Author: Sidhartha Shukla, David Pan, Bloomberg; Compiler: Deng Tong, Golden Finance

Bitcoin miners are preparing ahead of schedule for the expected drop in revenue from the so-called “halving,” which is expected to take place in April when the Bitcoin block The chain’s network protocol will halve the rewards for validating transactions.

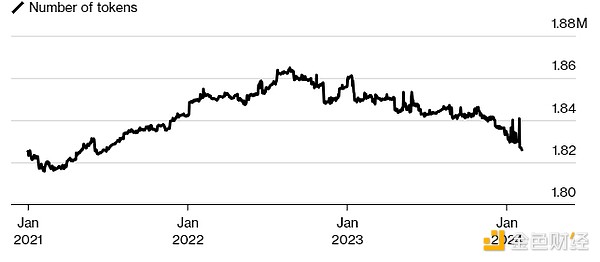

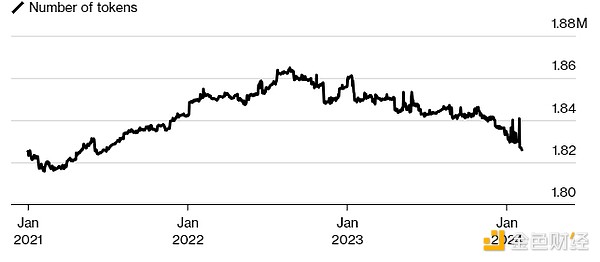

Unsold Bitcoin reserves held in company-related digital wallets have dropped by 8,400 tokens to 1.8 million since the start of 2024, according to CryptoQuant data. the lowest level since June. Analysts say this decrease indicates that miners are selling their coins.

“Miners have begun selling more Bitcoin to strengthen their balance sheets and fund growth capital expenditures ahead of April’s halving to prepare for a less profitable period,”

strong>Matthew Siegel, director of digital asset research at VanEck, said. "After the halving, scale will become even more important."

The halving, which occurs every four years, reduces the number of Bitcoins that miners earn by running power-hungry computers to solve complex puzzles . The halving is key to limiting the Bitcoin supply to 21 million coins. In the upcoming event, the reward will be reduced from 6.25 coins to 3.125 coins per block.

Bitcoin miner reserves

The largest digital asset held by miners has been declining

Source: CryptoQuant

Miners' selling appears to have put pressure on Bitcoin prices since the first U.S. transaction to directly hold the digital asset was approved on January 10 Bitcoin prices have been troubled since the launch of exchange-traded funds. During that time, the price of Bitcoin has fallen by approximately 6% to $43,000.

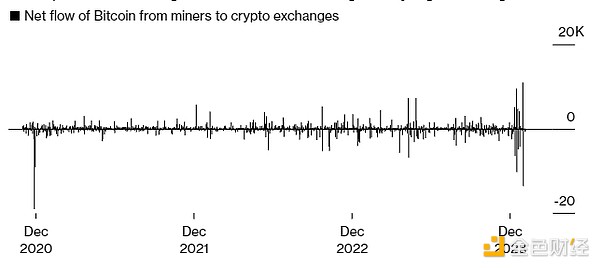

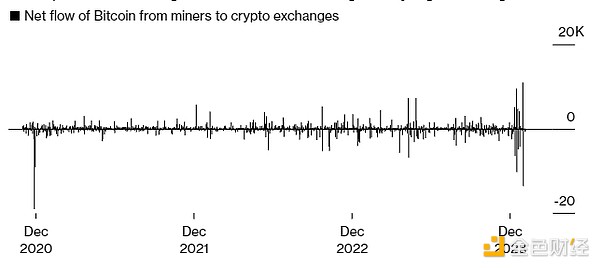

According to data from CryptoQuant, 3,617 Bitcoins have flowed from miner wallets to exchanges since the ETF was approved. On February 1, there was a net outflow of 13,542 tokens, the largest single-day outflow since December 2020.

Crypto exchange Bitfinex wrote in a recent report: "Miners appear to be selling their Bitcoin holdings to fund the purchase of more efficient mining equipment." "Reduced revenue may have an impact on Smaller mining operations will have a particularly large impact, potentially causing them to exit the market."

Although smaller mining companies have lower access to capital markets, they may Dipping into their Bitcoin reserves, larger companies have been tapping into cash reserves and raising funds by selling shares.

Bitcoin Trend

Increased number of coins transferred from miners to exchanges may signal a sell-off

Source: CryptoQuant

Marathon Digital Holdings, the largest miner in the United States, said it has sold Bitcoin reserves in the past to pay for operations cost. But since cutting debt last year, the company has been increasing its cash and Bitcoin positions.

“Marathon has approximately $1 billion in cash and Bitcoin on its balance sheet,” said Charlie Schumacher, the company’s vice president of corporate communications. “This reserve fund, consisting of 15,741 Bitcoins, provides us with the flexibility to do well as Bitcoin’s historical price cycles cycle, or to take advantage of consolidation opportunities when the industry comes under pressure.”

Last year, Bitcoin rebounded 157%, a bet on expanding demand for U.S. spot ETFs and the conventional wisdom that the halving would support the token’s price. But this year, gains for the largest digital asset have stalled.

JinseFinance

JinseFinance