Author: Matt Hougan, Chief Investment Officer of Bitwise; Compiled by: 0xjs@金财经

Bitcoin needs three factors to reach a record high in 2024; another factor may accelerate Bitcoin’s development .

I am often asked to predict prices. Sometimes I even give predictions. For example, late last year we predicted that Bitcoin would double by 2024 and trade above $80,000.

I still think this is true.

But The price prediction is conditional. They depend on what's going on in the world. With this in mind, I believe the following conditions would need to be met for my Bitcoin price prediction of $80,000 to come true:

The good news is, there aren’t many conditions.

Conditions for Bitcoin to rise to $80,000

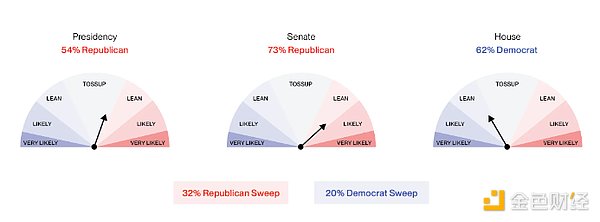

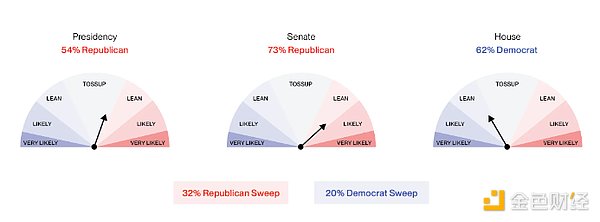

1. Election: As long as the Democratic Party does not win a big victory

The US election is of great significance to cryptocurrency. Most people see this as a binary outcome: Trump = good, Harris = bad.

There is no doubt that a Republican victory bodes well for cryptocurrencies, given their strong support for cryptocurrencies. I think it's more nuanced on the Democratic side.

Democrats have wildly different views on cryptocurrencies, from the “anti-crypto brigade” of Sen. Elizabeth Warren (D-Mass.) to Rep. Ritchie Torres (D-Mass.) New York State Democratic Party). The problem over the past four years has been that Warren’s faction has controlled policy and agency appointments, creating a hostile environment for the industry.

Bitcoin does not need politicians to thrive. It just requires politicians to go away. I doubt they will unless the Democrats sweep both houses of Congress and the White House,at which point the Democrats will take a more neutral stance on the industry.

You can already read the comments from Maxine Waters (D-Calif.), the top Democrat on the House Financial Services CommitteeSeeing Democrats surrender to this reality, she recently said, "Cryptocurrencies are inevitable." We received $80,000 in Bitcoin. (It is worth mentioning that Polymarket currently believes that the probability of a Democratic victory is 20%.)

Polymarket Forecast: The balance of power after the 2024 election

Source: Bitwise Asset Management, data from Polymarket. Data as of October 8, 2024.

Source: Bitwise Asset Management, data from Polymarket. Data as of October 8, 2024.

2. Economy: Two interest rate cuts + continuous global stimulus measures

People are attracted to Bitcoin The number one reason is simple: you don't trust the government and its currency. This idea gave birth to Bitcoin in 2008 and remains a powerful driver of cryptocurrencies today. It is so widely accepted that even BlackRock uses it in its marketing pitch for Bitcoin.

This is why cryptocurrencies rallied despite the Fed cutting interest rates by 50 basis points despite a growing U.S. economy; and why cryptocurrencies rallied after China launched a 2 trillion yuan economic stimulus package in late September. The currency surged.

The market is hungry for more stimulus measures. The market currently expects the Federal Reserve to further relax its policy by 50 basis points before the end of the year, and China will also launch more fiscal stimulus measures.

If both are realized at the same time, I estimate that we will have a rebound in the fourth quarter. If not, I think disappointment could weigh on the market.

3. Cryptocurrency: No Major Negative Surprises

The last thing we need to achieve a new high of $80,000 is to ensure a period without major surprises. No major hacks. There are no large-scale new lawsuits. There are no previously locked tokens suddenly entering the market.

Unfortunately, the history of cryptocurrency is filled with countless such surprises. Over the past few quarters, we have been in a range-bound situation as previously locked Bitcoin was released from bankrupt exchange Mt. Gox and government coffers.

If we can get through the end of the year without a similar shock, I expect record highs and beyond.

How else can I help? Altcoins

Some Bitcoin users may hate me for saying this, but I think the broader cryptocurrency rally will help with this prediction.

To be clear: Bitcoin’s long-term success does not require Ethereum, Solana, or new altcoins. In fact, it is often victimized by shenanigans in the altcoin space. But if we're going to see a full-blown rally in the short term — say to $100,000 in just a few months — then it would be helpful to have some pro-crypto sentiment sweep through the market.

The last long-term period of volatility I recall for Bitcoin was from June 2019 to June 2020, when Bitcoin was trading in a tight range of $8,000 to $10,000 (except during fell briefly during the COVID-19 pandemic). In late summer 2020, Bitcoin began to rise and headed straight for $60,000. Much of this is driven by COVID-era stimulus, but some is, for lack of a better word, sentiment. Specifically, the “DeFi Summer” of 2020 gave investors a reason to get excited about cryptocurrencies again, and some of those animal spirits spilled over to Bitcoin.

Except for Bitcoin, these animal spirits have been scarce this year. But I can almost see them rising in areas like stablecoins, whose AUM is hitting all-time highs; new high-throughput blockchains, where the community is rallying around projects like Sui, Aptos, and Monad; and innovative projects like Babylon , which is looking into ways to allow Bitcoin investors to earn from staking. Strong and sustained momentum in these areas will enhance a melt-up scenario.

Conclusion

It is worth remembering that Bitcoin has performed quite well this year. It's one of the best-performing assets globally, up 49%, and its news flow is very strong. We’ve already seen a Bitcoin ETF launch and become the best performing ETF of all time. We have already seen widespread institutional adoption, with 60% of large hedge funds currently holding Bitcoin. We’ve also seen Bitcoin enter the mainstream political conversation in a way that was unimaginable just a few years ago. Two years ago FTX was imploding and Sam Bankman-Fried was making headlines; today Larry Fink is on TV talking about Bitcoin taking over the world.

All of this suggests that regardless of how the news develops, Bitcoin can reach $80,000 (or more) next year. But if we want to get there by the end of the year, the playbook above might help.

Weatherly

Weatherly

Source: Bitwise Asset Management, data from Polymarket. Data as of October 8, 2024.

Source: Bitwise Asset Management, data from Polymarket. Data as of October 8, 2024.