Comprehensive source: coindesk and cointelegraph

Compiled by: Qin Jin

On March 11, Bitcoin traded in Asia It broke through $71,000 for the first time during the period, which is a new price record set by Bitcoin. Bitcoin has been rising steadily since the Bitcoin spot ETF was approved in the United States on January 11. Ethereum breaks above $4,000.

The rally has pushed the annualized premium rate for three-month futures on major exchanges including Binance to more than 25%. Higher premiums may attract cash-out and arbitrage traders, thereby increasing overall market liquidity.

There are three reasons behind Bitcoin’s breakthrough of $71,000. First, the London Stock Exchange decided to accept applications for Bitcoin and Ethereum Exchange Traded Notes (ETNs). . Britain's Financial Conduct Authority on Monday opened the door for institutional investors to create crypto-asset-backed exchange-traded notes. The London Stock Exchange subsequently confirmed that it will accept applications for Bitcoin and Ethereum ETNs in the second quarter of this year.

The founder of communications service company LondonCryptoClub said that the rise of Bitcoin and Ethereum is the result of the superposition of multiple factors. The London Stock Exchange just announced that it will accept applications for Bitcoin and Ethereum ETNs, and Asia is buying in the illiquid market, adding to the continued positive news. The strong supply and demand dynamics of Bitcoin ETFs continue unabated.

Meanwhile, what had been a macroeconomic headwind is now a tailwind as U.S. interest rates and the dollar appear to have peaked and are turning lower. Additionally, as we approach key resistance levels, short-term speculative traders attempt to buy at the top, short at these key resistance levels, and then get cleared out, creating a false negative gamma effect that drives Bitcoin higher.

The second is the lack of liquidity in Asian markets. Japan’s Nikkei and Australia’s ASX fell 2% after a Reuters report said the Bank of Japan may raise its benchmark interest rate above zero this month. Some analysts have long warned that the Bank of Japan is a major source of uncertainty in traditional and cryptocurrency markets. Nonetheless, due to the supply and demand imbalance caused by recent large inflows into U.S.-listed Bitcoin spot ETFs, coupled with the Bitcoin halving, the market consensus is that any Bitcoin decline is likely to be short-lived.

Finally, institutional interest in the Bitcoin ETF launched in the United States is increasing. According to Dune data, since the launch of the Bitcoin ETF, ETF issuers have accumulated 4.06% of the current Bitcoin supply, with total on-chain holdings exceeding $56.9 billion. At this rate, the ETF is expected to absorb 8.65% of BTC supply annually.

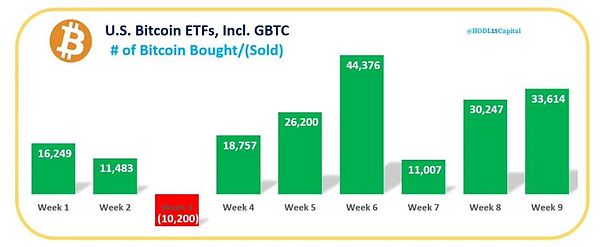

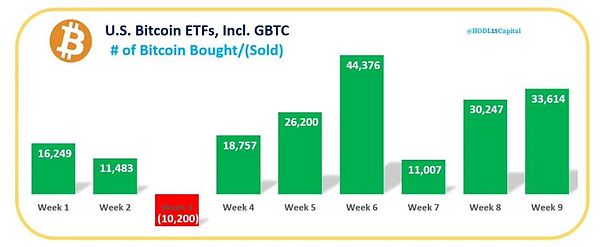

According to HODL15 Capital data, spot Bitcoin ETFs accumulated a total of 33,000 BTC (approximately $2.3 billion) last week, including Grayscale’s GBTC fund, which The outflow of funds exceeded 10,200 BTC.

Digital asset management company Bitwise said in an investment report sent to investors on March 9 that it expected that by the end of June, more institutions representing "trillions of dollars in assets" would be ready to buy Bitcoin spot ETFs.

At the same time, Bitcoin "whales" continue to hold Bitcoin despite the price reaching new highs. As of March 9, the number of unique addresses holding at least 1,000 BTC has risen to 2,107. However, this is still lower than the record of 2,489 addresses set in February 2021, when Bitcoin was trading above $46,000.

JinseFinance

JinseFinance