Original: Liu Jiaolian

On a February day, the grass is growing and the orioles are flying, and the willows are brushing against the embankments intoxicated by the spring smoke.

In less than a week, it will be the second day of the lunar calendar. This crypto market is really full of grass and birds flying.

Not long ago, Bitcoin was furious and broke through the important mark of $60,000.

Breaking the barrier means breaking the circle, which will trigger the spread of the media outside the circle, and begin to attract a large amount of incremental attention and funds.

While Bitcoin is taking a breather, copycats are beginning to compete with each other.

However, Bitcoin seems unwilling to give copycats too many opportunities to shine, so it started to rise again today, breaking 65k, setting a new high and continuing to lead the rise!

Just as Jiao Lian previously discussed: "If you look at it from the perspective of breathing theory, it is still just approaching the surface (not yet), and the breath is almost exhaling all the breath of the 2021 bull market. What if we don’t inhale more air above the mid-orbit and crash down suddenly without breathing out underwater? It doesn’t seem very reasonable.”

A Planet member asked : Is Bitcoin’s endgame (beyond) gold? That is, a scale of US$10 trillion.

Teacher’s answer: Beyond gold may not be the end.

On the contrary, surpassing gold may be just the beginning of a good show.

Hal Finney, the cryptographer who was the first to come into contact with Satoshi Nakamoto and participate in BTC, estimated as early as 2009 that BTC might eventually reach $10 million.

Looking closely, Hal Finney’s benchmark is the scale of real estate in the world.

However, Jiaolian feels that whether it is benchmarked against gold or against real estate, it may not be enough to describe the full potential of BTC. What limits our thinking is that we can only use known things to imagine a future full of huge unknowns!

Jiaolian believes that the end of Bitcoin may be equal to the sum of all remaining values of mankind!

In the future, everything that has the property of storing value today, including but not limited to legal currency, houses, stocks, gold, etc., will undergo "de-Storage of Value" (de-SoV- ization - a new word for teaching chain synthesis), return to their respective use values, and no longer assume the function of value storage for humans. The value storage function will all be attributed to BTC and carried by it.

Bitcoin’s mission will not end until humans are still “Earthlings” and fail to leave the Earth and immigrate to Mars or other galaxies.

After Homo sapiens evolves from an earth species to a star species, it is temporarily unpredictable how to overcome problems such as the limited speed of light and Bitcoin data synchronization delays.

The other day, I asked the children if they knew, as Homo sapiens, which organ in the body distinguishes us from all other animals and makes us the top predator on the earth?

The children answered first: It is the brain.

I raised my hand and waved it and said: No. Think again?

The children were slightly hesitant and asked tentatively: Is it a hand?

I smiled: Yes. It's our hands.

When apes evolved hands with opposable thumbs, they had the most powerful violent organ on the planet.

After Homo erectus stood up, the hominid's last natural enemy - the direcat - became extinct forever. All the original surface predators were defeated by the absolute strength of human beings' super throwing power. The cry of human babies has become a deep fear engraved in the genes of all medium and large terrestrial animals on the earth.

In order to cope with the flexible use of hands, the human brain has evolved rapidly. Homo sapiens was born.

The dexterous work of human hands does not create or destroy existing material elements in the universe, but only arranges and combines various atoms to reshape their shapes.

2 to 3 million years ago was the Stone Age of human society. The main component of stone is silica. Human beings use their dexterous hands to reshape silica into various useful forms, such as stone knives and stone axes.

Human civilization has entered the silicon-based era.

Compared to other animals, the "human" who plays with silicon (Si) best wins.

3000-5000 years ago, humans learned to make iron tools. However, it took until the Industrial Revolution in the 18th century for civilization to enter the age of steel. The torrent of steel is on the battlefield and on the road. Steel production has become an important indicator of whether an industrial country is strong or not.

Although silicon (the main material of houses) is still important, iron (Fe) is the fundamental determinant of national strength.

Human beings have molded iron atoms into missiles, aircraft carriers, cars, and industrial robots...

Human civilization has entered the iron-based era.

The country that plays iron best wins.

Decades to a few years ago, computers, the Internet, mobile phones, AI (computing power chips), mining machines (computing power chips), and the torrent of information technology were reshaping the shape of human civilization. The main element of the chip is silicon (Si).

Human beings have refocused their attention on silicon atoms, extracted them from the sand, and used lasers to carve various circuits on them to turn them into computing chips.

The stock prices of the companies that make the best use of silicon have skyrocketed. For example, NVIDIA.

Human civilization is spiraling upward, and this is true: from the era of silicon-based civilization to the era of iron-based civilization, now, the silicon-based era is beginning again.

Silicon is a non-metal. The best currency that ancient humans who did not understand metal could find was some non-metallic currency, such as shells.

Iron is a metal, so modern humans who understand metals gradually discovered that gold, which is also a metal, is a better currency in the era of iron-based civilization.

When humans re-recognized silicon and learned that silicon is a semiconductor, chips based on ultrapure silicon gave information a digital form - bits, and finally Bitcoin was born in 2008-2009. .

Compared with shells, gold is a currency with a cultural difference. Compared with gold, Bitcoin is also a currency with a cultural generation gap.

Silicon atoms are still silicon atoms, but chips are no longer stone bricks.

People who believe in houses and people who believe in BTC belong to completely different civilizational eras. It's normal to not be able to talk!

All civilizations were created by the labor of human hands.

Labor transforms people.

And all this is because humans have evolved hands that are different from any other animal, hands that are dexterous and suitable for labor.

When the material materials obtained by the hard work of these hands just meet people's own needs, there is nothing left. However, if something unexpected happens, the basic volatility of nature will kill people.

So people work harder, work as hard as possible, and produce more than they need at the moment to prepare for a rainy day.

It is human instinct to plan ahead. Most animals are satisfied with this meal and look for another meal. Only humans will think about what they will eat in the future while eating this meal.

Progress in productivity has become the eternal pursuit of mankind.

We produce more than we consume. When the unified weight and measure of money is used to measure this excess production, it is reflected in the fact that the money earned exceeds the money spent, and the income exceeds the expenditure. The same goes for businesses.

People even invented an idiom, "living within one's means", and regarded it as a virtue.

Entrepreneurs want to pursue profits, and currency speculators want to buy low and sell high. They are essentially external manifestations of the same human instinct.

When the money earned exceeds the money spent, and when the income exceeds the expenditure, savings are formed.

However, Keynes put forward a surprising point: Savings is an individual virtue, but it is an overall crisis.

Just imagine, if everyone produces more than they consume, then when everyone adds up, total production must be greater than total consumption. This total excess production cannot be sold, resulting in overcapacity, which in turn triggers a capitalist economic crisis.

Keynes said in his "General Theory" (full name "General Theory of Employment, Interest and Money") that the matter of saving is not so much that the person wants to postpone today's consumption until the future. People just decide not to consume today.

If I eat one less bowl of noodles today and eat it again tomorrow, the bowl of noodles I eat tomorrow will definitely not be the same bowl of noodles I eat today. Today's bowl of noodles will either be eaten by another person, or it will be too much.

The boss who sells noodles will inevitably hope to sell as much noodles as possible. Because labor is the least durable resource. If it is not used today, it cannot be postponed to tomorrow. Time will never come again, just seize the day.

After reasoning to the extreme, everyone decided to eat one less bowl of noodles today and save the money. There would be an absolute surplus of noodles, and the ramen man’s labor today would be wasted.

Saving money, the so-called stored value, is by no means the same as saving materials. By saving money, nothing material is being preserved for future use.

Saving money means reducing consumption. Reducing consumption will lead to two consequences: either, producers will produce at a loss, resulting in overproduction; or, producers will live within their means and reduce production, resulting in economic recession.

Therefore, the solution proposed by Keynes is to start with the elimination of savings - although this may seem very counter-intuitive at first glance!

Obviously, mathematics is ruthless. If you want to balance production and consumption to make them equal, you will inevitably need some people, companies, or institutions to consume more than they produce. In other words, not only will there be no savings, but you will also need to borrow money for consumption!

In other words, the original formula: production - consumption = surplus> 0

Now using monetary means to promote loan consumption, the formula becomes: production - (consumption + debt consumption) = 0

The remaining question is who will bear this heavy debt? Is it the government with deficit spending, or the residents taking out loans to buy houses?

But Keynes’s solution eliminated the virtues of human honesty and frugality from the bottom of the economic foundation, and allowed the sickle of finance to harvest the surplus of the entire society, inspiring excessive currency issuance, consumerism, and credit bubbles. issues such as the cycle and the sharp increase in the gap between rich and poor.

There may be another solution to this problem!

Before the birth of this solution, the solutions people thought about were all based on the idea of "redistributing surplus". There are actually two mainstream ideas: one is to redistribute surplus according to power; the other is Keynes's redistribution of surplus according to debt capacity and consume the surplus.

If there is such a kind of production, from the perspective of consumption, it does not produce anything at all, but purely consumes the materials and energy required for production, and its consumption can be automatically and dynamically adjusted to make it It always happens that the remaining capacity is "wasted", then production and consumption can return to balance.

In fact, the information industry, content industry, and AIGC industry are also a way to "waste" excess material production capacity. Unfortunately, since people only have 24 hours in a day, there is a ceiling for human consumption of content. ! After information explosion and information overload, AI with more productivity has now appeared, and the content industry itself has fallen into the dilemma of overcapacity. For example, a large number of up owners have withdrawn, and a large number of tail creators have difficulty making any money. These are all signs of excess.

Let’s temporarily call this special production mentioned above “POW”.

So the original formula: production - consumption = surplus> 0

will become: (production - POW) - consumption = 0

Unbalanced The formula is balanced!

It can be seen that in the final balance formula, the "capacity" of "POW" is exactly equal to the "surplus" of the original formula.

The European labor movement in the 19th century was also an attempt to force a balance between production and consumption through the elimination of production. However, what is very different from the "POW" we mentioned is that the European workers' movement smashed the machine, which was a kind of destruction (in this sense, isn't the war an ultimate rebalance - a destructive rebalance? ); and "POW" is not only not a kind of destruction, but also a kind of production!

The destruction of the means of production is obviously waste. From a cosmic perspective, without making any value judgments, there is really no difference between consumption and waste. They are both the dissipation of value and the increase of entropy.

The so-called production activities of human beings also consume energy and cause an increase in entropy for the universe. However, unlike consumption or waste, production activities will cause a decrease in entropy locally - that is, for the universe Labor objects such as atoms and bits are organized in an orderly manner.

Gold mining is actually a production activity with extremely high net energy consumption. However, unlike gold mining, when gold mining is expanded, more gold will be mined, and the output of this "POW" will not increase with the increase in production capacity, even within any time window. No matter how much capacity one puts into it, one cannot increase or decrease its output!

When its output reaches an upper limit, it will continue to consume production capacity without producing any output, thus truly becoming a net consumption type of production.

The product of this special production "POW" that consumes net production capacity has a name that everyone is familiar with - BTC (Bitcoin).

"POW" consumes energy but does not produce anything practical for consumption. It just uses a value symbol BTC to mark the results of this production activity, and BTC does not follow the production capacity. Expansion increases, but it is a limited quantity with an upper limit, and the difficulty of production is adjusted to consume any large production capacity. Its limited quantity can ensure that human desires will never be satisfied and there will never be any surplus problems.

In the more than ten years since the birth of Bitcoin, countless economists, and even Nobel Prize winners in economics, have repeatedly criticized Bitcoin as having no practical value and being a pure waste.

They were dead wrong! As economic researchers, they have long forgotten the fundamental problems in economics that the founders of economics were awake at night and diligently trying to solve.

Bitcoin, precisely in the era after Keynes, is most likely to be the answer to completely solve this fundamental economic problem that has plagued human civilization for hundreds of years!

This solution does not require any person or government department to bear a heavy debt burden, nor does it require the destruction and destruction of the means of production and wealth accumulated by mankind. Therefore, there is no need for bankruptcy or violence. Revolution, without the need for bloody wars, can completely consume excess production capacity and allow the inherently unbalanced economic system of mankind to automatically maintain balance.

When humans finally realize the great significance of BTC production, we can get from the above final balance formula: (production - POW) - consumption = 0:

BTC stored value = POW net consumption = production - consumption = surplus

This transformed formula is a clear and clear statement of the end of Bitcoin: the total value of BTC will be equal to the sum of the value of all human surplus!

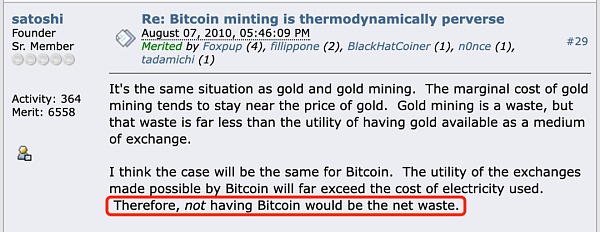

The production of BTC is not a waste. On the contrary, it is also counterintuitive at first glance. The production without BTC will produce greater waste. As the inventor of Bitcoin, Satoshi Nakamoto, pointed out on August 7, 2010: "Not having Bitcoin would be the net waste."

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Coinlive

Coinlive  Cointelegraph

Cointelegraph