Author: James Butterfill Source: CoinShares Compiler: Shaw Golden Finance

In an era of economic uncertainty, rising national debt, increasing inflationary pressures, and heightened geopolitical tensions, governments are re-examining the composition of their strategic reserve assets. Traditionally, commodities such as gold, foreign exchange, and oil have been buffers for stabilizing the economy and hedging against crises. Bitcoin, a decentralized, limited-supply digital asset launched in 2009, is now gaining attention. The United States established a strategic reserve of Bitcoin in March 2025, a move that marked a key turning point and sparked a global discussion about the role of Bitcoin in national reserves. We will explore the economic rationale for Bitcoin as a strategic reserve asset, weigh its pros and cons, and draw on recent developments, academic research, and global trends.

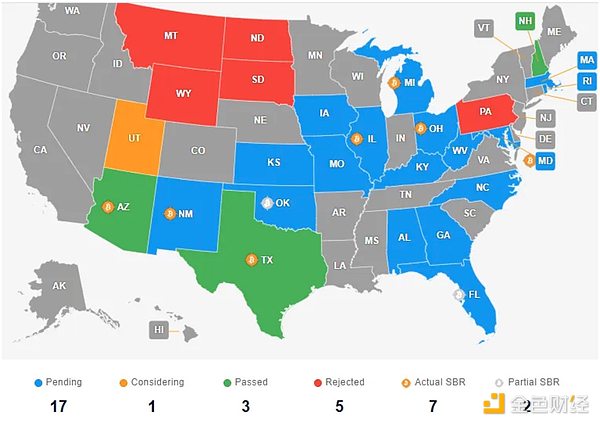

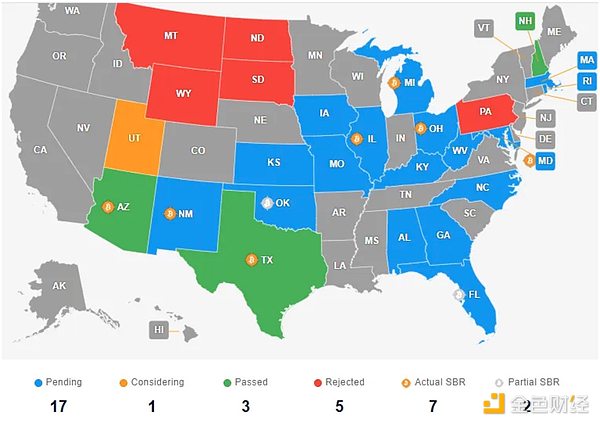

Central banks hold strategic reserve assets to ensure economic stability, manage the balance of payments, and enhance resilience in times of crisis. Gold, valued at $2.2 trillion in central bank reserves and $12.3 trillion in foreign exchange reserves worldwide as of the first quarter of 2024, is the cornerstone of this system. These assets can hedge against inflation, diversify risk, and reflect economic credibility. Bitcoin, with its fixed supply of 21 million coins and censorship-resistant blockchain technology, is gradually becoming a complement to traditional assets. Driven by Bitcoin's unique properties and the evolution of the global financial landscape, countries such as El Salvador, Brazil, and now the United States are leading this transformation. We have also seen some US states, such as New Hampshire, pass HB 302 to establish the first US Bitcoin and digital asset reserve. Arizona has also proposed a similar proposal, which was recently approved by the governor, indicating that state officials are gaining interest in Bitcoin. Texas also recently passed Senate Bill 21, which formally established the Bitcoin Strategic Reserve Fund, which is independent of state finances.

Source: bitcoinreservemonitor.com

Source: bitcoinreservemonitor.com

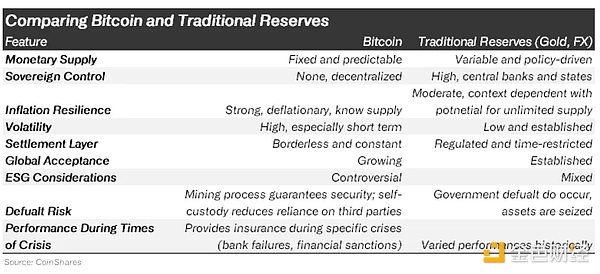

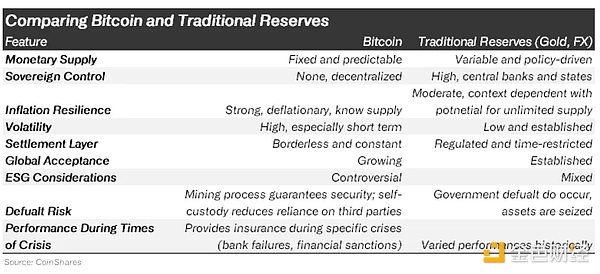

Why have governments, which have always been cautious, begun to compare Bitcoin with traditional assets such as gold and foreign currencies? The answer lies in structural dynamics rather than speculative enthusiasm.

How Bitcoin is Different

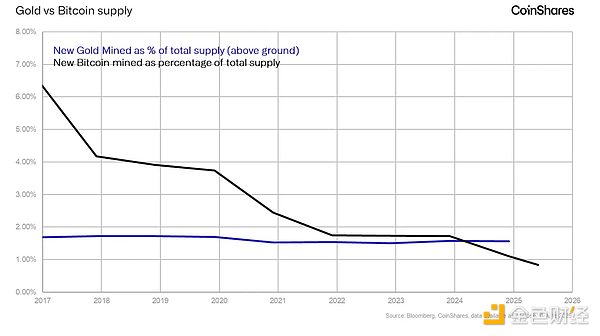

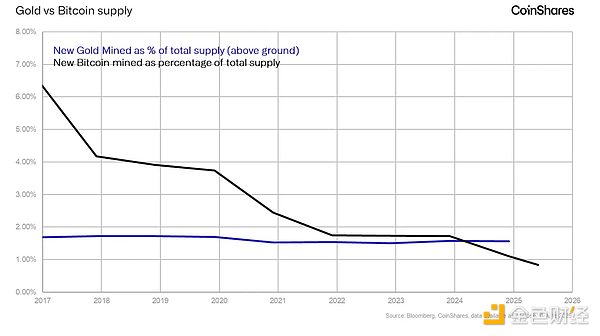

Unmanipulable Scarcity: Bitcoin’s supply is capped at 21 million. Unlike fiat currencies or even gold, this fixed cap is not subject to political decisions. It provides predictability during a period of sustained balance sheet expansion.

Since its creation in 2009, Bitcoin’s annualized inflation rate has fallen from 50% to around 0.83% after the 2024 halving, while global fiat currencies have averaged 2%-5% annual inflation (or even higher in hyperinflationary economies such as Venezuela). From 2009 to date, Bitcoin’s price has risen an average of 165% per year, outperforming traditional assets such as gold (7.6% annual return) over the same period.

Reliable inflation hedge: US inflation rises by about 20% between 2020 and 2024. During the same period, Bitcoin’s value has increased by more than 1,000%. This is more than just a correlation, it reflects the increased demand for assets that can protect against currency depreciation.

Reliable inflation hedge: US inflation rises by about 20% between 2020 and 2024. During the same period, Bitcoin’s value has increased by more than 1,000%. This is more than just a correlation, it reflects the increased demand for assets that can protect against currency depreciation.

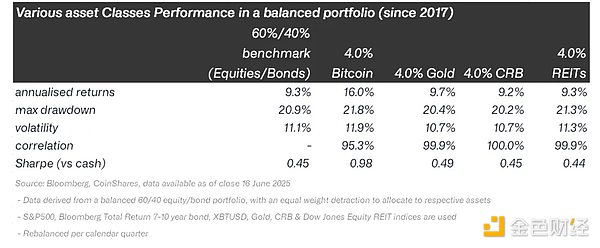

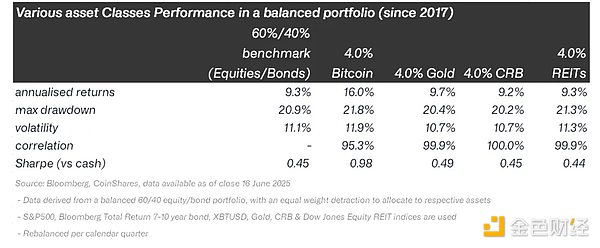

True portfolio diversification: Bitcoin’s low correlation with traditional assets makes it an effective diversification tool. Even with higher volatility, a modest 4% allocation can improve the overall Sharpe ratio of a reserve portfolio. Central banks are already starting to mimic these advantages.

Resilience to Sanctions: Bitcoin cannot be seized or frozen. In a world where access to global financial infrastructure is sometimes restricted for political reasons, Bitcoin provides sovereign flexibility. It helps protect countries facing geopolitical constraints.

Resilience to Sanctions: Bitcoin cannot be seized or frozen. In a world where access to global financial infrastructure is sometimes restricted for political reasons, Bitcoin provides sovereign flexibility. It helps protect countries facing geopolitical constraints.

Strategic Advantages: Bitcoin is a globally recognized, borderless asset that can be transferred instantly without relying on intermediaries such as banks or SWIFT. This is critical for international trade, remittances, or reserves in countries with unstable financial systems.

Signal of Technological Credibility: Owning Bitcoin shows that a country is engaging in financial innovation. This is both a sign of awareness and a sign of willingness. This is more than just a currency hedge, it is also a demonstration of leadership in a changing financial landscape.

Signal of Innovation: Bitcoin adoption positions a country as a leader in the digital economy, attracting investment and promoting innovation. The United States' strategic Bitcoin reserve reflects its forward-looking policies. This is in line with El Salvador's adoption of Bitcoin in 2021, raising its global tech profile. In a world that is transitioning to digital finance, Bitcoin fits in with the technological evolution of money, unlike static traditional reserve assets.

Crisis Resilience: Bitcoin's decentralized nature makes it immune to the impact of a breakdown in the traditional financial system, such as a bank default, sovereign debt crisis, or currency collapse. Its cryptographic security ensures that value can be stored without trust.

Silicon Valley Bank collapsed (March 2023), Bitcoin rose 40% from $20,000 to $28,000 in two weeks, while US bank stocks fell 25% over the same period, and many of our clients expressed the need for an asset that is not correlated to the financial system.

During the 2022 Russia-Ukraine conflict, Bitcoin was used to circumvent financial sanctions and capital controls. Ukrainian NGOs and individuals received over $100 million in Bitcoin donations, demonstrating its usefulness in crisis situations where the traditional financial system is constrained.

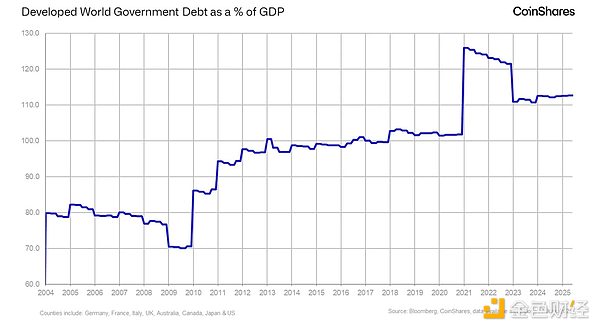

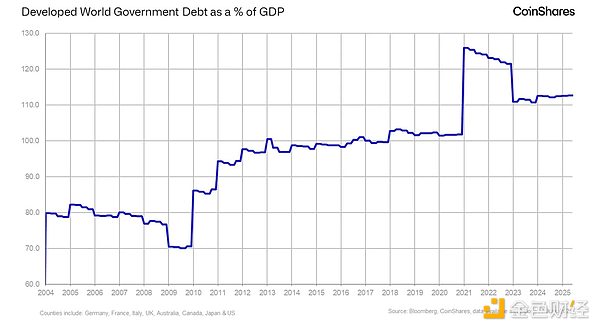

In a world of rising sovereign debt (US debt is 115% of GDP), Bitcoin offers a non-sovereign alternative that is not subject to default risk or quantitative easing.

Technical resilience: Since 2009, the Bitcoin network has had an uptime of 99.98%, and the core protocol has never been successfully hacked. Its hash rate (the computing power that ensures network security) reached about 900 EH/s in 2025, making it the most secure blockchain by computing power standards.

Technical resilience: Since 2009, the Bitcoin network has had an uptime of 99.98%, and the core protocol has never been successfully hacked. Its hash rate (the computing power that ensures network security) reached about 900 EH/s in 2025, making it the most secure blockchain by computing power standards.

Bitcoin's resistance to network attacks and its global node distribution make it a robust long-term store of value compared to centralized systems that are vulnerable to single points of failure. Its increasing security is reflected in the growth of its hash rate, which has risen from 1 EH/s in 2016 to 900 EH/s in 2025.

Understand the Risks

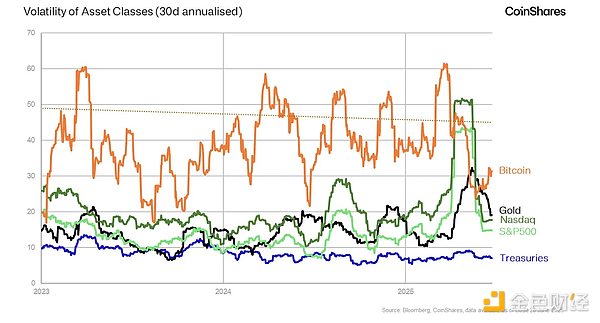

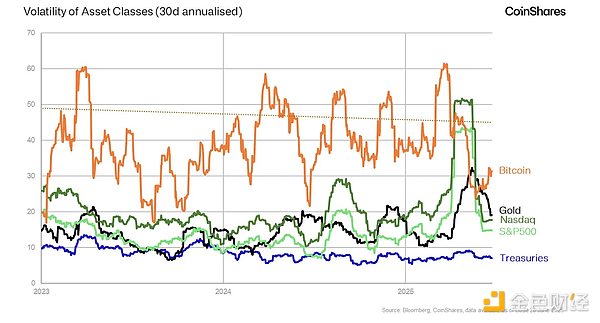

Volatility: Bitcoin remains volatile. This is because it is a relatively young asset compared to other asset classes. While its volatility makes reserve management more complex, its volatility recently fell below that of gold for the first time. As Bitcoin matures as an asset and its fundamentals become better understood, its volatility is likely to decline further.

Limited Settlement Applications: Although Bitcoin is widely accepted, it is not widely used for trade settlement. This limits the direct application of Bitcoin unless it is supported by a broader infrastructure (such as a stablecoin or payment platform).

Limited Settlement Applications: Although Bitcoin is widely accepted, it is not widely used for trade settlement. This limits the direct application of Bitcoin unless it is supported by a broader infrastructure (such as a stablecoin or payment platform).

Regulatory Uncertainty: Not all jurisdictions have a clear stance on Bitcoin. This can create complexity for reserve managers, especially in international arrangements.

Lack of Flexibility During Crisis: Bitcoin’s fixed supply means that its supply cannot be increased in an emergency. This limitation is part of its appeal, but it also prevents it from being used as a countercyclical tool like fiat currencies.

How Bitcoin Compares to Traditional Reserves

Central Banks Should Hold Bitcoin

For countries seeking economic resilience in the digital age, Bitcoin offers a forward-looking option. Its ability to hedge against inflation, diversify portfolios, and hedge against geopolitical risks makes it a powerful complement to gold and foreign exchange reserves. With a $35 trillion national debt and bipartisan support, the United States has included Bitcoin in its reserve system in 2025, indicating that its acceptance is growing, but economists remain skeptical about its speculative nature.

The global financial system is under pressure, and rising debt, persistent inflation, and geopolitical rifts require new tools. The US 2025 reserve adjustment, Brazil's RESBit proposal, and Russia's exploration all reflect a game theory competition around ensuring the limited supply of Bitcoin. Central banks already hold $2.2 trillion in gold and $12.3 trillion in foreign exchange, but these assets have limitations: gold's physical limits and foreign exchange are subject to centralized policies. Bitcoin's $2 trillion market value and growing institutional adoption make it a viable supplement.

Alex

Alex

Reliable inflation hedge: US inflation rises by about 20% between 2020 and 2024. During the same period, Bitcoin’s value has increased by more than 1,000%. This is more than just a correlation, it reflects the increased demand for assets that can protect against currency depreciation.

Reliable inflation hedge: US inflation rises by about 20% between 2020 and 2024. During the same period, Bitcoin’s value has increased by more than 1,000%. This is more than just a correlation, it reflects the increased demand for assets that can protect against currency depreciation.  Resilience to Sanctions: Bitcoin cannot be seized or frozen. In a world where access to global financial infrastructure is sometimes restricted for political reasons, Bitcoin provides sovereign flexibility. It helps protect countries facing geopolitical constraints.

Resilience to Sanctions: Bitcoin cannot be seized or frozen. In a world where access to global financial infrastructure is sometimes restricted for political reasons, Bitcoin provides sovereign flexibility. It helps protect countries facing geopolitical constraints.  Technical resilience: Since 2009, the Bitcoin network has had an uptime of 99.98%, and the core protocol has never been successfully hacked. Its hash rate (the computing power that ensures network security) reached about 900 EH/s in 2025, making it the most secure blockchain by computing power standards.

Technical resilience: Since 2009, the Bitcoin network has had an uptime of 99.98%, and the core protocol has never been successfully hacked. Its hash rate (the computing power that ensures network security) reached about 900 EH/s in 2025, making it the most secure blockchain by computing power standards. Limited Settlement Applications: Although Bitcoin is widely accepted, it is not widely used for trade settlement. This limits the direct application of Bitcoin unless it is supported by a broader infrastructure (such as a stablecoin or payment platform).

Limited Settlement Applications: Although Bitcoin is widely accepted, it is not widely used for trade settlement. This limits the direct application of Bitcoin unless it is supported by a broader infrastructure (such as a stablecoin or payment platform).