Abstract

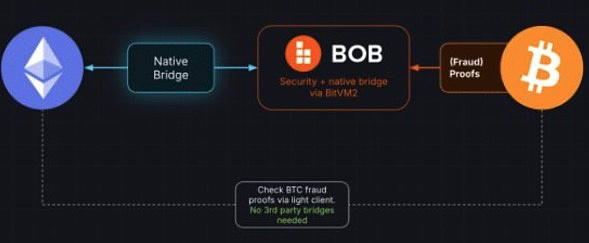

BOB belongs to a new type of L2: Hybrid L2. BOB is secured by BTC L1, the most secure L1, and uses this security to create a trustless bridge to connect BTC, ETH and other L1 blockchains. Therefore, Hybrid L2 does not rely on third-party bridging tools to achieve interoperability, while solving the decentralized BTC multi-chain liquidity problem.

1. Introduction

BTC was created as a decentralized, transparent and censorship-resistant payment system. Ten years later, smart contract chains have driven the creation of DeFi applications and other innovative products such as NFTs, tokenized social media and games, and DAOs and other trustless governance structures. In this context, while BTC L1 remains at the core of global cryptocurrency adoption, it has fallen behind in terms of innovation and developer activity.

Despite its slow development and lack of flexibility, BTC L1 is still larger than all other cryptocurrencies combined in terms of market capitalization, trading volume, and number of active users. As of October 2024, BTC has 300 million users worldwide, a market capitalization of $1 trillion, and unrivaled brand recognition and dominance. However, BTC L1 has the lowest DeFi activity of all cryptocurrencies: Ethereum's DeFi TVL to market capitalization ratio is 30%, while BTC's DeFi TVL accounts for only 0.1%, a difference of 300 times.

In the past few years, many people have tried to introduce smart contracts and DeFi on BTC L1 through protocol changes and forks, but these attempts have failed. BTC L1 opposes any protocol upgrades that may significantly change its functionality or increase complexity. Therefore, BTC L1 will not have native programmability like Ethereum for a long time to come, and BTC L2 will eventually become the best solution for DeFi in the BTC ecosystem.

1.1 Hybrid L2

Hybrid L2 is a BTC L2 solution that aims to solve the main challenges of expanding DeFi on BTC L1. This L2 often has three key properties:

BTC L1 Security: Use OP verification and error proofs on BTC L1 through BitVM2.

Trustless BTC bridge: Using the improved BitVM bridge design, users can deposit and withdraw BTC as long as BTC L1 is secure and there is at least one honest node in the network that can perform on-chain disputes. This new security model is called "existence is trustworthy" (1-of-n), and because it relies on minimal assumptions, it is much more secure than the existing BTC multi-signature bridge.

Trustless Ethereum bridge: BOB uses BTC L1 security and combines the L1/L2 Ethereum OP rollups bridge design to encode Ethereum's L2 withdrawals as part of the L1 smart contract to ensure the correctness of L2 withdrawals. This design can be extended to most L1 chains with smart contracts.

As the first Hybrid L2, BOB provides a practical solution for trustless cross-chain interoperability: First, BTC L1, as the most secure decentralized network, can protect L2 and all cross-chain bridges at the same time. On top of this, BOB further solves the problem of decentralized cross-chain BTC liquidity - users can use the native BTC liquidity and BTC L1's secure withdrawal mechanism through the BOB network to deposit assets on various chains. Ultimately, BOB maintains the security and sustainability of BTC L1 by paying fees to BTC L1.

2. The current status of BTC L2: a blessing and a curse

BTC L2 has the potential to bring innovation to BTC L1 while keeping its core principles intact. It can unlock the prospects of DeFi use cases, enabling trading, lending, and staking without relying on centralized exchanges. This is a huge opportunity to unlock the trillion-dollar market for BTC. Currently, dozens of chains have claimed to be "BTC L2".

However, building BTC L2 is a difficult task, and previous attempts have failed to achieve the level of success of Ethereum. We believe there are three major challenges to successfully launching BTC L2:

BTC secure and trustless BTC bridge:This is the key feature that distinguishes BTC L2 from all other chains. The security of BTC L1 allows users to deposit and withdraw BTC without relying on a third party. To date, almost all BTC bridges rely on multi-signatures. BOB is the first team in history to realize this blueprint through BitVM2.

Build a competitive ecosystem:L2 can only succeed if its dApp ecosystem succeeds. The key to creating a successful product is to provide the best development tools and DeFi infrastructure, such as wallets, institutional custody, and oracles. This means that the L2 team must keep up with the pace of development, such as ms-level transaction speeds and abstracted gas fees. Without a competitive developer environment, it will be difficult for BTC L1 applications to compete with competitors on Ethereum and other networks.

Introducing blue-chip liquidity (cold start problem):Introducing stablecoins, fiat deposit/withdrawal channels, and bridges to other networks is crucial in the DeFi ecosystem. For developers, network effects are the determining factor for the success of new products, so developing projects on isolated chains brings significant challenges.

3. BOB's Background: Bridge, Light Client, and BitVM

BOB's innovation is mainly reflected in three core technical concepts: cross-chain bridging, light client, and BitVM. These technologies together constitute BOB's value proposition, so it is necessary for us to explore these three in depth.

3.1 Light Client

BTC L1's "Simplified Payment Verification" (SPV) light client protocol allows nodes to perform payment verification without downloading the full blockchain data. This method only requires the light client to verify the consensus finality through the block header and can be verified based on the selected transaction.

BTC L1's light client has verifiable security and can be verified by other blockchains with smart contract functions. For example, Threshold has been running such light clients on Ethereum for many years. However, Ethereum does not have a secure light client because Ethereum needs to store and track the public keys of more than one million validators, which increases the complexity of the system.

3.2 Cross-chain Bridge

We have demonstrated two properties of "bridging" or "wrapping" assets to different blockchains:

a) it allows both chains to operate correctly at the same time;

b) it is difficult to achieve without a trusted third party.

In practice, we can reduce the reliance on third parties by allowing any network participant to assume the responsibility of verification. Through the so-called "light client bridge", chain A and chain B can verify their respective consensus protocols through each other's smart contracts. When we deposit asset a into the bridge on chain A, the smart contract on chain B verifies that the transaction has been agreed upon on chain A before minting the wrapped token b(a). Vice versa, when we destroy b(a) on chain B, we must first verify that the transaction has been agreed upon on chain A. Due to the complexity of light clients, this design currently has very few successful implementation cases.

3.3 BitVM

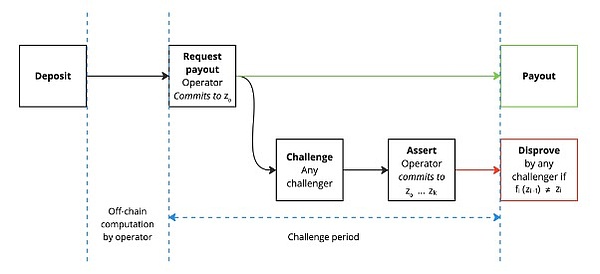

BitVM is a mechanism for executing arbitration procedures in an OP manner on BTC L1. Its execution occurs off-chain, and when it fails, it is resolved through on-chain disputes. Its two main use cases are OP aggregation of BTC L1 (similar to Arbitrum) and trustless bridging. In both cases, BitVM allows users to deposit and withdraw BTC from L2, and as long as there is an honest node in the network, the deposit cannot be stolen.

The most commonly used version of BitVM is BitVM2. Its design summary is as follows:

Compress the program into a SNARK verifier and implement it in the BTC L1 script.

Split validators into subprogram chunks under 4MB for execution in BTC L1 transactions.

BitVM2 operators submit programs via the Taproot tree during setup and pre-sign transactions.

Users deposit funds into BitVM2 (e.g. bridge deposits).

Anyone can challenge the operator when attempting to withdraw funds from BitVM2.

If challenged, the operator must reveal the results of all intermediate subprograms and show their final calculation results.

If the operator cheats, some of the subprogram results revealed will be wrong, and anyone can prove that the operator cheated by executing a specific subprogram.

Cheating operators will be kicked out and will no longer be able to access deposits.

Source: bitvm.org

A detailed overview of BitVM2 can be found in our latest paper.

4. BOB Hybrid L2

BOB's Hybrid L2 innovative design is based on BTC L1's trust concept as a decentralized network and its simplicity in consensus verification.

4.1 BTC L1 Security

BOB's Hybrid L2 will use BTC L1 for settlement and security. The currently recognized ideal design of BTC L2 is based on zk-rollups: all state changes are calculated off-chain, and then verified and recorded on-chain through zk proofs. However, as of now, BTC L1 cannot support zk-rollups because implementing zk prover in BTC L1 script requires additional opcodes to avoid consensus forgery. Therefore, BOB achieves security through BitVM2's OP verification. This method generates a validity proof for each state transition and publishes it to BTC L1 together with the state difference. When paired with BitVM2, any network participant can initiate a challenge through the fault proof mechanism to overturn the failed operation within 7 days and ensure security.

This means that with BitVM2, we can let any node in the network participate in the fault proof mechanism to challenge when a bug is found. This design makes the security almost equivalent to BTC L1 itself: as long as there is a node in the network that is online and honest, the fault proof can be triggered.

4.2 Trust-Minimized BTC L1 Bridge

BitVM2 fault proofs also enable BOB to create a trust-minimized BTC L1 bridge. Specifically, this is a light client bridge, where BTC L1 supports BOB through a light client running in BitVM2. This bridge allows users to deposit BTC into the BOB network and withdraw it back to the BTC L1 network when needed while ensuring security. This new design relies on an "existential honesty" security model, which only requires a 1-of-n honesty assumption to ensure correct operation, which is stricter than existing multi-signature bridge schemes.

Of the existing BTC bridges, most rely on multi-signature schemes and require most signers to be honest. However, in the design of BitVM2, even if all bridge operators are dishonest, as long as there is an online participant in the network, the funds cannot be stolen. This design solves the security risks in multi-signature schemes and constitutes the most secure BTC bridge scheme in history.

4.3 Trust-Minimized Ethereum Bridge

BOB's Hybrid design also supports secure access to ETH and ERC20, similar to the design of Optimism. When a user wants to withdraw assets from L2 to Ethereum, they must wait for a 7-day challenge period to ensure that there are no fault proofs. This mechanism ensures the security of asset bridges between Ethereum and BTC L1 networks, thereby solving the inherent risks of cross-chain bridges.

In BOB's Hybrid L2 design, the ETH bridge smart contract waits for BOB to complete final confirmation on the BTC L1 network to ensure that all proofs are correct. This function is part of the bridge smart contract, which can verify the BTC L1 blockchain and is implemented by the BTC L1 light client. Therefore, any user who deposits ETH and ERC20 tokens into BOB can withdraw these assets back to Ethereum as long as the BTC L1 network is secure and there is an online node that can trigger the error proof.

Source: BoB

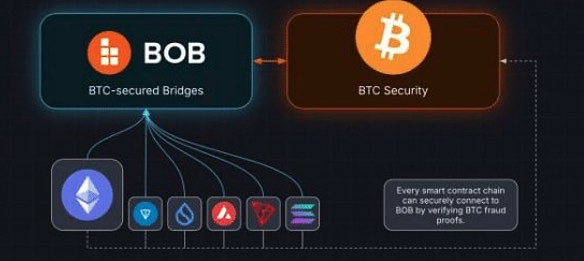

5. Outlook: BOB as the center of DeFi

The uniqueness of Hybrid L2 will push BOB to the largest DeFi ecosystem in the industry. Currently BOB is leveraging the network effects of BTC L1 and ETH, and will expand to other chains in the future.

5.1 Self-reliance through Ethereum

For dApps built on BOB, they can benefit from Ethereum’s best infrastructure and development tools while introducing DeFi’s core user base and connecting with all exchanges and institutional players. It is worth noting that almost all Ethereum users own BTC, and most BTC users also use ETH DeFi.

5.2 Growth driven by BTC L1

Over time, the additional security and access to BTC provided by BTC L1 through the trust-minimized BitVM2 bridge will unlock more untapped BTC liquidity pools and allow dApps on BOB to not only catch up with their Ethereum competitors, but also surpass them. This effect will be further enhanced by BTC L1’s global adoption and diverse user base: while ETH L2 competes for the same user base, BOB’s dApp can leverage BTC’s user base of over 300 million and thousands of real-world businesses.

5.3 BTC L1 as a multi-chain DeFi hub

BTC L1, ETH, and stablecoins account for 90% of the market. However, just like existing banks, we believe that in the future there will be hundreds of chains focusing on different use cases or geographic locations. All of these chains will need secure access to BTC L1, and they will also need a way to exchange assets between them.

Today, centralized exchanges play this role: they connect all chains, allowing users to deposit and withdraw assets, and exchange assets to the corresponding L1. However, centralized exchanges have also caused major problems in the past and will continue to do so until we fully transition to DeFi.

On the contrary, BOB's mission is to make BTC L1 the cornerstone of a secure and transparent DeFi ecosystem. As a Hybrid L2, BOB will securely bridge assets through BTC to any smart contract chain that can verify the BTC L1 blockchain. This means that 90% of modern L1 and L2 chains, including Solana, Tron, Sui, Aptos, Monad, Avalanche, Cosmos, Polkadot, etc. can safely deposit and withdraw assets through BOB. All of this is done through BTC L1 with trust-minimized operations without relying on third-party bridging.

Source: BoB

Using BTC L1 as a trust anchor to create an interoperable DeFi ecosystem is the core advantage of the Hybrid L2 design. Rather than dispersing BTC L1 liquidity across dozens of chains, BOB will centralize liquidity around BTC, providing a truly viable alternative to centralized exchanges and putting BTC at the center of DeFi.

6. Conclusion

BOB Hybrid L2 solves some of the most pressing challenges in building a decentralized financial system on top of BTC L1. It provides the necessary infrastructure by creating a BTC bridge that inherits the security of BTC L1 and maintains trust minimization, enabling a wide range of users to join BTC L1 without relying on centralized service providers. At the same time, BOB prevents the fragmentation of BTC liquidity through trust-minimized bridges to Ethereum and other smart contract L1 chains, and provides a practical, BTC L1 security-based solution to the long-standing cross-chain interoperability problem, making BTC the core of DeFi.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Catherine

Catherine cryptopotato

cryptopotato Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph