Author: Grapefruit, ChainCatcher

On May 29, the asset size of BlackRock's iShares Bitcoin Spot ETF IBIT has surpassed Grayscale's GBTC, becoming the world's largest Bitcoin spot ETF with the largest BTC holdings.

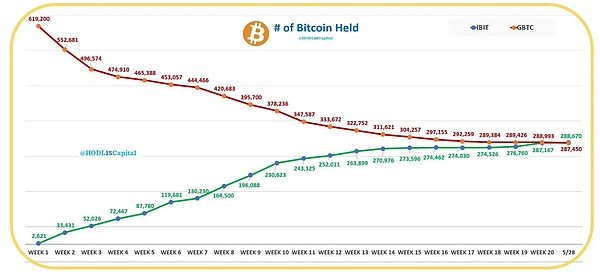

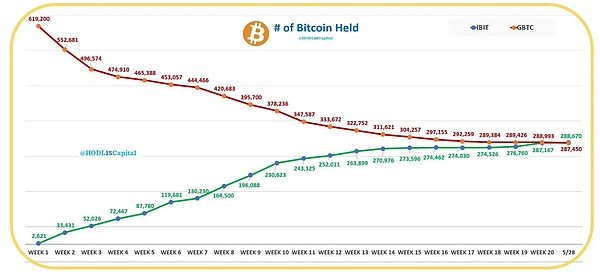

According to HODL15Capital data, on May 28, BlackRock's Bitcoin Spot ETF IBIT inflowed about $102 million (1,503 BTC), and the number of BTC held has exceeded 288,670, equivalent to about $19.795 billion.

On the same day, the funds managed by Grayscale's GBTC outflowed more than $105 million (about 1,543 BTC), which was the largest day of fund outflow in the past two weeks. GBTC held about 287,450 BTC, worth $19.758 billion.

The BTC scale of IBIT's assets under management has officially surpassed GBTC, and is more than $30 million ahead of GBTC, becoming the world's largest Bitcoin spot ETF with the largest BTC holdings.

Four months after its launch, IBIT has attracted about $20 billion

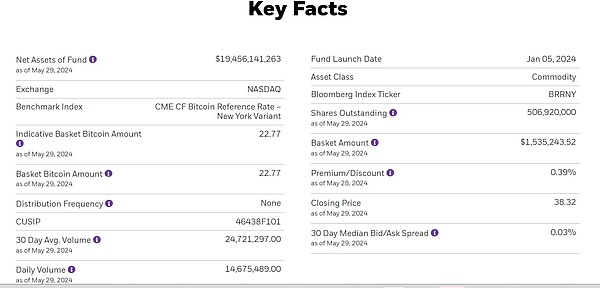

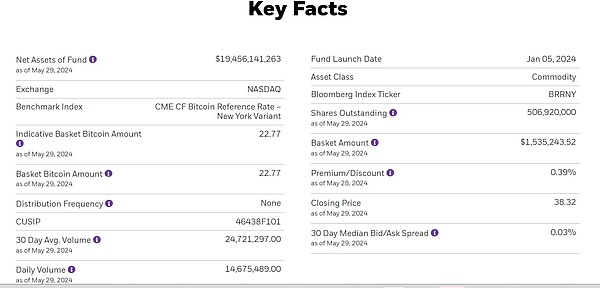

According to data from BlackRock's official website, as of May 30, IBIT's average daily trading volume in the past 30 days was $24.72 million.

Since its launch on January 11, IBIT has successfully attracted BTC worth about $20 billion in just four months, making it one of the fastest growing ETFs in history.

Regarding IBIT's excellent performance in such a short period of time, Eric Balchunas, an ETF analyst at Bloomberg, said in an article that IBIT is a legend. In history, only one ETF has reached an asset size of US$20 billion in less than 1,000 days. JEPI took 985 days to do so, while IBIT only took about 137 days to achieve the same scale.

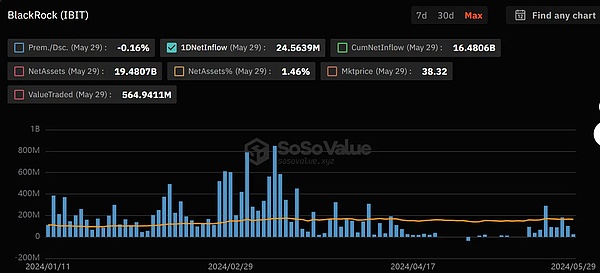

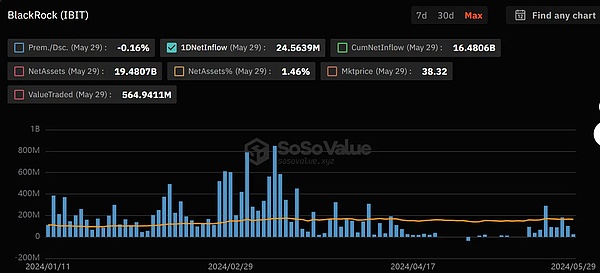

According to SoSoValue data, IBIT has seen positive inflows for more than three consecutive months since it went online on January 11 until mid-April.

Among them, the funds that flowed in on the first day of listing exceeded $110 million, when the BTC price was $46,000; on March 12, the amount of funds that flowed in reached the highest level, about $848 million, and the next day (March 13), the BTC price hit a historical high of $73,700.

Regarding the growth of IBIT funds, Eric Balchunas said that IBIT has low fees, high liquidity, and a strong brand influence of BlackRock iShares.

In addition, he added that although the total number of transactions in IBIT has decreased recently, the average transaction size has increased, which means that large investors have replaced retail "small fish".

Behind the outflow of GBTC funds: expensive fees, premium or discount risks

GBTC and IBIT are both Bitcoin spot ETFs. Why do they perform in opposite directions? During the same period, GBTC has been experiencing capital outflows, while IBIT has been experiencing capital inflows?

According to the HODL15Capital data statistics, since IBIT went online, GBTC has been experiencing capital outflows almost every week, which has given IBIT the opportunity to quickly surpass it.

GBTC, owned by Grayscale, has existed since 2013 and is the earliest compliant product for the public to participate in BTC investment. Before the launch of the Bitcoin spot ETF, it managed about 619,000 BTC.

"Grayscale GBTC increases or decreases BTC positions" was once considered by the crypto community to be an important indicator of BTC price barometer.

Why has GBTC's asset management scale been shrinking after the launch of Bitcoin spot ETFs such as BlackRock's IBIT and Fidelity's FBTC? This is mainly because GBTC and Bitcoin spot ETF products operate differently.

GBTC is a Bitcoin trust fund, that is, investors give their money to Grayscale, which purchases and keeps cryptocurrencies on behalf of investors, and then issues shares to investors, representing their shares in the trust fund, and investors can only buy shares in the secondary market, and redemption is not supported.

GBTC's share price is related to the number of Bitcoins it holds and its market value, but it often has a high premium or discount. A premium means that GBTC's share price is higher than the value of Bitcoin per share it holds, and a discount means that GBTC's share price is lower than the value of Bitcoin per share it holds.

Bitcoin spot ETF is an ETF that directly holds Bitcoin, and its price is consistent with the Bitcoin market price, and there will be no premium or discount.

In January this year, GBTC was approved by the SEC to be converted into a Bitcoin spot ETF, and investors are supported to freely redeem their fund shares through authorized dealers (APs) and convert their ETF shares into US dollar cash. This means that GBTC holders cannot cash out their gains before the product is converted into an ETF.

There are two main reasons behind the outflow of GBTC funds:

First, GBTC's fund management fee is too high, which is 5-6 times that of similar competitors. GBTC's management fee is about 1.5%, while the fee rate of Bitcoin spot ETF is only about 0.2% or lower;

Second, it can avoid the risk of GBTC's premium or discount, because GBTC's non-redemption mechanism may cause a large difference between its fund price and the market value of Bitcoin, while the difference between the price of Bitcoin spot ETF and the market price of Bitcoin is small.

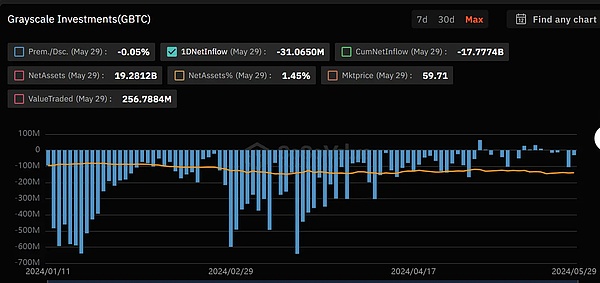

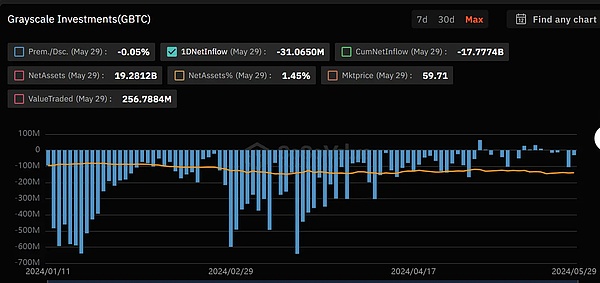

According to SoSoValue data, since the launch of Bitcoin ETF, GBTC has been in a state of net outflow for 4 consecutive months, and the outflow rate has slowed down since May.

As of May 30, GBTC's asset management scale is worth $19.28 billion. In the past four months, a total of 332,000 BTC have flowed out, and about 287,000 BTC are still held.

IBIT has become a new driving force affecting BTC price trends

Today, IBIT's fund management scale has surpassed GBTC by about $200 million, and will also become a new driving force behind the price trend of Bitcoin.

Market maker Wintermute said: "This represents a major shift in the supply and demand pattern of BTC. Now investors will no longer focus on GBTC, but on the inflow and outflow of funds from IBIT, which may drive users to pay attention to Bitcoin ETFs or the BTC behind them."

As of May 30, the total net asset value of Bitcoin spot ETFs was US$57.683 billion, and IBIT accounted for more than 33.7% of the market share.

Among them, there are three Bitcoin ETFs with a scale of tens of billions of dollars, including IBIT (US$19.48 billion), GBTC (US$19.28 billion), and FBTC (US$10.94 billion).

Bitcoin spot ETFs represented by IBIT are becoming the entry point for traditional capital to enter the crypto field. Compared with the last round of institutional bull market brought by Grayscale, the world's largest asset management companies such as BlackRock have brought in a larger amount of funds this time.

Anais

Anais