Author: Climber, Golden Finance

The recent crypto market has warmed up, and the price of BTC has continued to rise, approaching the $70,000 mark several times. As the last quarter of this year, most altcoins are still at the price level of last year's bear market.

At present, Polymarket predicts that the probability of Bitcoin reaching $70,000 this month has risen to 74%, and the total net inflow of Bitcoin ETFs last week also exceeded $20 billion for the first time. In addition, there are many signals in the market that Bitcoin is about to start a new round of rising prices.

However, the crypto market is always unpredictable, and there are still negative factors and bearish views. QCP Capital said that the US election is approaching, and the uncertainty of the BTC market has increased. To this end, Golden Finance has sorted out the recent research and judgment of various parties on the crypto market and the possible positive and negative factors, so that readers can have a clearer understanding of the crypto trend.

Positive factors

Keywords: rate cuts, elections, overweight

Lisa Shalett, chief investment officer of Morgan Stanley Wealth Management, said the Federal Reserve, which focuses on the labor market, will continue to cut interest rates. The Fed is now focusing on the "mixed" labor market. The Fed will continue to cut interest rates in November, but policymakers are cautious because inflation is no longer cooling down quickly.

On October 17, Polymarket data showed that Trump's probability of winning the US presidential election rose to 61.3%, a record high.

10x Research said that MicroStrategy's stock price may continue to rise, which is expected to drive up Bitcoin prices. In the past week, the stock rose 16%, with a market value of $43 billion, a record high. In addition, strong bond demand may prompt MicroStrategy to raise more funds to buy Bitcoin. He said that the strategy of borrowing money to buy coins is reasonable, and the rise in stock prices may form a positive feedback loop, further pushing up Bitcoin prices.

CryptoQuant data shows that the surge in stablecoin and Bitcoin transactions may provide a basis for BTC to rise in the coming weeks. Stablecoin liquidity continued to grow to a record $169 billion at the end of September, up 31% year-to-date (YTD). Tether's USDT is still dominant, with its market value increasing by $28 billion to nearly $120 billion, accounting for 71% of the market share.

Goldman Sachs Trading Department: The S&P 500 is expected to rise to 6,270 points by the end of the year. Data calculations from 1928 found that the median historical return of the S&P 500 between October 15 and December 31 was 5.17%. In the election year, the median return was even slightly higher than 7%, which means that the year-end level could reach 6,270 points.

K33 Analyst: Bitcoin futures premiums climbed to a 5-month high, and current institutional preferences indicate that they are increasing long positions.

CryptoQuant analysts said that the monthly growth rate of Bitcoin demand was the highest since April, and Bitcoin demand seems to be recovering.

a16z crypto report: The number of active addresses and usage of cryptocurrencies hit a record high. As of September, there were about 617 million cryptocurrency holders worldwide, with 60 million monthly active users. In 2024, monthly active crypto addresses will rise to more than 220 million, with Base topping the Ethereum EVM chain with 22 million addresses, while Solana dominates the non-EVM chain with more than 100 million addresses. This year also has the largest number of mobile wallet users, with the United States accounting for 12% of global users.

On October 17, the total net inflow of Bitcoin ETFs exceeded US$20 billion for the first time.

Matrixport: Mining stocks have performed poorly, and Bitcoin spot ETFs may become the best investment strategy. MicroStrategy has performed significantly better than other crypto assets with its strategy of borrowing to buy Bitcoin. This positive trend could continue to provide support for Bitcoin prices.

South Korea may soon allow Bitcoin spot ETFs, and the Financial Services Commission (FSC) of South Korea will take important steps to shape the country's cryptocurrency landscape, including discussions on allowing Bitcoin spot exchange-traded funds (ETFs) and allowing companies to open cryptocurrency exchange accounts.

Bull:

Standard Chartered: Bitcoin could reach $73,800 before the US presidential election in November, up 12% from current levels.

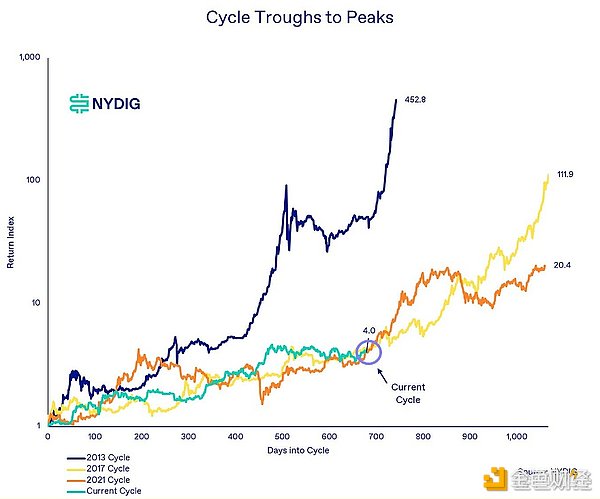

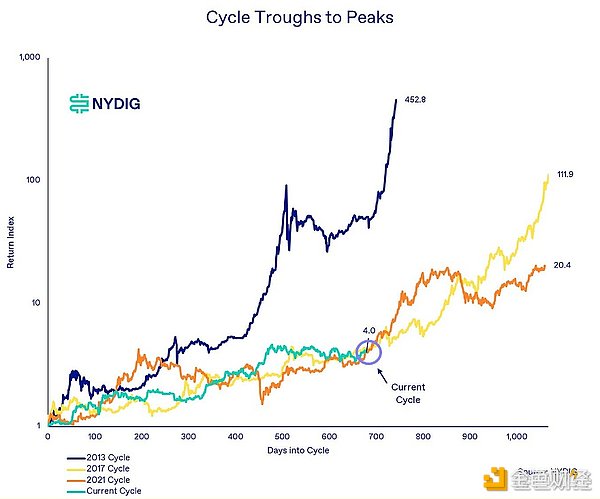

NYDIG: Bitcoin's performance is exactly the same as the previous two cycle levels, and Q4 may be the best performing quarter.

Analysts: Bitcoin's upward momentum is strong and is expected to break through $70,000 in a few weeks

Glassnode: Bitcoin's recent decline is relatively mild, consistent with the historical bull market pattern

Zerocap Chief Investment Officer Jonathan de Wet said in an investor report that Bitcoin's upward momentum remains strong and is expected to break through $70,000 in a few weeks, and pointed out that technical breakthroughs provide a solid foundation for further increases.

QCP Capital: Crypto asset prices are positively correlated with Trump's probability of winning. In addition, QCP expects that as global central banks enter a rate cut cycle, market liquidity will increase, driving risk assets up. The European Central Bank is expected to cut interest rates by 25 basis points tomorrow, the People's Bank of China continues to maintain an accommodative stance, and the Federal Reserve is expected to cut interest rates twice this year and four times in 2025.

Santiment: After BTC broke through $66,000, the market gradually became optimistic. , Traders are looking for opportunities in the GameFi and Memecoin sectors, and the discussion rate between these altcoin sectors shows a continued increase in interest levels.

CryptoQuant: Bitcoin has the potential to rise against the backdrop of falling US Treasury yields and rising gold. With the decline in 13-week US Treasury yields, gold has risen by nearly 5%, and Bitcoin may also benefit from this trend.

Top trader Eugene: Stop shorting and turn bullish. Short positions have been closed, and Bitcoin's open interest has disappeared as the price of BTC has risen, so it has flipped to long.

Victory Securities: Bitcoin's slow rise is waiting for spillover effects, the weak balance in the market has been broken, short-term holders have gradually increased their holdings, and the recovery phase may begin.

10T Holdings founder: US election results will not prevent Bitcoin from reaching $100,000.

21Shares analyst: CPI data will have a "favorable impact" on Bitcoin prices because borrowing costs will be lower. We expect market flows to recover after recent geopolitical tensions disrupted the financial landscape. ”

DWF Labs partner: The crypto market is recovering, no need to worry.

Negative factors and bearish views

Keywords: sell-off, regulation, geopolitics

On October 16, Arkham Research discovered that Tesla had transferred 11,509 bitcoins (worth about $770 million) to a new address, which appears to be the company's entire bitcoin reserve. These transfers took place in the past hour, and Tesla conducted six test transactions before these tokens were transferred. This is the first time Tesla has interacted with its Bitcoin wallet since Tesla sold most of its assets in 2022.

The company invested $1.5 billion in Bitcoin in February 2021. It is not clear what the purpose of the transfer is. Some people in the community believe that the company may be preparing to sell. Tesla will announce its third-quarter financial results after the close of trading on October 23.

CryptoQuant CEO said that if Tesla sells Bitcoin, the impact will be slightly more than half of the German government.

The US Supreme Court refused to hear Battle BornInvestments and others appealed for 69,370 bitcoins (worth $4.4 billion) related to the Silk Road, which means that these bitcoins may soon be auctioned.

QCP Capital: Geopolitical risks before the US election are the biggest hidden danger at present, especially the conflict between Iran and Israel.

Fed Kashkari: Bitcoin has been around for more than ten years, but it is still useless.

The situation on the Korean Peninsula continues to escalate. At around 12 noon local time on October 15, North Korea blew up parts of the Gyeongui Line and the East Sea Line connecting North and South Korea north of the military demarcation line between North and South Korea. Subsequently, the South Korean army retaliated against North Korea.

Trader Peter Brandt: Bitcoin's rally often occurs in the second half of the halving cycle, and market trends show potential downside risks. Bitcoin has not reached a new high for 30 consecutive weeks, and similar situations in history usually lead to price declines of more than 75%. At the same time, it warned that if Bitcoin falls below $48,000, its analysis will become invalid and the market needs to be reassessed.

Galaxy: Crypto venture capital has cooled down, with investment in the third quarter down 20% month-on-month and the number of transactions down 17%. In the first three quarters of this year, the crypto industry received a total of $8 billion in investment, and investment in 2024 is expected to be slightly higher than in 2023. Compared with the investment scale of more than $30 billion in 2021 and 2022, the current market heat has dropped significantly.

Trump economic adviser: potential new government will support a strong dollar, or limit the rise of cryptocurrencies

IntoTheBlock data showed that the total amount of high-risk loans (defined as loans within 5% of the liquidation price) rose to $55 million on Wednesday, reaching the highest level since June 2022. A loan within 5% of the liquidation price means that if the price of the collateral falls by 5%, it will no longer cover the loan, triggering liquidation.

Summary

The current BTC price continues to hit record highs, and the sentiment in the market is also mainly bullish, but most of the altcoins still have limited gains. Among the major track sectors, the Meme coin has the greatest wealth effect, while other narratives are slightly weak. Therefore, the overall bull market in the crypto market may still face great challenges.

Aaron

Aaron