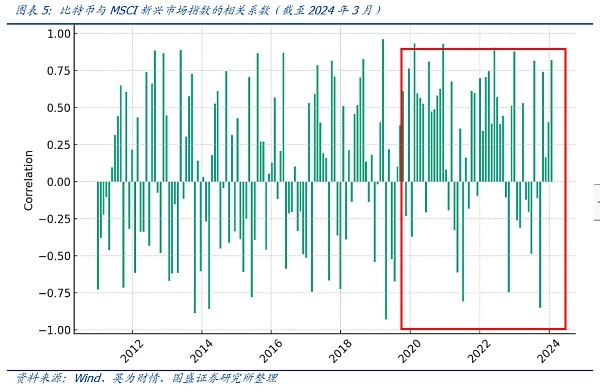

Since 2020, Bitcoin has shown a relatively obvious positive correlation with the MSCI Emerging Markets Index, while before that, the correlation had no obvious positive or negative tendency. Bitcoin, as a digital asset, is not directly related to the development of emerging markets from the perspective of the economic industrial chain. However, if we look at the technological innovation and the attitude of funds towards emerging assets, the correlation between the two is gradually strengthening.

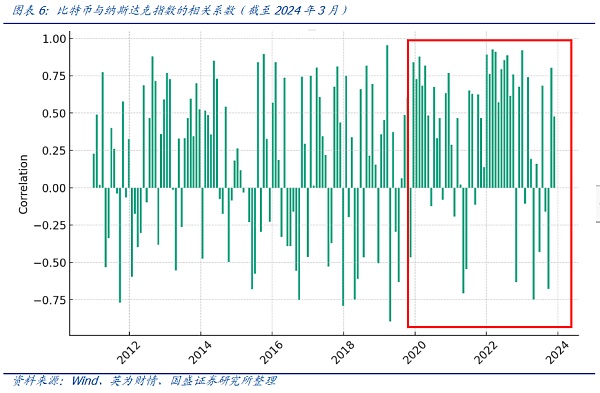

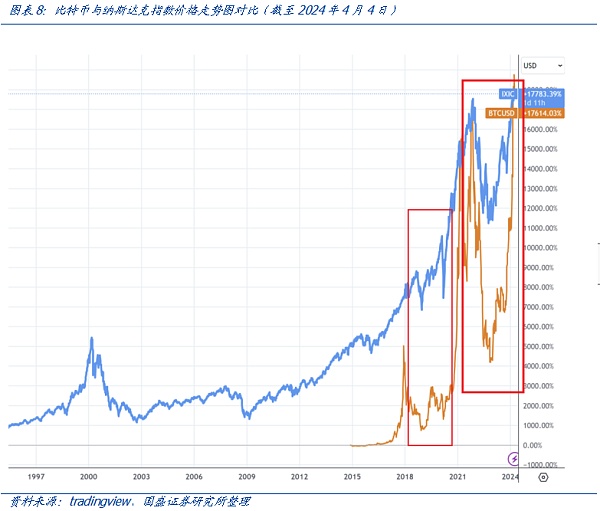

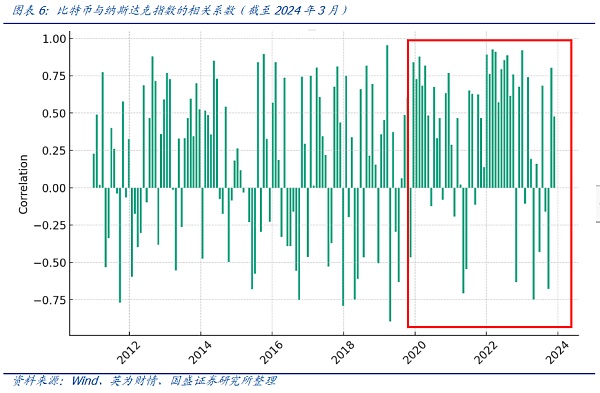

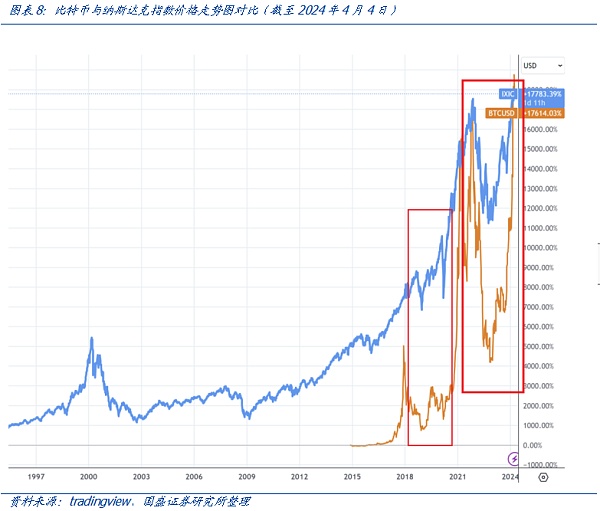

Since 2010, Bitcoin has shown a certain positive correlation with the Nasdaq index, and after 2020, the Bitcoin index and the Nasdaq have shown a strong positive correlation, reflecting the technological innovation attribute. Bitcoin landed in the US futures market in 2017, and the US SEC approved the Bitcoin spot ETF in January 2024. Against this background, after Bitcoin entered the US capital market, it showed an increasingly positive correlation with the Nasdaq. It can be inferred that Bitcoin is more reflected in the perception of funds in the US capital market as a technological innovation attribute and a high-risk attribute. Back to the micro level, comparing the trend chart of Bitcoin and Nasdaq, from 2018 to 2021, both showed fluctuations, and in mid-to-late November 2021, both reached a historical high. In the subsequent adjustment, both reached an adjustment low between October and November 2022, and the trend since then has hit a record high. The two show an increasingly high positive correlation.

Just from the perspective of whether it can become digital gold, we believe that Bitcoin currently has the following problems and restrictions:

1) The structure of Bitcoin chips makes it still a long way from becoming a reserve asset;

2) Potential problems such as Bitcoin forks and quantum attacks;

3) Risks brought by Bitcoin mining energy consumption and computing power fluctuations.

1. Core Views

New currency? Digital gold? Internet value platform? What are the asset attributes of Bitcoin?

There is no doubt that Bitcoin has gradually become the most controversial asset in the past decade. Its short-term price fluctuates sharply, but it brings astonishing returns to investors in the long run. In recent years, with the gradual entry of Bitcoin futures and Bitcoin spot ETFs into the US capital market, Bitcoin has in fact been accepted by mainstream funds in these countries. Since the 2008 Satoshi Nakamoto white paper named Bitcoin "electronic cash", new visions such as "digital gold" and "global currency" have gradually been raised by people. The answers to these questions may only be left to time, but we can observe from the price performance of Bitcoin: what is Bitcoin more like?

In order to figure out what Bitcoin is more like from the perspective of price performance, this article will conduct a correlation analysis between Bitcoin's price since 2010 and the asset price index represented by the price, including: Geopolitical Risk Index (GPR), Crude Oil (WTI) Index, Gold Price (GC.CMX), MSCI Emerging Markets Index and Nasdaq Index, trying to study the current status of Bitcoin's asset attributes, and further explore what is still missing from Bitcoin's representative vision of "digital gold".

2. The current status of Bitcoin's price performance: technological innovation risk assets

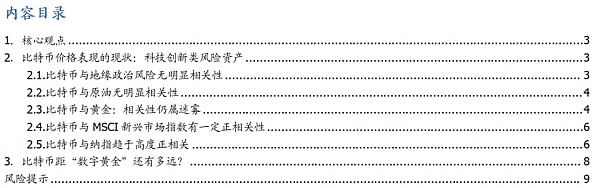

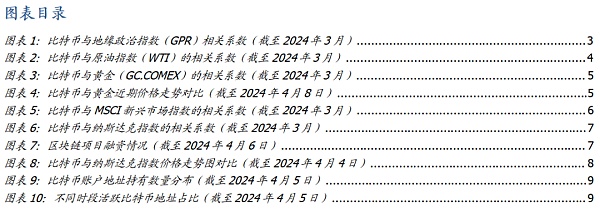

2.1. Bitcoin has no obvious correlation with geopolitical risks

From the correlation coefficient since 2010, there is no obvious correlation between Bitcoin prices and geopolitical risks, and the correlation coefficient between the two shows irregular positive and negative fluctuations. In the short term, when some geopolitical tensions occur, Bitcoin prices occasionally rise in the short term, and the market may associate the two. However, from the perspective of the longer-term correlation coefficient, there is no obvious positive or negative correlation between Bitcoin price performance and geopolitics. In fact, since Bitcoin began mining in 2009, under the established rule of halving every four years, it has shown a relatively obvious cyclical bull and bear market, and geopolitical risks do not seem to be related to Bitcoin's market performance.

Based on the above analysis, Bitcoin has not shown obvious risk aversion characteristics over a long period of time.

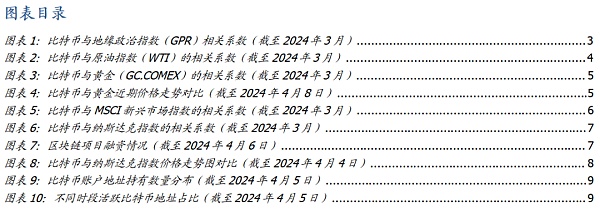

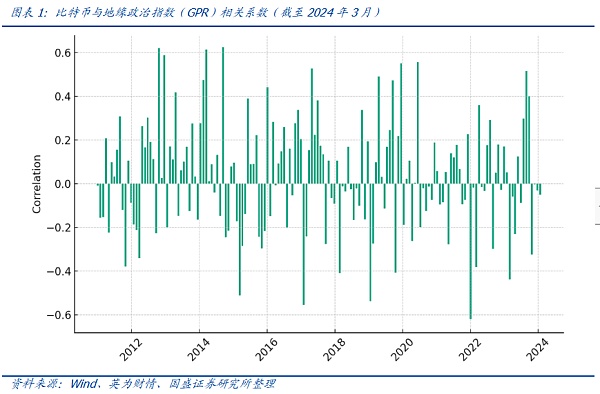

2.2. Bitcoin and crude oil have no obvious correlation

From the correlation coefficient since 2010, there is no obvious stable correlation between Bitcoin price and crude oil price. The correlation coefficient between the two shows irregular positive and negative fluctuations. As an important commodity, the price of crude oil is affected by many factors such as global macroeconomic conditions, supply and demand, and geopolitics. However, these factors do not constitute a major impact on Bitcoin prices. Although Bitcoin, as a commodity, landed in the US futures market in 2017, this is because Bitcoin is still in the early chaotic stage in terms of US regulatory rules, which is a special historical situation.

In fact, Bitcoin is not currently involved in the actual activities of global economic production and operation, so it is reasonable to show no correlation with crude oil.

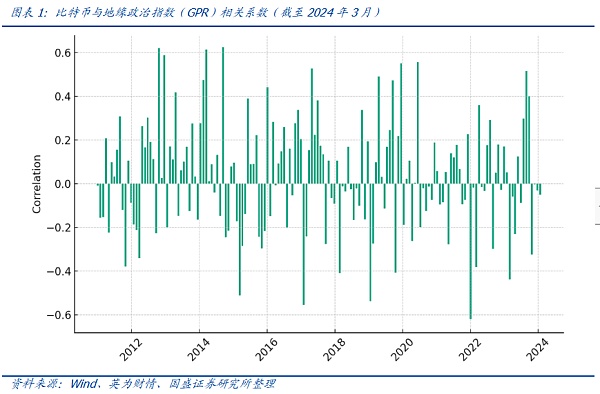

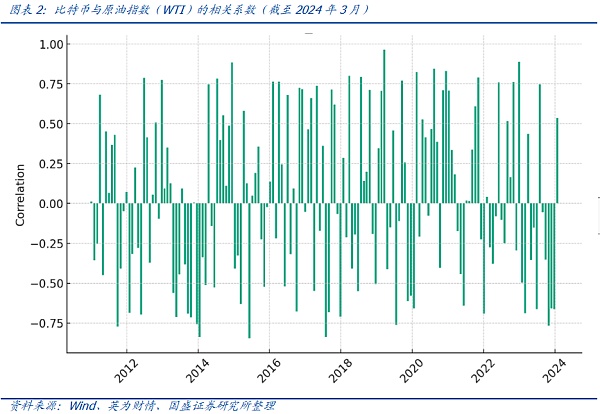

2.3. Bitcoin and gold: correlation is still a mystery

In 2008, Satoshi Nakamoto used "Peer-to-Peer Electronic Cash System" to justify Bitcoin. After more than ten years, the view that Bitcoin will become "digital gold" has gradually emerged, and there are not a few who hold this view. The supply of gold and Bitcoin is limited (strictly speaking, the supply of Bitcoin is more fixed than that of gold), and some people believe that Bitcoin, like gold, has the potential to become a substitute for legal currency. From the perspective of risk aversion, in certain geopolitical conflicts during certain time periods, Bitcoin may become a short-term risk aversion option for some people. Therefore, "digital gold" may be the most promising goal and positioning of Bitcoin.

From the correlation coefficient since 2010, the correlation between Bitcoin price and gold price is unclear. In the early days, the Bitcoin market was not mature enough, and its market performance was more inclined to high-risk, high-return assets, while market participants were more fans of cryptocurrencies, and seemed to have little connection with traditional capital market investors (especially institutional investors) - and the risk averse who bought gold, they were also a different group. In contrast, the traditional gold market is more regarded as a safe-haven asset, and investors are more inclined to buy gold for risk aversion and value preservation when the economy is uncertain. Therefore, the lack of obvious correlation between Bitcoin price and gold price during this period also reflects the expectations of market traders. With the launch of Bitcoin futures, spot ETFs and other products in the US market, more traditional investors and institutions have been attracted to participate in transactions. So, is the market beginning to regard Bitcoin as a digital gold, an asset with risk aversion and inflation hedging functions?

From the correlation coefficient between Bitcoin and gold, the positive correlation period between the two has gradually increased since 2020. However, from the perspective of trading logic, volatility, and short-term price response to macroeconomic policies, the two are not positively correlated with each other in an intrinsic logic. After 2017, the global financial market has faced many uncertainties, including trade wars, geopolitical tensions, etc. Considering the loose monetary policy of the Federal Reserve, gold and Bitcoin have their own logic of rising. From the perspective of prices over a period of time, they show a certain trend in the same direction.

However, if we observe the price trend in the past month, we will find that gold has continued to rise for 4 weeks, while Bitcoin has shown obvious fluctuations in the past 4 weeks. This divergence may suggest that the two have different inherent logics.

From the perspective of the internal logic of participating groups, sources of funds, and user cognition, Bitcoin is currently different from gold. This will be further analyzed in the correlation analysis between Bitcoin and the MSCI Emerging Markets Index, especially the Nasdaq Index.

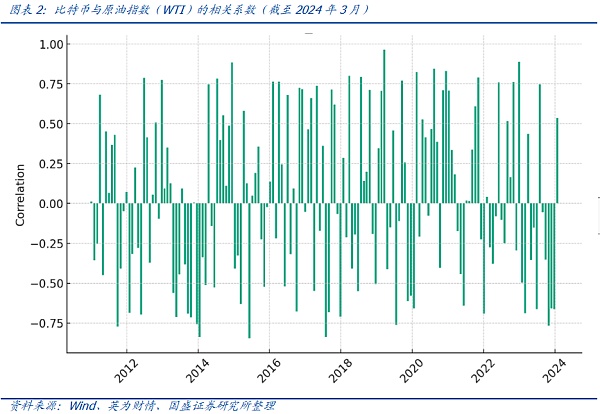

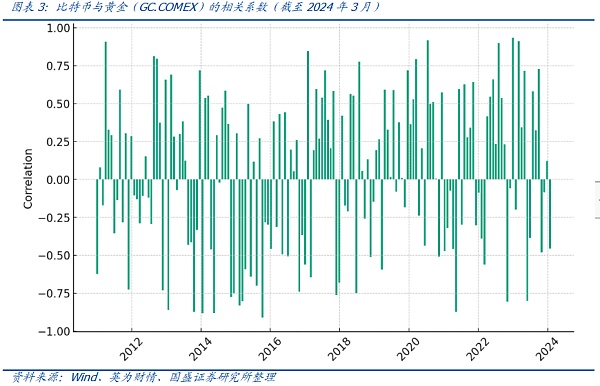

2.4. Bitcoin has a certain positive correlation with the MSCI Emerging Markets Index

Since 2020, Bitcoin and the MSCI Emerging Markets Index have shown a relatively obvious positive correlation, while before that, the correlation had no obvious positive or negative tendency. As a digital asset, Bitcoin is not directly related to the development of emerging markets from the perspective of the economic industrial chain. However, if we look at technological innovation and the attitude of funds towards emerging assets, the correlation between the two is gradually strengthening. This is even more obvious from the correlation performance of Bitcoin and the Nasdaq Index.

2.5. Bitcoin and Nasdaq tend to be highly positively correlated

Since 2010, Bitcoin and Nasdaq have shown a certain positive correlation, and after 2020, the Bitcoin index and Nasdaq have shown a strong positive correlation. In 2017, Bitcoin landed in the US futures market, Tesla purchased Bitcoin in 2021, and the US SEC approved the Bitcoin spot ETF in January 2024. Against this background, after Bitcoin entered the US capital market, it showed an increasingly positive correlation with the Nasdaq. It can be inferred that Bitcoin is more reflected in the perception of funds in the US capital market as a technological innovation attribute and a high-risk attribute.

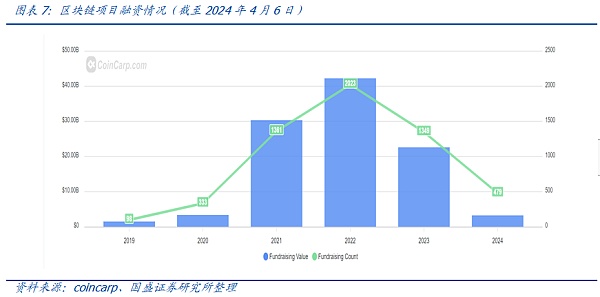

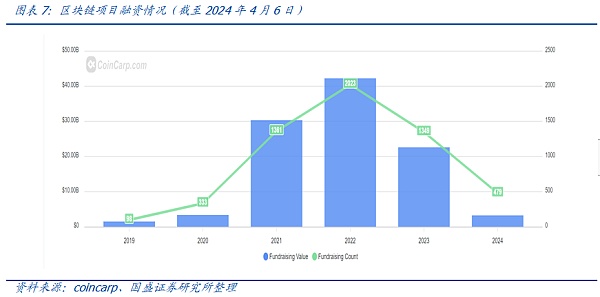

After all, Bitcoin uses blockchain technology to establish a decentralized value network, which is first of all the result of technological innovation. The emerging blockchain networks such as Ethereum that emerged after Bitcoin also provide a basic platform for new Internet applications as emerging decentralized technology networks. The blockchain network is a network platform that integrates technology and finance. Its ecological innovation is very active and is favored by many venture capital institutions. Therefore, it is understandable that Bitcoin and the Nasdaq have an increasingly strong positive correlation.

Back to the micro level, comparing the trend charts of Bitcoin and Nasdaq, from 2018 to 2021, both showed fluctuations, and in mid-to-late November 2021, both reached a historical high. In the subsequent adjustments, both reached an adjustment low between October and November 2022, and the subsequent trends have reached historical highs. The two show an increasingly high positive correlation.

An interesting point of view and assumption: There are currently 7 of the most important weighted stocks in the Nasdaq (Microsoft, Apple, Alphabet, Nvidia, Amazon, META and Tesla, etc.), and Bitcoin is more like the 8th important weight of the Nasdaq. This view has no strict logical basis, but Bitcoin's technological innovation and high-risk attributes have many similarities with these seven companies, not to mention that the correlation of price trends in fact confirms this point. In addition, with the passage of Bitcoin ETF, Bitcoin, an alternative asset, is directly connected to the US stock market, which has also strengthened the US stock market's pricing ability to a certain extent.

3. How far is Bitcoin from "digital gold"?

Digital gold is a more extensive and most labeled "vision" of Bitcoin. At present, there are still some gaps and restrictions. Just from the perspective of whether it can become digital gold, we believe that Bitcoin currently has the following problems and restrictions:

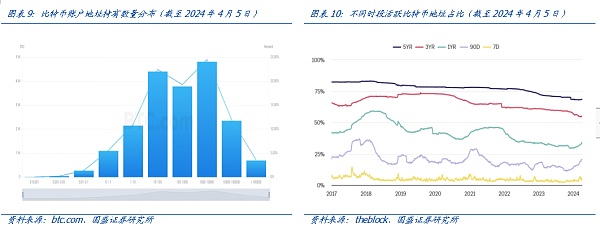

1) The chip structure of Bitcoin makes it still a long way from becoming a reserve asset, which is different from gold;

2) Potential problems such as Bitcoin forks and quantum attacks;

3) Risks brought by Bitcoin mining energy consumption and computing power fluctuations.

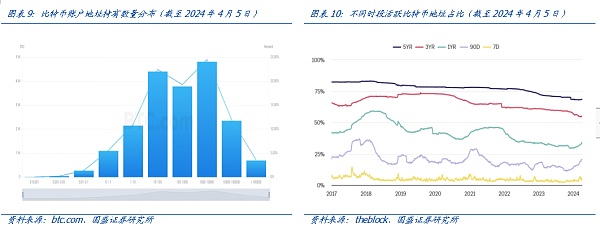

From the data on the chain, we can see that the largest number of accounts holding 10-100, 100-1000, and 1000-10000 bitcoins are accounted for, with all three types of addresses being around 4 million. The number of account addresses holding more than 100,000 bitcoins is more than 690,000 (accounting for 3.54%). Although a person can hold multiple addresses, in a sense, the structure of bitcoin chips is not dispersed enough and has not been adopted by enough people. Relatively speaking, there are too many account addresses that hold a huge number of bitcoins. In particular, how many bitcoins does Satoshi Nakamoto hold and what his current situation is are also issues that the market has to struggle with. Under such circumstances, it is clear that there is still a long way to go before Bitcoin becomes a national reserve - after all, major countries (central banks) around the world have to take this reality into consideration when choosing Bitcoin as a reserve asset.

The fork risk faced by Bitcoin (and other blockchain networks) is also different from the technological attribute risk of gold. In this regard, the prospectus of the Bitcoin spot ETF (ishares, IBIT) launched by BlackRock and other institutions in the US market in January this year also mentioned this risk. In addition, with the development of quantum computing, the encryption algorithm of the Bitcoin blockchain network faces quite serious challenges. Of course, quantum computing may impact the entire traditional information system cryptography technology system, but if it is regarded as "digital gold", the market has to consider the potential risks in this regard.

Furthermore, Bitcoin's unique POW mining system provides a computing power security barrier for the value of the Bitcoin network, but at the same time, if it is to become "digital gold", the huge energy consumption of Bitcoin mining and the stability of the mine are all issues that must be considered. Unexpected computing power fluctuations, mine management and other issues will bring challenges to the gold content of this "digital gold". After all, the preservation and maintenance of gold itself does not require such a complex system.

JinseFinance

JinseFinance